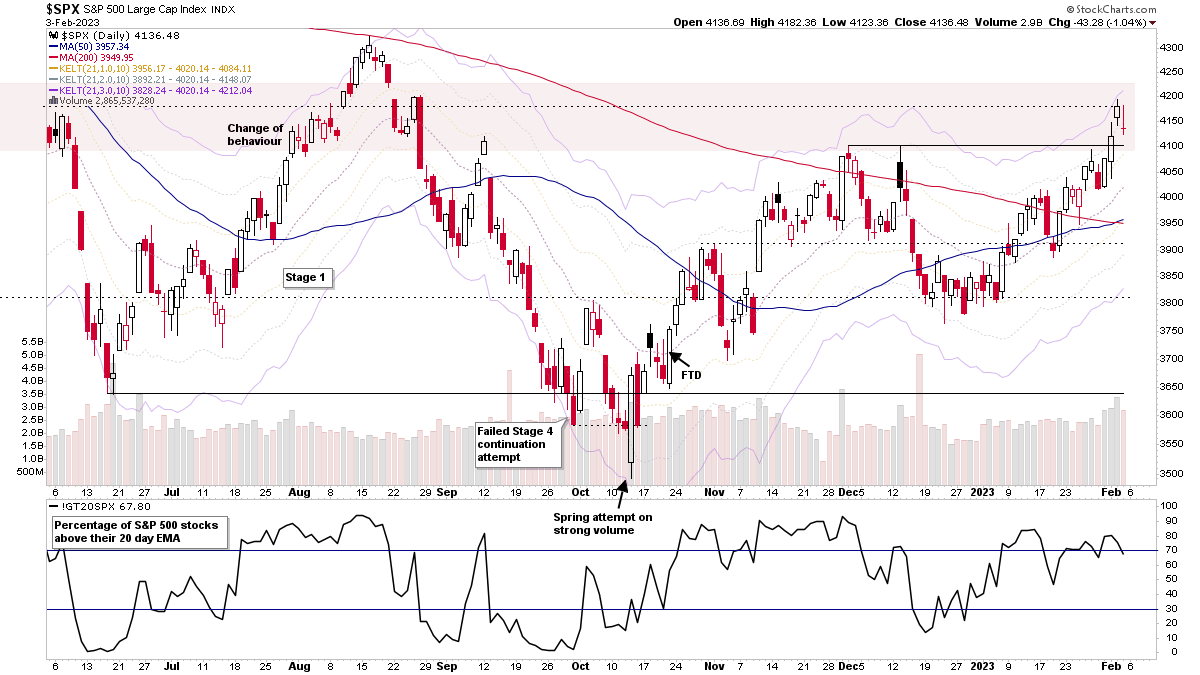

The Stage Analysis members weekend video featuring the regular content with the major US Indexes, the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

Blog

05 February, 2023

Stage Analysis Members Video – 5 February 2023 (1hr 31mins)

