S&P 500 Divergence and the US Stocks Watchlist – 21 March 2023

The full post is available to view by members only. For immediate access:

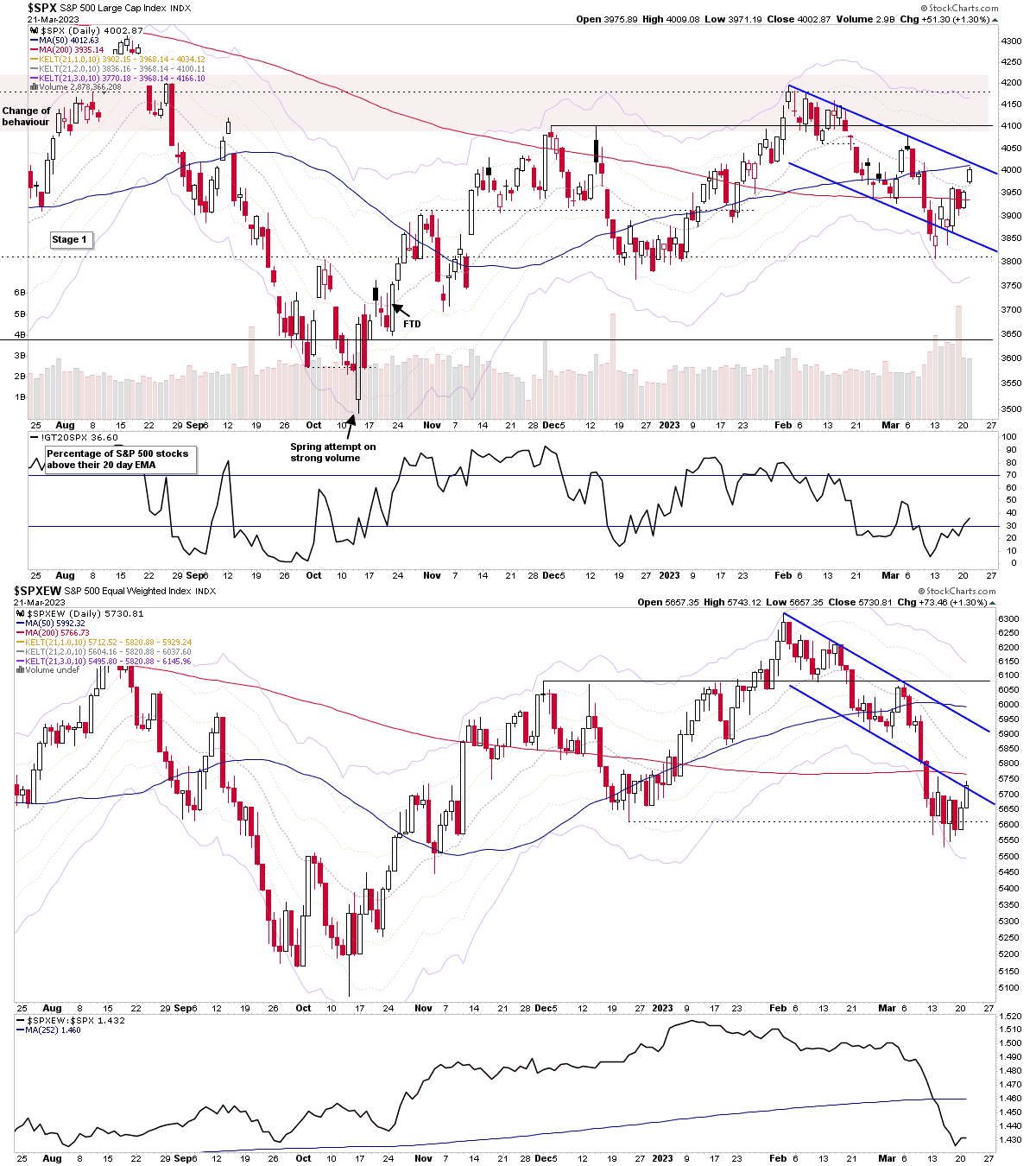

The S&P 500 moved strongly back above its 20 day EMA today. But as you can see in the above chart, there's a notable difference with the S&P 500 percentage of stocks above their 20 day EMA (middle indicator) which is at 36.60%, as the S&P 500 index is above its 20 day MA by almost 1%, and so you would expect at least 50% of S&P 500 stocks to be doing the same.

