Stock Market Update and US Stocks Watchlist – 22 June 2022

The full post is available to view by members only. For immediate access:

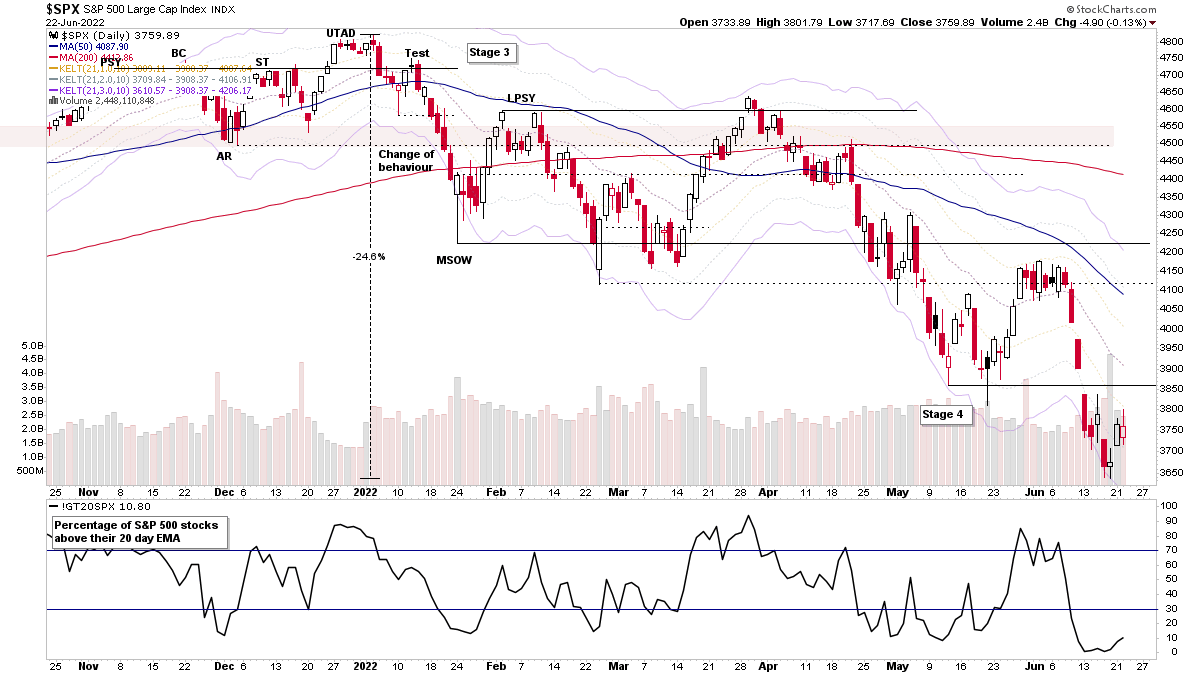

The S&P 500 and the majority of other stock market indexes remain in weekly Stage 4 declines, but the stopping action at the end of last week has led to a three-day move higher, which has turned up some of the short-term breadth measures, although they still have some work to do yet to turn back to positive status, and so may yet fail once more and continue lower in Stage 4.

However, if we see a strong Follow-Through Day (FTD) on Day 4 of the move off of the low, then the shorter-term swing traders that look for that kind of price action (CAN SLIM method traders for example) could jump back into the beaten-down growth names and some of the younger more speculative IPO stocks that have been appearing in the watchlist scans of late that are building bases still in Stage 4 or in Stage 1.

So watch for signs of strength tomorrow that could potentially turn the short-term breadth statuses back to positive.

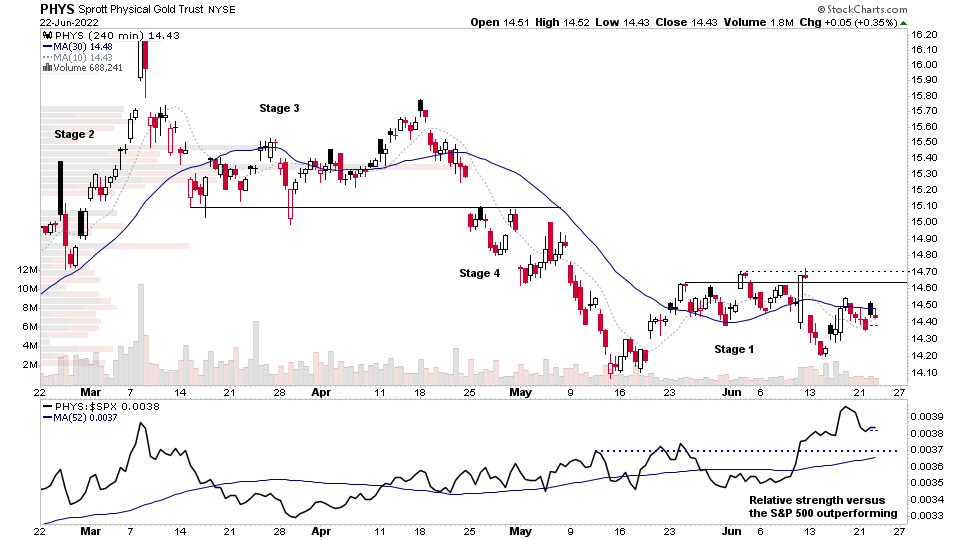

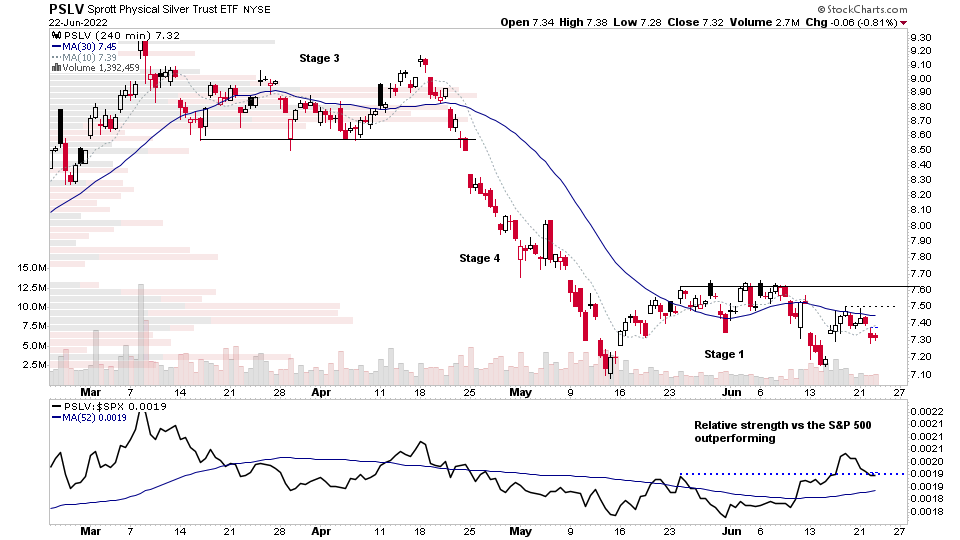

Gold and Silver

I've included the intraday 4-hour charts of the physical gold and silver ETFs (PHYS & PSLV) with Stages marked up on these timeframes, as Stage 2 breakouts on the lower timeframes can sometimes be an earlier entry point for a move on a higher timeframe. So are levels of interest to watch for how the price and volume act if they are tested. But both have been showing stronger Relative Strength (RS) than the S&P 500 during the last month.

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.