Follow Through Day – Part Four: Oversold Stage 4 Stocks Attempt to Rebound

The full post is available to view by members only. For immediate access:

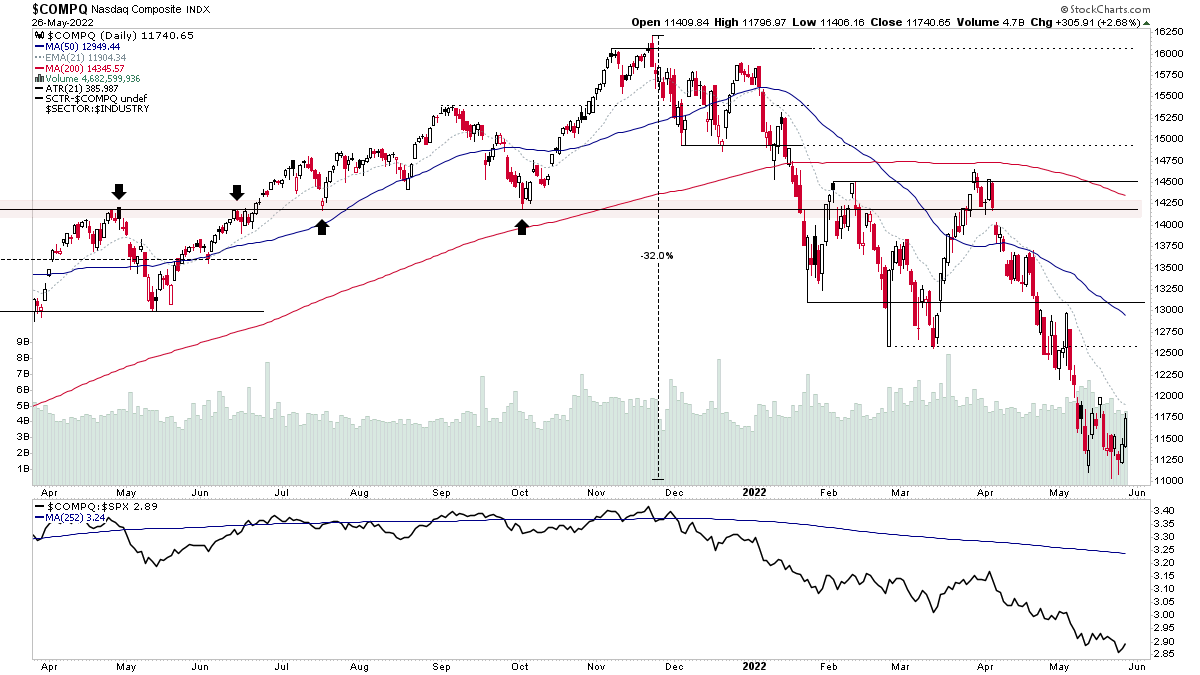

Today saw strong moves in the more depressed areas of the market with leadership from beaten down areas such as Growth, Consumer Discretionary, Communication Services, Technology, Software, Semiconductors and IPOs and more. Which triggered yet another Follow Through Day (FTD) attempt – the fourth this year – and IBD declaring a Confirmed Uptrend again. However, as with the previous FTD attempt you only need to look at the chart to see that we are long way from an uptrend, as the Nasdaq Composite is not even above its 21 day EMA yet, and is still -9.33% below it's 50 day, and a massive -18.16% below it's 200 day MA and in Stage 4.

So as I've said before. The FTD is nothing more than a potential short term sign of strength, four days or more after a swing low, and unlike IBD, we use Stan Weinstein's Stage Analysis method on multiple timeframes, as well as the market breadth charts to determine the trend. As you know that to be in Confirmed Uptrend, that the market needs to be in Stage 2 on both the charts and in the market breadth data.

But a simple starting point is to look at the index charts (the Nasdaq Composite for example) on the weekly chart, a daily chart and on the intraday chart (2 hour is my preference) and note the Stage on each. i.e currently they are:

- Weekly: Stage 4

- Daily: Stage 4

- Intraday: Stage 1 (Phase B)

So, from that you can see that the major trend is bearish, as the weekly chart is in Stage 4, and even the daily chart is in Stage 4. But the short term intraday chart (2 hour) is showing signs of basing in Stage 1, and so could potentially move into Stage 2 on that timeframe, which would be a counter trend rally within the weekly Stage 4 declining phase. But if that intraday Stage 2 rally had enough strength, then it could potentially change the longer term Stage back to early Stage 1 in time.

