Stock Market Update and the US Stocks Watchlist – 20 October 2022

The full post is available to view by members only. For immediate access:

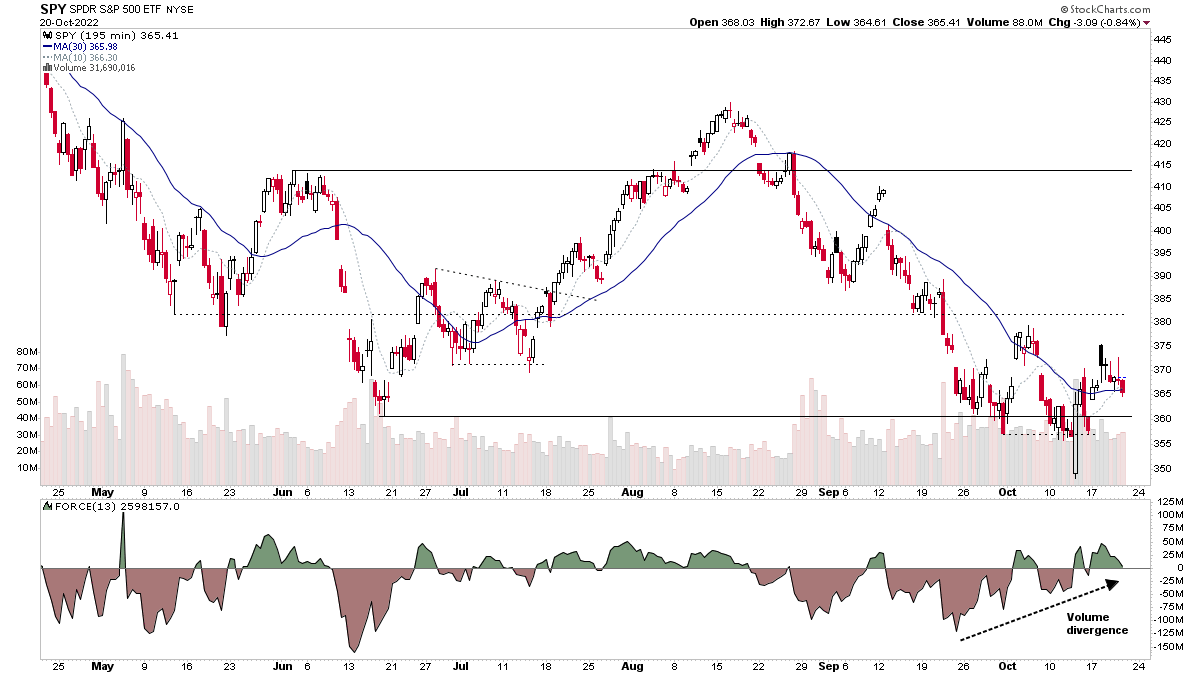

The S&P 500 and other major stock market indexes pulled back for another day, but remains above the swing low that formed a week ago on heavy volume on the 13th October.

The chart above shows the SPY etf on the 195 minute timeframe (2 bars a day), and highlights the 5 to 6 month structure that's been forming, and could turn out to be Stage 1. But remains on the borderline of returning to Stage 4. If looking for positives, then the heavy volume shakeout on the 13th formed a potential Wyckoff Spring, and so could turn out to be Phase C of the base structure, if the current test is successful, i.e. forms a higher low and resolves higher (above 380). Also of note is a divergence in the volume, which can be seen via the Force Index indicator, as supply has diminished over the last month.

Another thing to consider is that it is monthly options expirations tomorrow (Friday), and so in the SPY the maximum pain level is currently at the time of writing at 373 – which is the level that the most options would expire worthless, with a heavy put to call ratio.

