Extreme Volatility as the Stock Market Tests the Demand and the US Stocks Watchlist – 5 May 2022

The full post is available to view by members only. For immediate access:

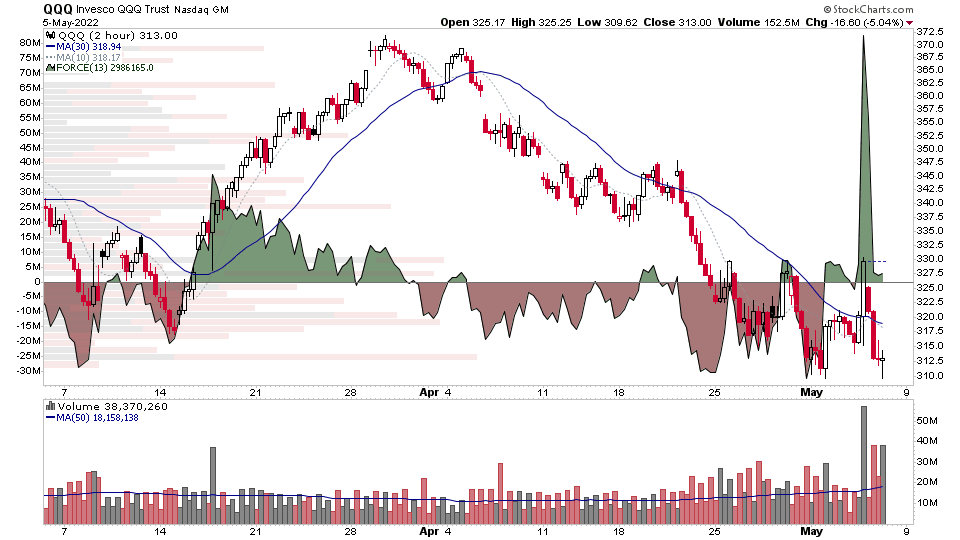

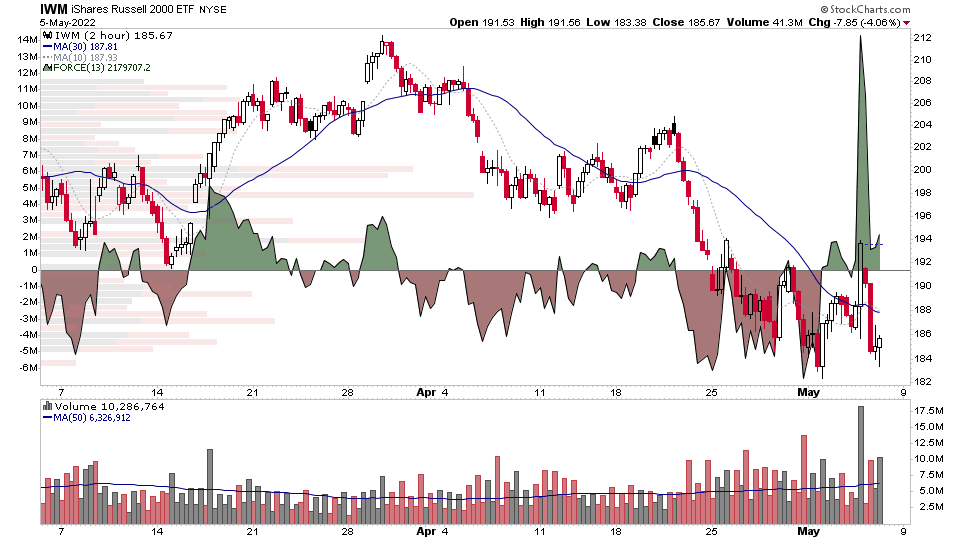

The stock market indexes (S&P 500, Nasdaq 100 and Russell 2000) flipped back lower today, with the potential Secondary Test (ST) that I mentioned in yesterdays post occurring extremely quickly, as the market inflicted maximum pain on the people that rushed to buy on the Fed news on Wednesday.

