Stock Market Update and the US Stocks Watchlist – 17 October 2022

The full post is available to view by members only. For immediate access:

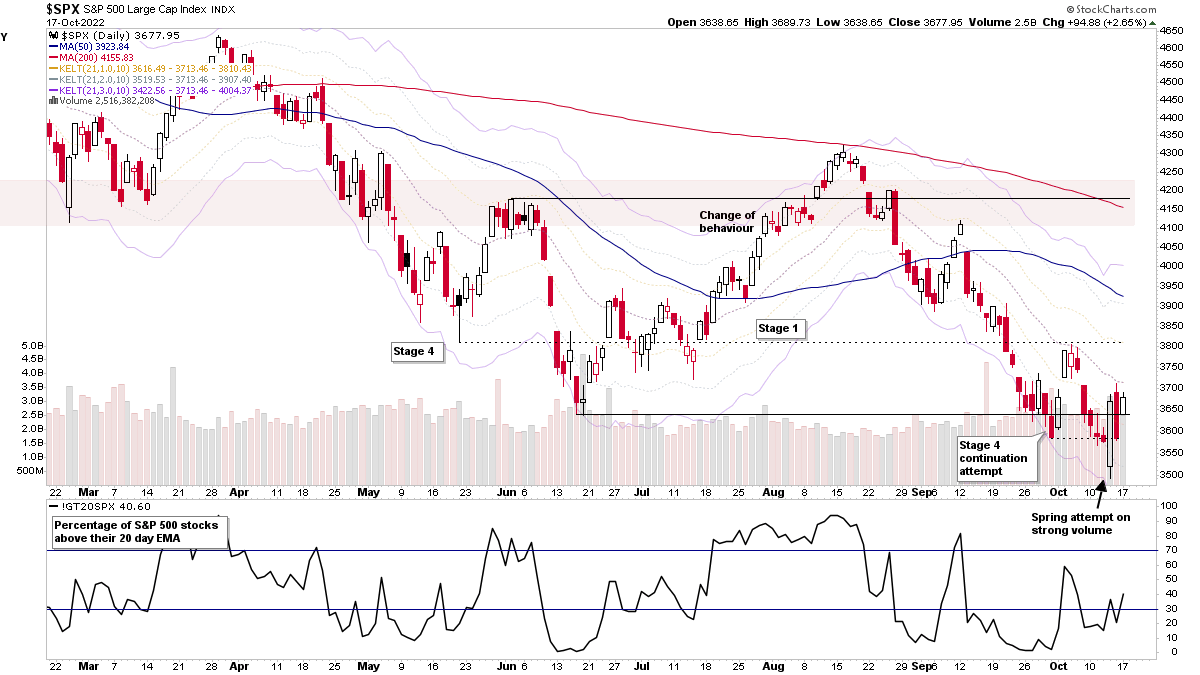

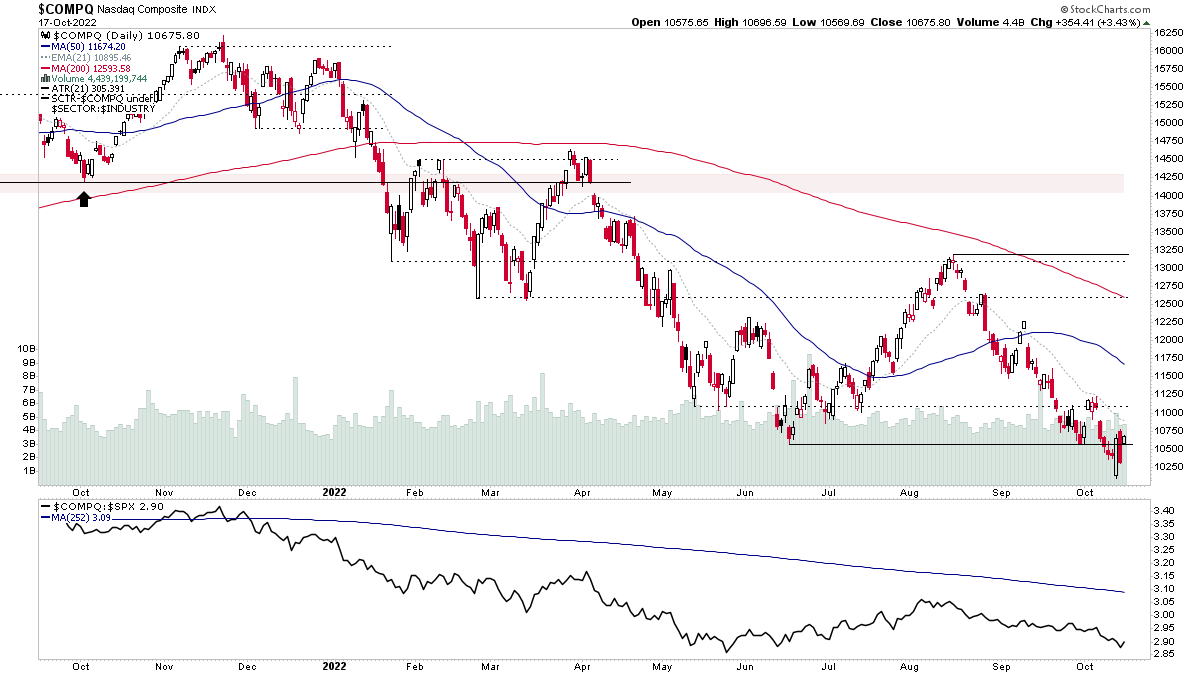

The heavy volume Spring attempt from last Thursday remains in play as a potential swing low, with a further reclaiming of the 5-day MA in the S&P 500 today – which marks Day 3 of a rally attempt from the swing low. So the S&P 500 and Nasdaq are both potentially in position for another CAN SLIM method Follow Through Day (FTD) attempt on Day 4 or later, which would require a 1.2% or greater move higher (the more the better) on greater than the previous days volume (again the more the better) as you want to see a powerful move with lots of confirmatory moves in individual stocks and breakouts.

