Stock Market Update and US Stocks Watchlist – 1 July 2022

The full post is available to view by members only. For immediate access:

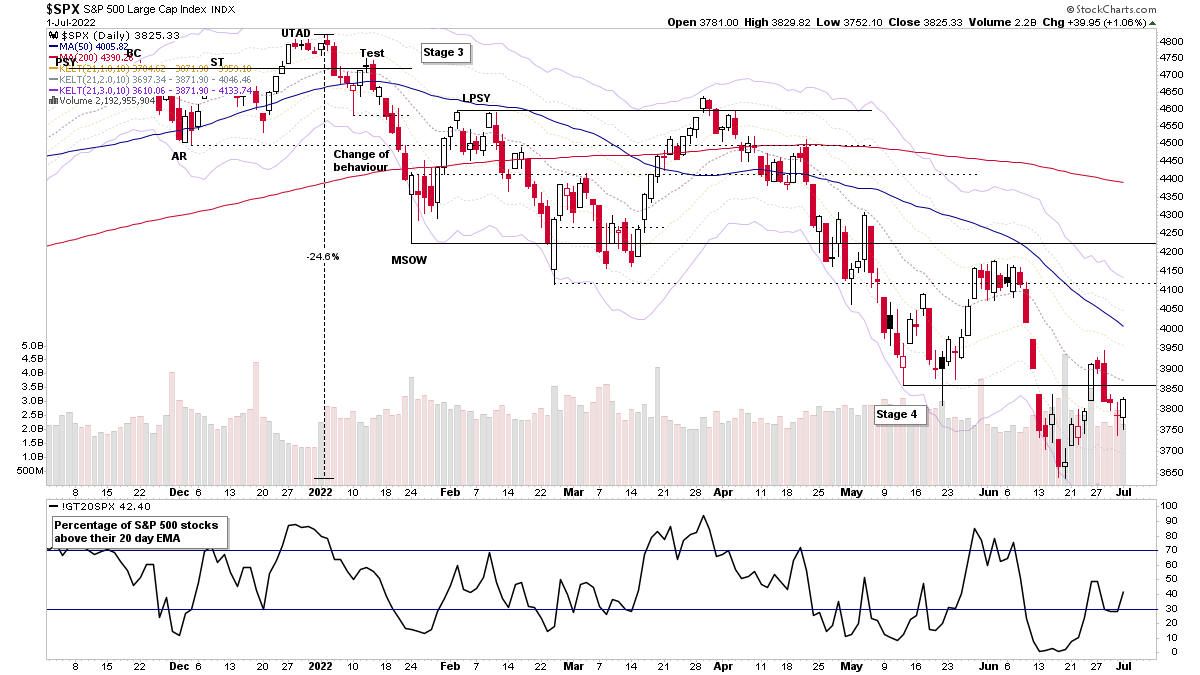

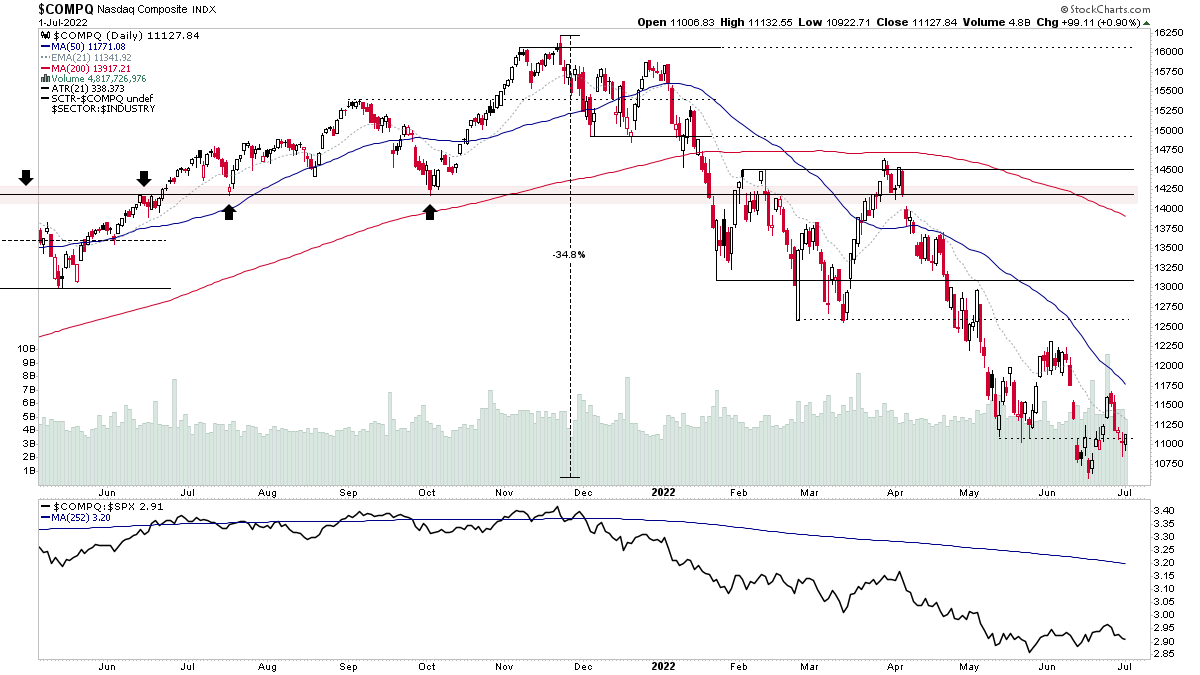

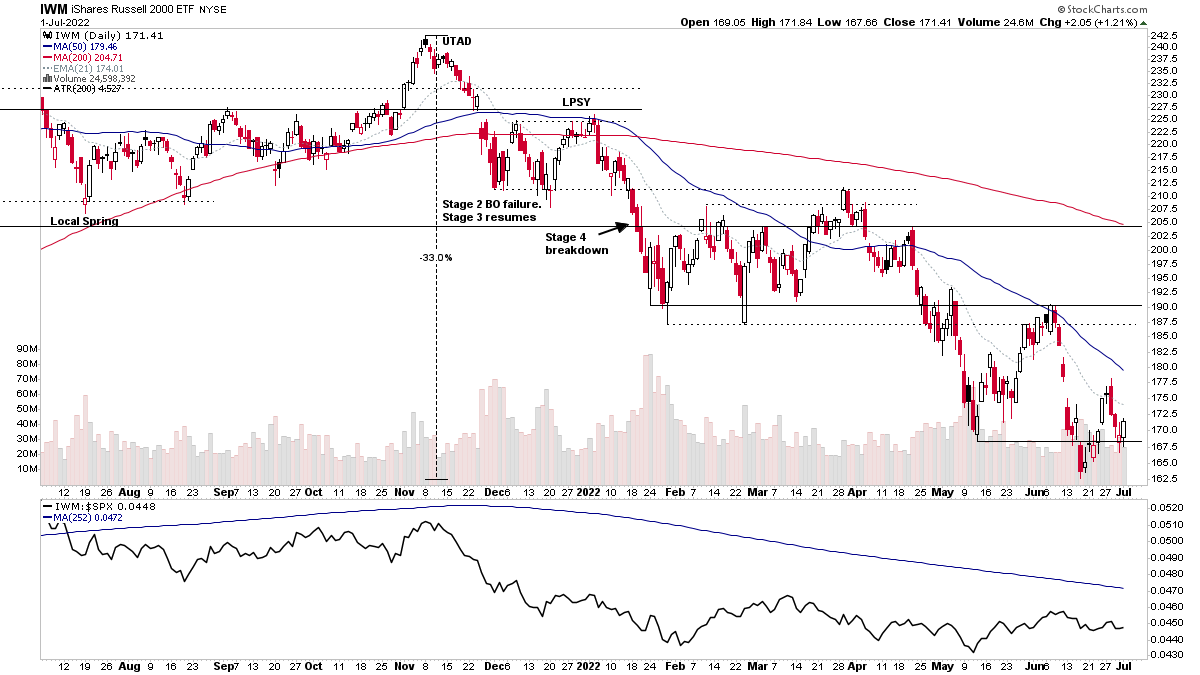

The S&P 500 percentage of stocks above their 20 day exponential moving averages closed the week at 42.40% with an attempt to make a high low after reaching the most extreme reading since March 2020 earlier in June. So while the indexes themselves continue to make lower highs and lower lows in a weekly Stage 4 downtrend. The short term breadth via the percentage of stocks is showing some potential signs of improvement under the surface with more than 1/3 of stocks back above their short term MAs than they were a few weeks ago, and this behaviour can also be seen across the other major markets.

I'll discuss this in more detail in the Stage Analysis Weekend Video, which is coming up a little bit later today.

