US Stocks Watchlist - 5 December 2021

There were 37 stocks for the US stocks watchlist today. Here's a small sample from the list:

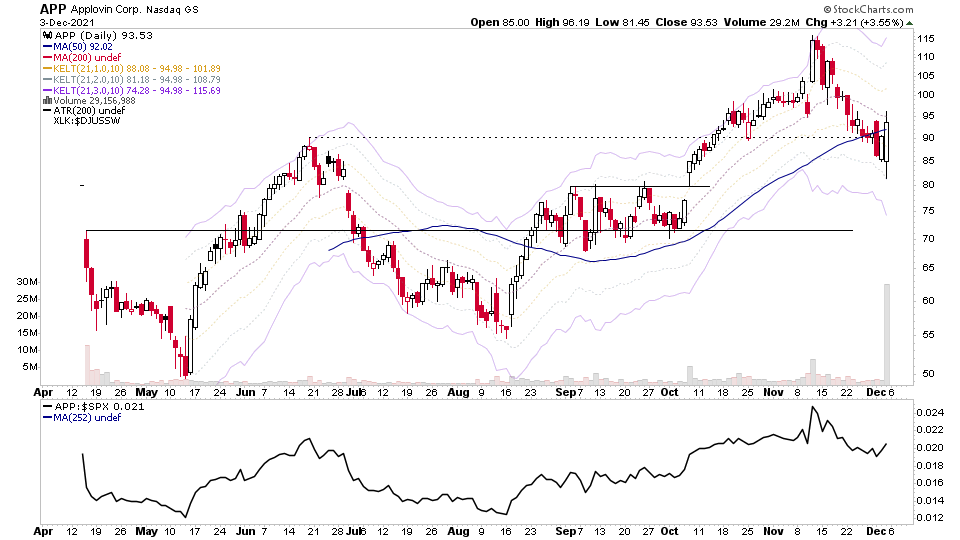

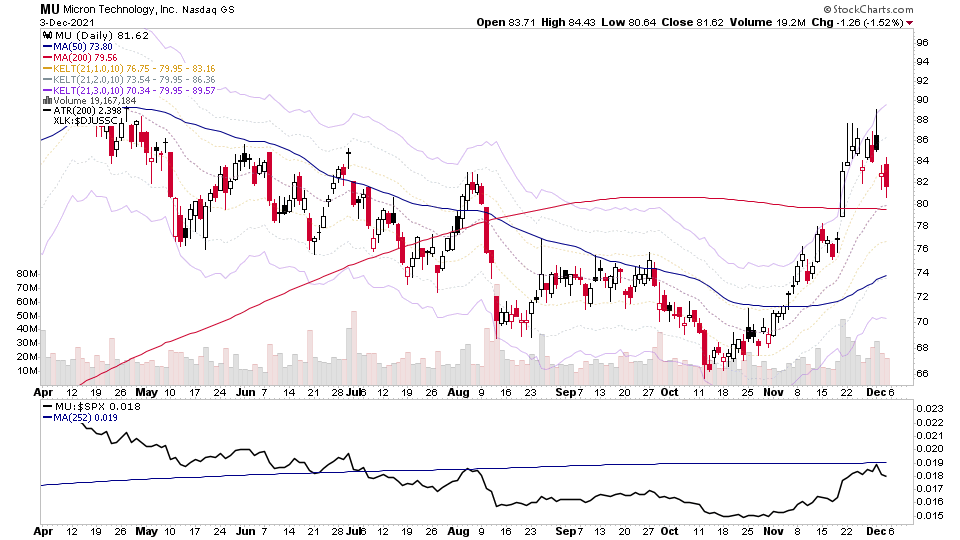

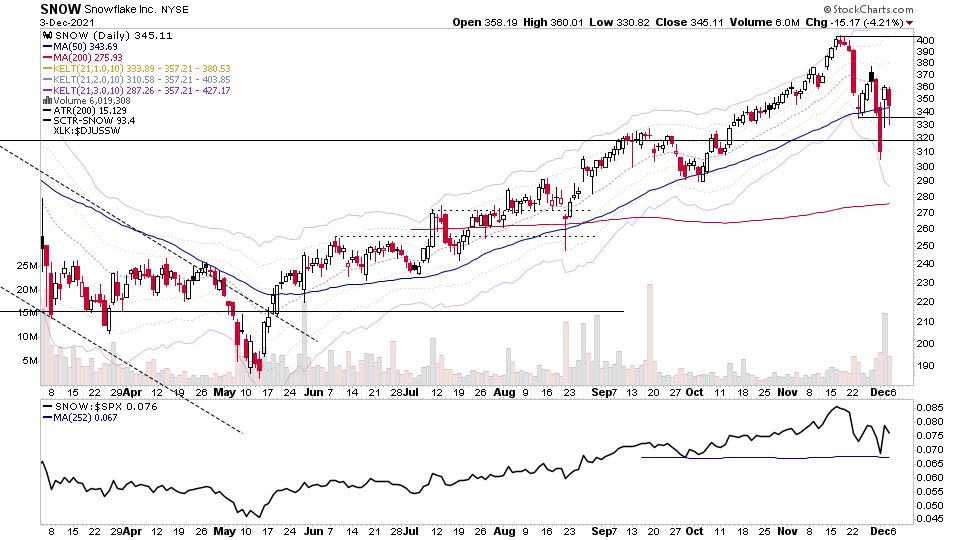