23 January, 2023

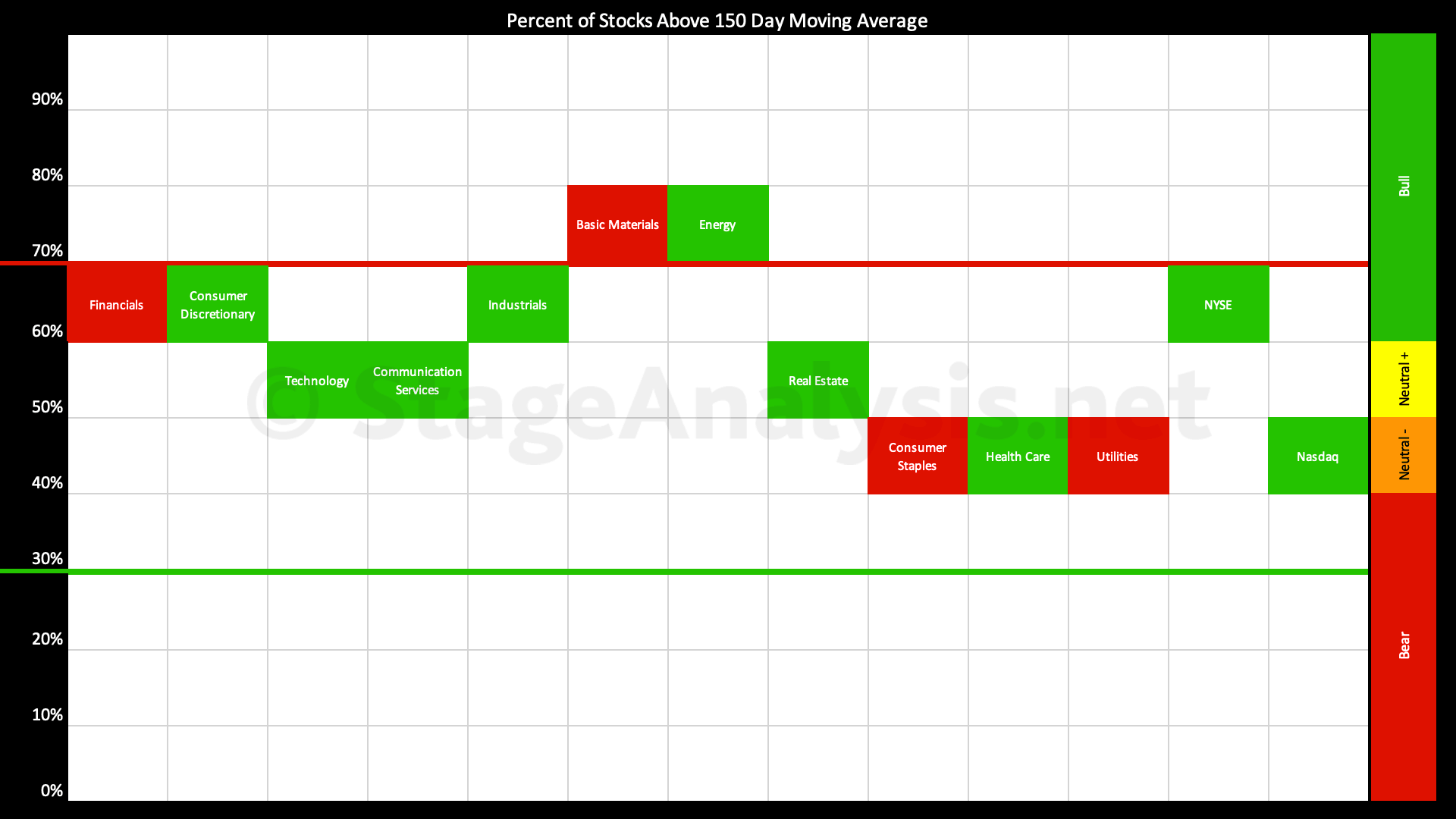

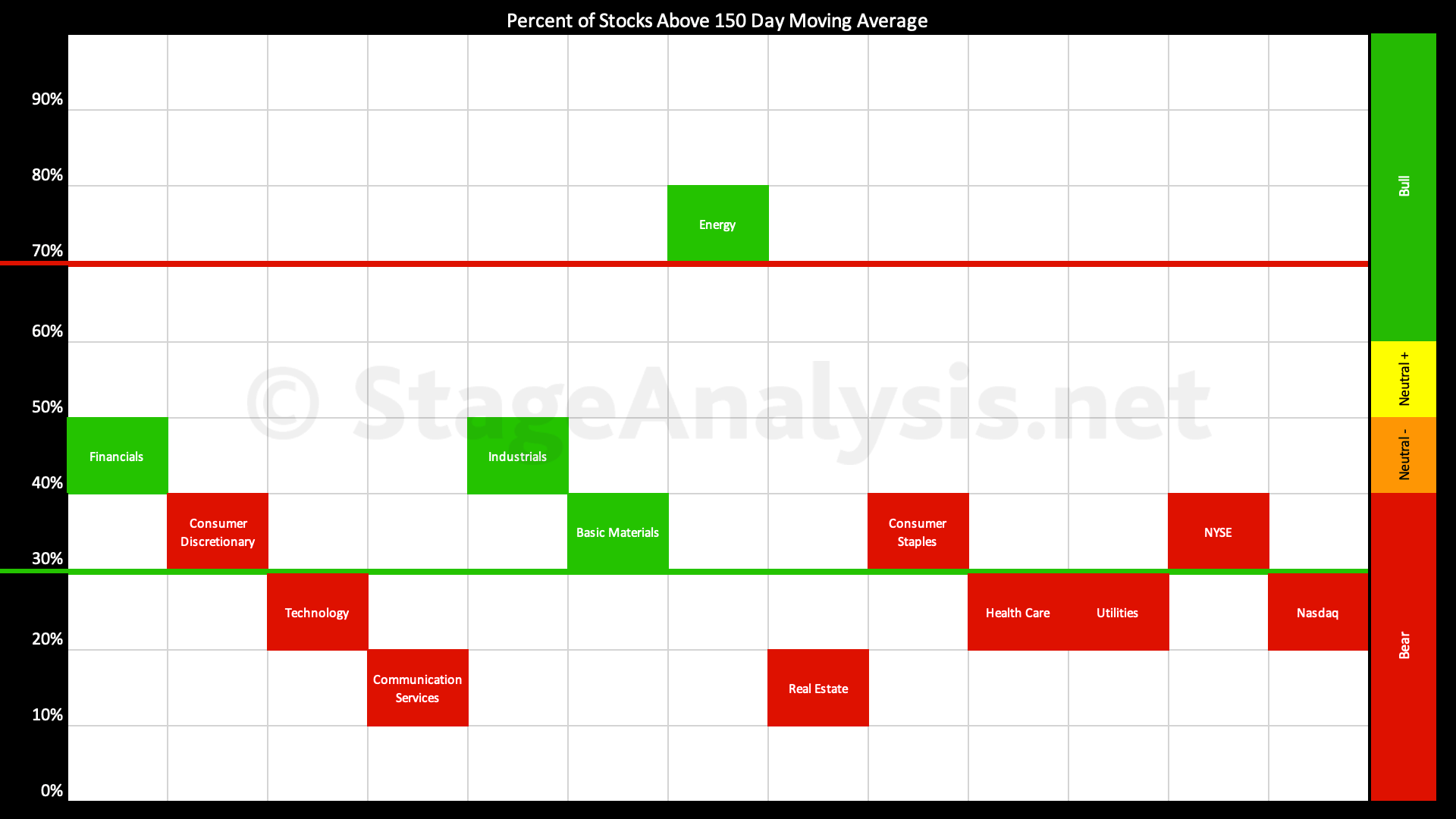

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has shown continued improvement over the last two weeks since the previous post of the 9th January 2023, increasing by a further +9.07% to 58.47% overall, which puts it at the top of the middle range (Neutral+), which is the Stage 1 zone.