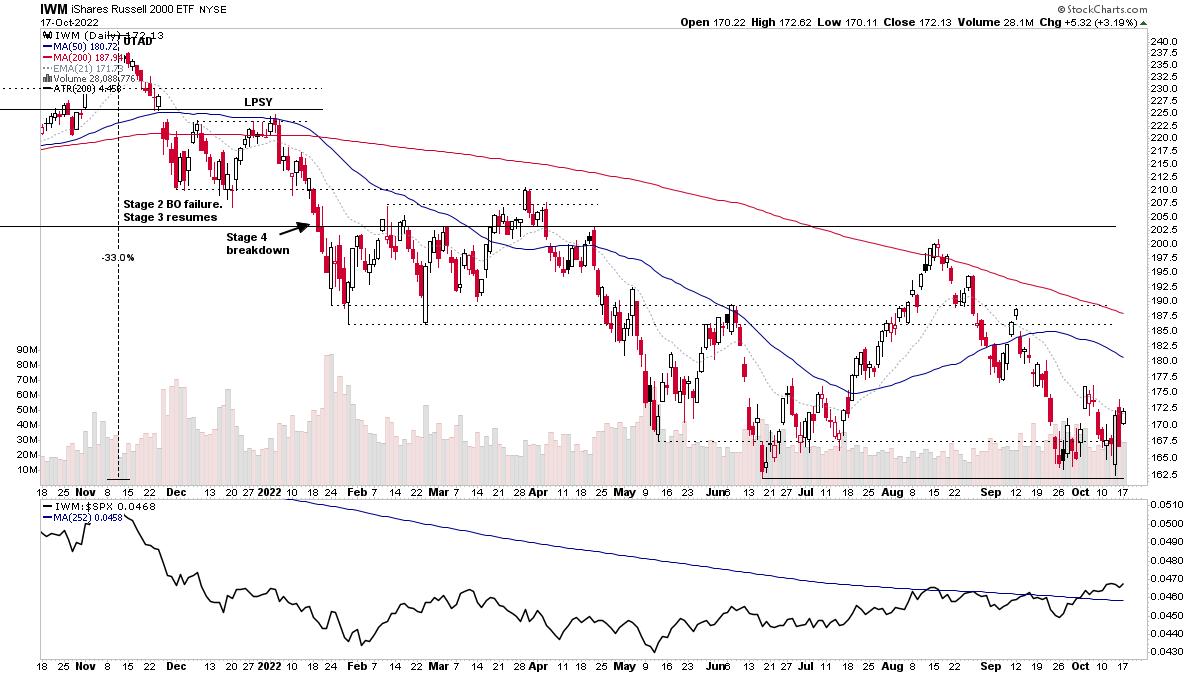

Note, that most FTDs fail during a Stage 4 market, which has been the case this year with numerous FTDs failing. So at Stage Analysis we recommend using it as part of the overall Weight of Evidence approach along with other short-term Market Breadth indicators – as it is only a short-term indicator – and why certain individuals online mock the Investors Business Daily (IBD) trend status used in conjunction with it. As on a FTD, Investors Business Daily will change the status to a Confirmed Uptrend, but it will only be 4 days from a swing low in a deep Stage 4 bear market, with a potential swing towards Stage 1 behaviour. So it would be far from what most people would consider an uptrend, except on an intraday timeframe.

But regardless of all that, it is still a useful secondary Market Breadth indicator, and so can be added to the overall Weight of Evidence as positive addition when it happens, and if it happens when other short-term market breadth indicators have also turned positive (which we saw today with the likes of the NYSE and Nasdaq Bullish Percent Index intraday (1-hour) chart and the NYSE and Nasdaq Percentage of Stocks above their 20 day EMA charts). Then it gives added weight to those short-term breadth signals, and hence may suggest some small test positions on the long side via progressive exposure in stocks, or by using ETFs, to start to build back a portfolio if it does then turn into a broader move on an intermediate timeframe.

