Blog

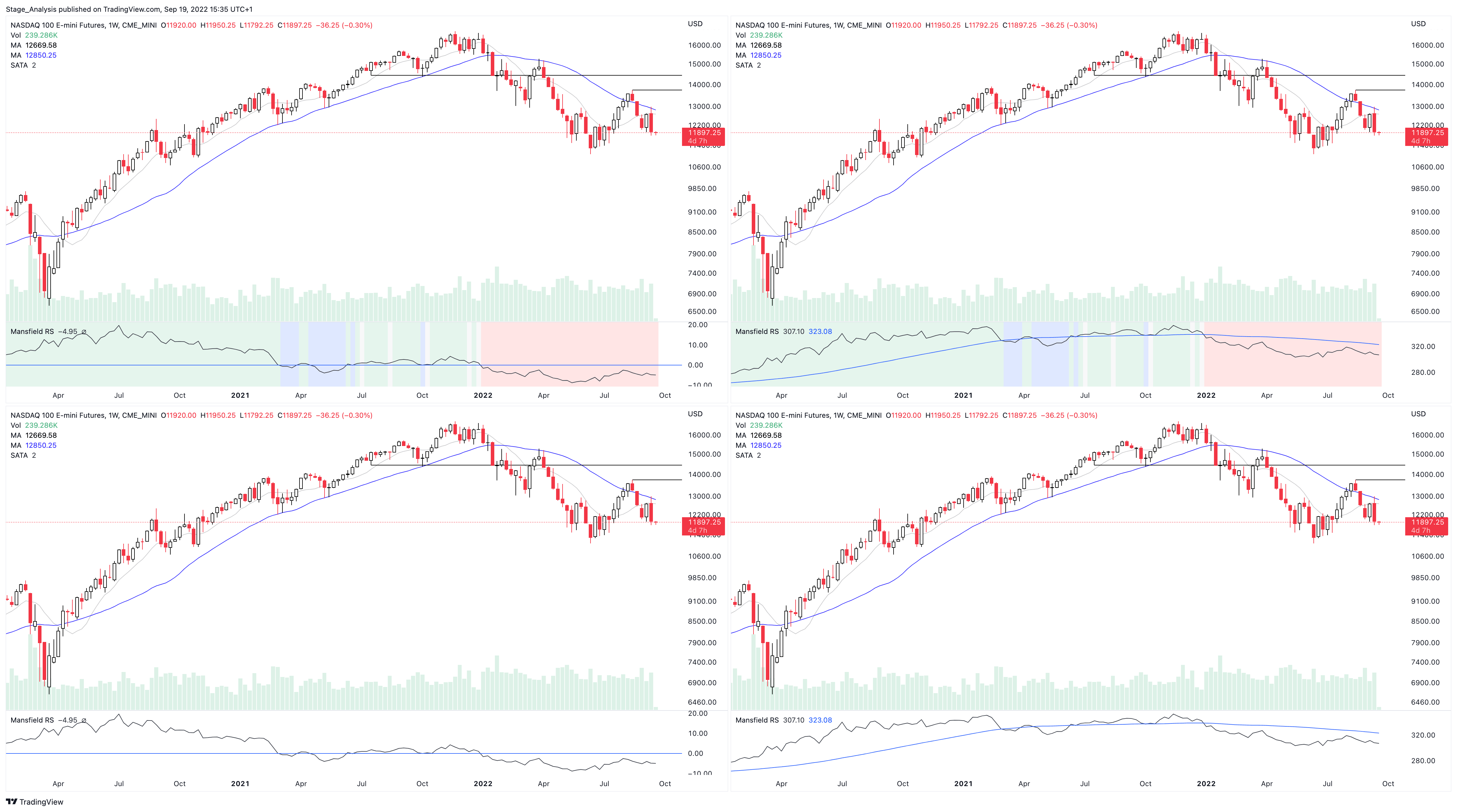

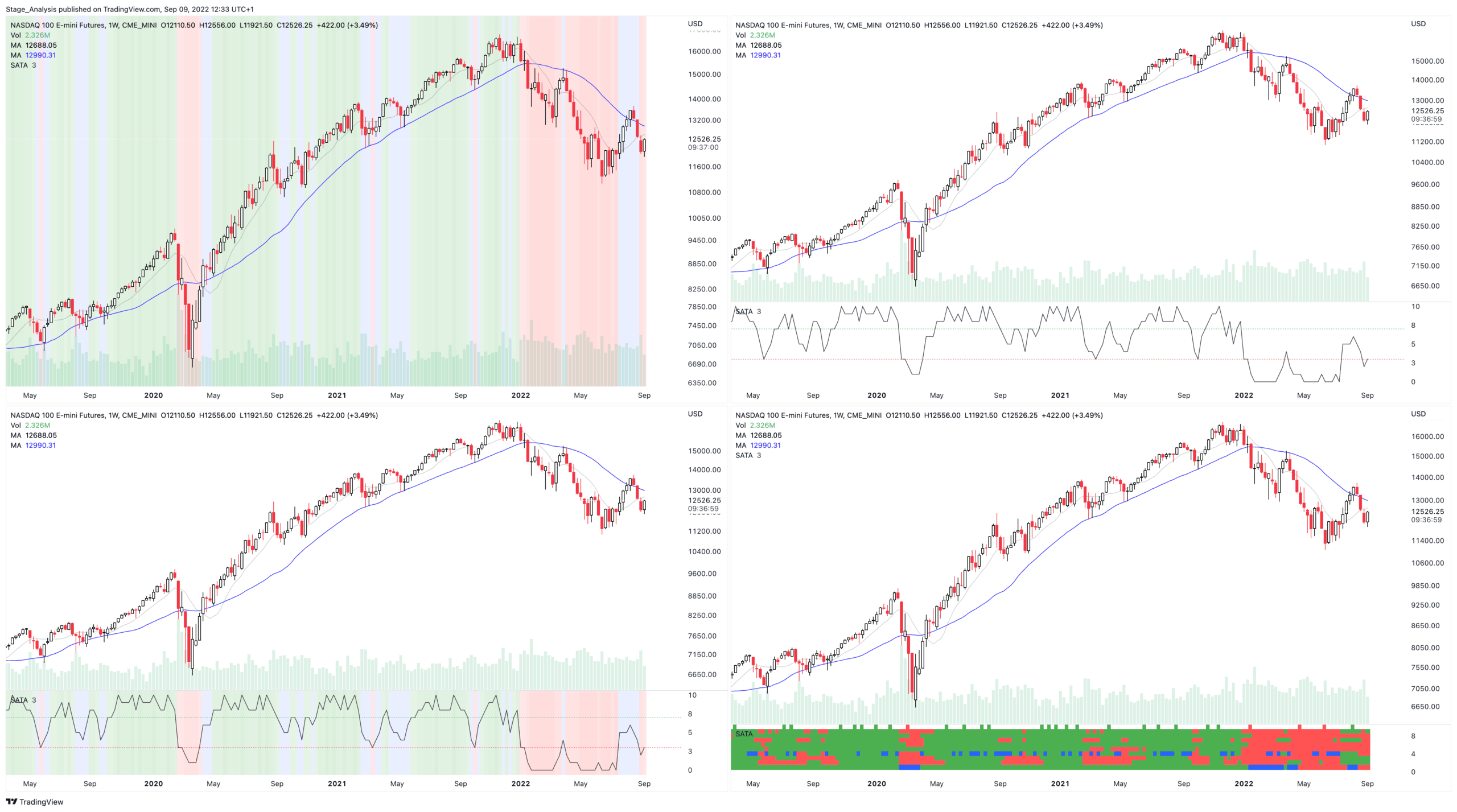

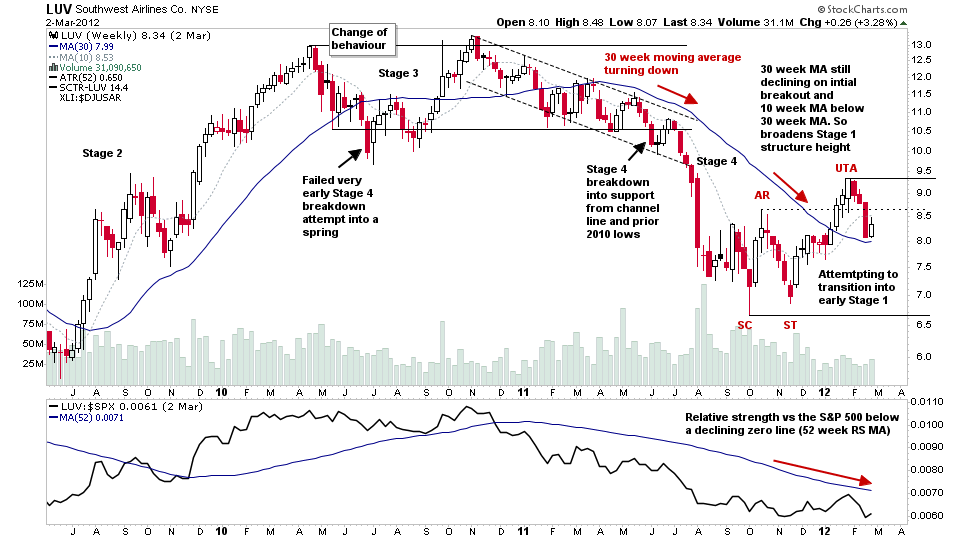