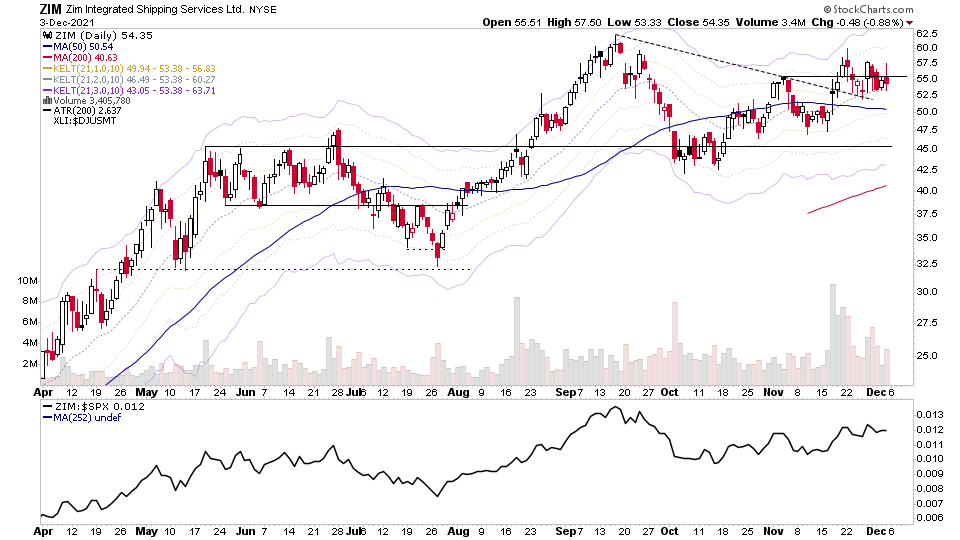

APP, SNOW, MU, ZIM, + 33 more...

Non-members

To see all the watchlist posts and other premium content, such as regular detailed videos and exclusive Stage Analysis tools, become a member