US Stocks Watchlist – 17 October 2022

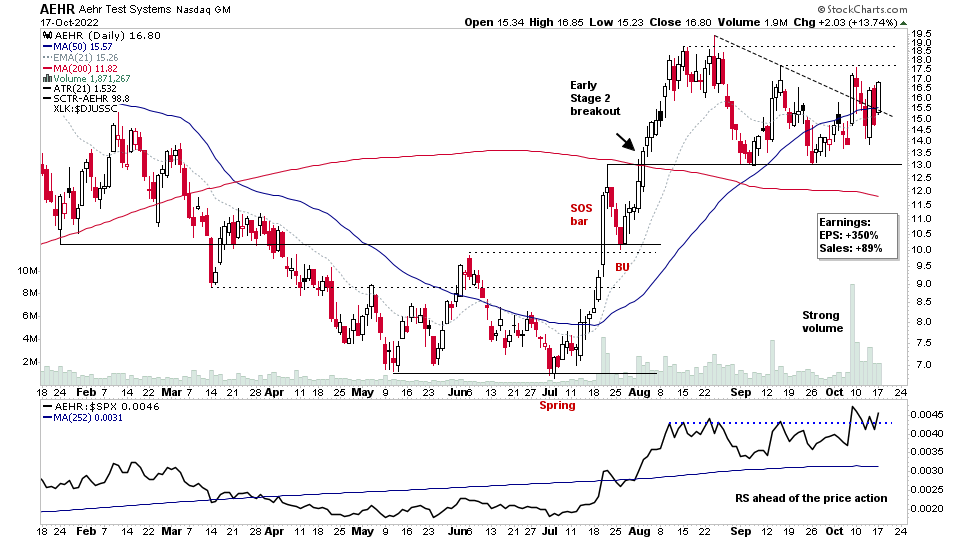

There were 23 stocks highlighted from the US stocks watchlist scans today

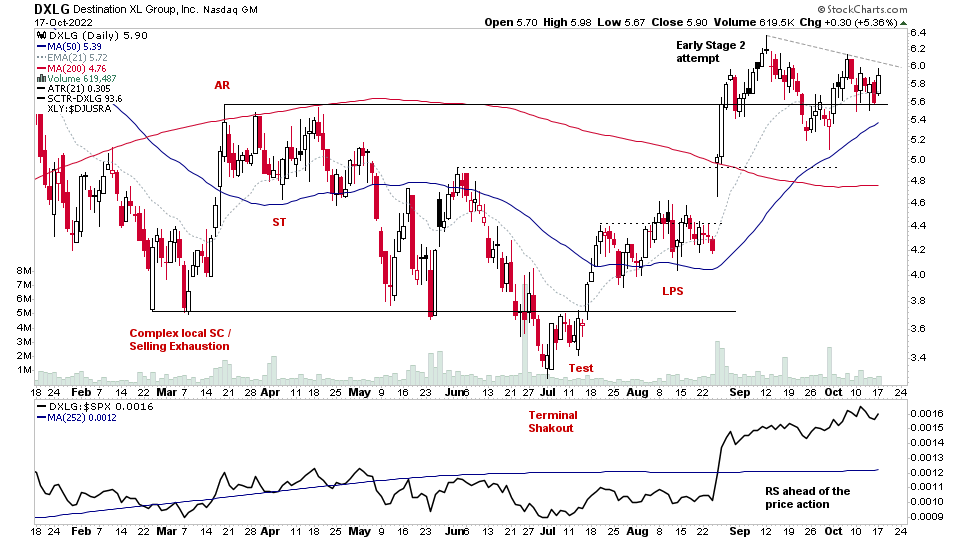

