Stock Market Update and US Stocks Watchlist – 5 July 2022

The full post is available to view by members only. For immediate access:

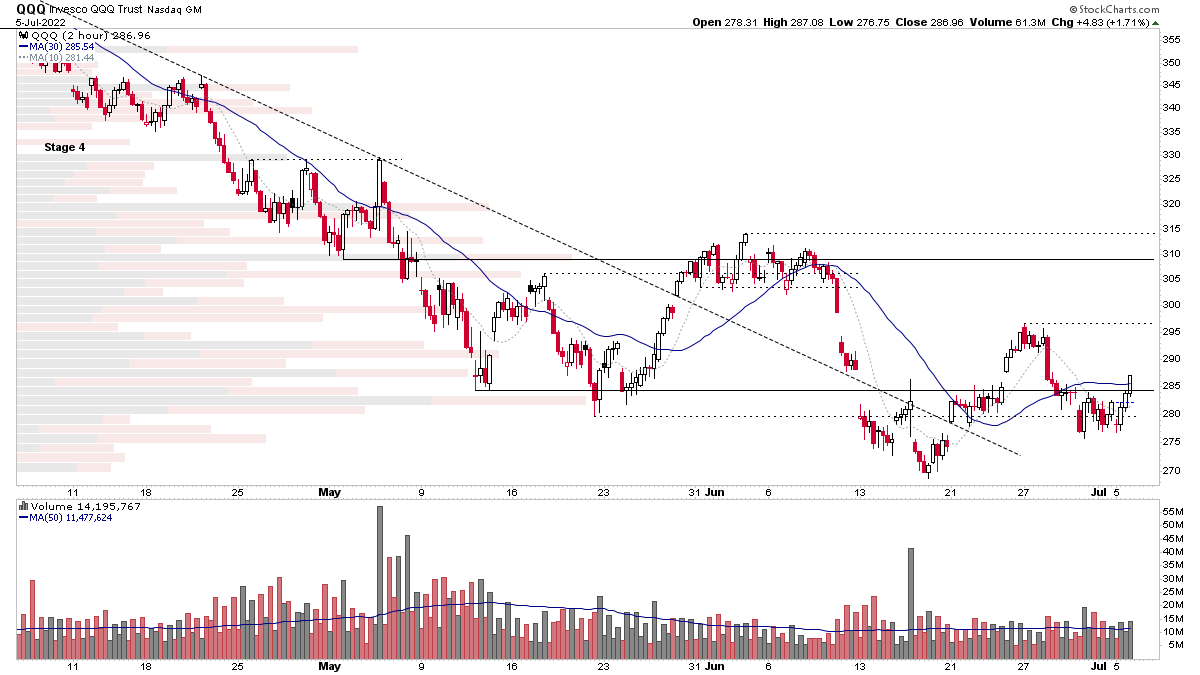

A mixed day in the stock market with the NYSE stocks down while the Nasdaq stocks were up. So rotation was the theme with money flowing out of the stronger RS areas, such as the Coal stocks, with the group chart now approaching its 200 day MA and moving into Stage 3. While more beaten up areas of the market had a stronger day, with the Nasdaq 100 closing up +1.71%, and as you can see on the intraday QQQ ETF chart above. The base structure is continuing to develop, with a potential higher low attempting to form. But the overall weekly Stage remains in a Stage 4 decline, so it could still just be another redistribution base structure, as we are in a downtrend. So we could just be treading water until earnings season gets under way next week.