US Stocks Watchlist – 20 October 2022

There were 14 stocks highlighted from the US stocks watchlist scans today

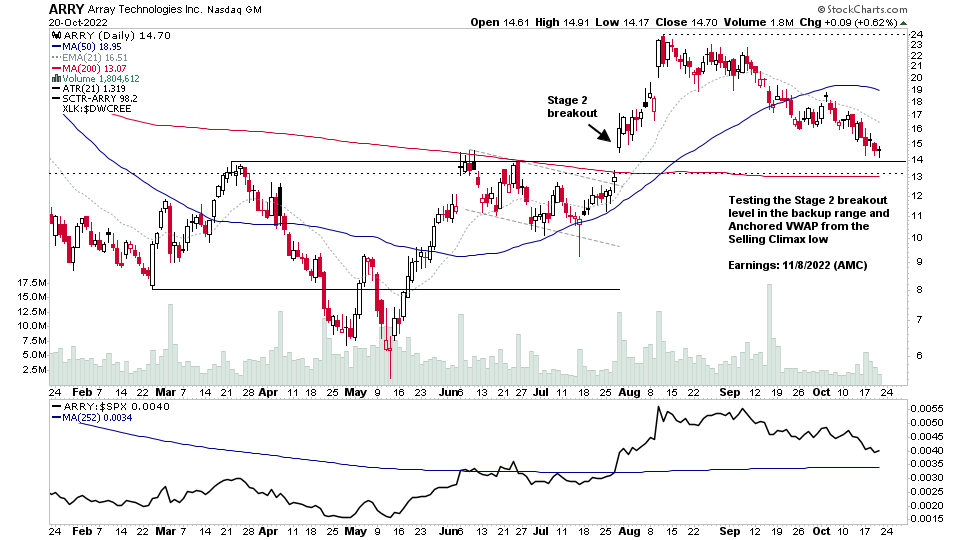

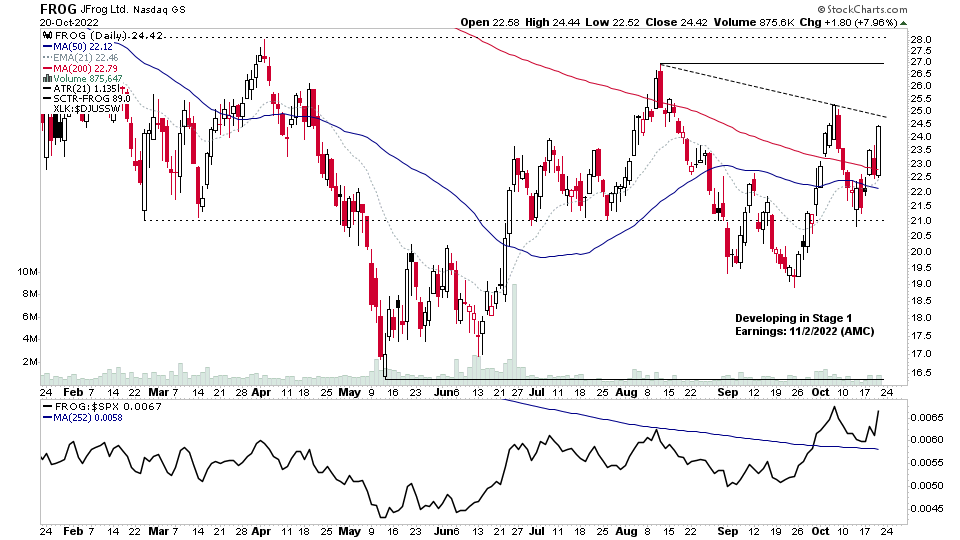

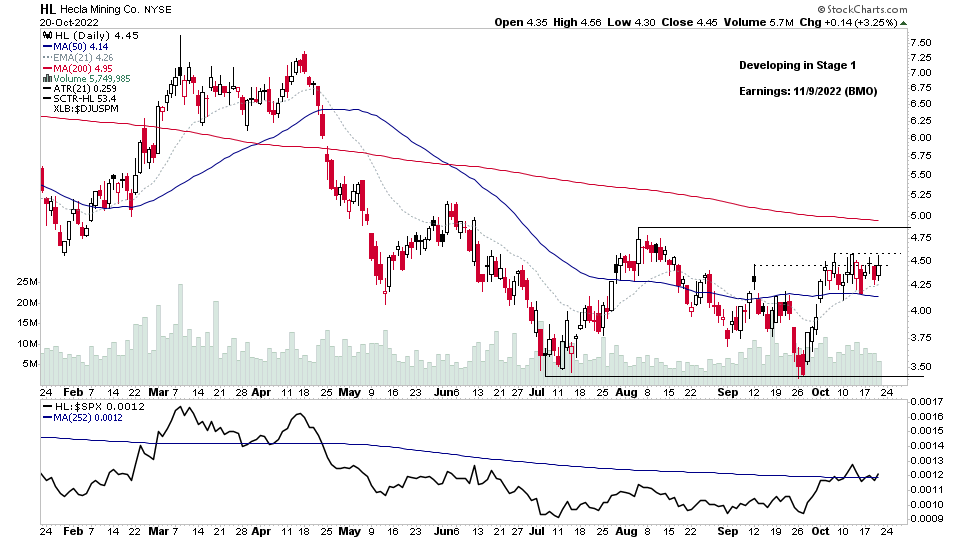

ARRY, FROG, HL + 11 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.