Top 5 Books To Learn the Wyckoff Method

This website is focused on Stan Weinstein's Stage Analysis method. However, as with any method there's a huge amount of crossover with other methods, and one of the most important to learn in order to master Stage Analysis is the Wyckoff method, which was originally created by Richard D. Wyckoff in the early part of the 20th century, and has been expanded by numerous traders over the last 100 years.

The Wyckoff method has its own version of the four stages via the Price Cycle model. For example:

- Accumulation = Stage 1

- Markup = Stage 2

- Distribution = Stage 3

- Markdown = Stage 4

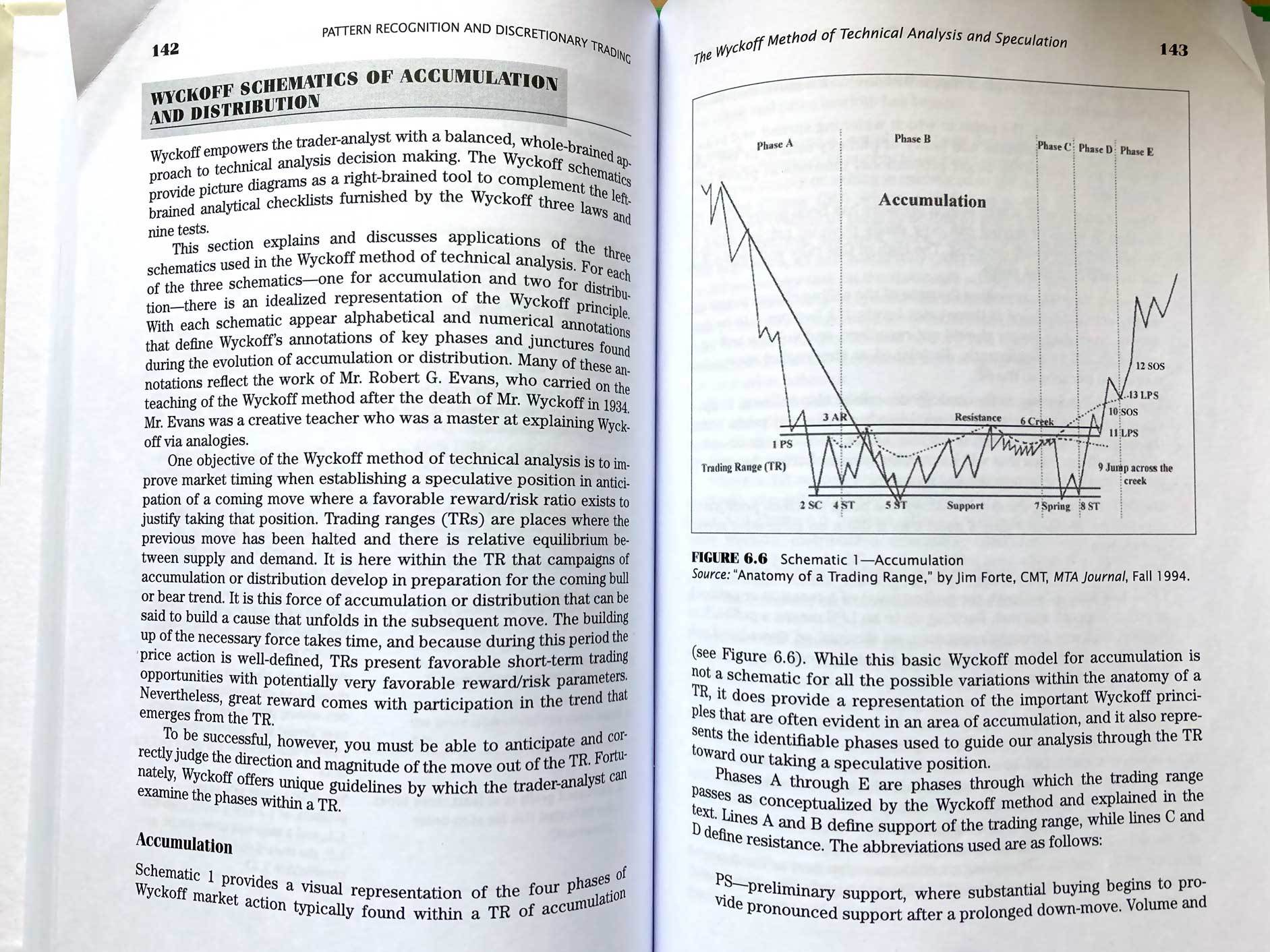

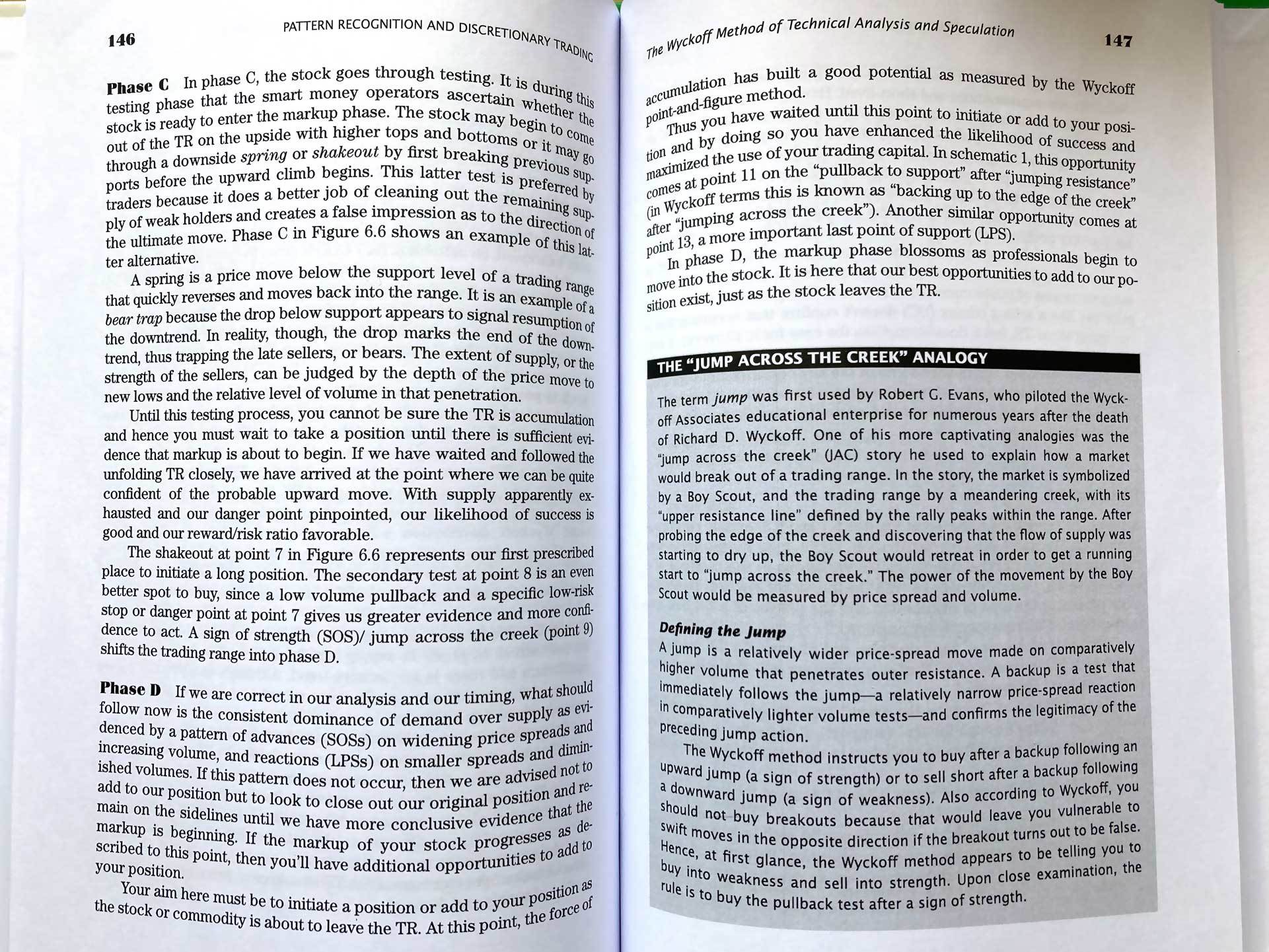

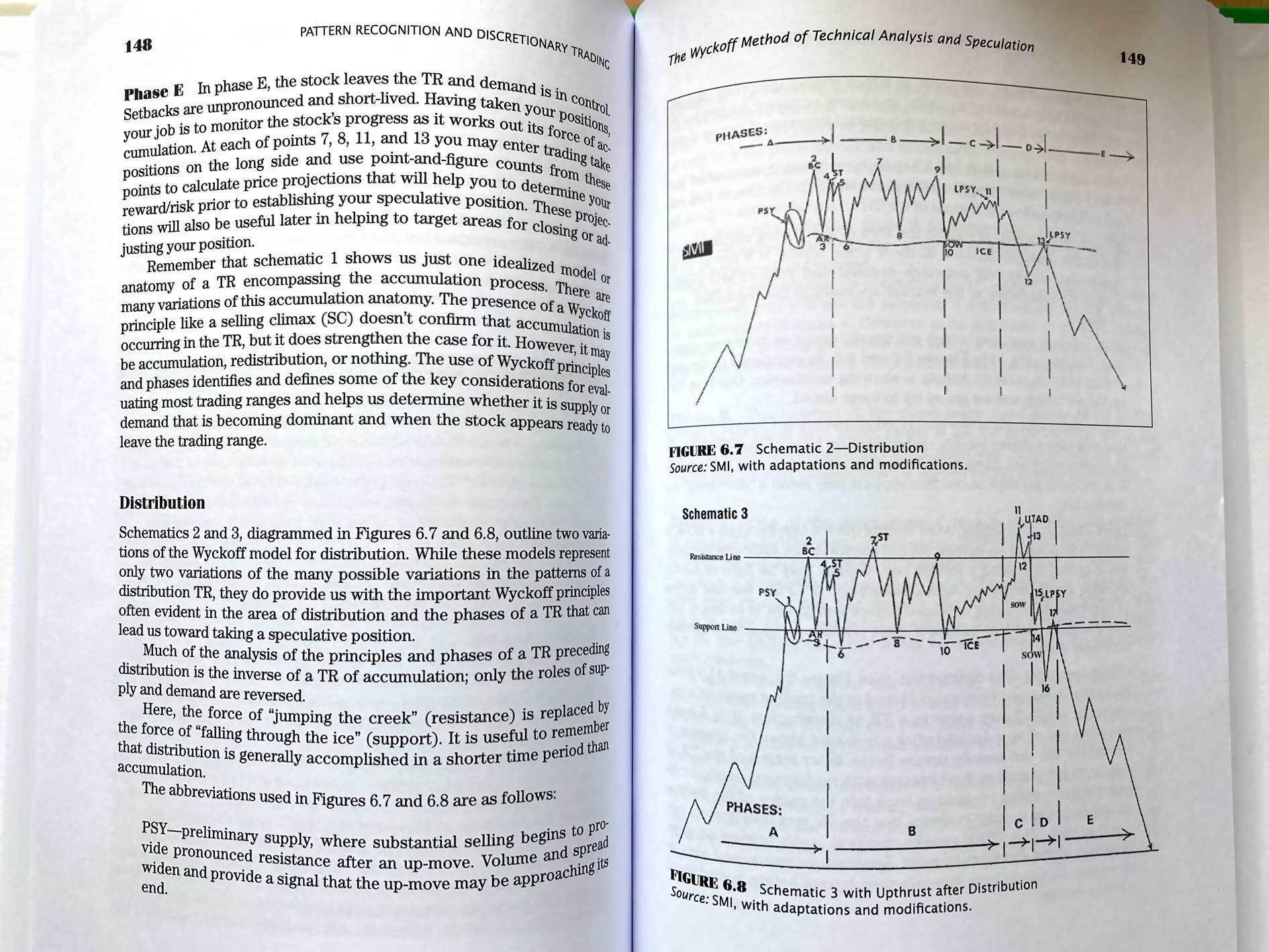

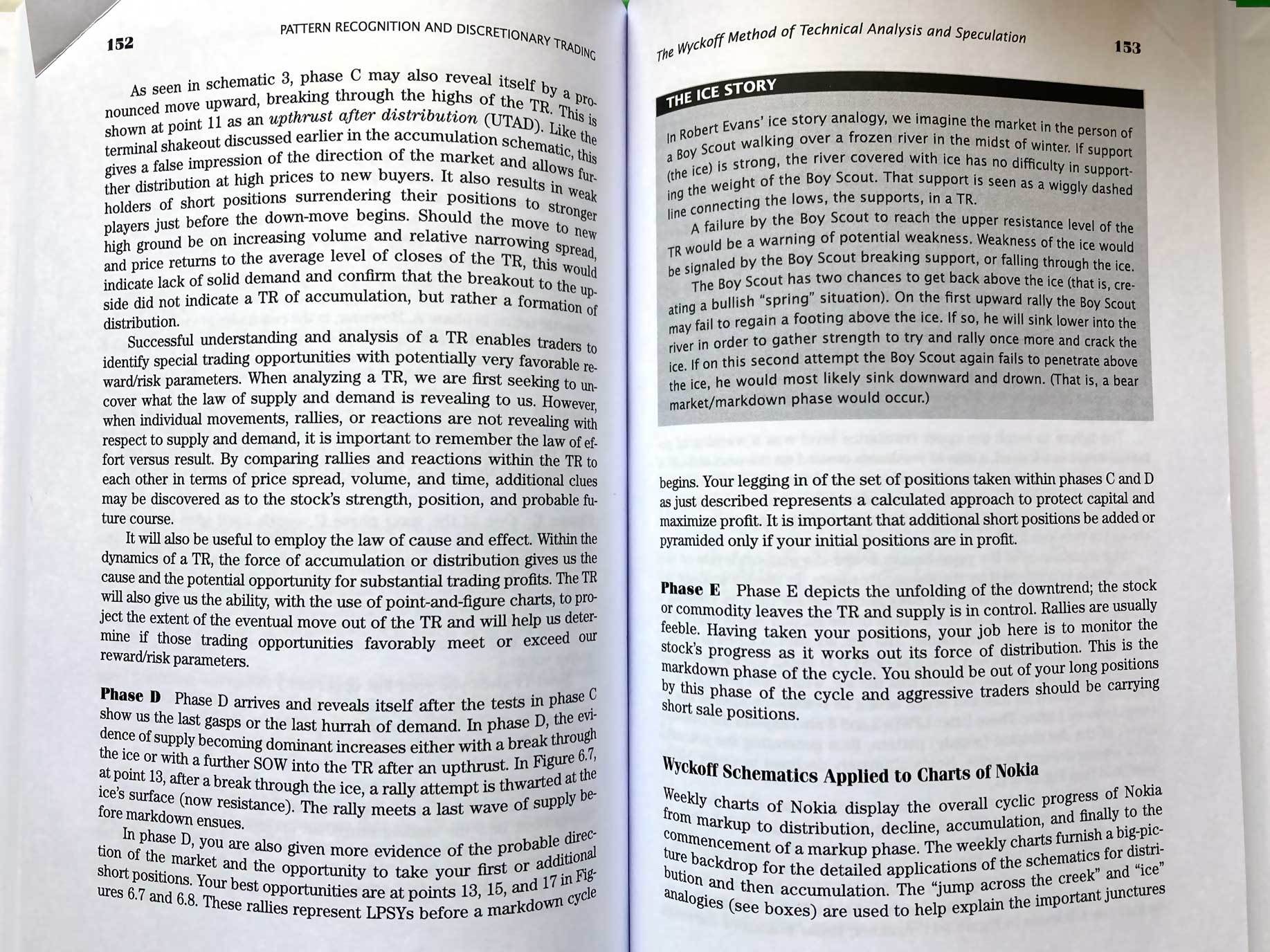

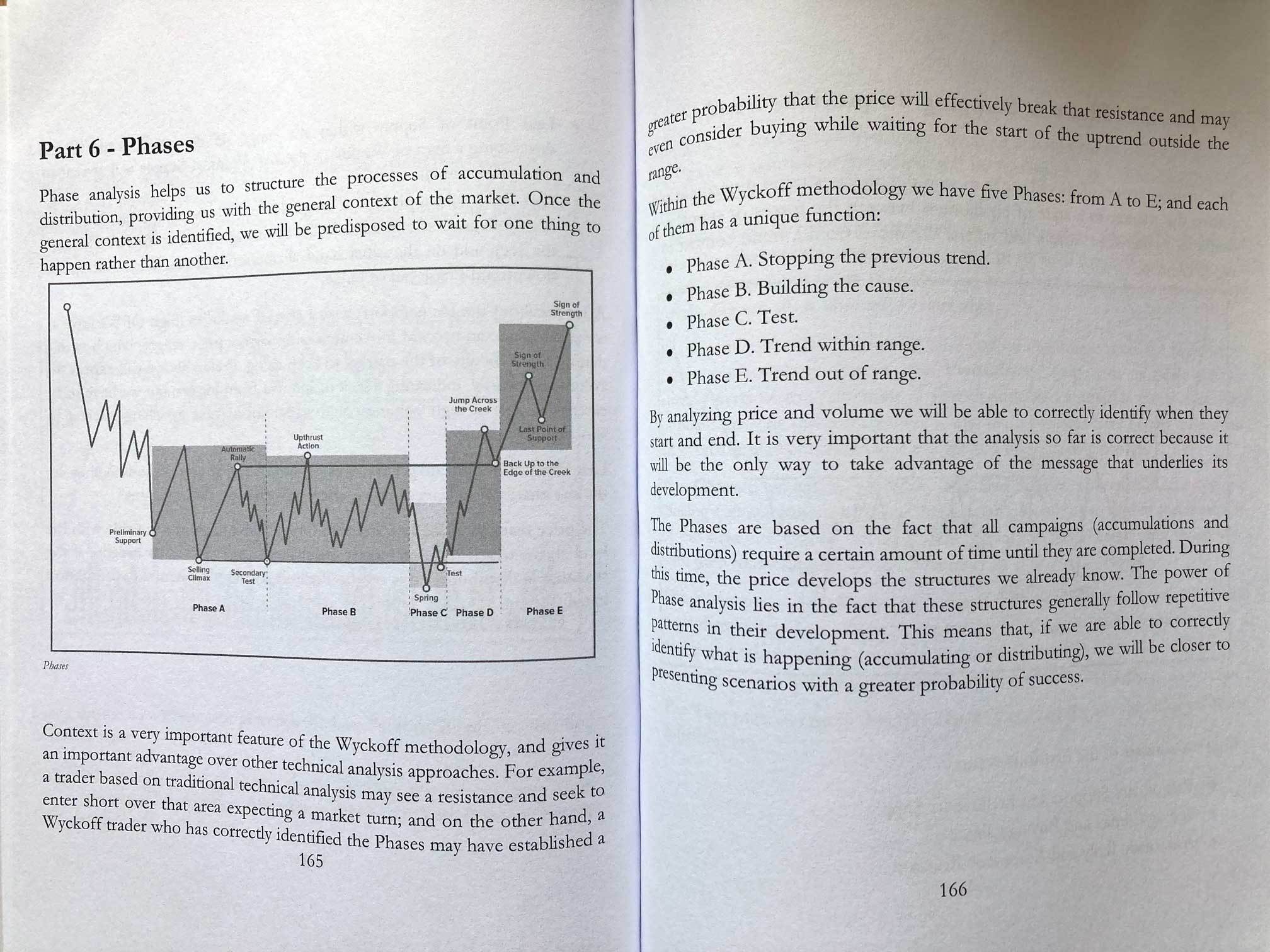

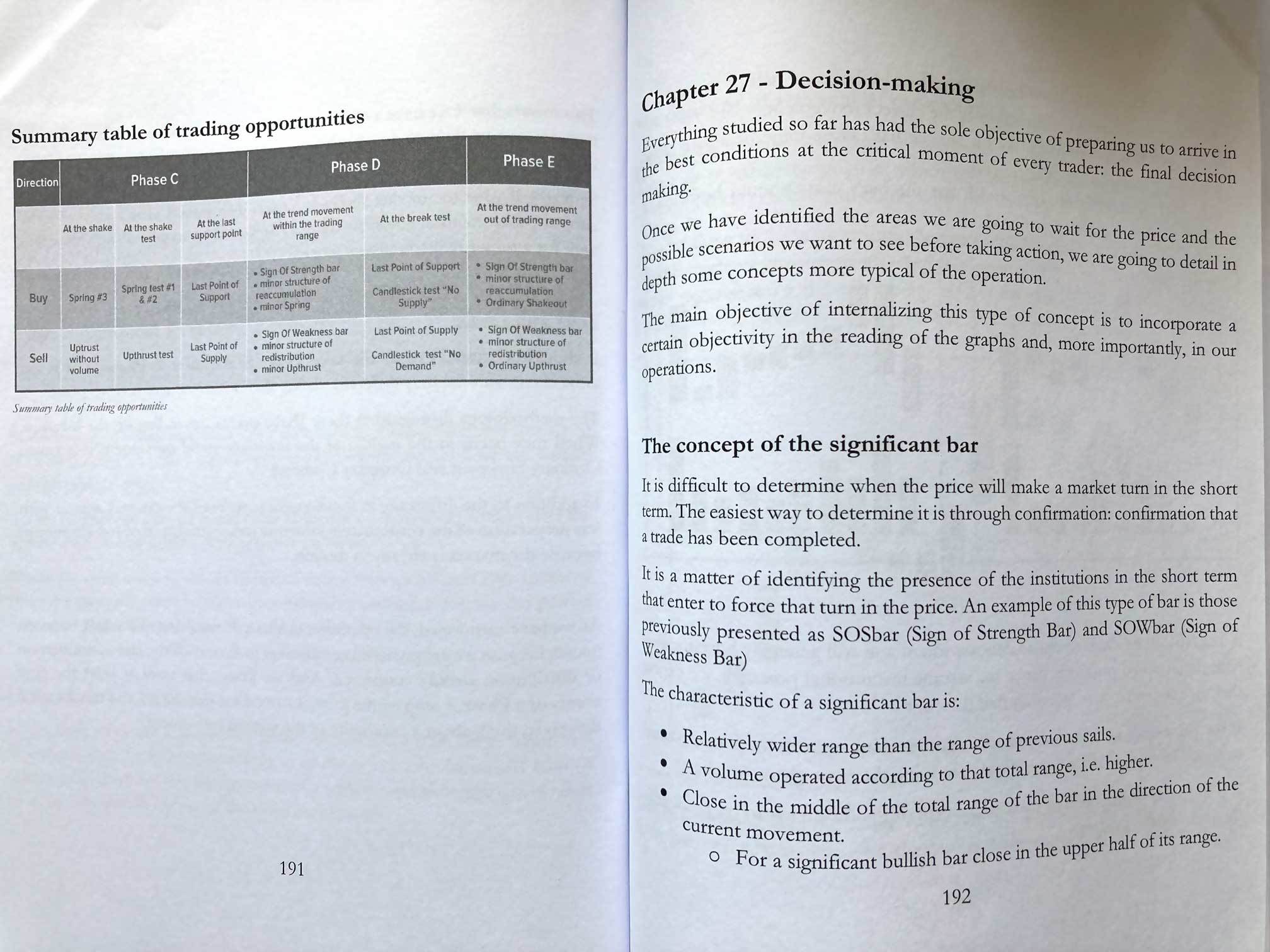

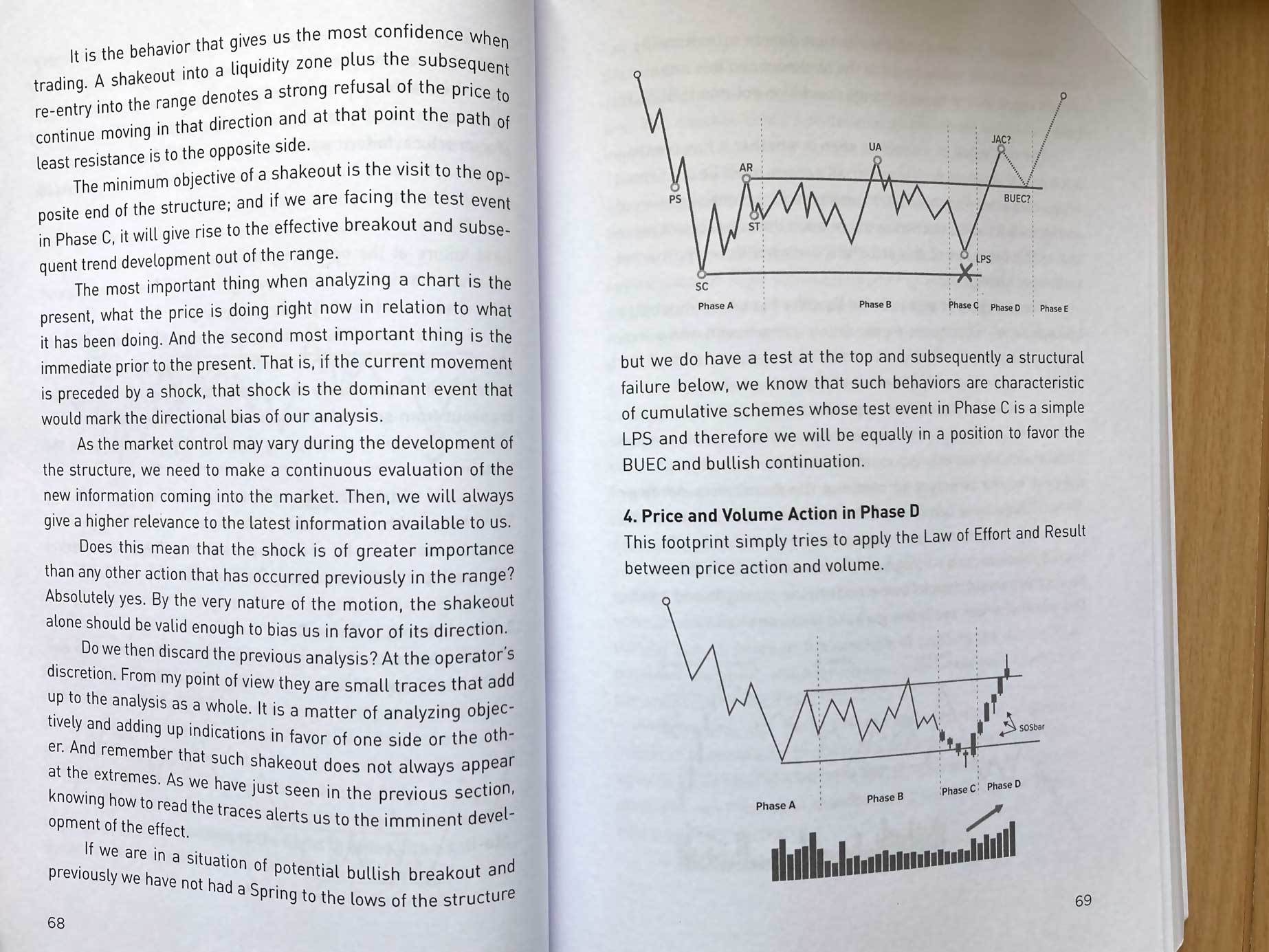

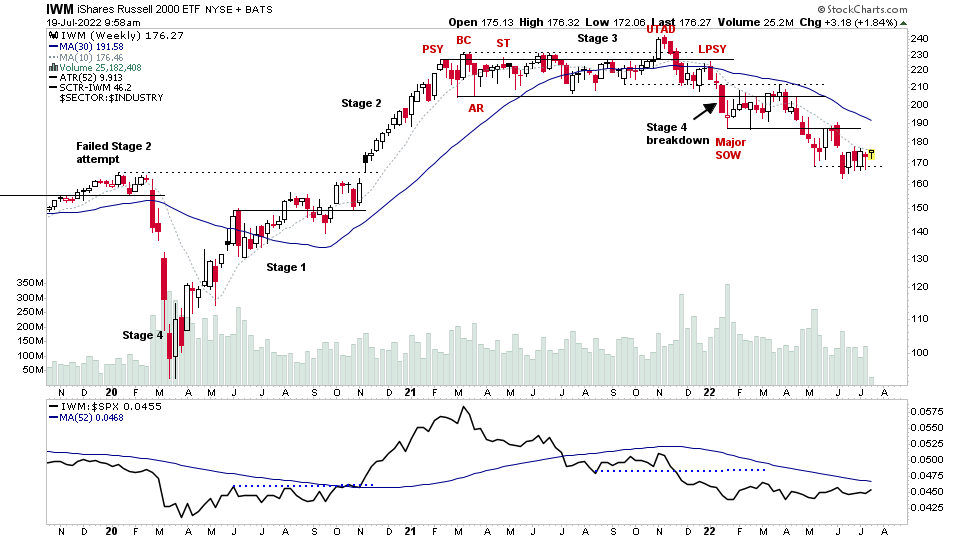