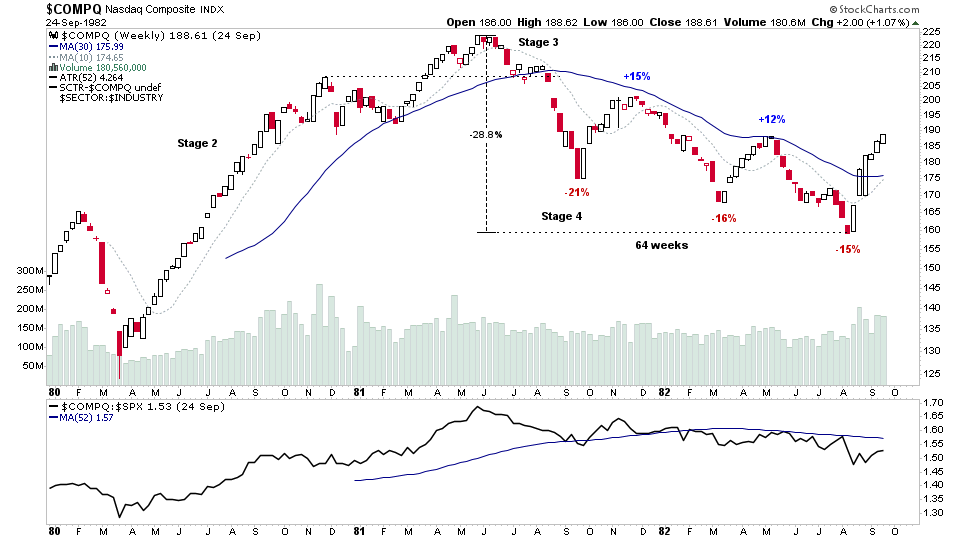

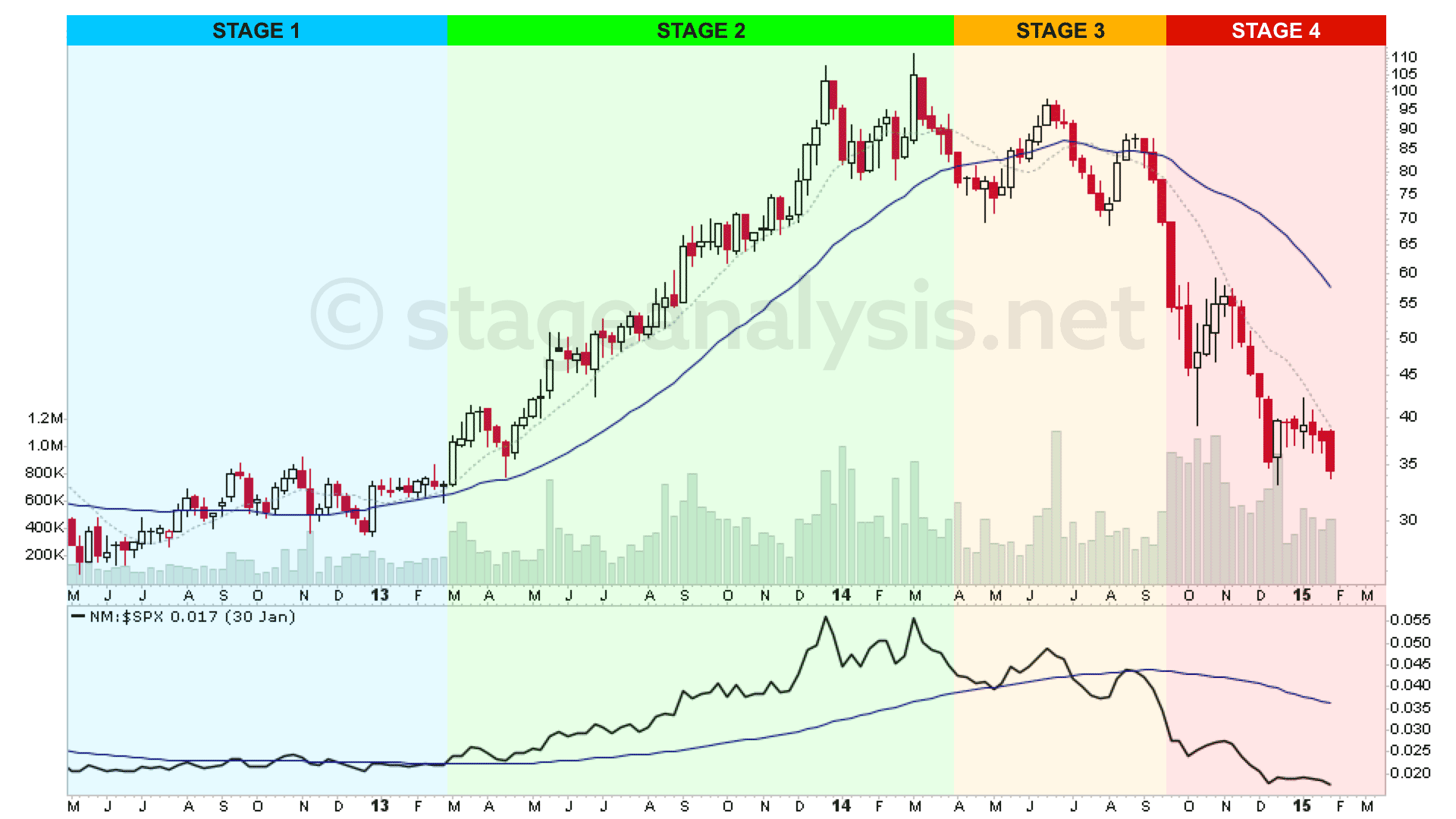

Learn the incredibly popular Stage Analysis method to gain an edge in your stock trading and investing. This video course makes no assumptions of prior experience of the Stage Analysis method or even any prior stock trading and investing knowledge.