Join Today

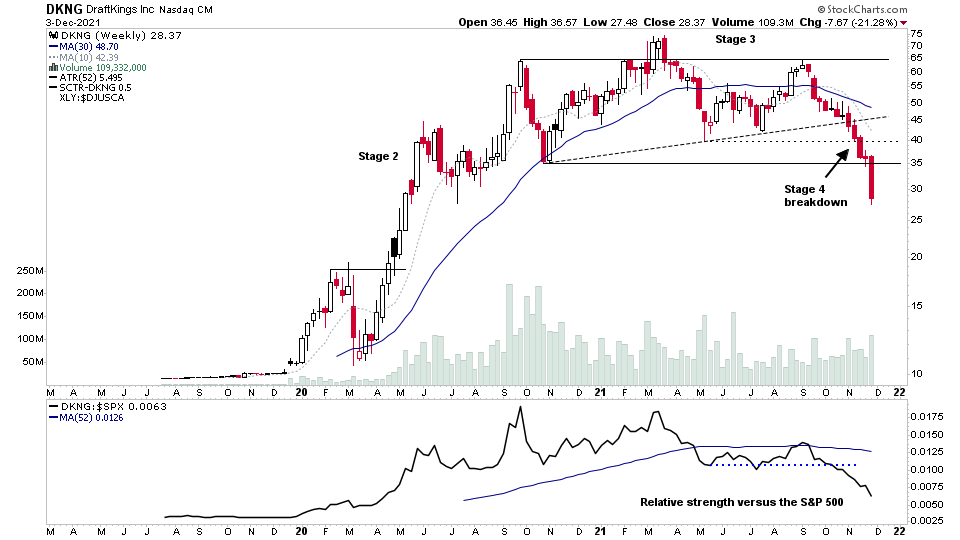

More and more charts dropping into Stage 4 like $DKNG over the last month with only 30% of US stocks now above their short, medium and long term moving averages. So a difficult environment for #stocks

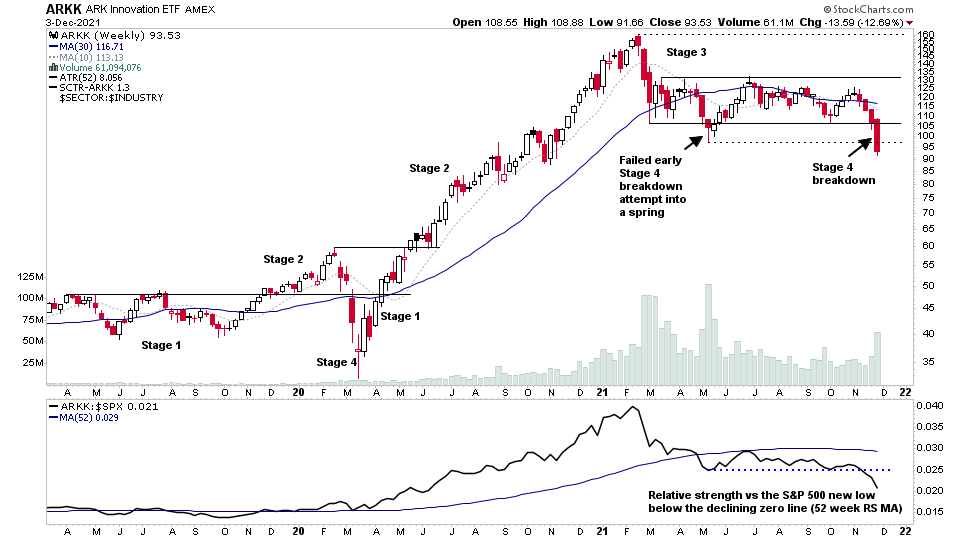

$ARKK broke down into Stage 4 this week, highlighting the weakness in the growth stocks especially.

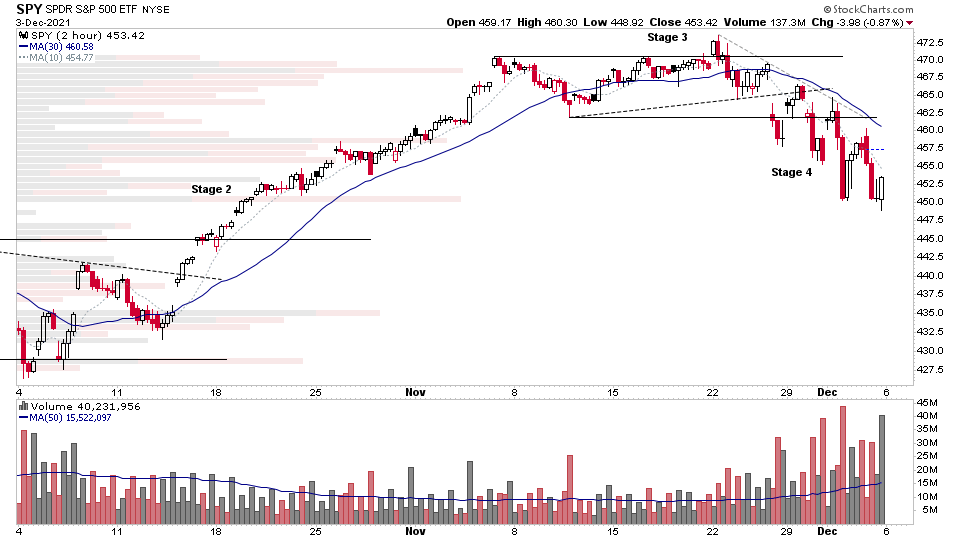

The S&P 500 is in Stage 4 on the intraday 2 hour timeframe, but is attempting to stop, and closed just under the 50 day MA on Friday.