It uses a similar top down approach focusing on the market, then sectors and industry groups, and then individual stocks. However, the Wyckoff method adds a vital component missing from Stan Weinstein's Stage Analysis book, which is a detailed analysis of base structures using price, volume and relative strength techniques, and breaks them down into five Phases from Phase A at the start of base structure to Phase E, as the stock is beginning a new directional trend. As well as adding additional earlier entry points using Springs and Upthrusts and other entry points within base structures to your toolkit.

So, by learning the Wyckoff method, it will help you to identify Stage 1 accumulation and Stage 3 distribution structures on the chart, and the behaviour to look for at the buying and selling climaxes that begin the transition to a base, as well as fine tuning your understanding of more minor base structures that occur in during the trending environments in Stage 2 or Stage 4, which are referred to as re-accumulation or re-distribution structures. One example of a re-accumulation base structure in Stage 2 that people might be familiar with, would a Volatility Contraction Pattern (VCP) – made famous by Mark Minervini's books.

I've put together a list of the five best books to get up and running with the Wyckoff method below, as well as some additional resources.

Books To Learn the Wyckoff Method

#1 – The Three Skills of Top Trading

Hank Pruden

Dr. Henry Pruden's book – The Three Skills of Top Trading – combines the essential aspects of the Wyckoff method with trader discipline and psychology in an entertaining and informative way. The chapters of the book specifically on the Wyckoff method are only around one third of the book, but they give very clear explanations and examples of the key aspects of the Wyckoff method and practical applications. So I highly recommend reading for anyone wanting to get started with the Wyckoff method.