US Stocks Watchlist – 1 July 2022

There were 30 stocks for the US stocks watchlist today

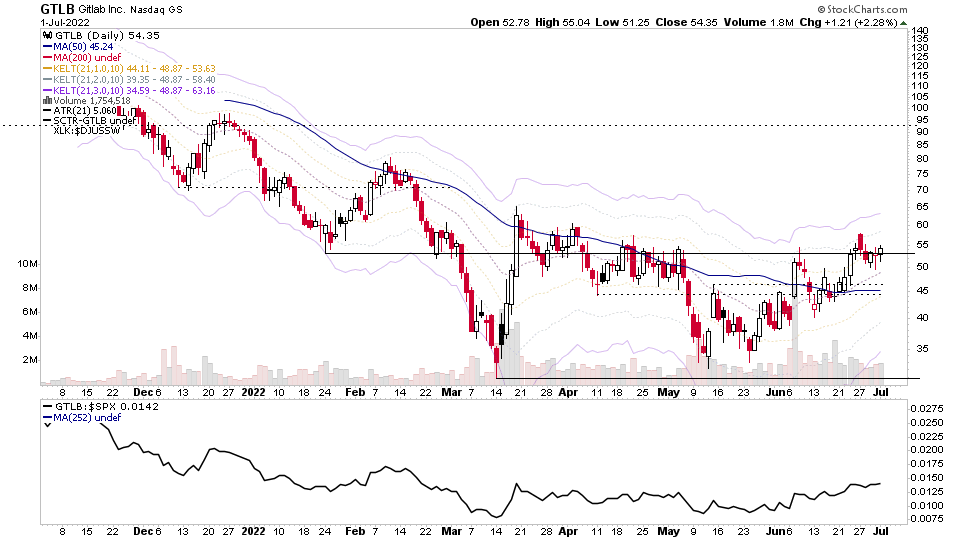

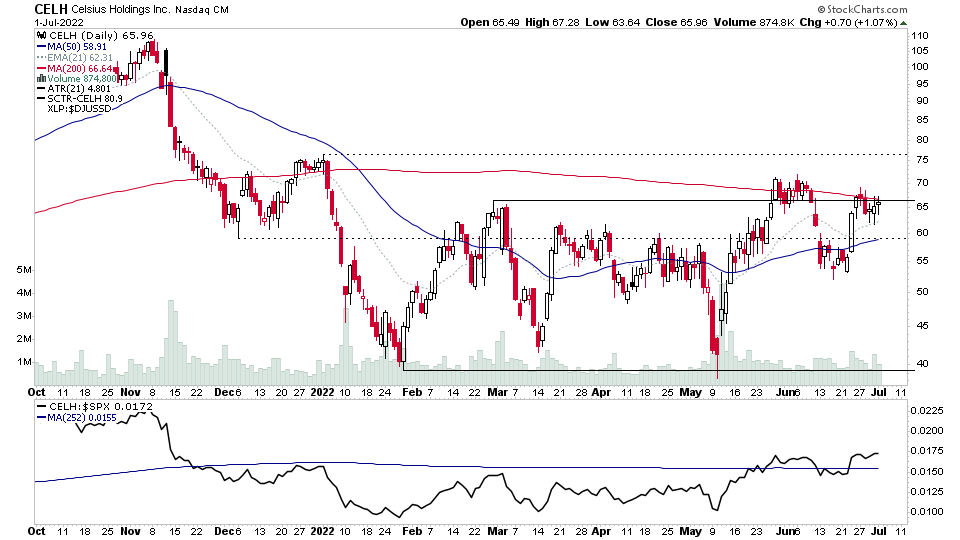

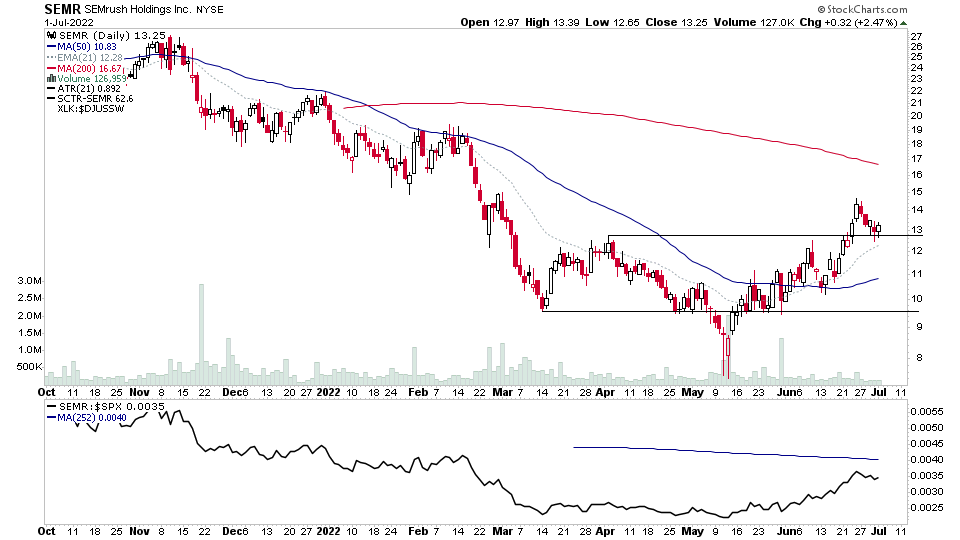