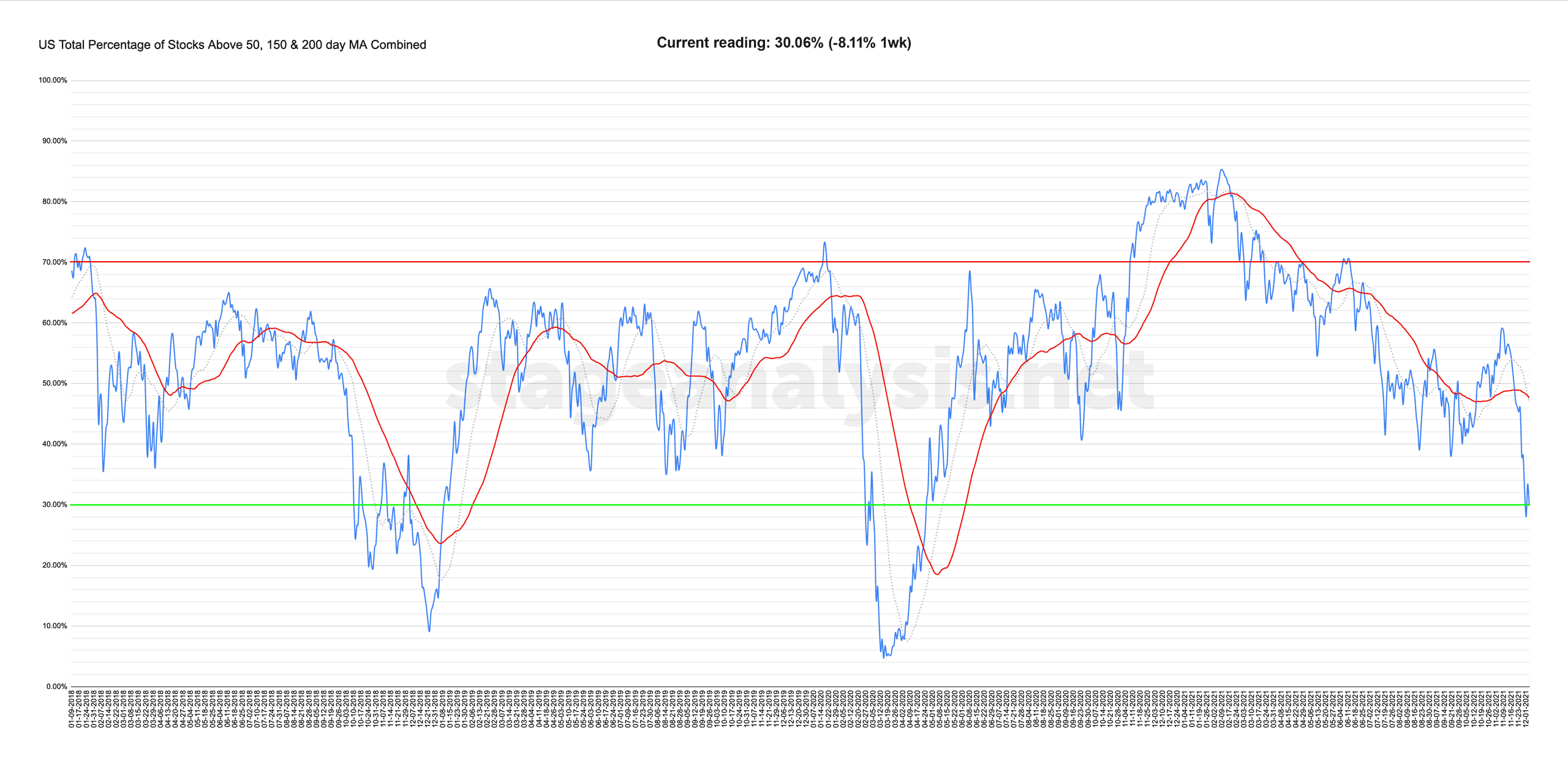

Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

30.06% (-8.11% 1wk)

A further sharp decline this week of over -8%, taking the US average down towards the top of the lower zone. Which as you can see it doesn't reach very often. So Stage 4 on the breadth data alone (below 40%), while the major indexes of the S&P 500 and Nasdaq 100 main in late Stage 2. So an anomaly to be resolved.

