Stage Analysis Members Weekend Video – 21 August 2022 (1hr 34mins)

21 August, 2022The full post is available to view by members only. For immediate access:

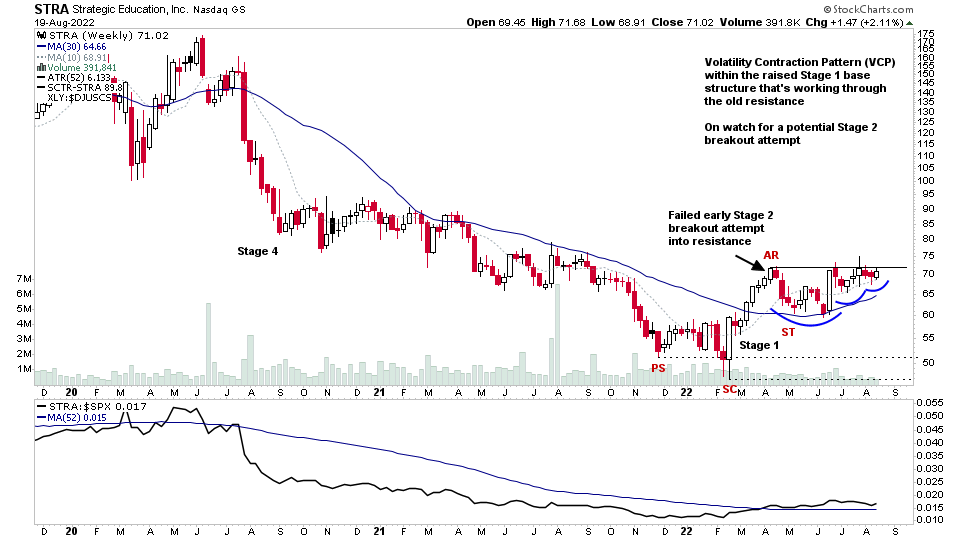

This weeks Stage Analysis Members video begins with a discussion of a more complex Stage 1 base structure that can develop when a stock has a very early Stage 2 breakout attempt from a small base that then quickly fails and broadens out into much larger Stage 1 base structure. This topic is a more advanced application of the method, but it is a common occurrence as people try to get in early before a proper basing process has occurred. So I talk about some of the common pitfalls and ways to avoid the potential opportunity costs.

In the members only content I go through the regular weekend content reviewing the major indexes, industry groups relative strength rankings, with a special feature going through the Stage Analysis of the weekly charts of the two leading groups currently – Renewable Energy Equipment and Coal.

Then a look at the IBD Industry Groups Bell Curve – Bullish % chart and Market Breadth Breadth update to help to determine the current weight of evidence, and then in the final part of the video I go through detailed mark-ups of some of the recent US watchlist stocks.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.