But take it one step at a time and by using this simple technique you can understand the type of market environment that you are in. And then manage risk accordingly – which in this case may mean doing nothing if counter trend trading isn't part of your edge.

US Stocks Watchlist – 26 May 2022

There were 37 stocks for the US stocks watchlist today.

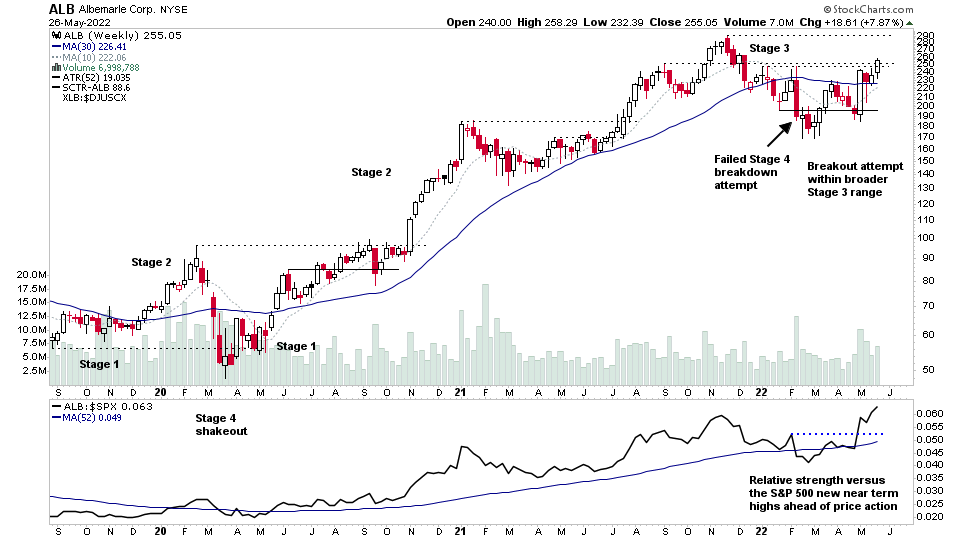

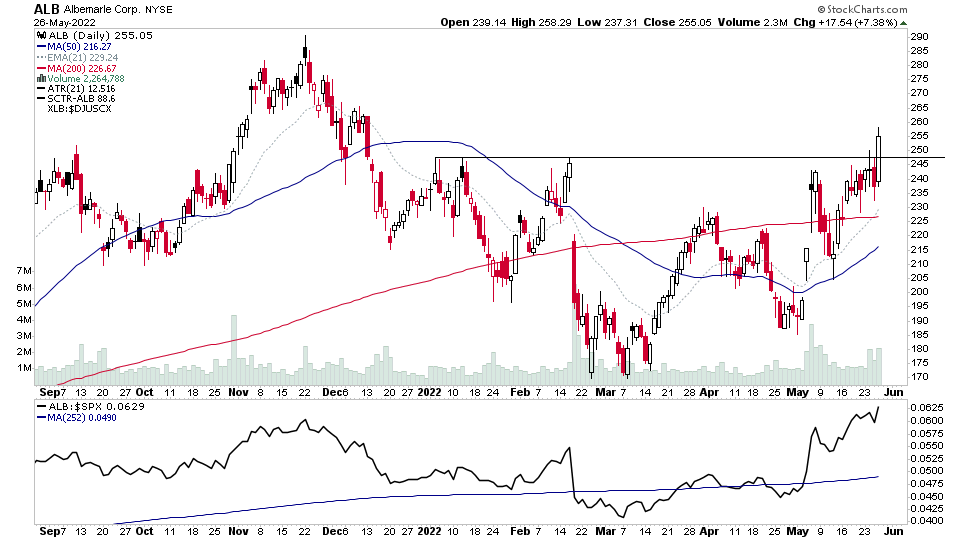

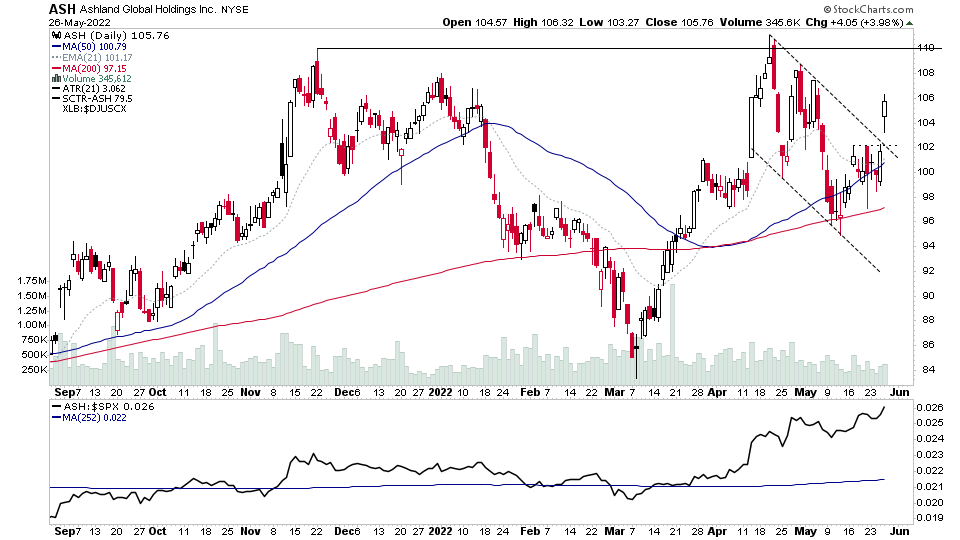

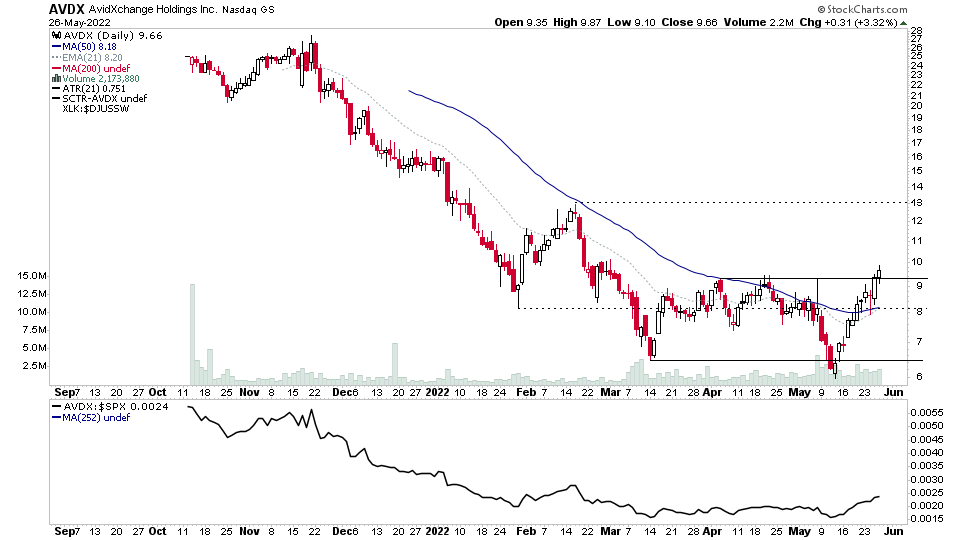

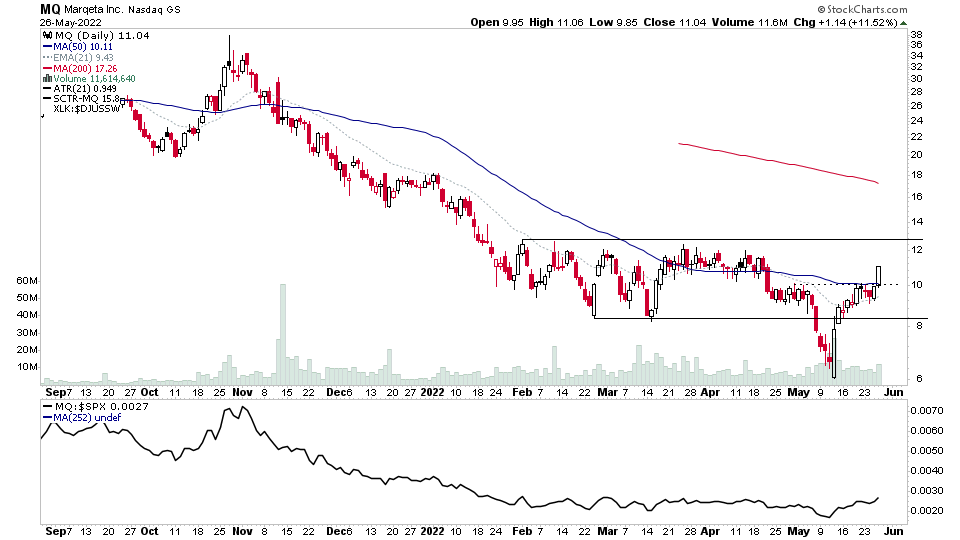

ALB, ASH, AVDX, MQ + 33 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.