Gold Attempting To Move Back Above the 200 Day MA and the US Stocks Watchlist – 19 May 2022

The full post is available to view by members only. For immediate access:

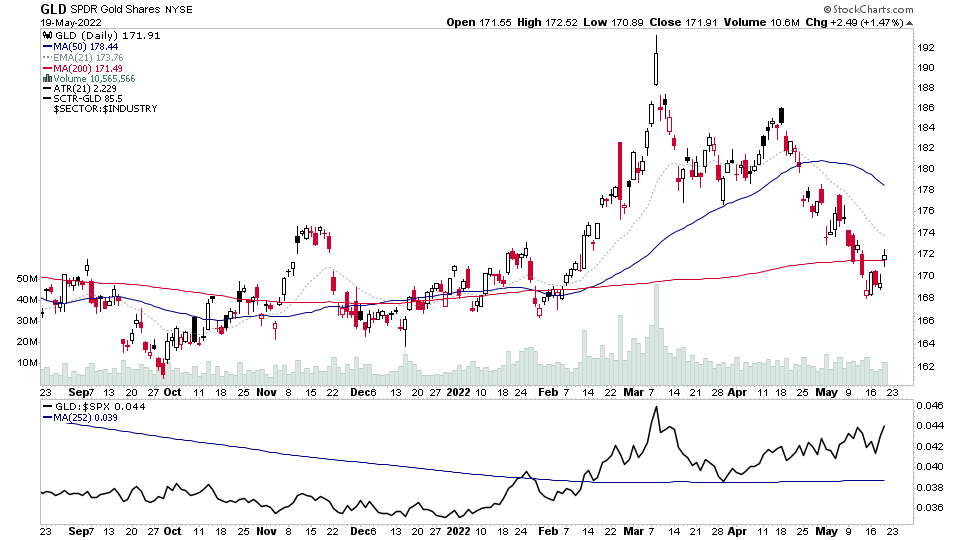

Gold and Miners are coming back into focus today, with a move by the Gold continuous futures back through the 200 day MA on increased volume, and so a potential spring type event at the moving average – which has also been showing up in the individual gold miners and some of the silver miners too over the last week or so.

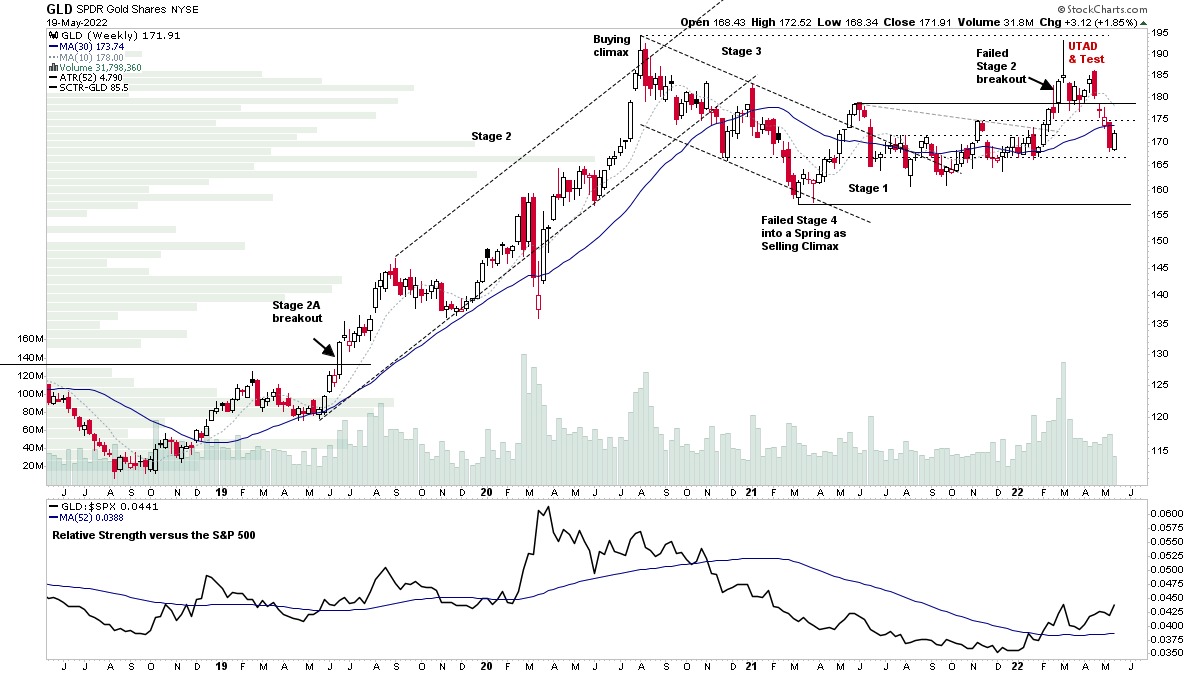

However, the weekly gold chart remains in a bearish Stage 3 position, after the failed Stage 2 breakout attempt rolled over and formed an Upthrust After Distribution (UTAD) and Test pattern over the last few months and dropped heavily back into the prior Stage 1 range and under the 30 week MA. And so any rebound attempt could run into resistance back near the breakdown area from the failed Stage 2 attempt.