We begin with the very basics and foundations of Stan Weinstein’s classic method, and introduce key concepts in a logical way, through detailed real life examples of stocks charts in the different stages. Taking you from complete beginner to some expert level Stage Analysis concepts. And so, by the end of the course you will be completely comfortable trading and investing using the Stage Analysis method and will never look at a stock chart in the same way again!

What you’ll learn

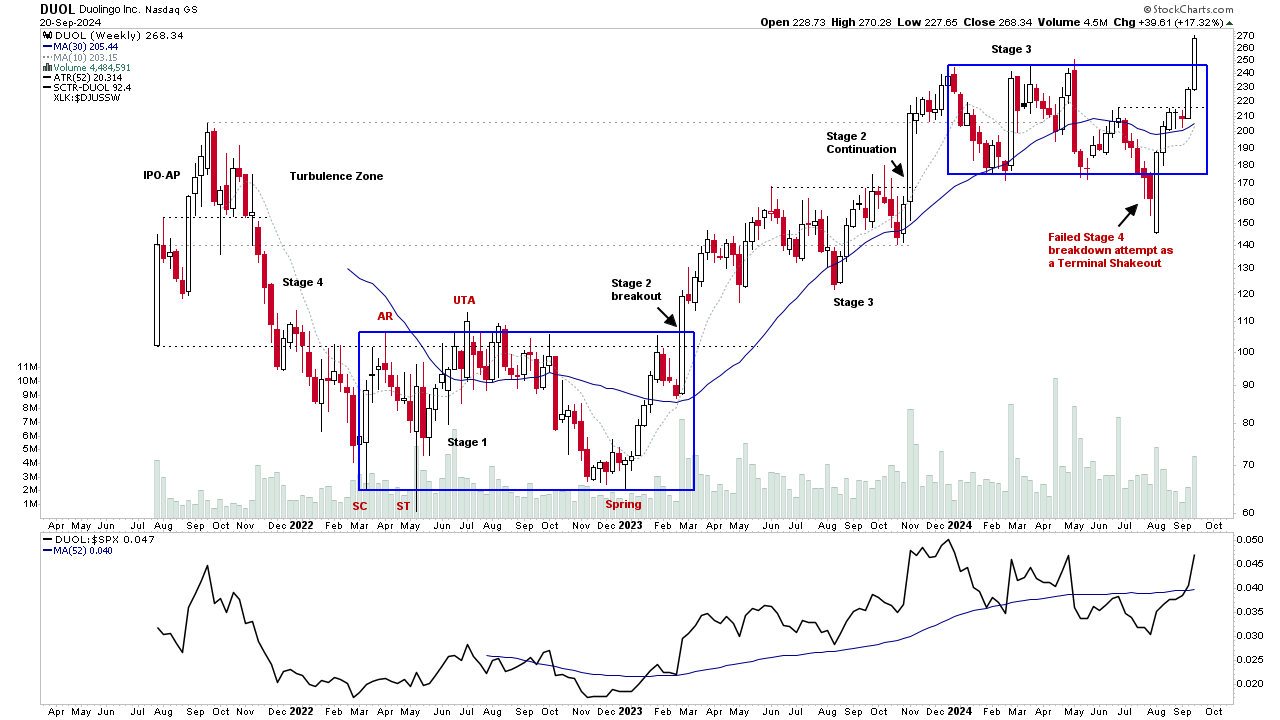

- Learn the Four Stages of the Stan Weinstein’s Stage Analysis Method