Buy on Amazon at: The Three Skills of Top Trading

#2 – The Wyckoff Methodology in Depth

Rubén Villahermosa

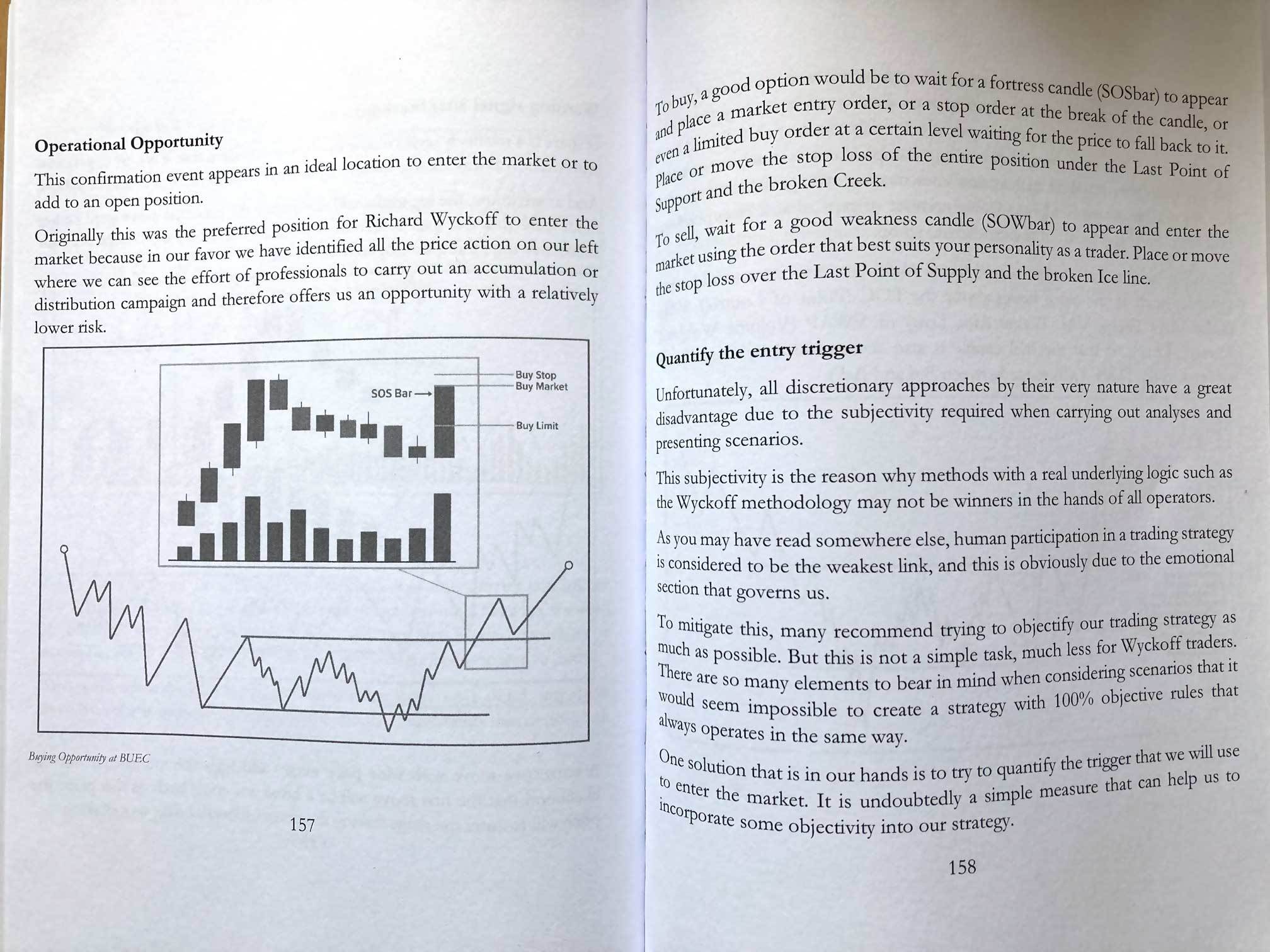

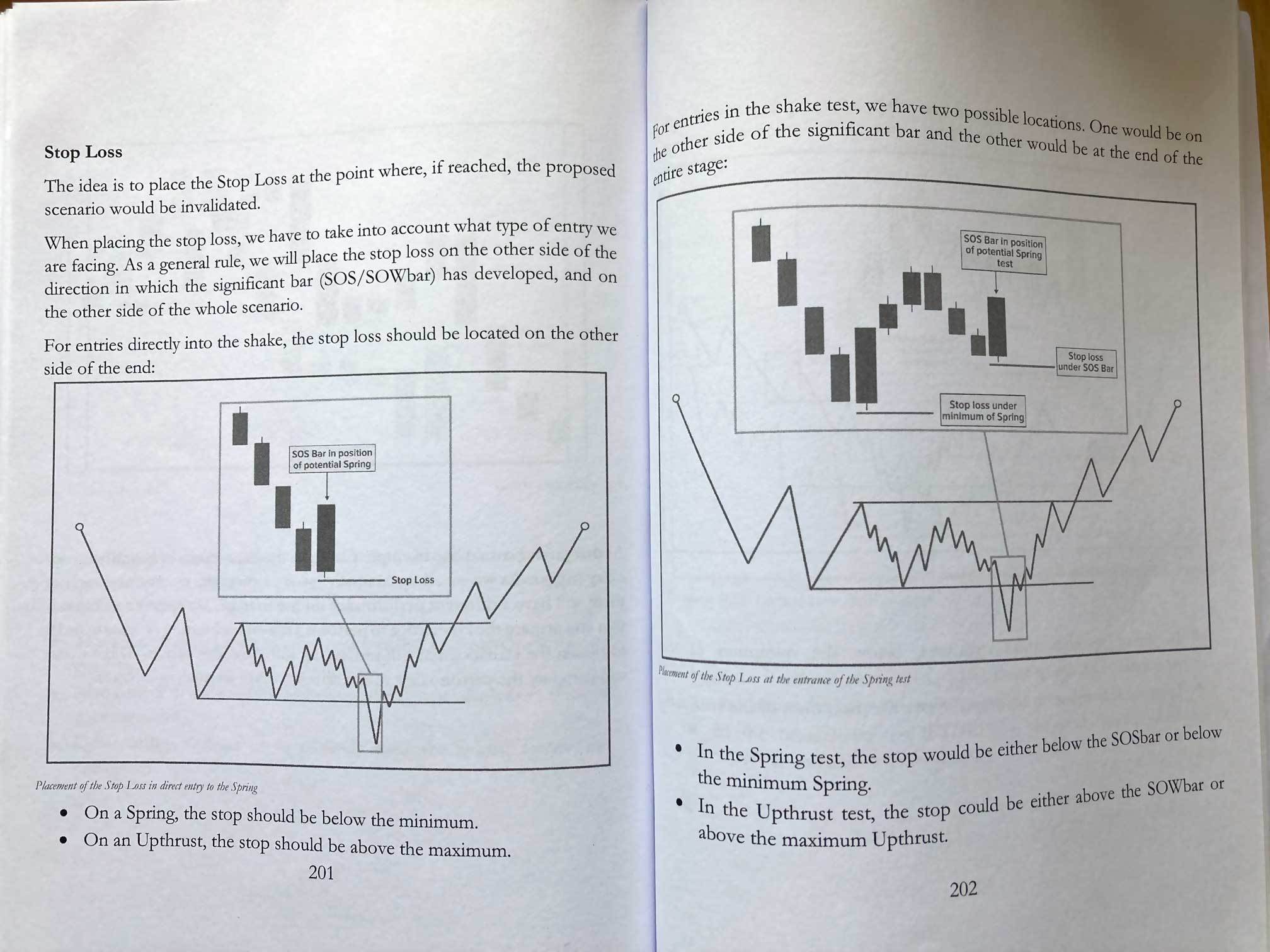

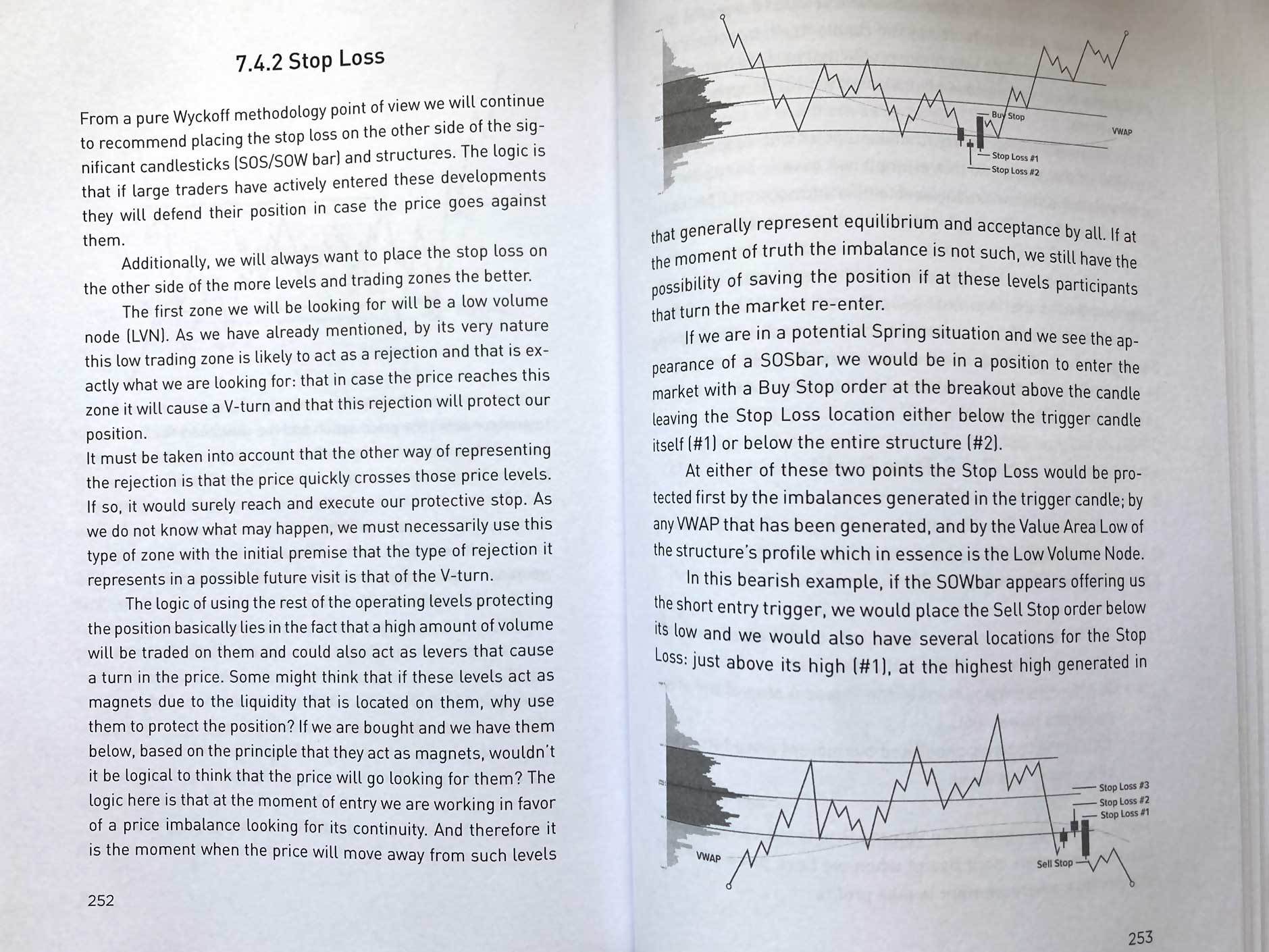

The Wyckoff Methodology in Depth is an excellent book to get up and running with the Wyckoff method, as it explains each concept step by step with clearly marked up examples, and has sections on typical entry points and stop loss positioning etc.

The book has been translated into English. So at times it can be a little unclear in a few places, but after a few reads you'll see a great deal of value from this book imo, and it's one that you'll go back to multiple times.