However, although there were very large declines in all of the major indexes today. Technically, on the intraday chart (2 hour), they all remain within the fledgling Stage 1 base structure that began with the Selling Climax (SC) on Monday, and has now formed the potential Automatic Rally (AR) high of the structure.

So was todays action the formation of a Secondary Test (ST)? Maybe. But you can never know for sure until after its formed and price has moved towards the next event. As it's always a judgement call in real time. So if it holds and we move higher tomorrow again, then we could have more confidence that it's a ST and that we have the first complete Phase of a fledgling Stage 1 base structure.

One observation from todays price and volume action is that volume is showing some signs of a change, which you can see in the intraday index charts with the Force Index indicator overlaid on them, which remained postive in all three today. And so is showing much less supply than at the last swing low – and hence is a potential Change of Character.

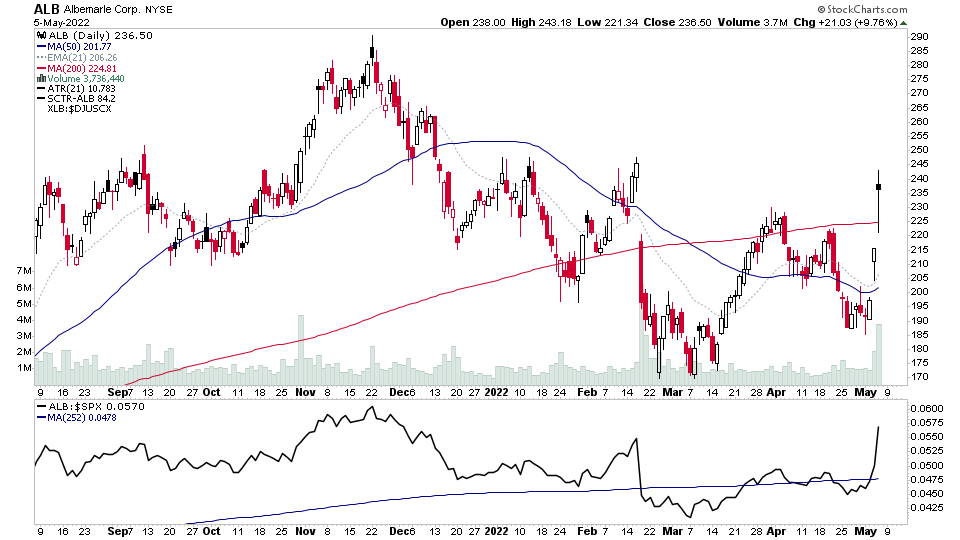

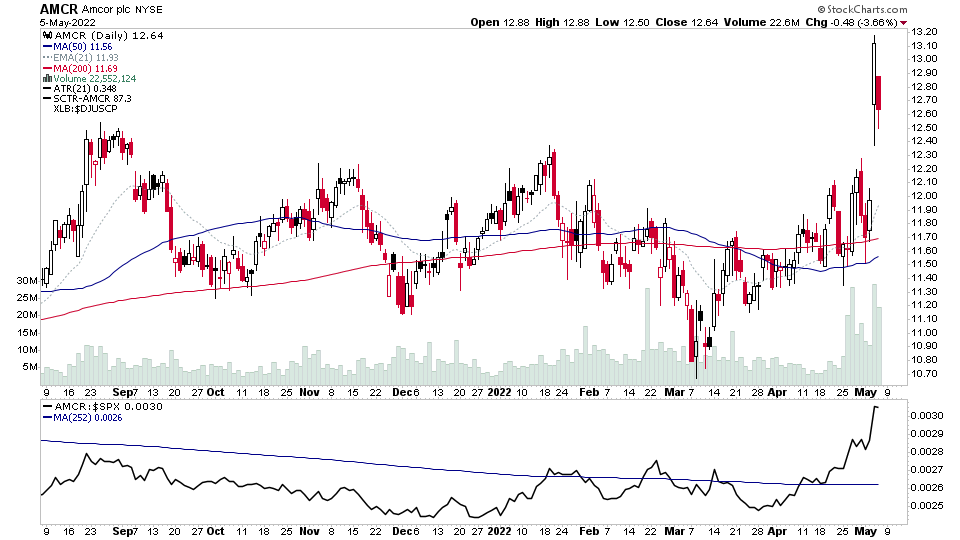

US Stocks Watchlist – 5 May 2022

There were 19 stocks for the US stocks watchlist today.