But there's only just over one-third of S&P 500 stocks above their 20 day EMA, which by digging a little deeper and comparing to the Equal Weight chart, you can see the difference more clearly including from the Mansfield RS line at the bottom of the chart, which compares the S&P 500 Equal Weight to the S&P 500 directly. So currently it appears that the mega-caps in the index are having an outsized effect on the S&P 500 performance in the near-term as the market heads into the Federal Reserve rate decision tomorrow.

So a volatile session is expected once the decision is announced and during the press conference that follows.

US Stocks Watchlist – 21 March 2023

There were 28 stocks highlighted from the US stocks watchlist scans today

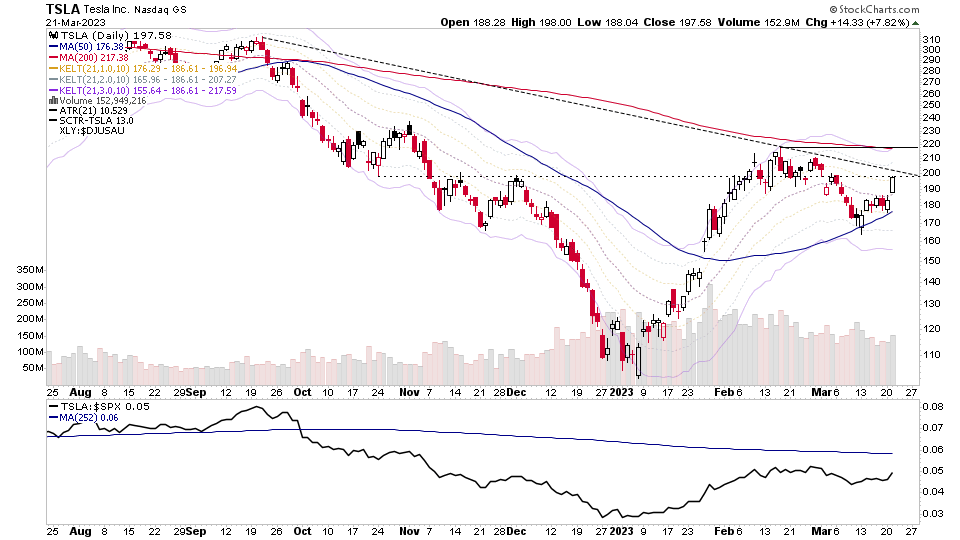

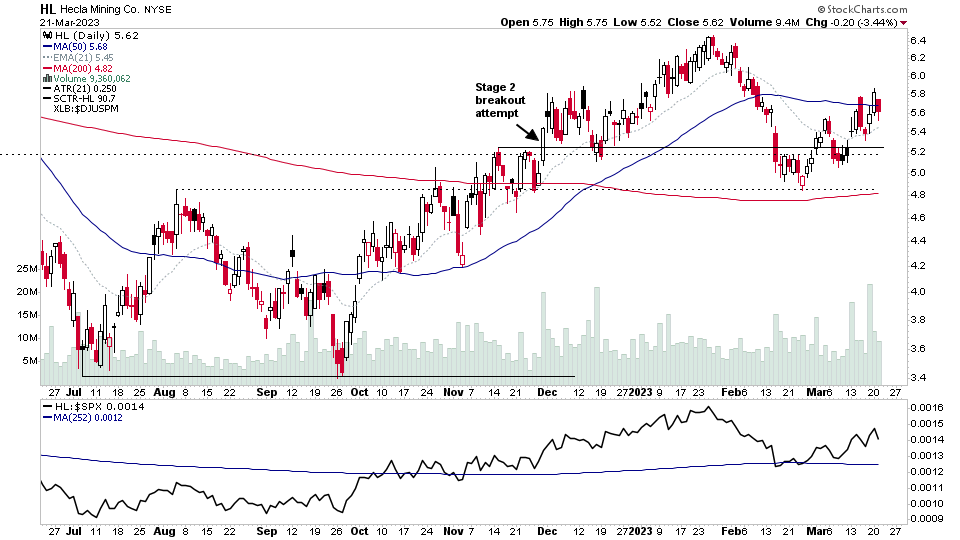

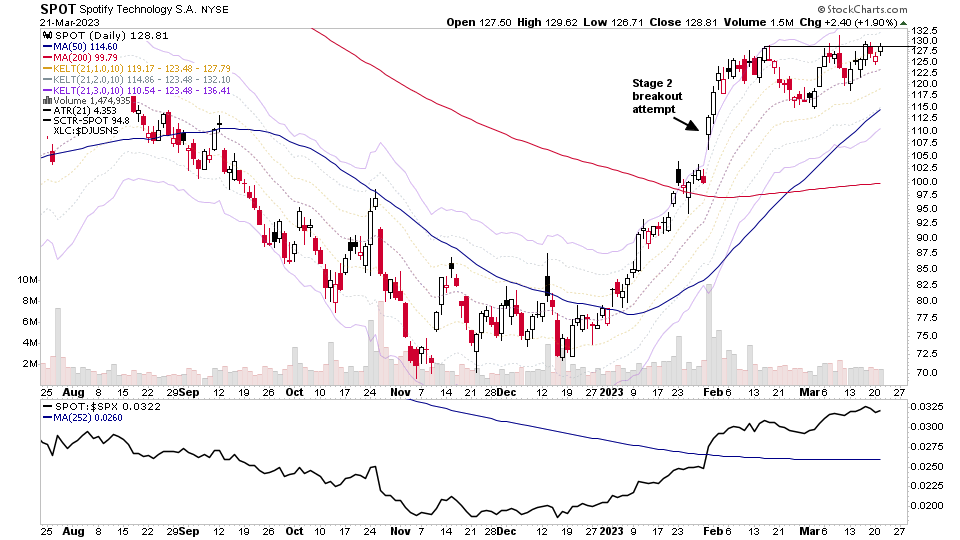

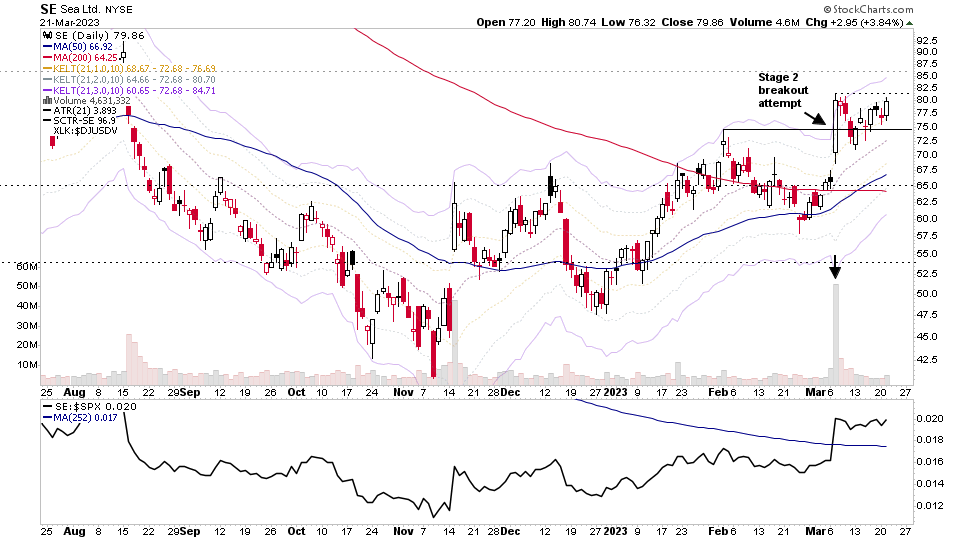

TSLA, HL, SPOT, SE + 24 more...