Buy on Amazon: The Wyckoff Methodology in Depth

#3 – Wyckoff 2.0: Structures, Volume Profile and Order Flow

Rubén Villahermosa

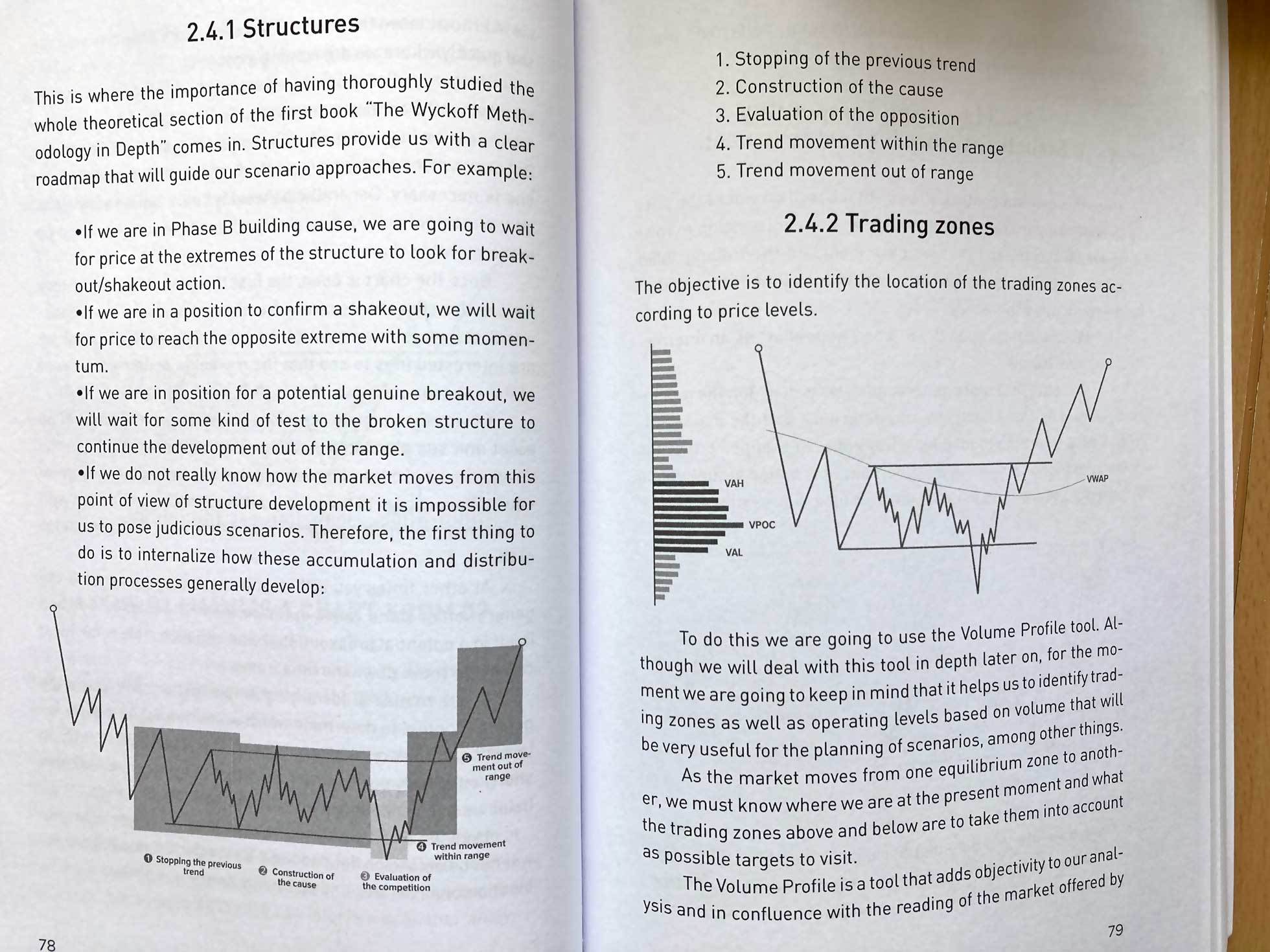

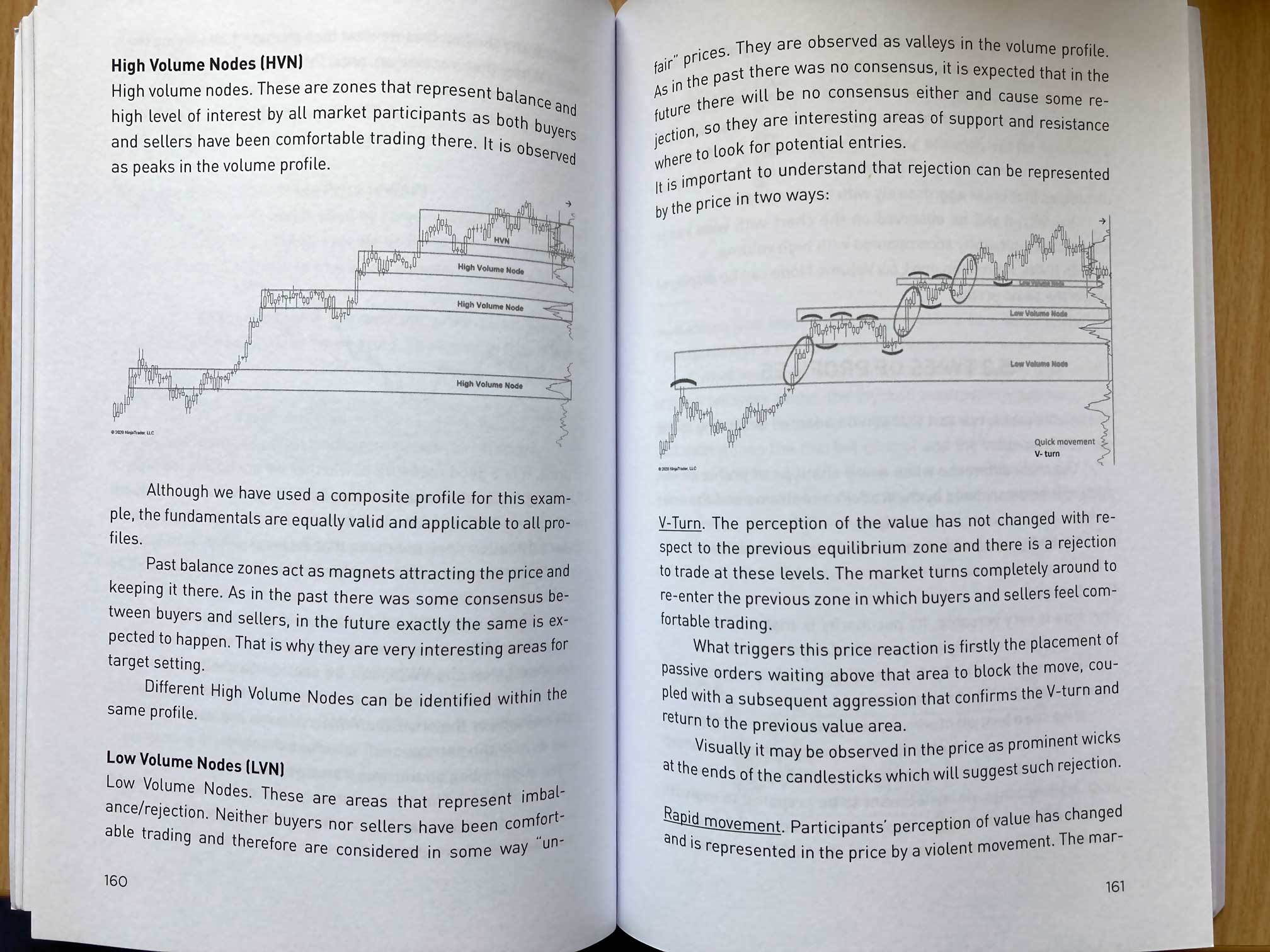

This book follows on from the excellent The Wyckoff Methodology in Depth book, and introduces more advanced concepts related to the Wyckoff method, as well combining with newer techniques / technologies by applying Volume Profile and Order Flow to the method, and so will take your understanding of the Wyckoff method to a more advanced level.