Read More

09 January, 2023

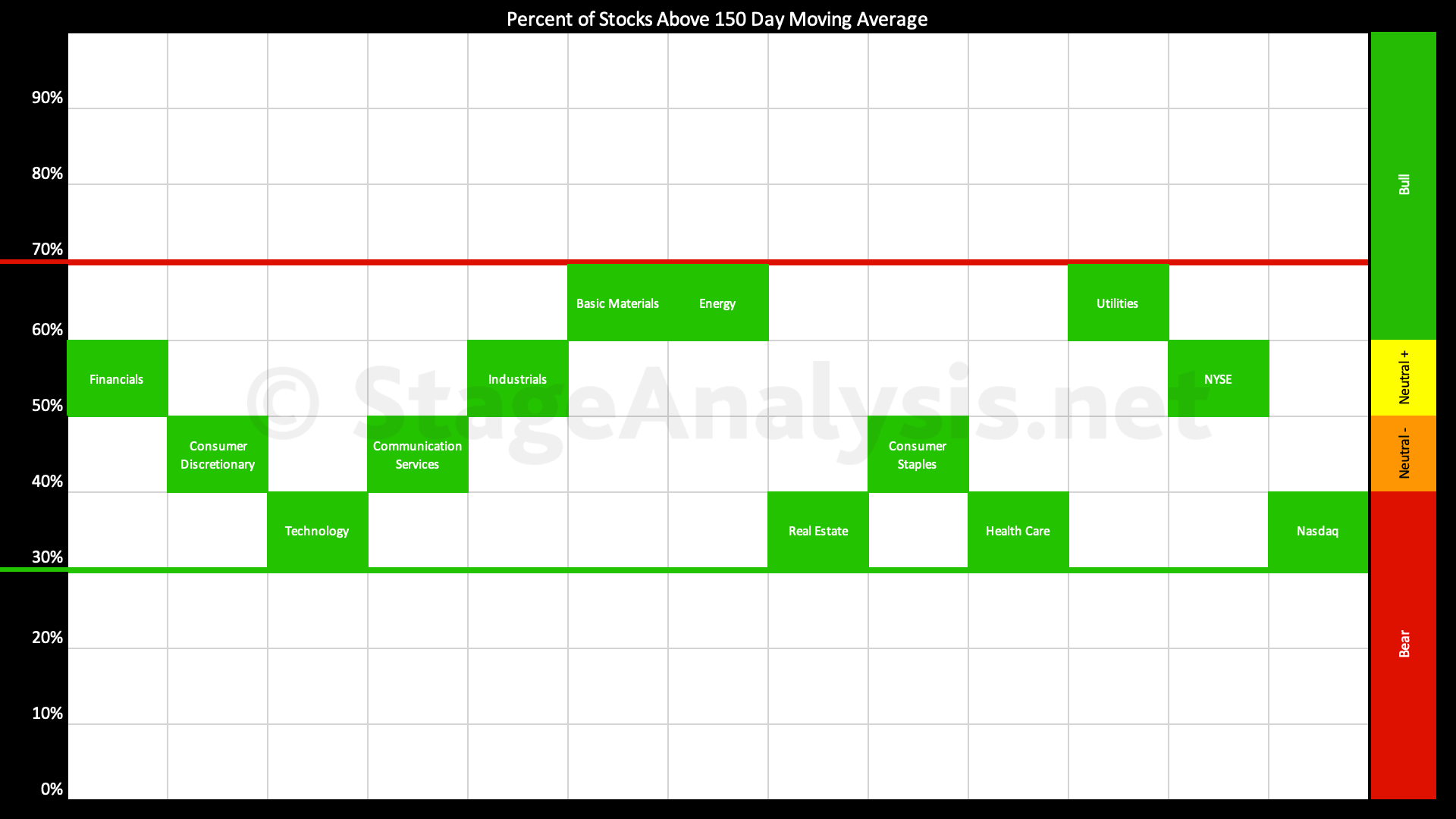

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has moved higher by +12.92% over the last three weeks since the previous post of the 19th December, and so the overall average is now at 49.40%, which is firmly back in the Stage 1 zone in the middle of the range.