US Stocks Watchlist – 19 May 2022

There were 30 stocks for the US stocks watchlist today.

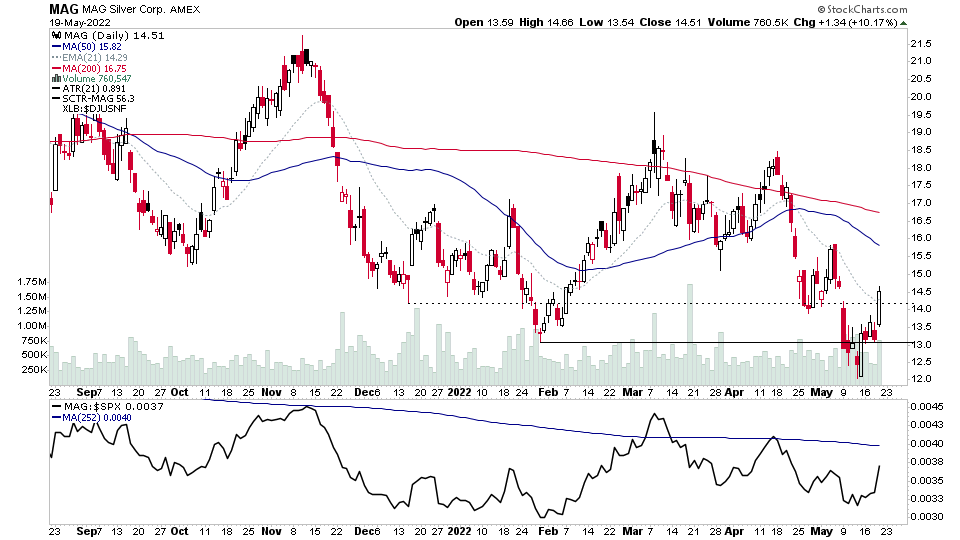

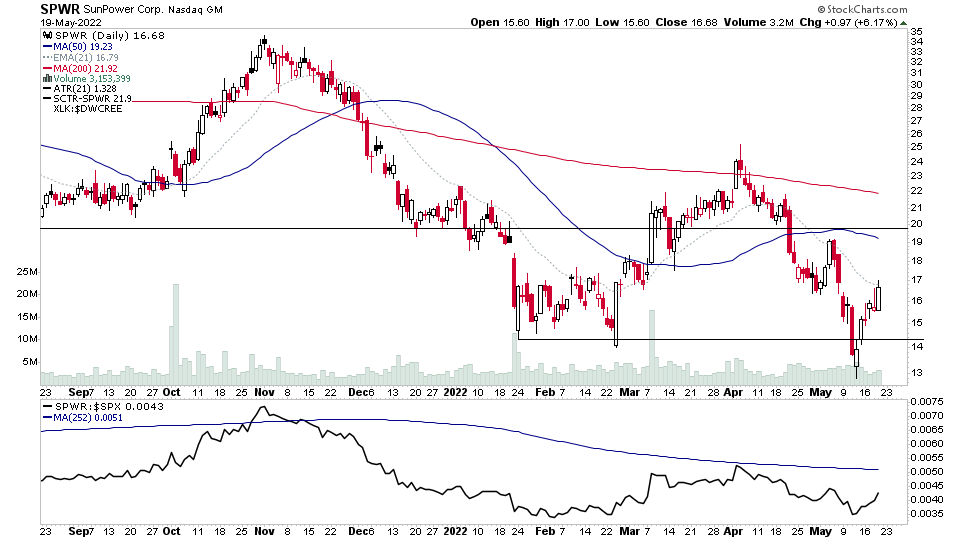

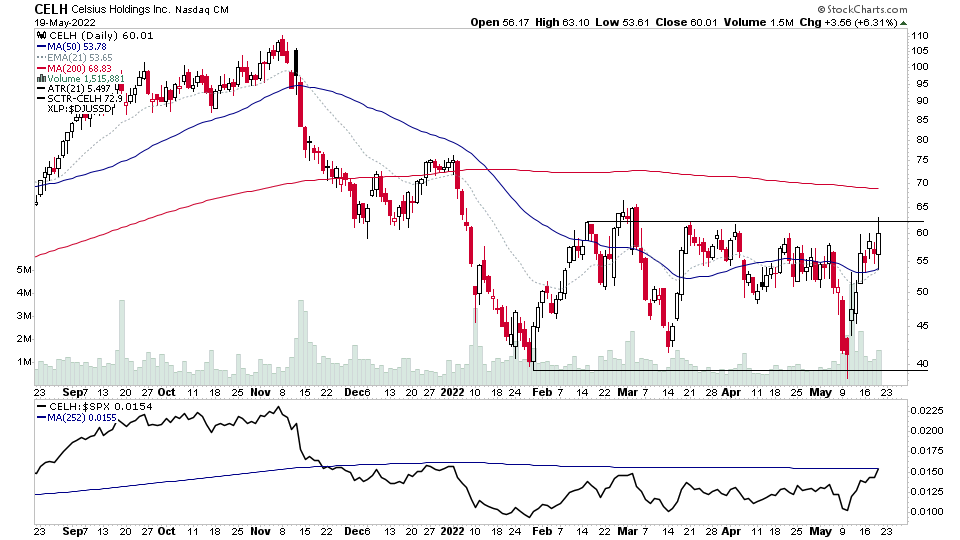

GLD, MAG, SPWR, CELH + 26 more...