Buy on Amazon: Wyckoff 2.0: Structures, Volume Profile and Order Flow

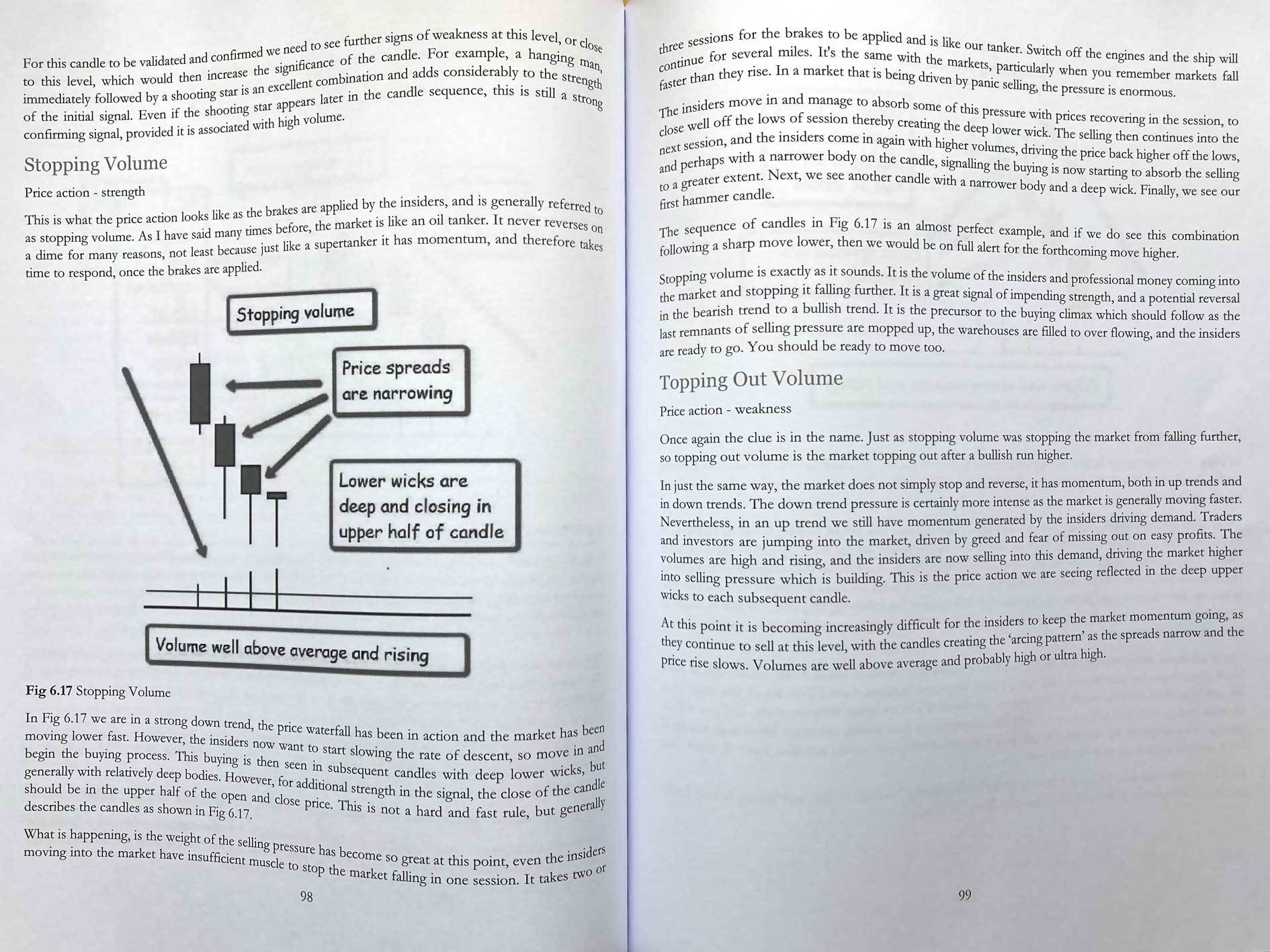

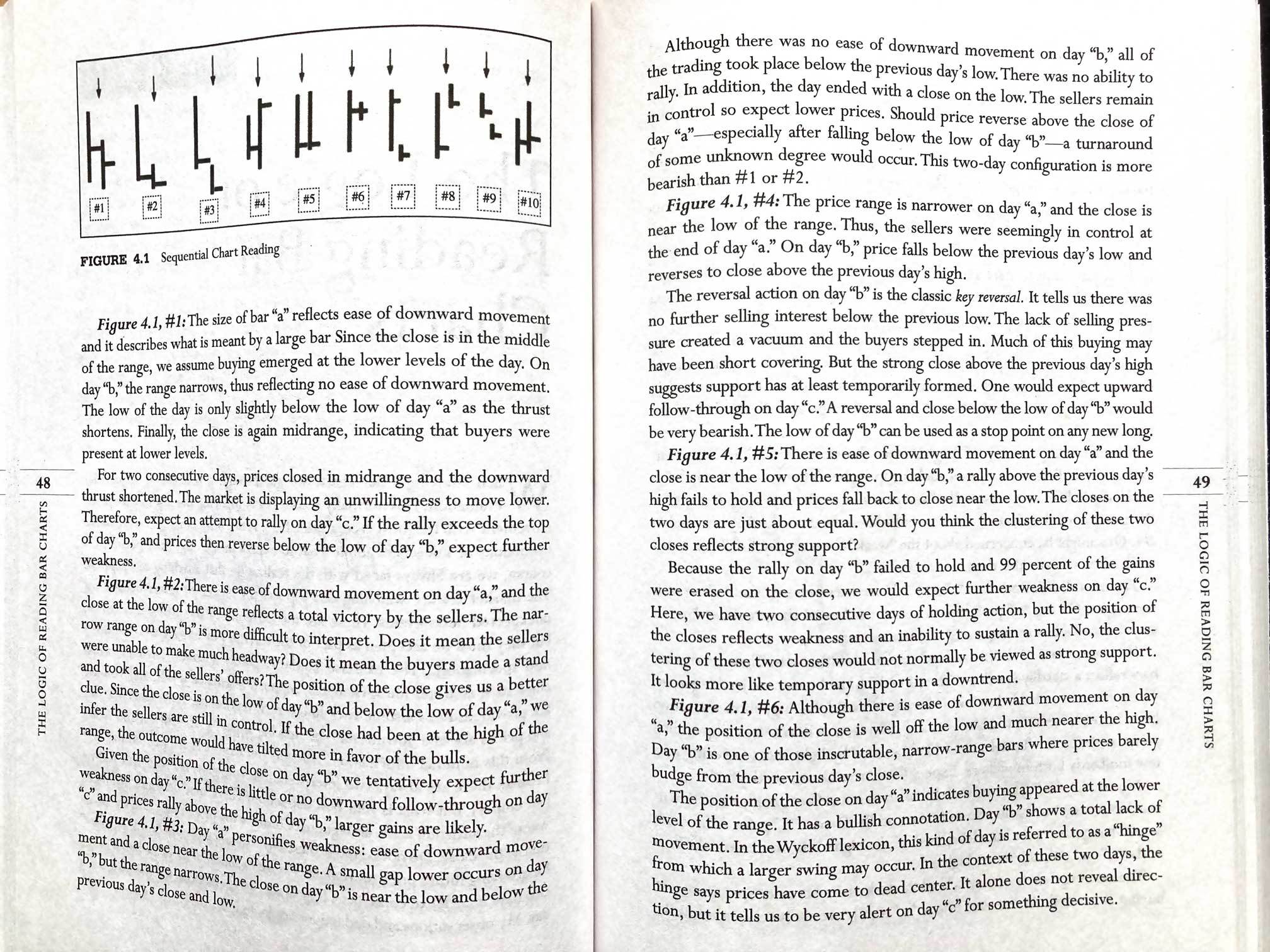

#4 – A Complete Guide To Volume Price Analysis

Anna Coulling

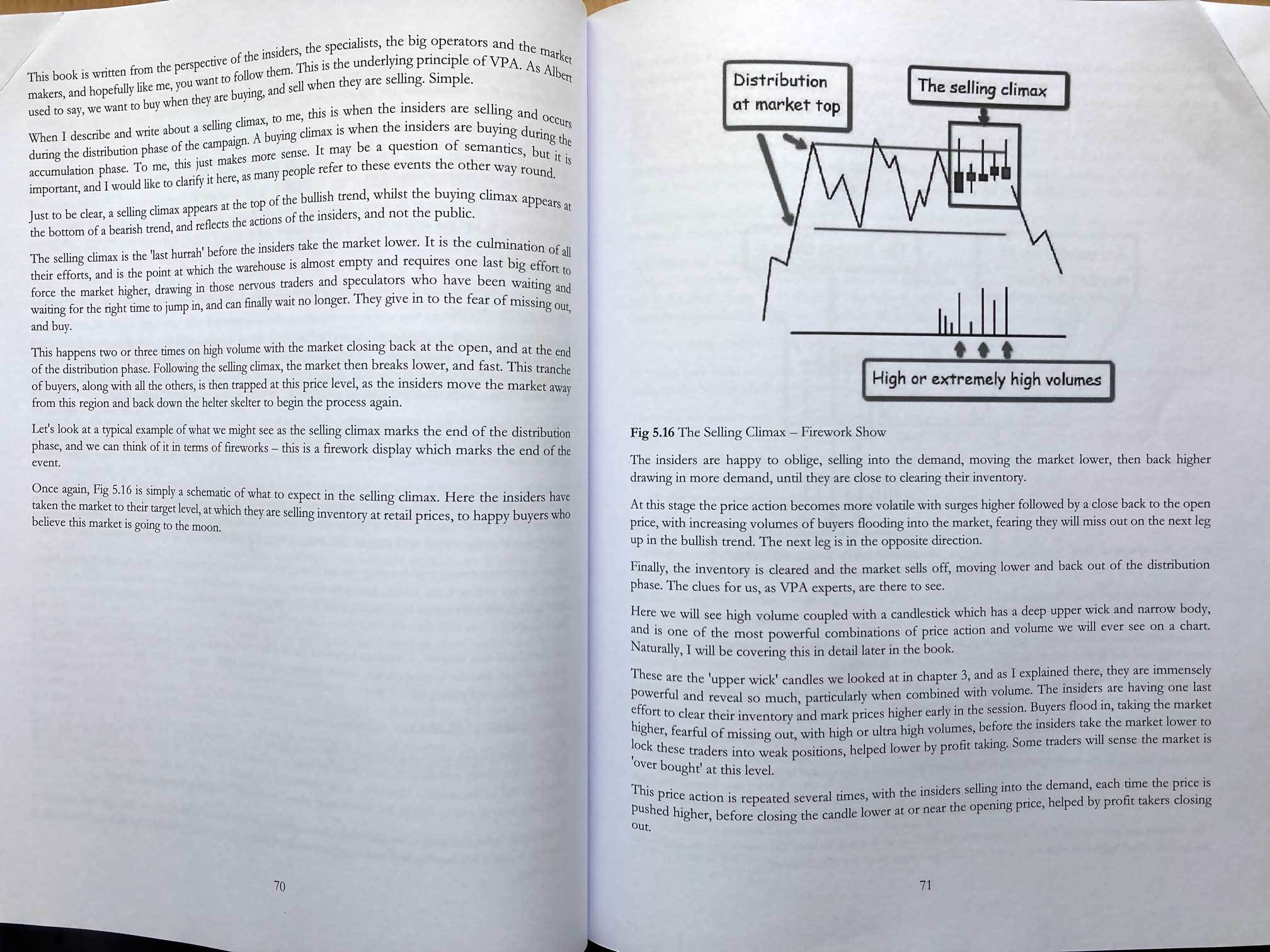

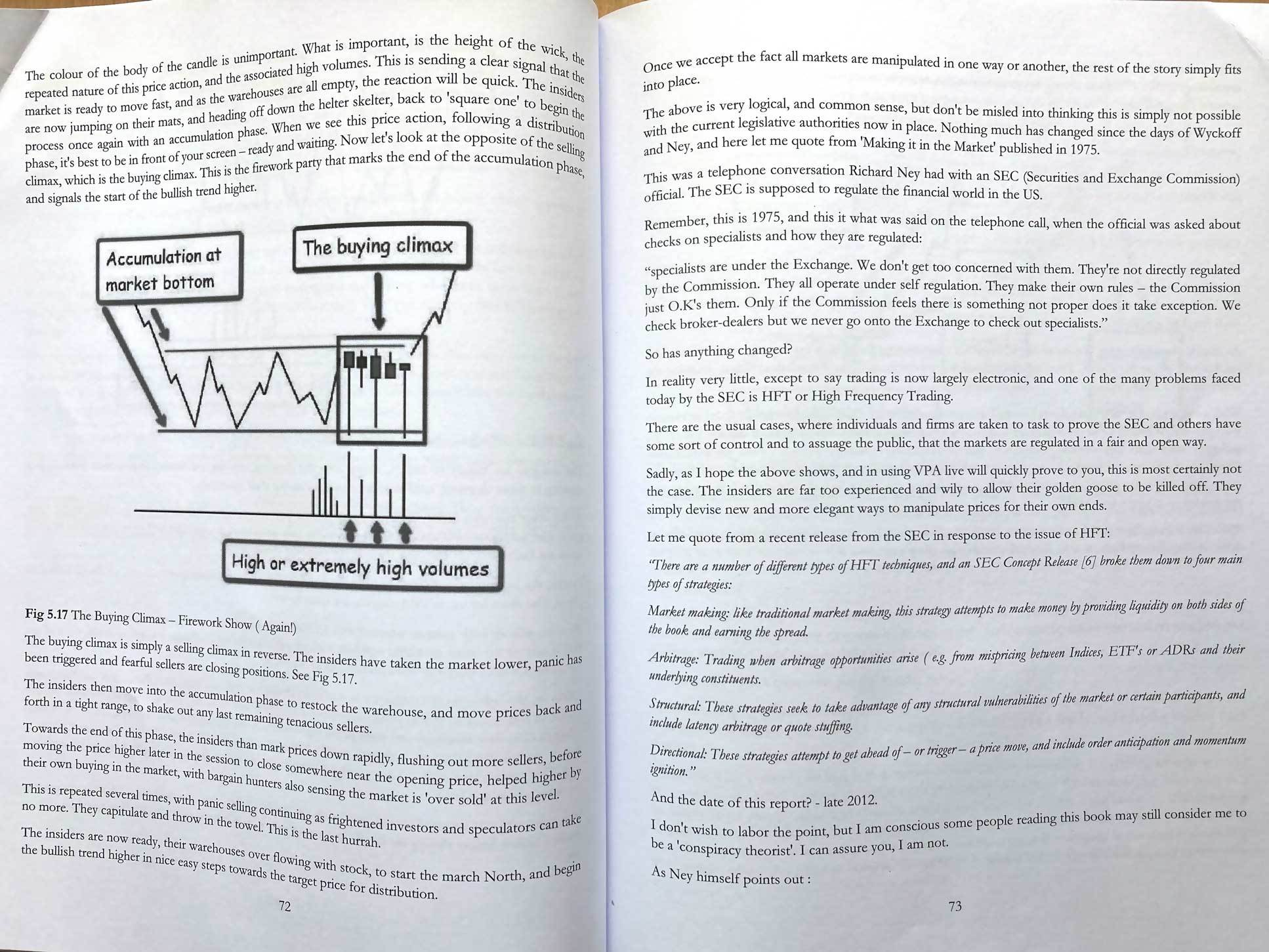

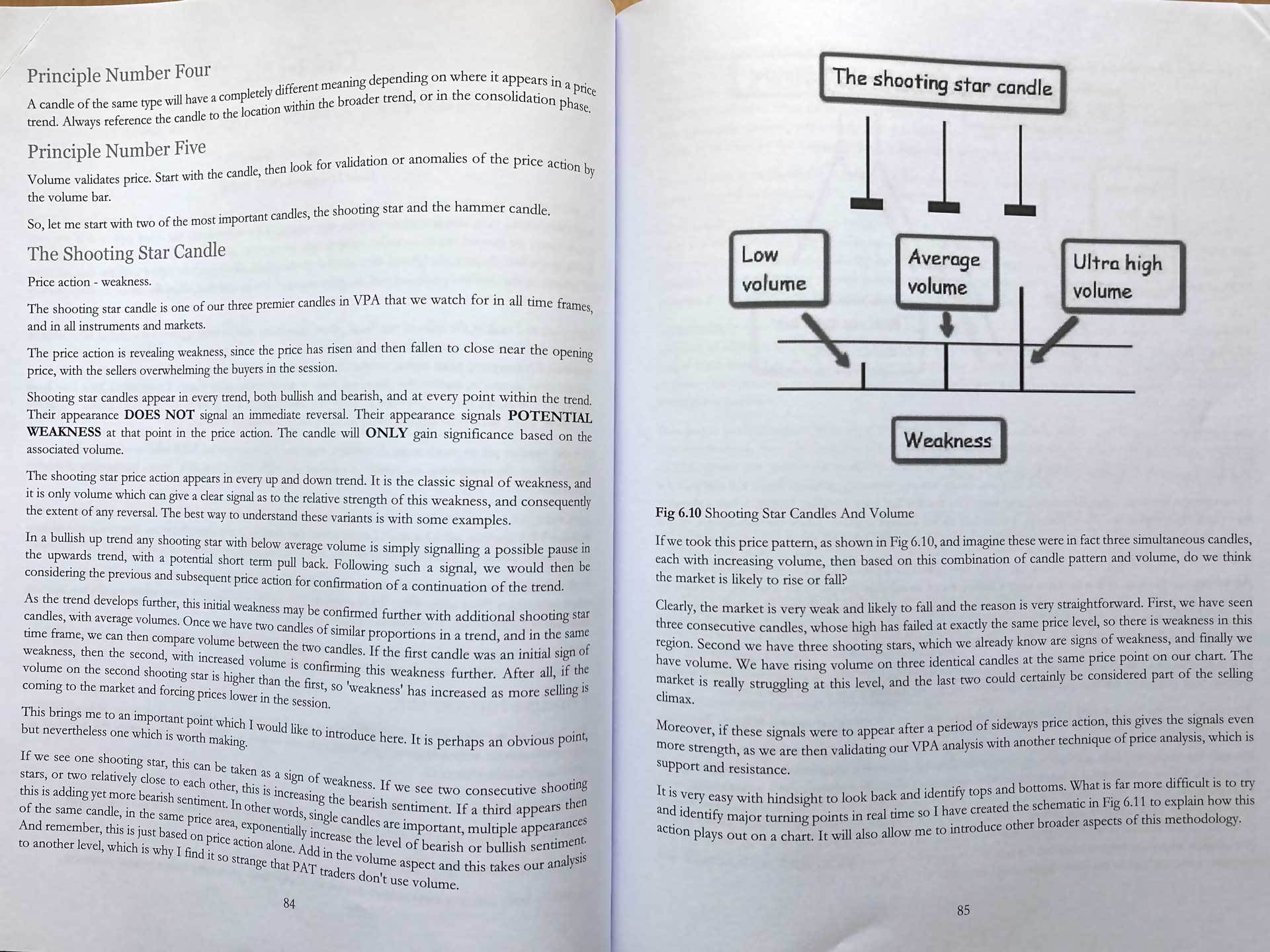

This book refers to Wyckoff multiple times throughout, but is primarily focused on tape reading techniques using by analysing price and volume behaviour. So is an excellent addition to your trading bookshelf.

Buy on Amazon: https://www.amazon.com/Complet...

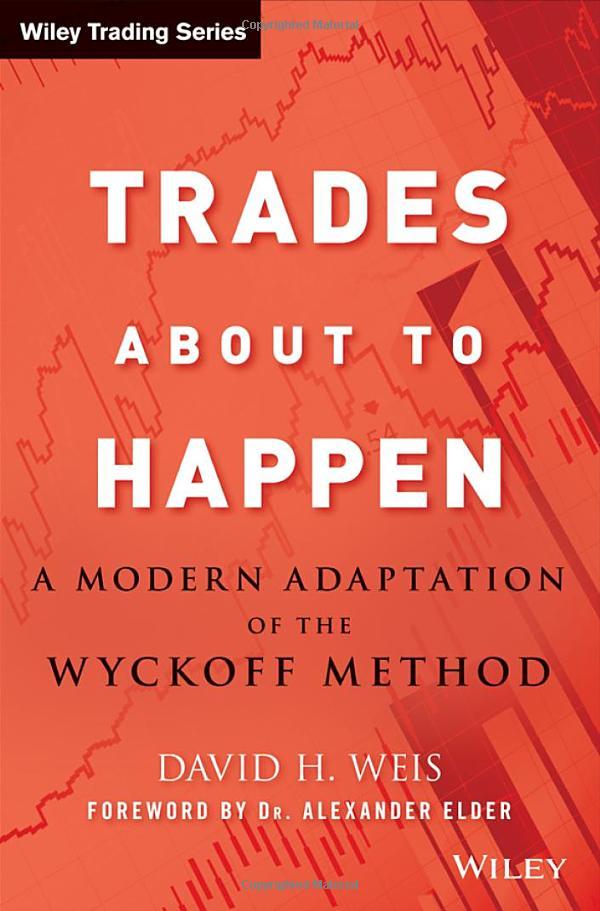

#5 – Trades About to Happen: A Modern Adaptation of the Wyckoff Method

David H. Weis

The final book of the five is by David H. Weis, and is focused more on Springs, Upthrusts, Absorption and Tape Reading techniques, and less directly about the Wyckoff method than some of the others mentioned above. But will help to deepen your understanding of some of the key concepts of the method, while introducing more modern approaches also.

Buy on Amazon: Trades About to Happen: A Modern Adaptation of the Wyckoff Method