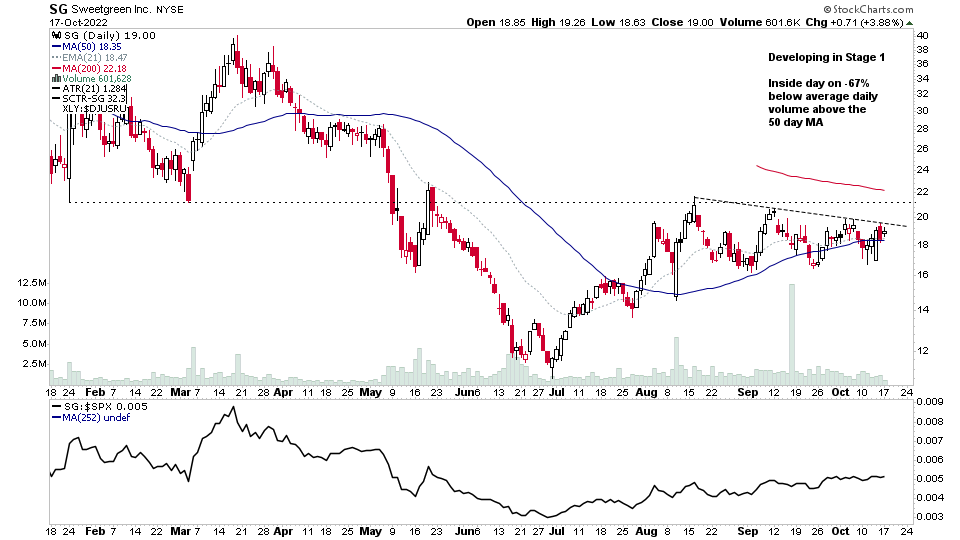

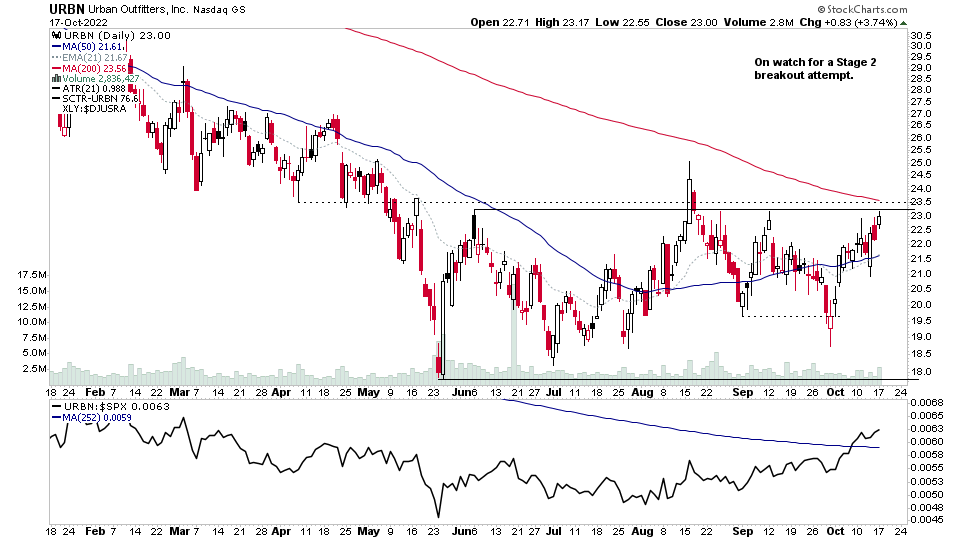

AEHR, DXLG, SG, URBN + 19 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.