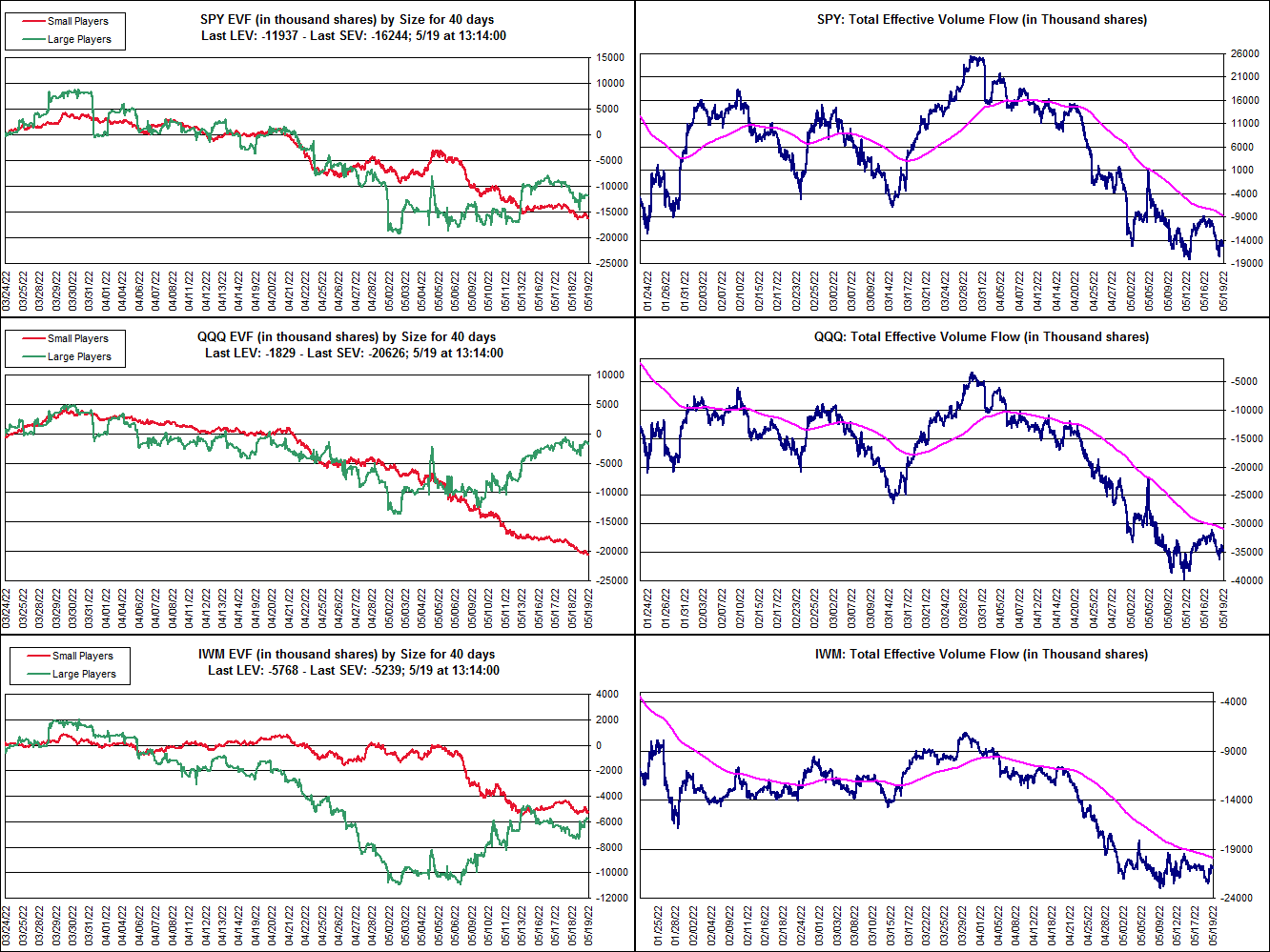

Market Breadth: Effective Volume

Updated large and small player Effective Volume charts of the SPY, QQQ and IWM etfs from effectivevolume.com for comparison.

The large and small player volume has diverged in the QQQ Nasdaq 100 etf since the 10th May and to a lesser level in the IWM Russell 2000 etf. While the SPY S&P 500 etf large and small player volume still remains fairly in-sync. However all should potential signs of basing action on their cumulative charts, but remain below their cumulative 20 day Moving Averages.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.