Read More

19 December, 2022

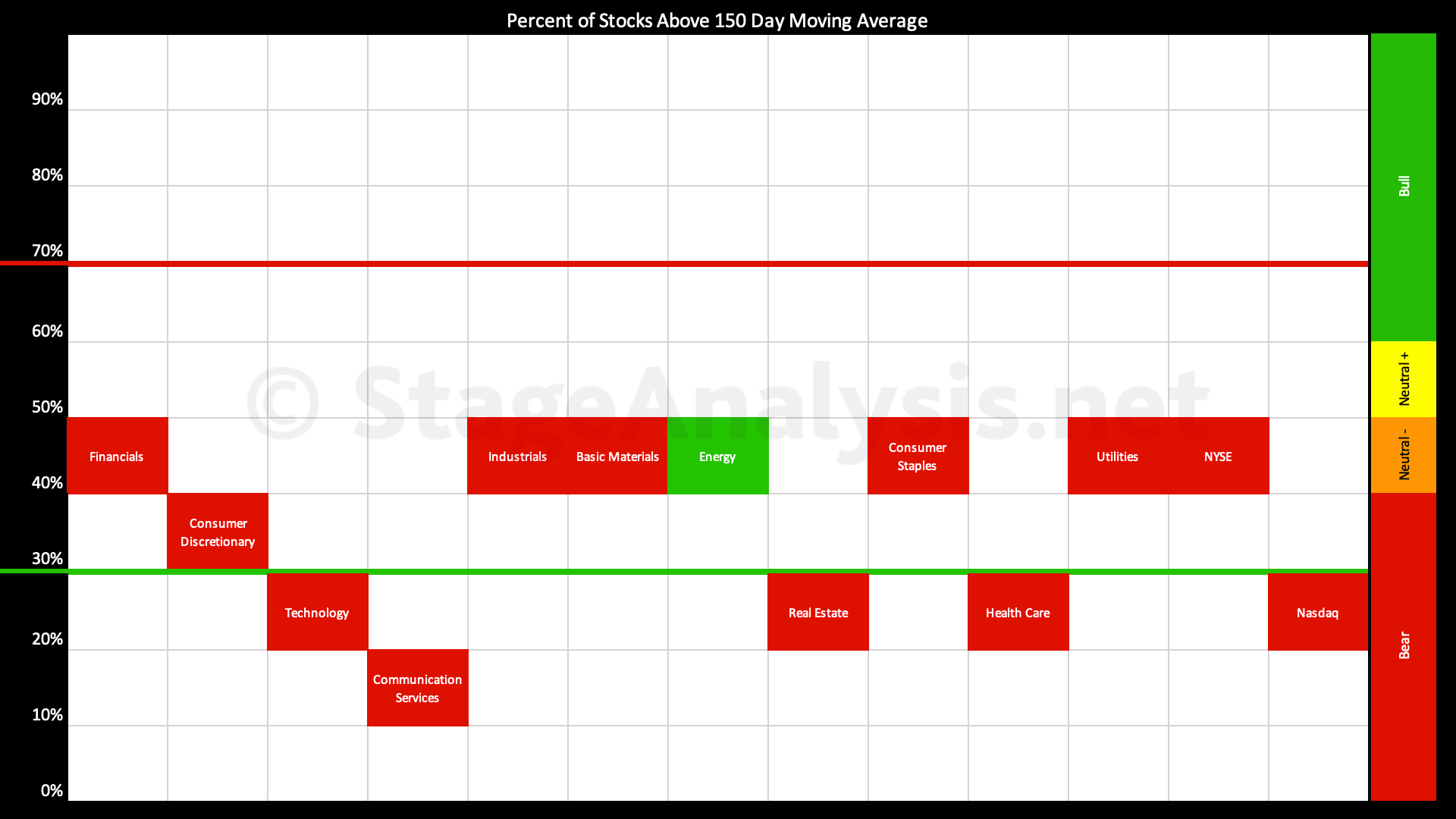

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has declined by -9.72% since the previous post on the 28th November, and so the overall average is now at 36.48% which is tipping it back into the Stage 4 zone once more, which it's spent the majority of 2022 in...