Other Resources

There are multiple other books by Richard D. Wyckoff himself that you can find online. A simple search on Amazon for Wyckoff in the Books section of the search will show you many options.

Wyckoff Analytics

Wyckoff Analytics have a number of excellent video courses in order to learn the Wyckoff method in great detail which run over 12 to 15 weeks each semester, which you can find on their website: Wyckoff Analytics

However, if they are out of your price range, then they also have an excellent Wyckoff Trading Method youtube channel where you can learn lots about the Wyckoff method for free.

Stockcharts

Stockcharts website has a detailed tutorial post that gives you basics of the Wyckoff method covering the Wyckoff Price Cycle, the Three Wyckoff Laws and the Wyckoff Schematics etc.

The Wyckoff Method: A Tutorial

Wyckoff Stock Market Institute

Founded in 1931 by Richard D. Wyckoff and has numerous resources from training courses to old voice recordings of Bob Evans who expanded the method over the years, explaining the various concepts called Evan's Echoes.

Wyckoff Stock Market Institute

Wyckoff Point and Figure Tutorial

Learn how to do the Wyckoff Point & Figure Horizontal Counting Method

Combining the Wyckoff method with Stan Weinstein's Stage Analysis method

Combining the techniques of Richard D. Wyckoff and Stan Weinstein will take your Stage Analysis skills to the next level and give you greater understanding of tape reading concepts using Volume Price Analysis (VPA) on stocks within their base structures to help to determine the bias.

Stan Weinstein's Professional Tape Reader newsletter in the 1970s and 80s had the slogan at the top – The Tape Tells All.

So learning to combine the Wyckoff method with Stage Analysis method will help to refine your tape reading skills, so that you can act with confidence with entries and exits on both sides of the market, as well as appropriate risk management at the right time and in the right stocks.

Below an example of the Wyckoff Distribution Schematic applied to the Stage 3 top in the Russell 2000 in 2021, which completed with a Stage 4 breakdown / Major Sign of Weakness (SOW) in January 2022.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.