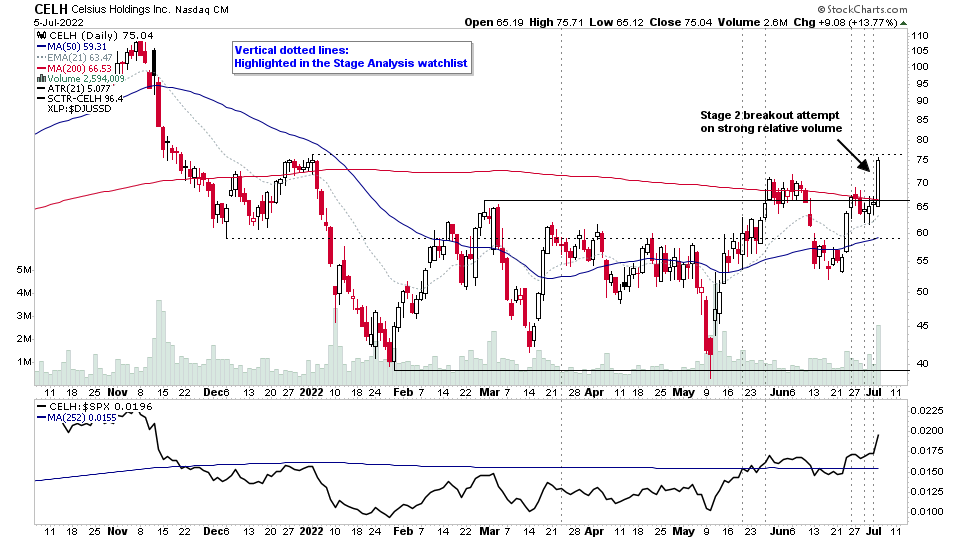

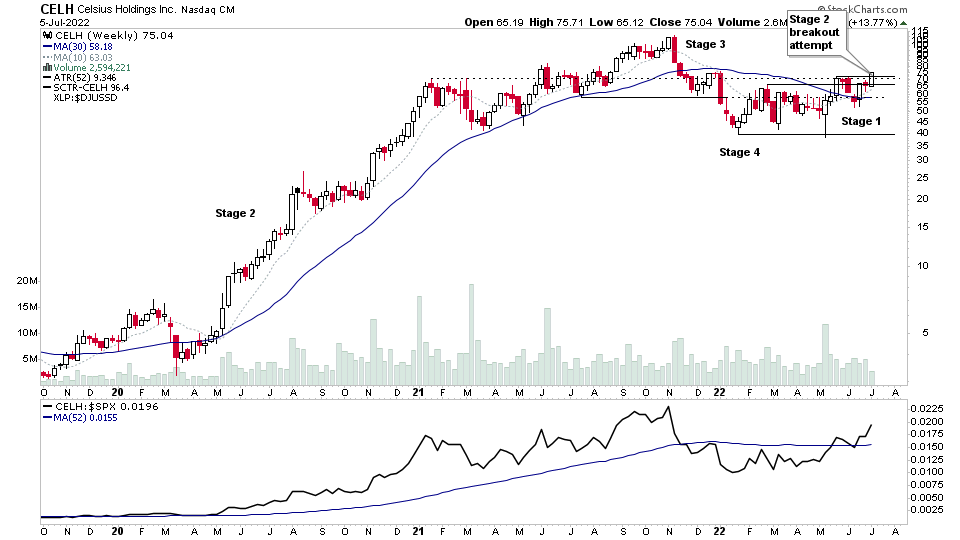

CELH – Stage 2 breakout attempt

CELH with a Stage 2 breakout attempt today on strong relative volume & RS vs the S&P 500 at new highs. It's been highlighted in the Stage Analysis watchlist six times since late March within the base structure – the last time was in the weekend watchlist. But, it has still got some resistance above to work through and is by no means is a confirmed move into Stage 2 yet. But, volume on the daily breakout today was strong at more than 2x the daily average. 3x plus is better, but in this Stage 4 market environment, it is a potential early leading stock.

Note the difference in the length & depth of the Stage 4 decline on the weekly chart compared to many stocks which have retraced their entire prior Stage 2 advances. It doesn't mean it can't still fail and form an upthrust. But this is the type of pattern that we what we are looking currently, which is a relatively shallow Stage 4 decline that didn't retrace all of the prior Stage 2 advance, and stocks that don't have strong overhead resistance zones.