Read More

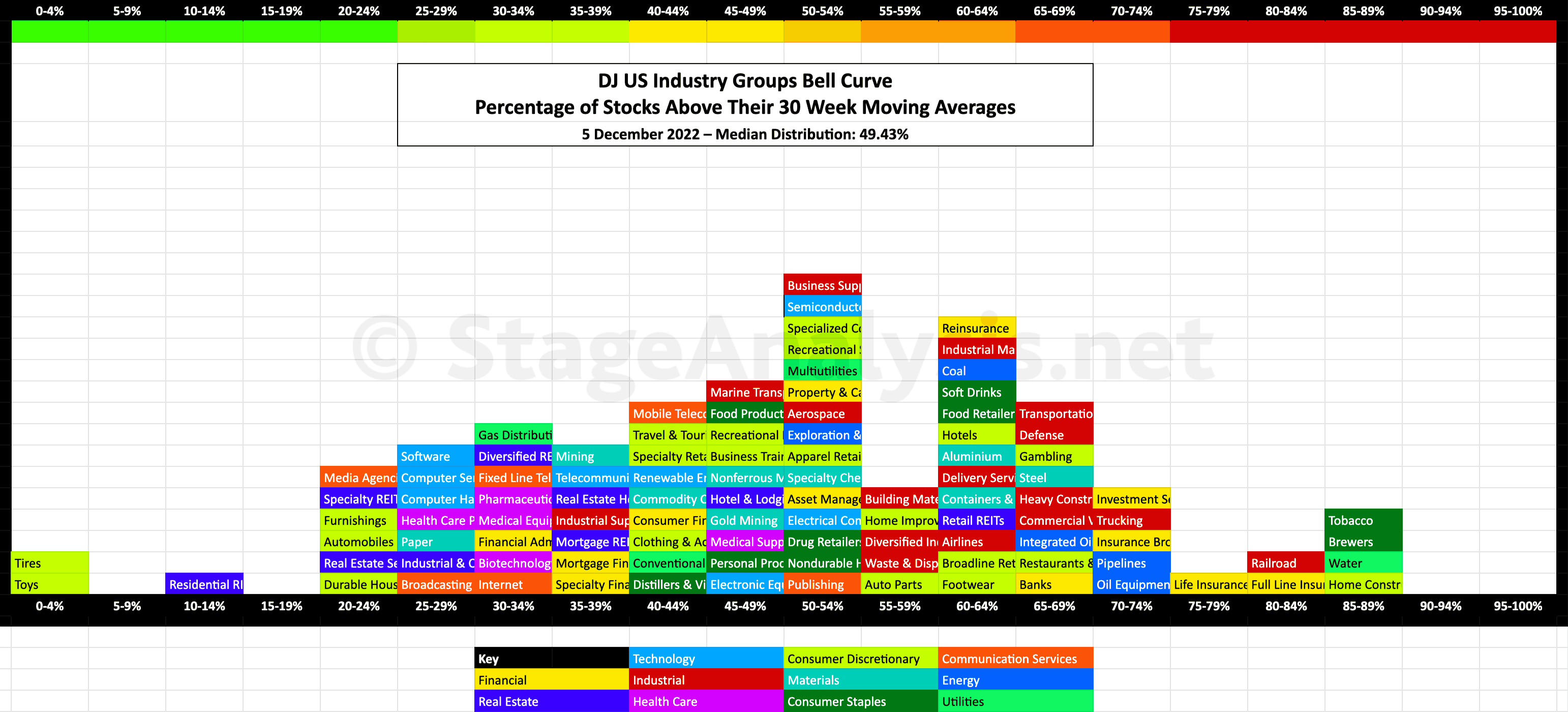

05 December, 2022

US Industry Groups Bell Curve – Exclusive to StageAnalysis.net

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More

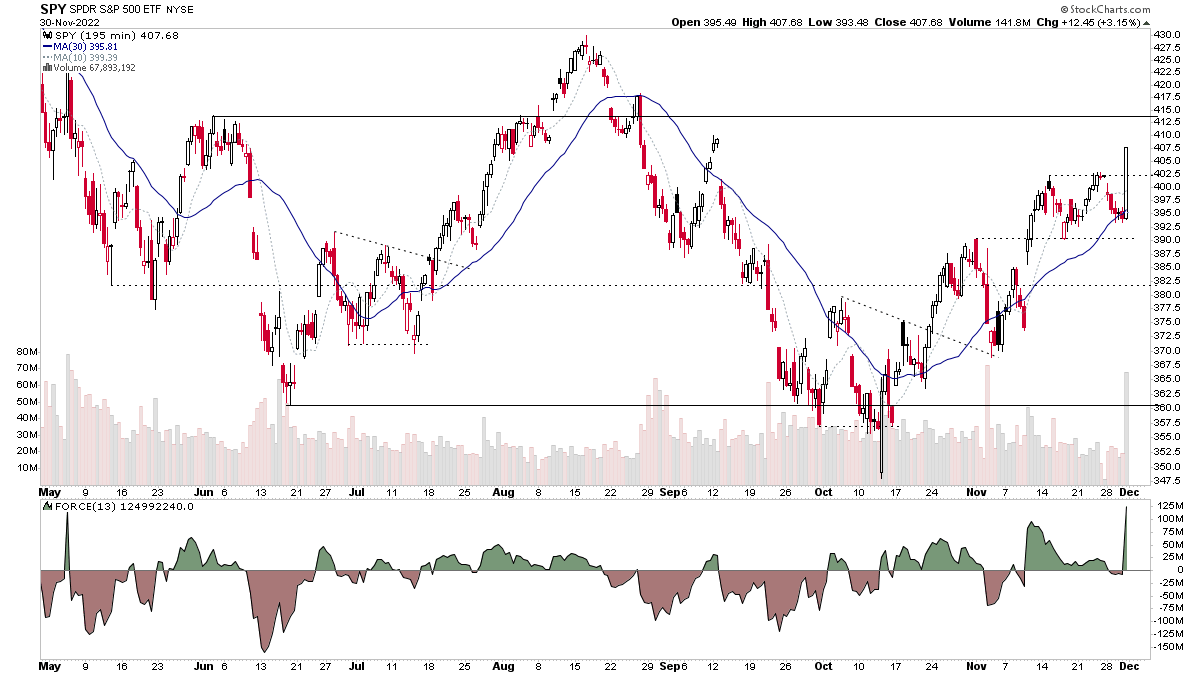

30 November, 2022

Stage Analysis Members Video – 30 November 2022 (56 mins)

The Stage Analysis members midweek video discussing the market indexes, sector breadth, short-term market breadth and the US watchlist stocks in more detail with live markups.