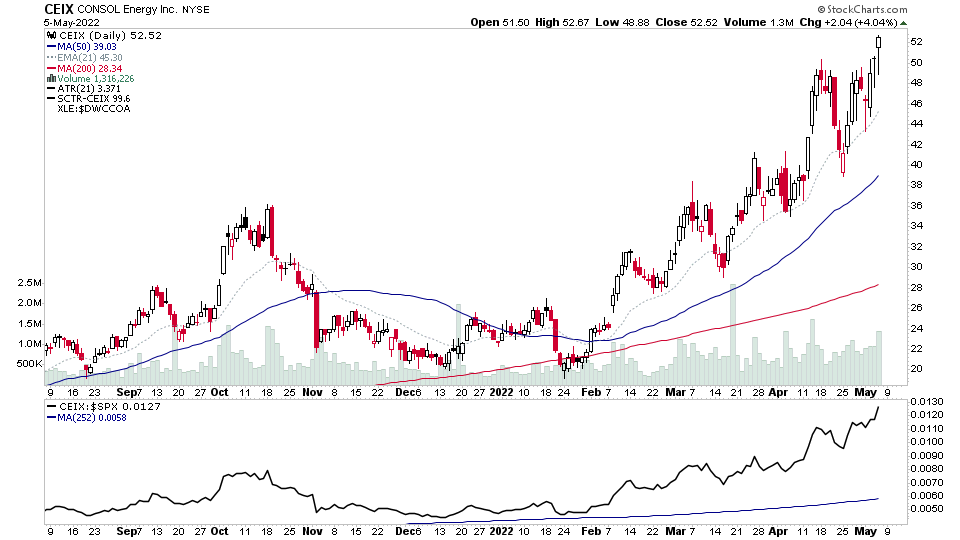

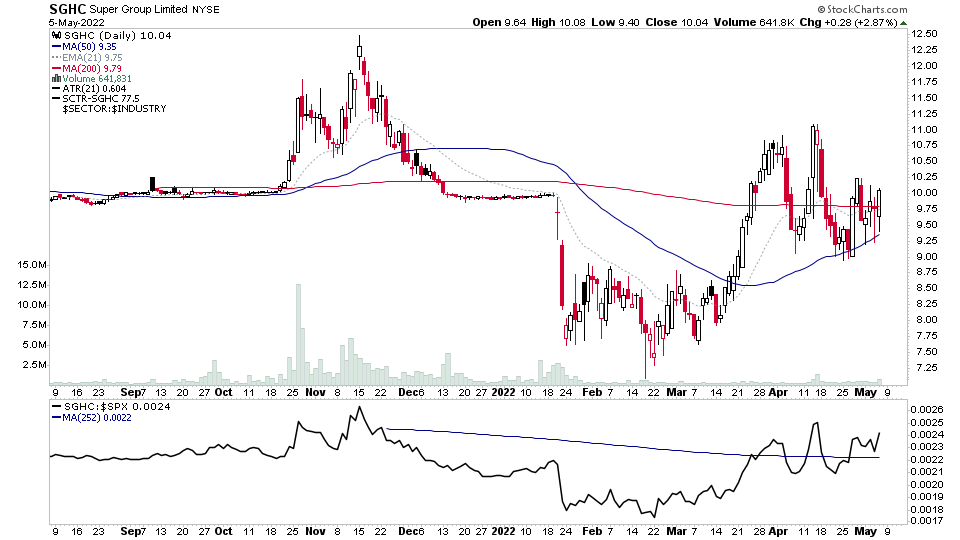

ALB, AMCR, CEIX, SGHC + 15 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.