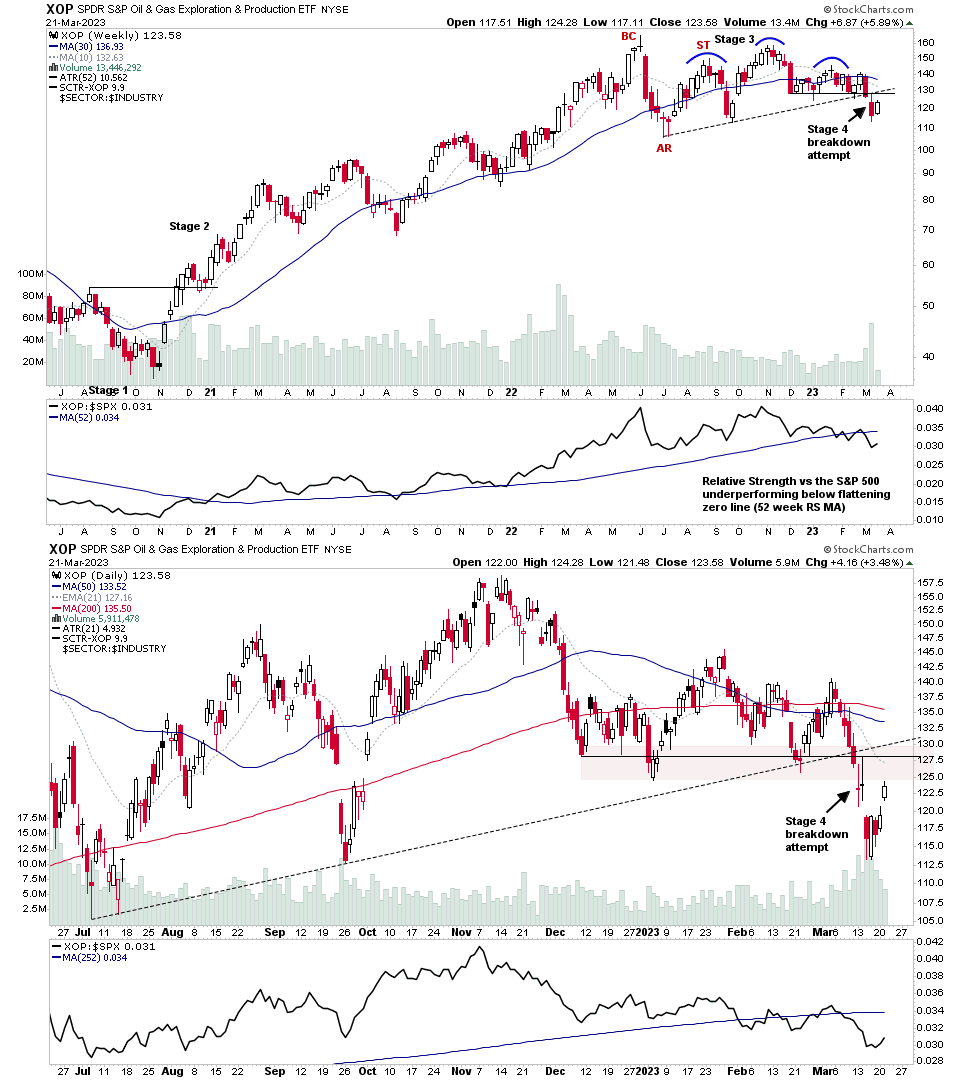

Oil & Gas Exploration & Production Group – Stage 4 Secondary Zone?

The Exploration & Production ETF (XOP) has rebounded from the initial Stage 4 breakdown attempt swing low back towards the breakdown level. So it is on watch for if it develops the Stage 4 secondary entry point, which occurs on a pullback to the Stage 4 breakdown level, which then starts to rollover at the support turned resistance of the breakdown level/zone.

See the post from last week which includes the short entry points diagram from Stan Weinstein's book and also highlighted a number of inverse ETFs from the Oil groups for potential ways to short the group – Crude Oil Attempting a Stage 4 Continuation Breakdown and the US Stocks Watchlist – 14 March 2023

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.