Read More

28 November, 2022

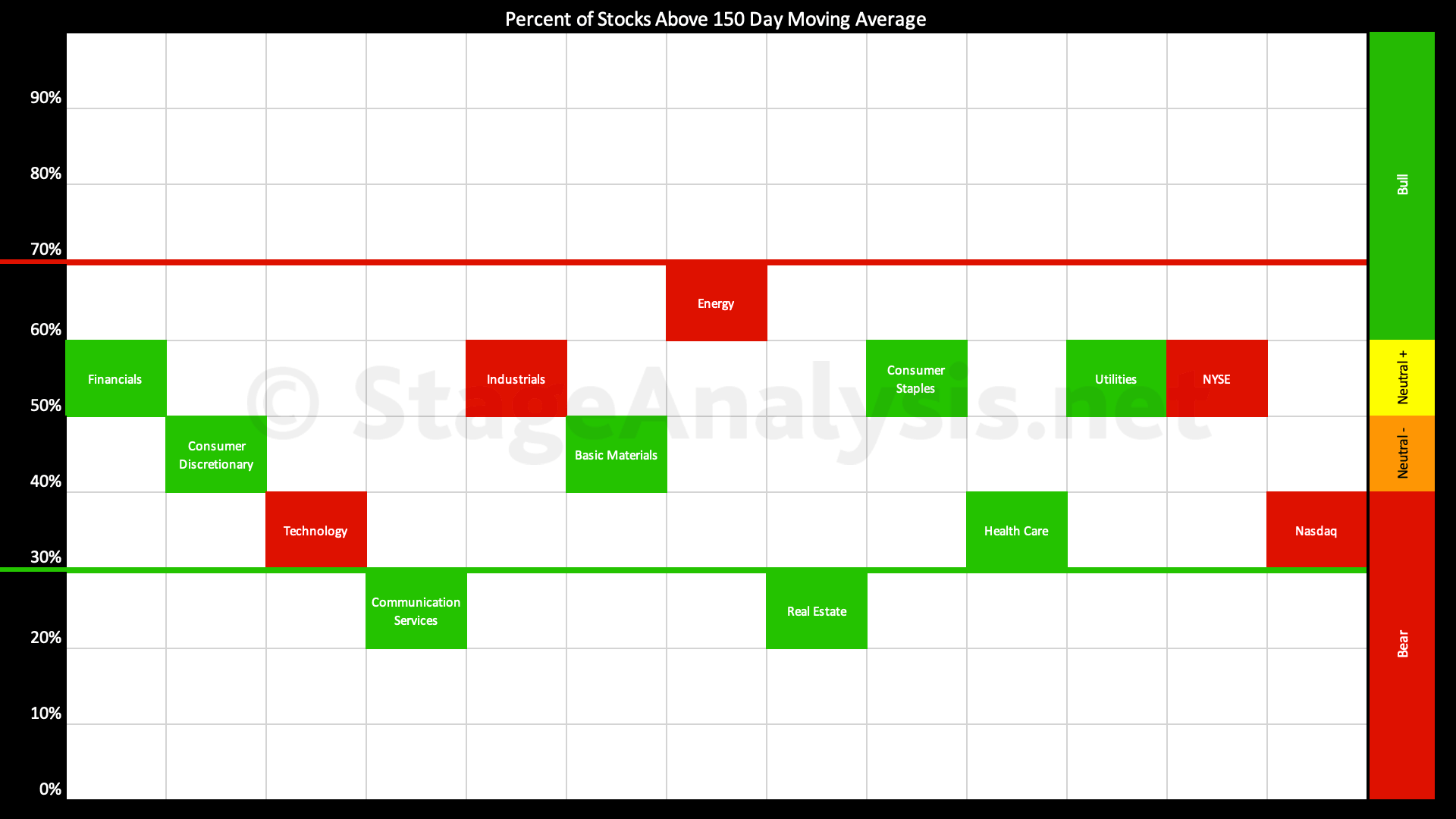

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has continued to improve since my previous post on the 9th November, which was the day before the secondary Follow Through Day (FTD) in multiple of the major US stock market indexes.

Read More

13 November, 2022

Stage Analysis Members Video – 13 November 2022 (1hr 21mins)

