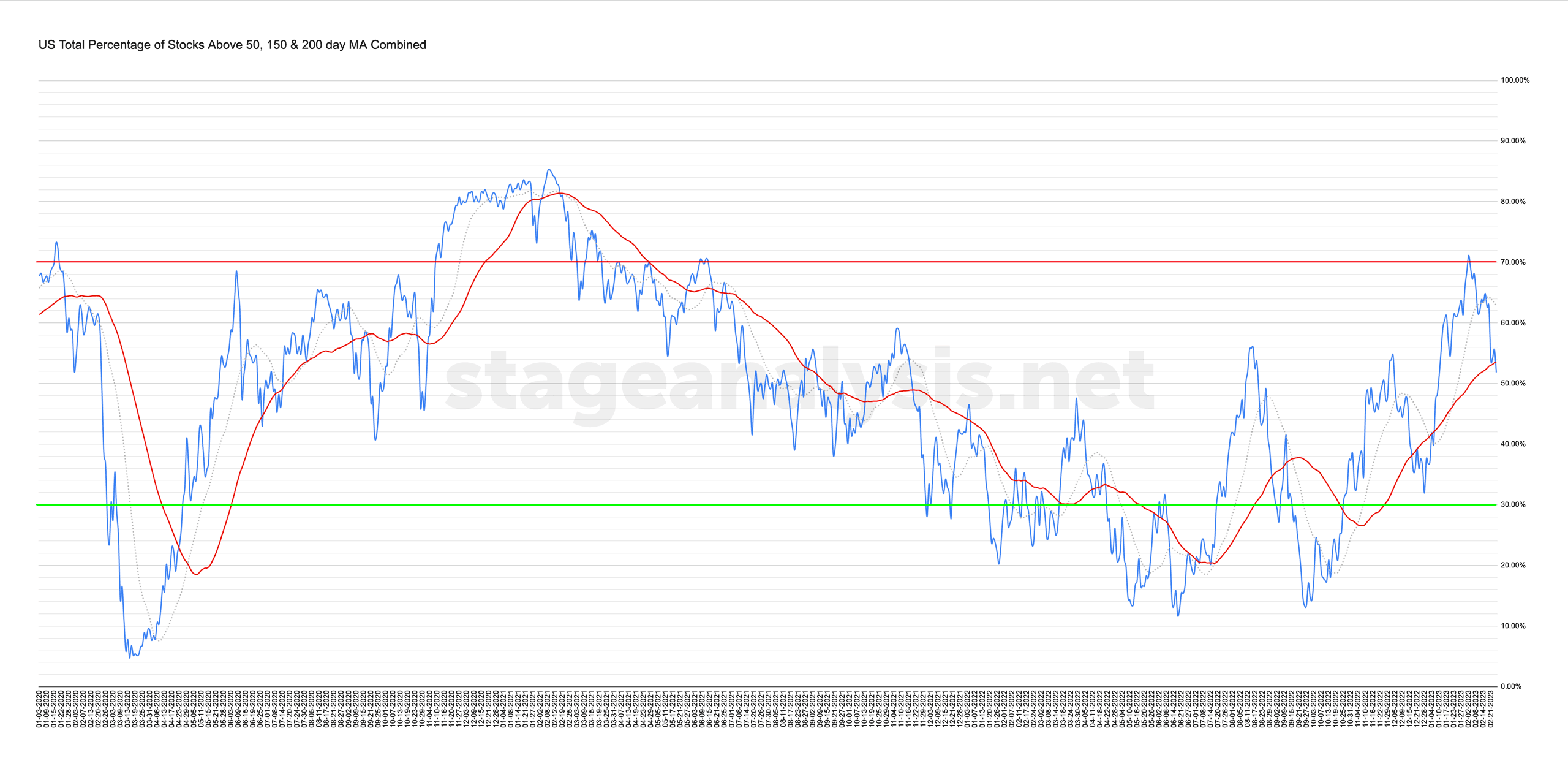

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

51.83% (-10.75% 1wk)

Status: Difficult Environment – Stage 1 zone

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) had a stronger decline this week, dropping -10.75%.

The overall combined average now stands at 51.83% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages, and crossed below its own 50 day MA signal line on Friday by -1.68%, and is -11.02% below the declining 20 day MA also.

