Top 5 Books To Learn Stan Weinstein’s Stage Analysis Method

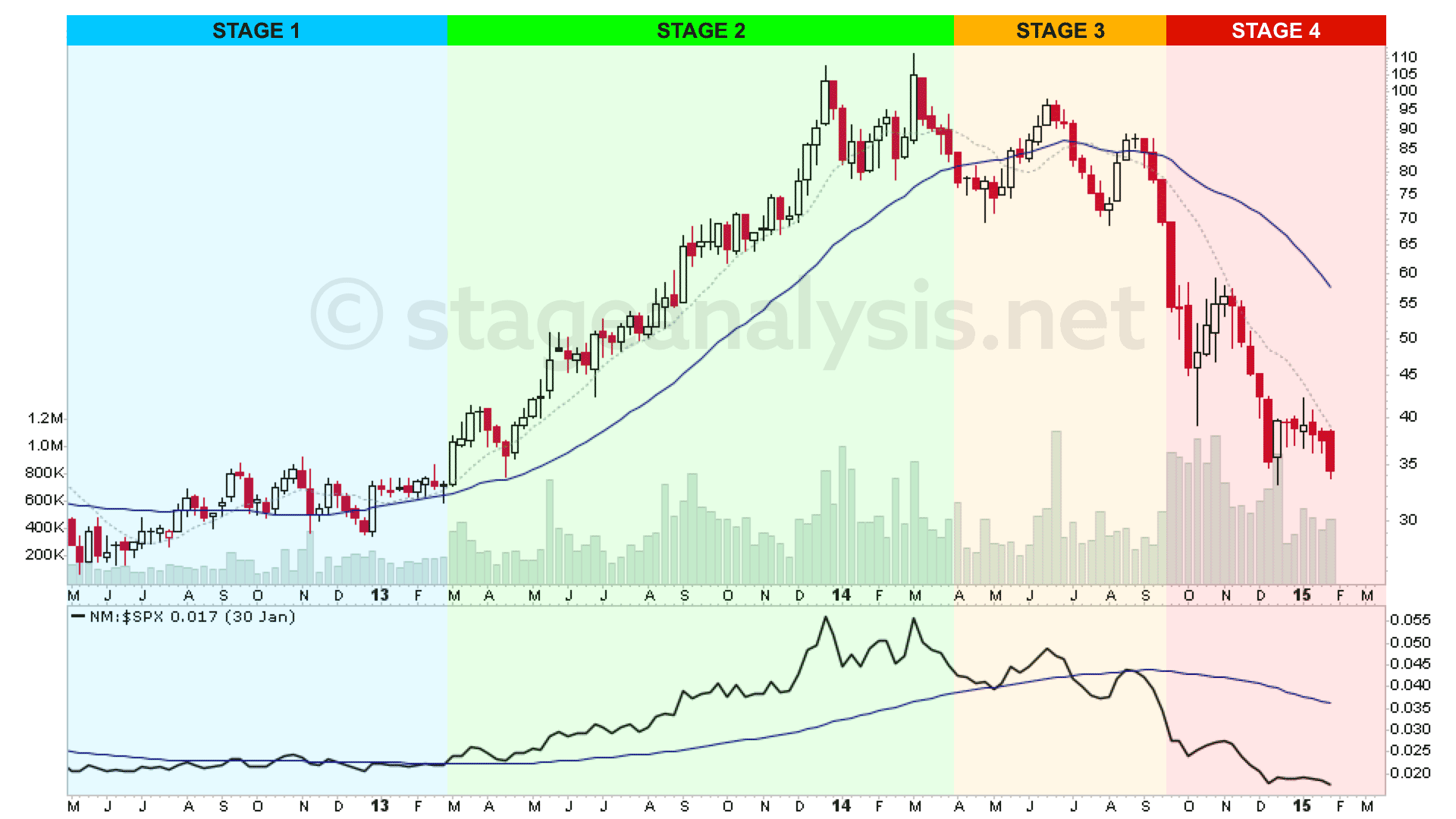

The Stage Analysis method this website is based upon comes from Stan Weinstein's classic book, which is called Stan Weinstein's Secrets For Profiting in Bull and Bear Markets. The method has stood the test of time through multiple extremes of both bull and bear markets over the last 30+ years; and to this day Stan Weinstein still runs his institutional investment service called the Global Trend Alert – which he launched in the early 1990s.*

*The Global Trend Alert service replaced The Professional Tape Reader newsletter that he'd run since the early 1970s – which for example had around 15,000 subscribers in late 1983, according to a New York Times article from that year.