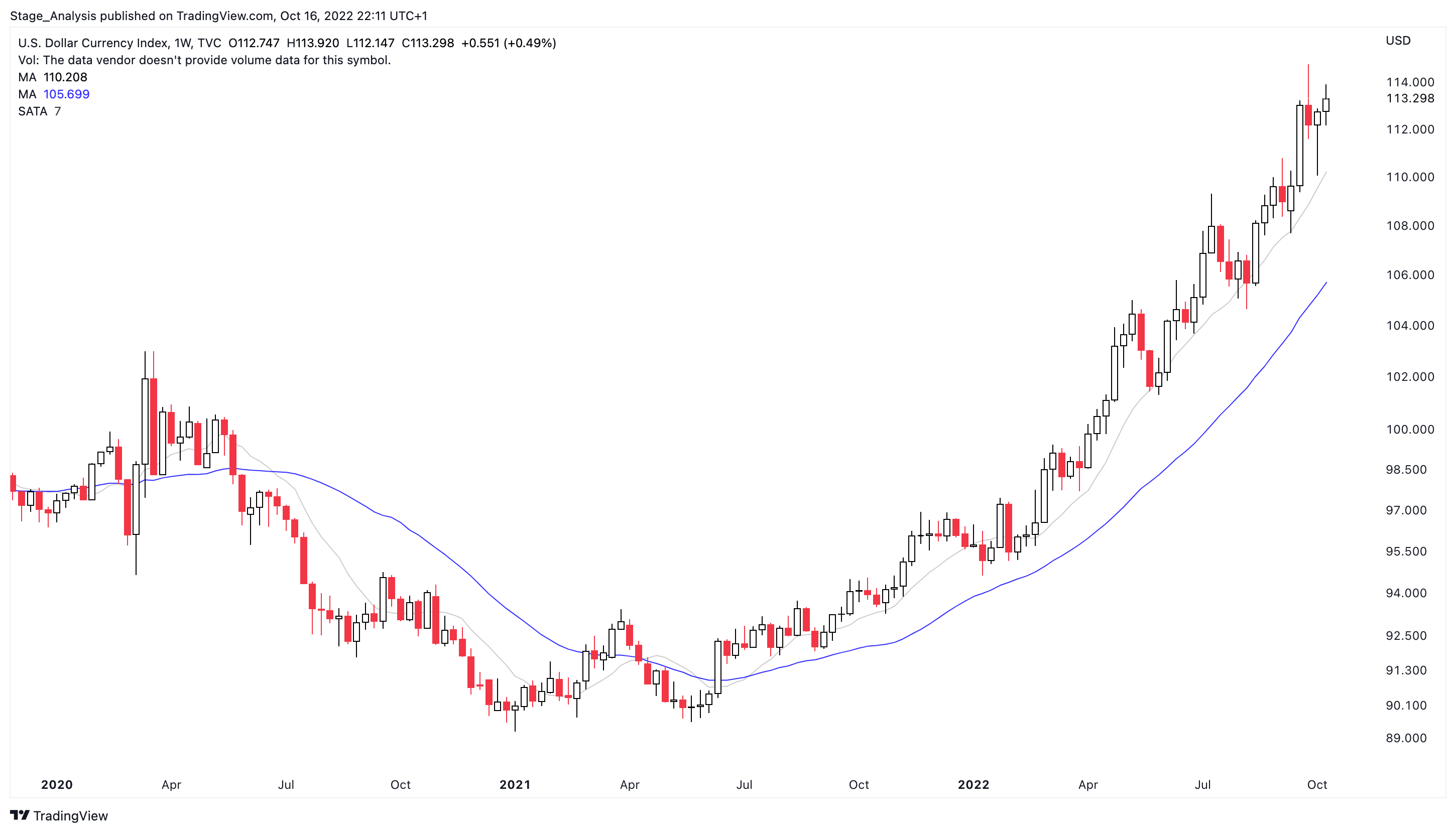

The Stage Analysis members weekend video, this week discussing the significant bar in the US Dollar Index and price and volume action in the major stock market indexes. Plus Stage Analysis of the individual sectors and the Industry Groups Relative Strength Rankings, with a look in more depth of some of the groups making the strongest moves. Also discussion of the strong shift in the IBD Industry Groups Bell Curve – Bullish Percent data, and the Market Breadth Update to help to determine the current Weight of Evidence. And finishing with live markups of the weekends US Stocks Watchlist.

Read More

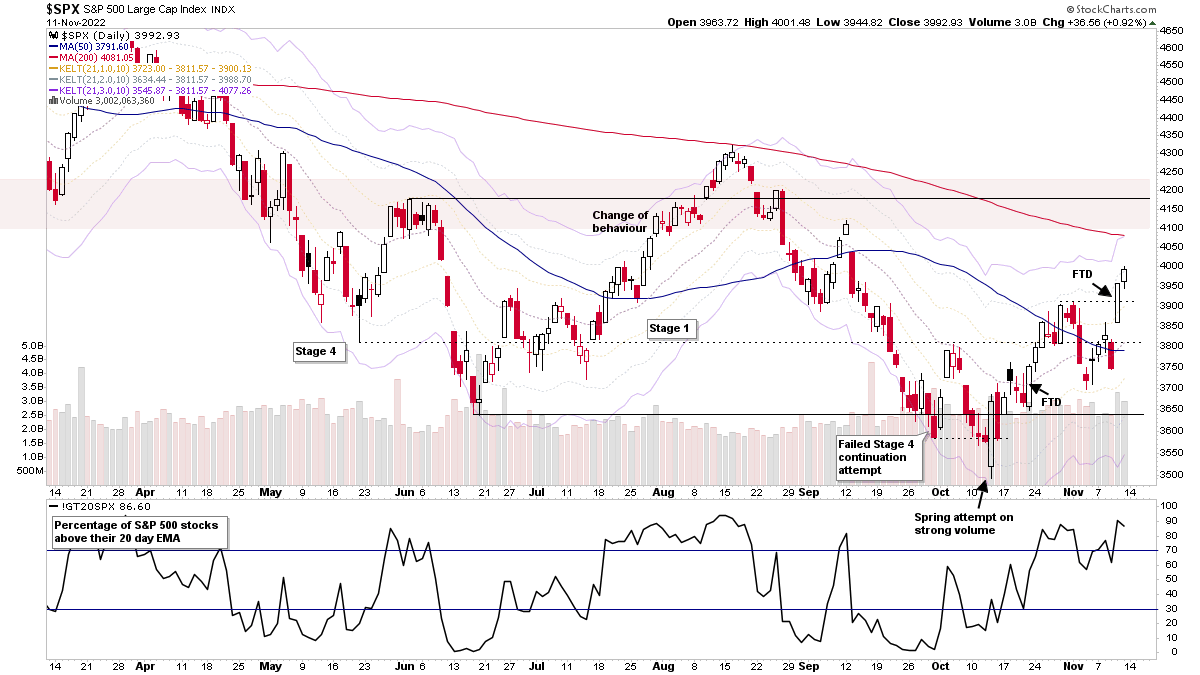

09 November, 2022

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has improved over the last month since my previous post on the 11th October when it was starting to rebound from lowest reading of the year at 14.76% on the 30th September...

Read More

16 October, 2022

Stage Analysis Members Weekend Video – 16 October 2022 (1hr 14mins)

The regular members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail.

Read More