So with the cross below the 50 day MA signal line, the status changes to Difficult Environment (as its below both the MAs) and it has fallen back into the middle range, which is the more neutral Stage 1 zone (40% to 60% range).

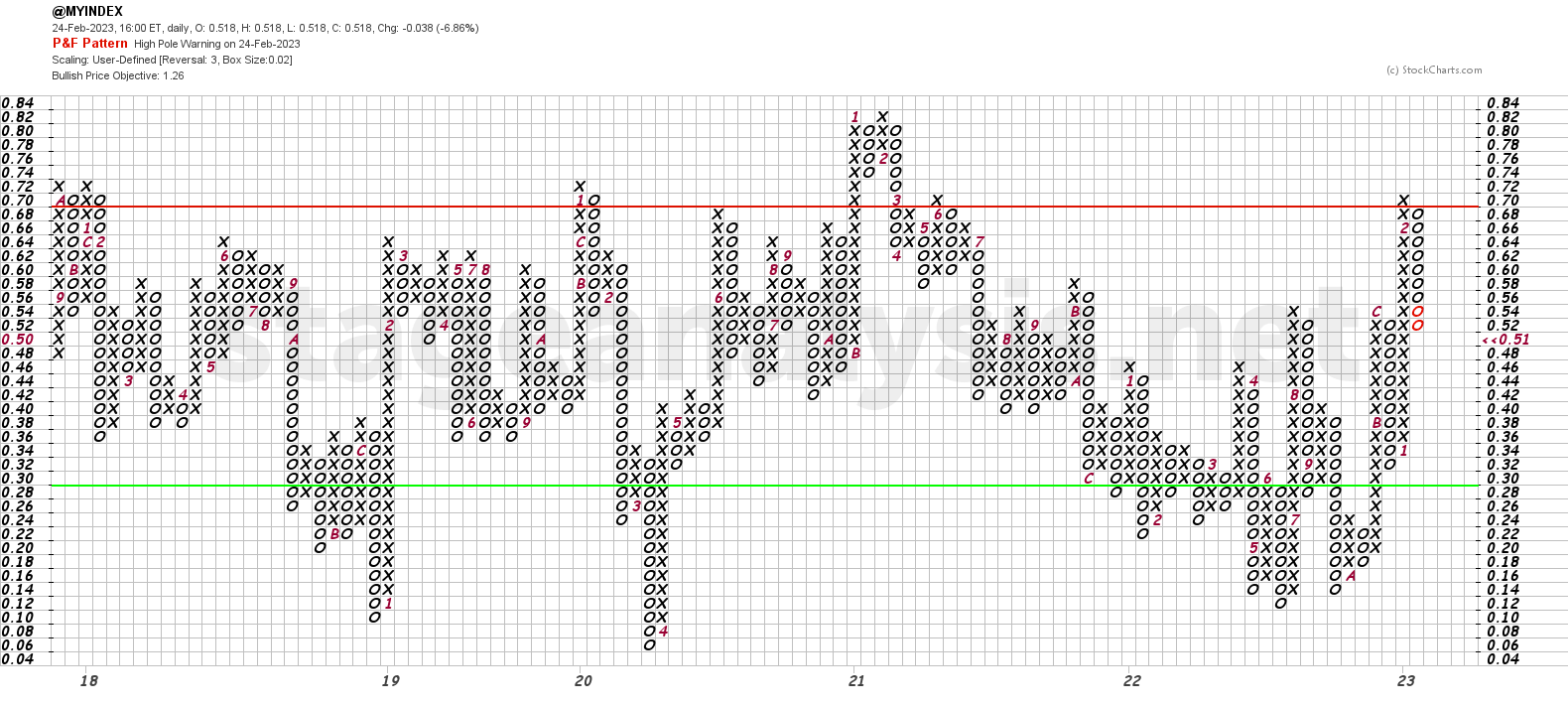

The Point and Figure (P&F) chart (shown above), declined by a further 5 Os this week, triggering a High Pole Warning on Friday, meaning it's declined by more half of the prior column of Xs. So the strategy based on the P&F chart remains on Defense (since the reversal to the column of Os on the 9th February), with the P&F status on Bear Alert status.

To learn more about the P&F statuses & their meanings view the Bullish Percent post.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.