Status: Difficult Environment

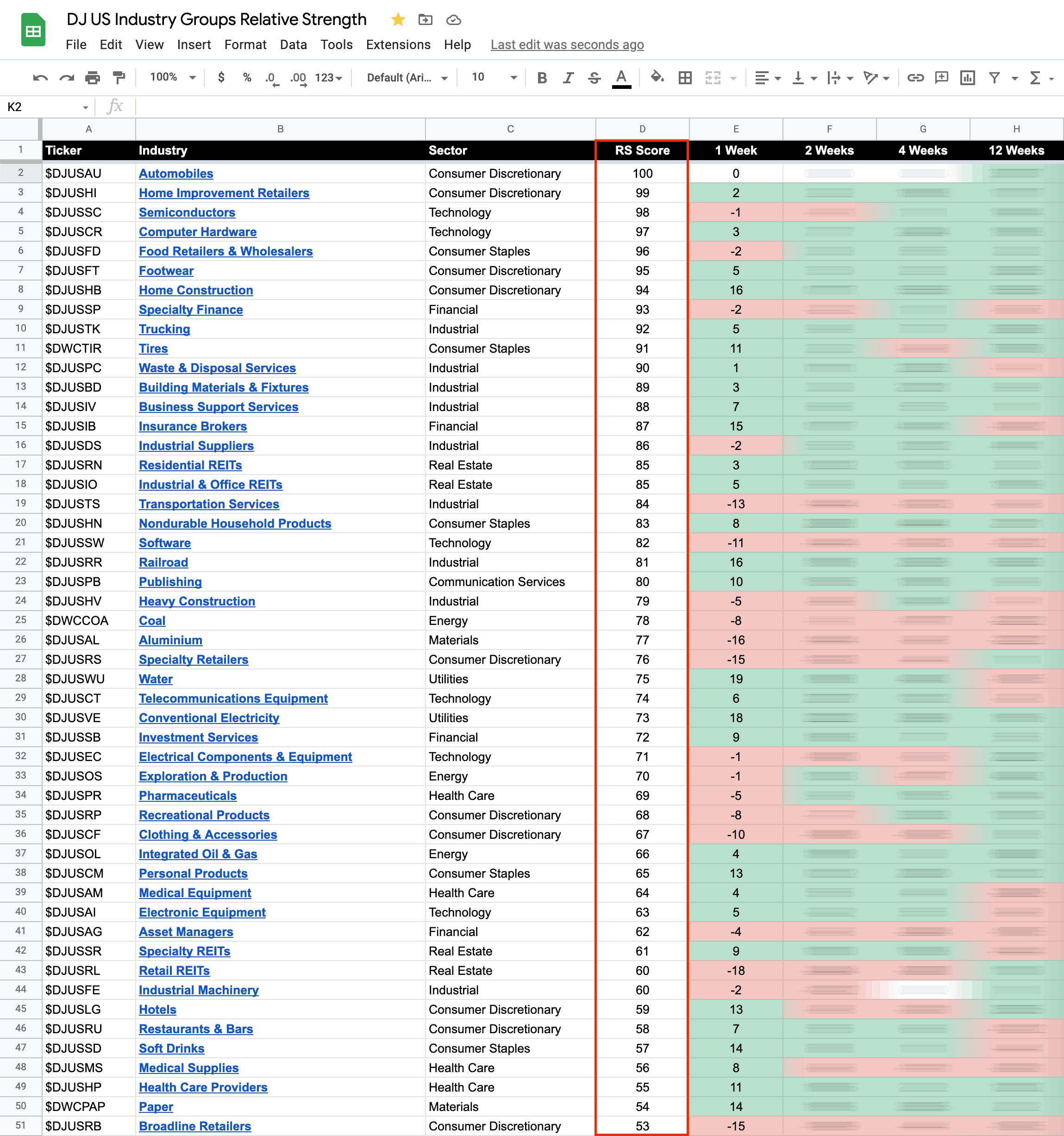

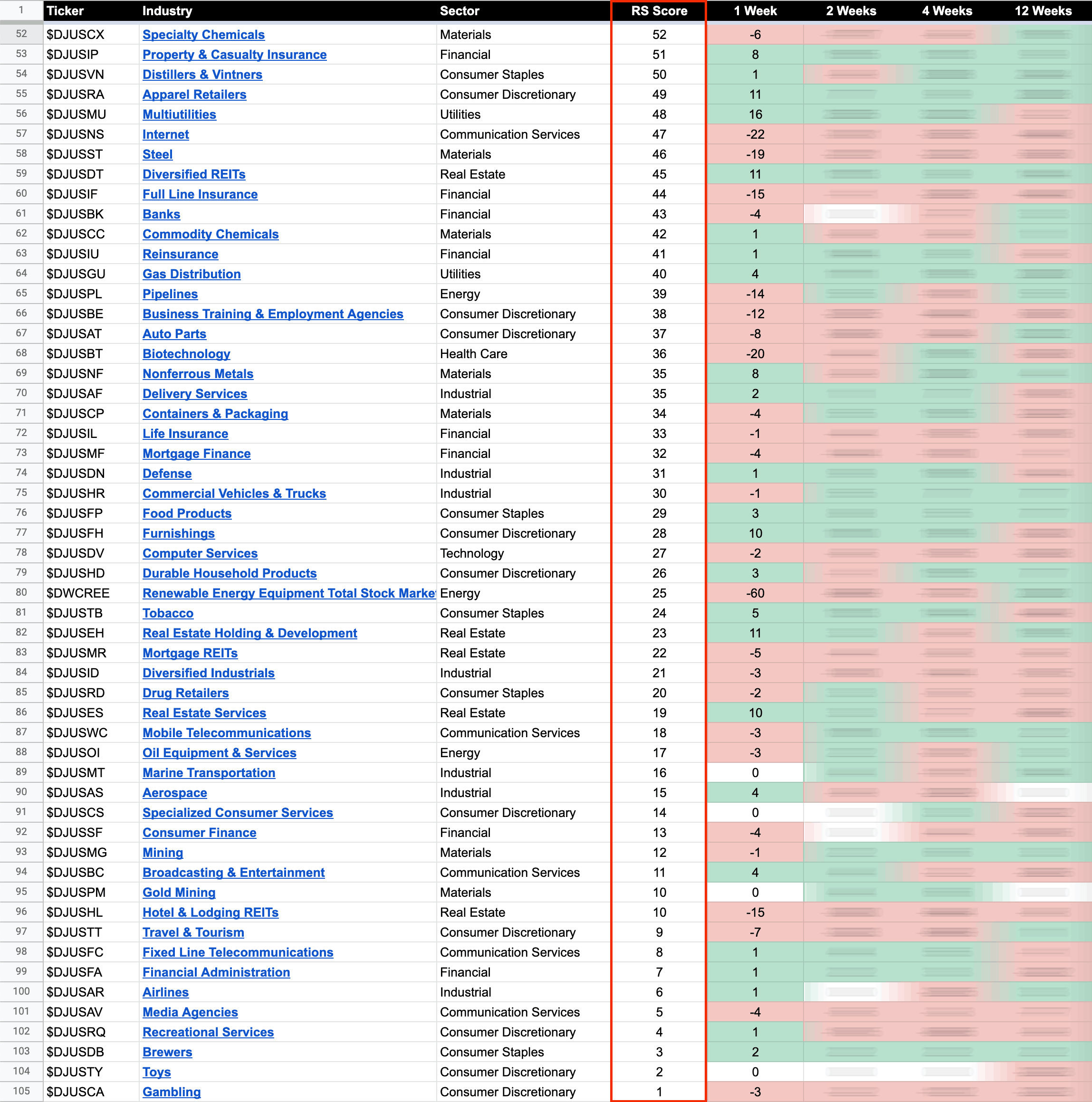

104 Dow Jones Industry Groups sorted by Relative Strength

104 Dow Jones Industry Groups sorted by Relative Strength using stockcharts SCTR score

The purpose of the RS tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd.

100 is strongest, 0 is weakest

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.