Top 5 Books to Learn Stage Analysis

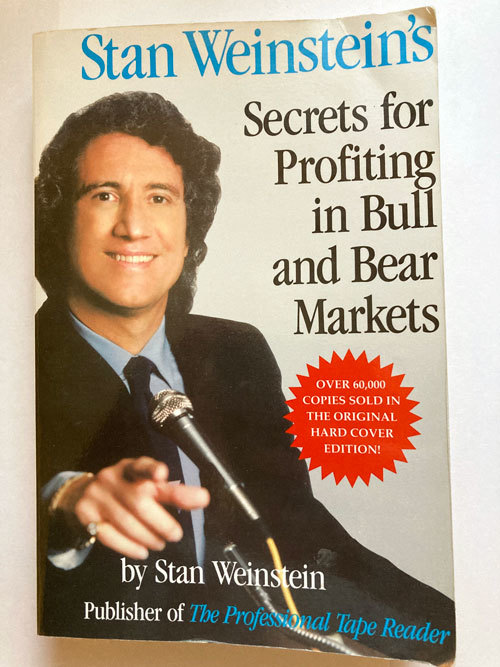

#1 – Stan Weinstein's Secrets For Profiting in Bull and Bear Markets

Stan Weinstein

To begin to learn the Stage Analysis method you should read Stan Weinstein's book – which was published in 1988 following the famous US stock market crash of 1987 – and although more than 30 years old now, the concepts that it teaches of price, volume, relative strength / performance versus the market, sector and industry group strength / weakness and market breadth are timeless and covers stock trading techniques for both investors and shorter term position traders.

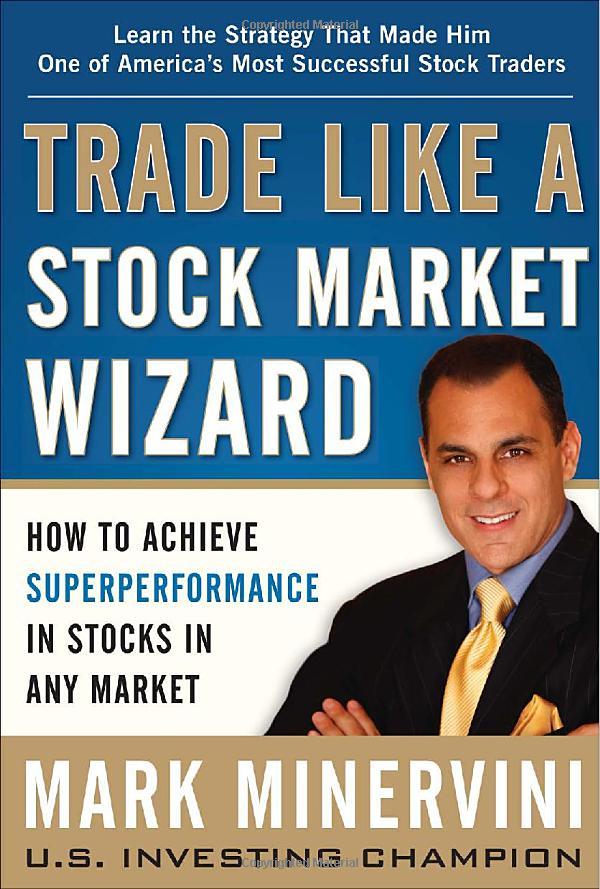

#2 – Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market

Mark Minervini

The second book that you should read after finishing Stan Weinstein's Secrets For Profiting in Bull and Bear Markets book is the first of Mark Minervini's books which is called Trade Like a Stock Market Wizard.

Mark talks in the book about how he met Stan Weinstein and then incorporated the Four Stages into his own method, which is much shorter in terms of the timeframes that he operates on, as it is more of a Swing Trading method. But the concepts introduced in the book (for example the Volatility Contraction Pattern – VCP) really complement the Trader method from Stan Weinstein's book, and so if you are interested in using Stage Analysis for swing trading or position trading, then this book really expands on those areas.

#3 – Think & Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard

Mark Minervini

The third book in the top 5 list is Mark Minervini's second book called Think & Trade Like a Champion, which was a follow on to his first book and expands on some of the concepts introduced in the first book. But also goes into new areas including detailed risk management sections. Arguably this is the better of the two Minervini books. But I feel that it is essential to read them both to understand the concepts fully.

#4 – Point and Figure Charting: The Essential Application for Forecasting and Tracking Market Prices

Thomas J. Dorsey

The fourth book in our top 5 list of books to learn Stage Analysis is called Point and Figure Charting by Thomas J. Dorsey, which most people would likely be surprised by, as it's not a well known book and doesn't have any direct link to the Stage Analysis method. However, the concepts that it teaches based on comparative Relative Strength techniques, Group Themes and an in-depth look at numerous essential Market Breadth indicators that are used in the Stan Weinstein's Stage Analysis method. So it should be added to your collection if you want to take Stage Analysis to a more advanced level, as Market Breadth and Relative Strength analysis are essential parts of the method and as a bonus, you'll learn to use Point and Figure charts – which will expand your charting toolset.

#5 – Technical Analysis Using Multiple Timeframes

Brian Shannon

And the final book in the top 5 list of books to learn Stan Weinstein's Stage Analysis method is Technical Analysis Using Multiple Timeframes by Brian Shannon, that focuses on short term swing trading with a multi-time frame approach and combines the Four Stages as part of Brian's own trading techniques, which focus around the Anchored Volume Weighted Average (Anchored VWAP) indicator. So it is another essential read if you want to become more advanced in using the Stage Analysis method as the techniques presented and multiple timeframe techniques are relevant whether you are a swing trader, position trader or long term investor.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.