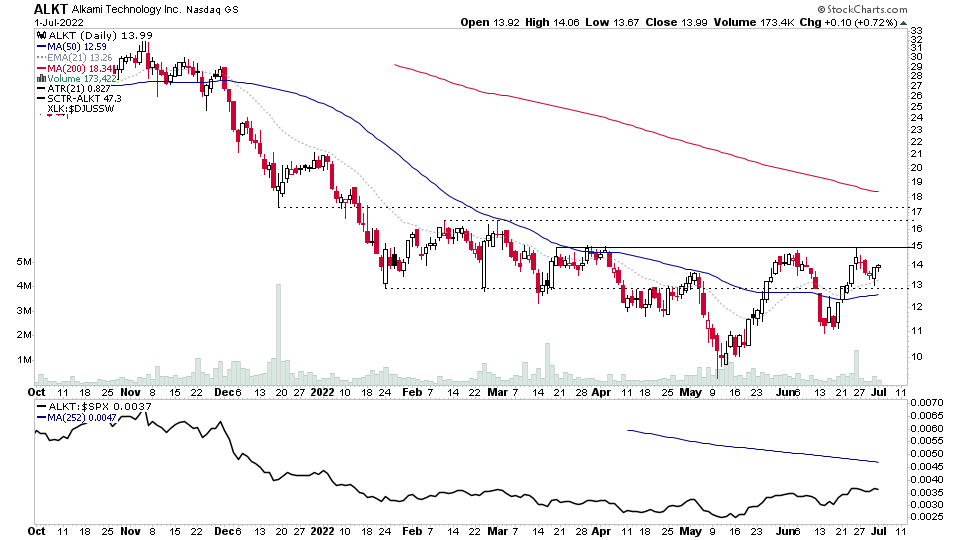

ALKT, CELH, GTLB, SEMR + 26 more...

The Software group (IPO-type stocks) continues to be the major theme since the June low.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.