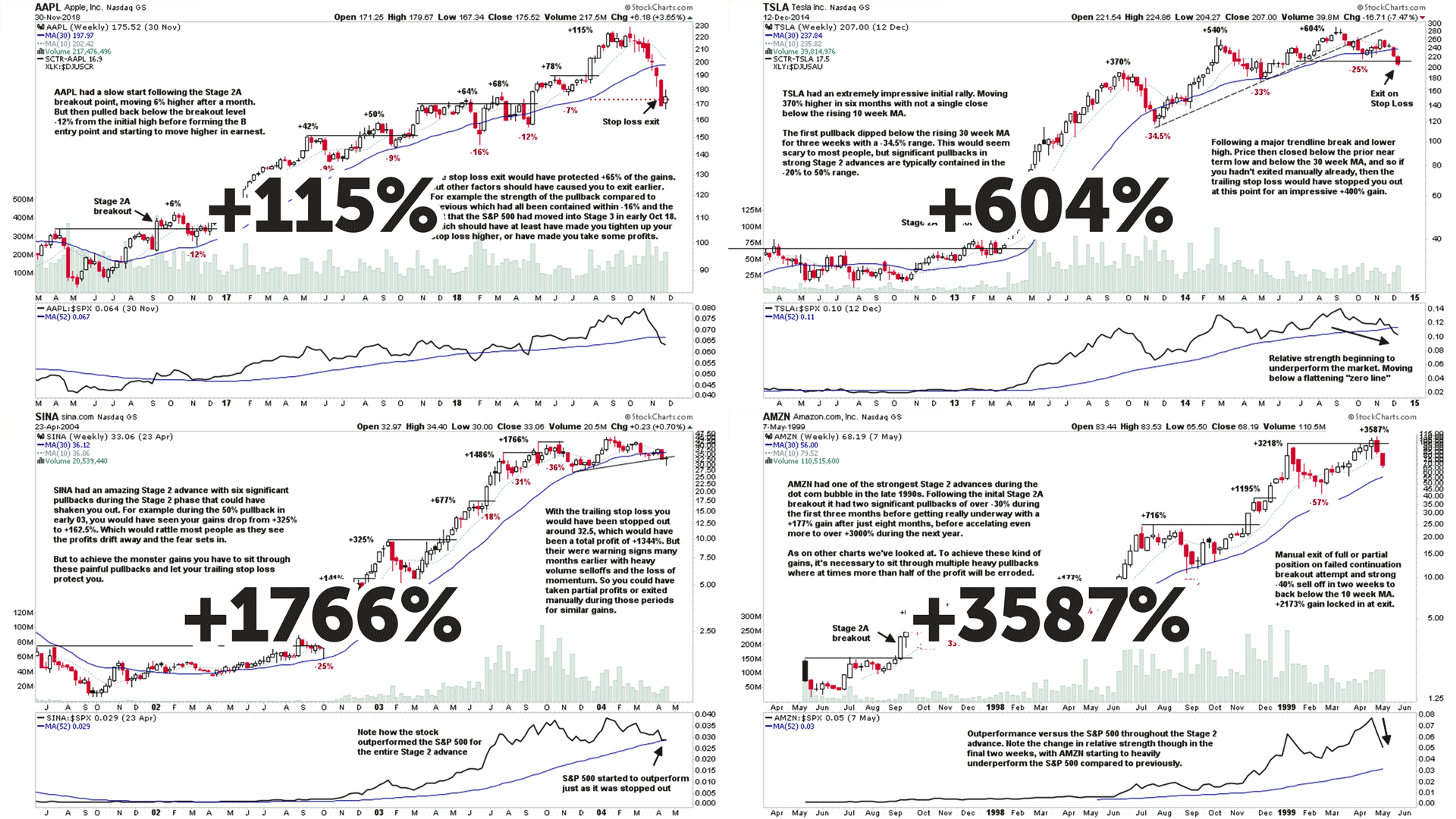

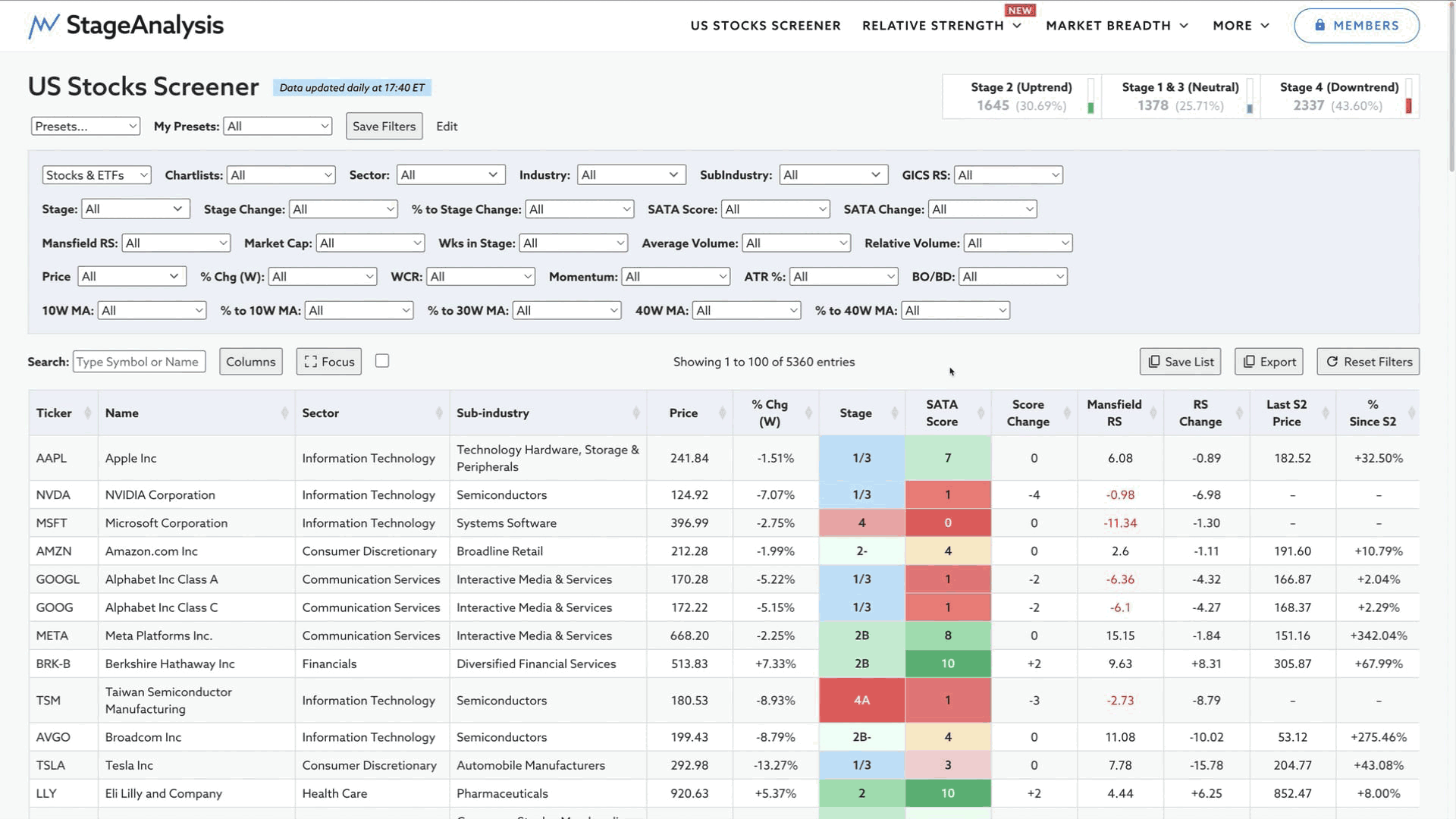

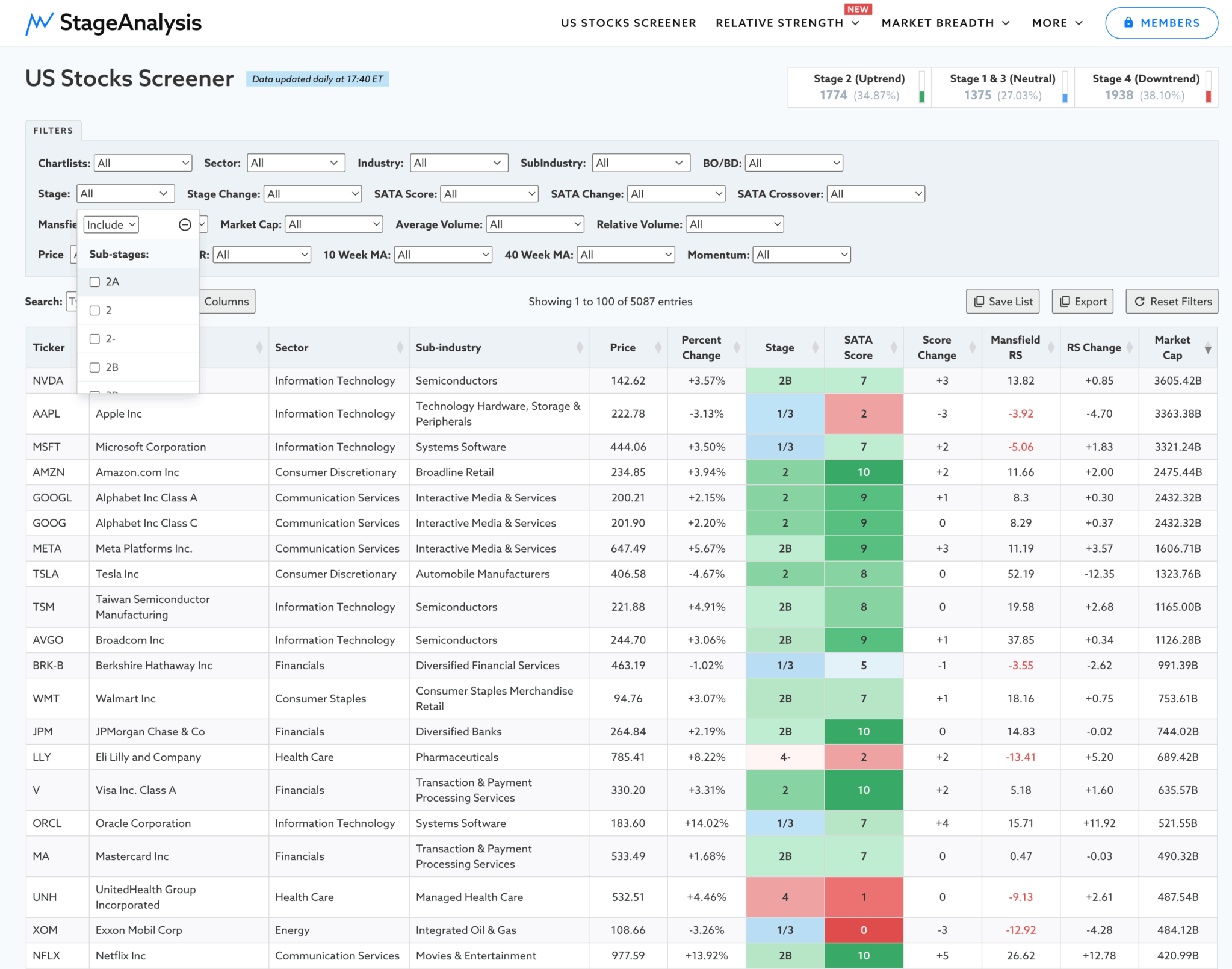

- The Stage Analysis Investor & Trader Methods – When to Buy, and When to Sell for Maximum Gains

- The Key Components of the Stage Analysis Method to Find the Stocks With the A+ Potential

- A Classic Technical Analysis Method That Will Let You Enter and Exit Stock Trades With Confidence

- Learn the Ideal Stage 2 Entry Points to Maximise Profit Potential and Minimise Risk

Start learning today: https://www.udemy.com/course/l...