US Stocks Watchlist – 5 July 2022

There were 14 stocks for the US stocks watchlist today

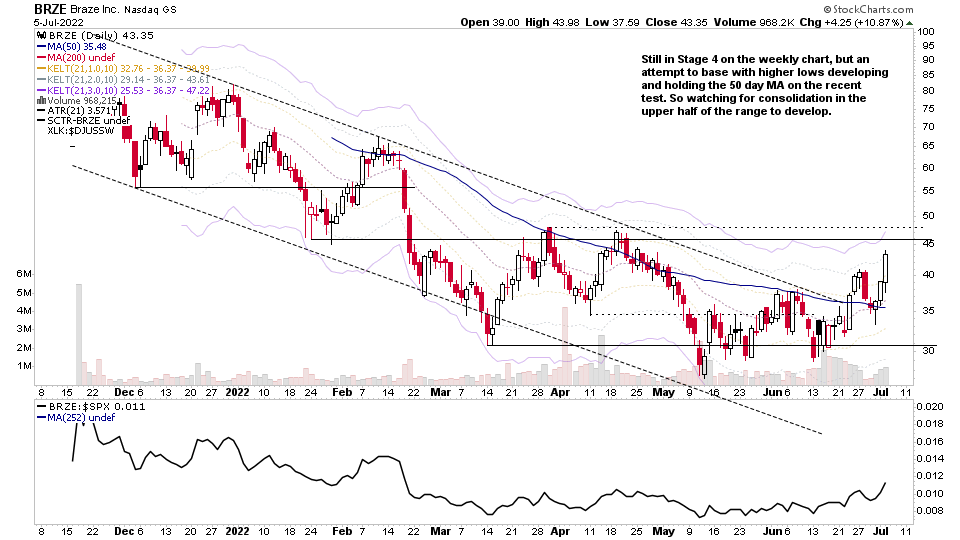

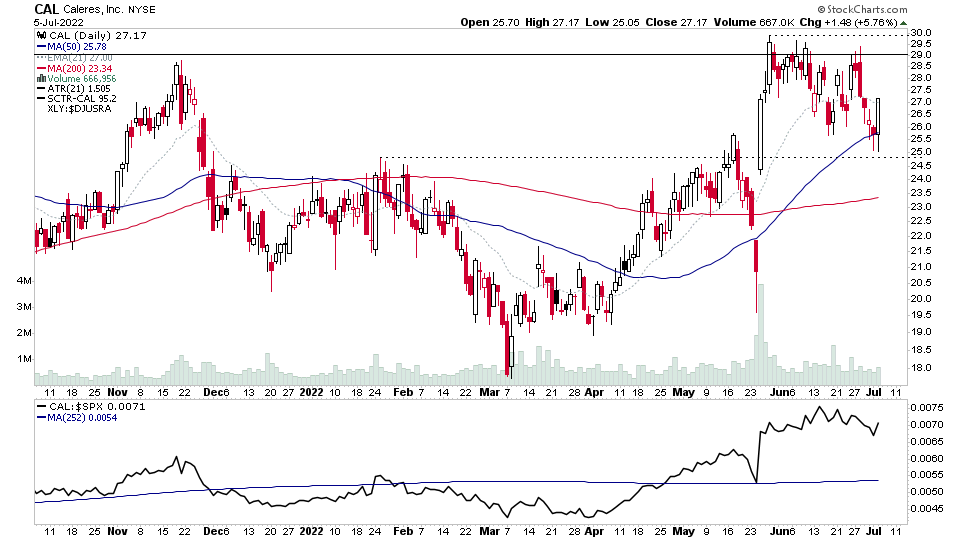

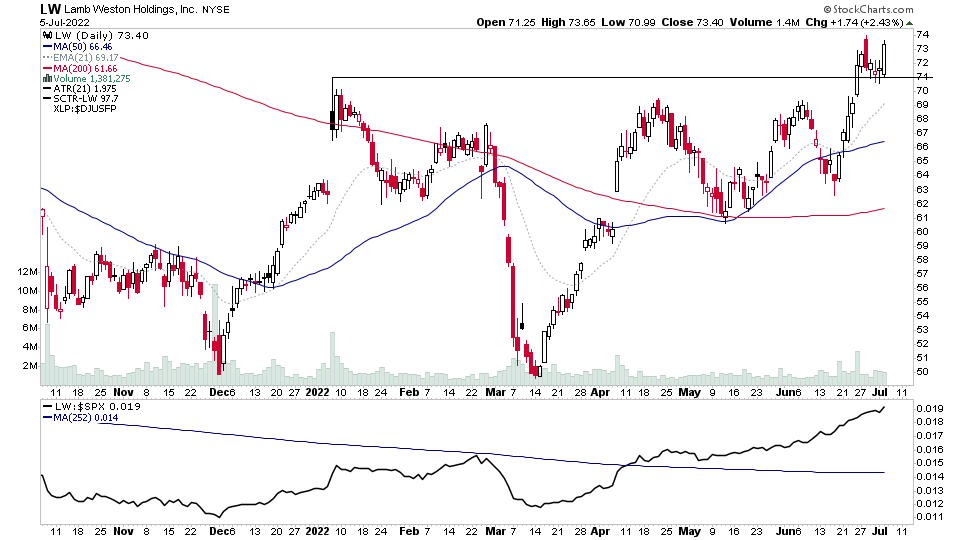

BRZE, CAL, LW + 11 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.