US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

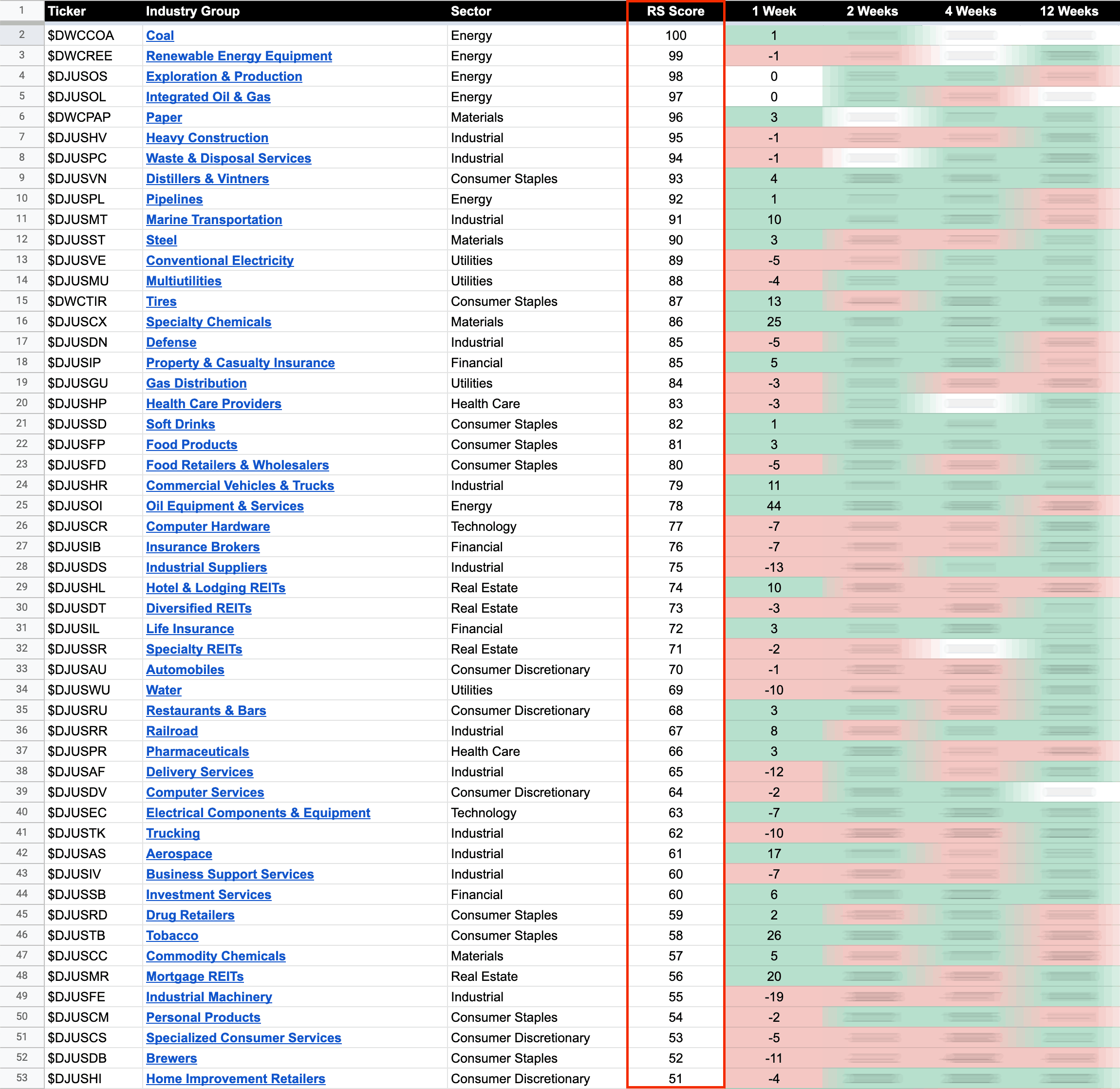

US Industry Groups by Highest RS Score

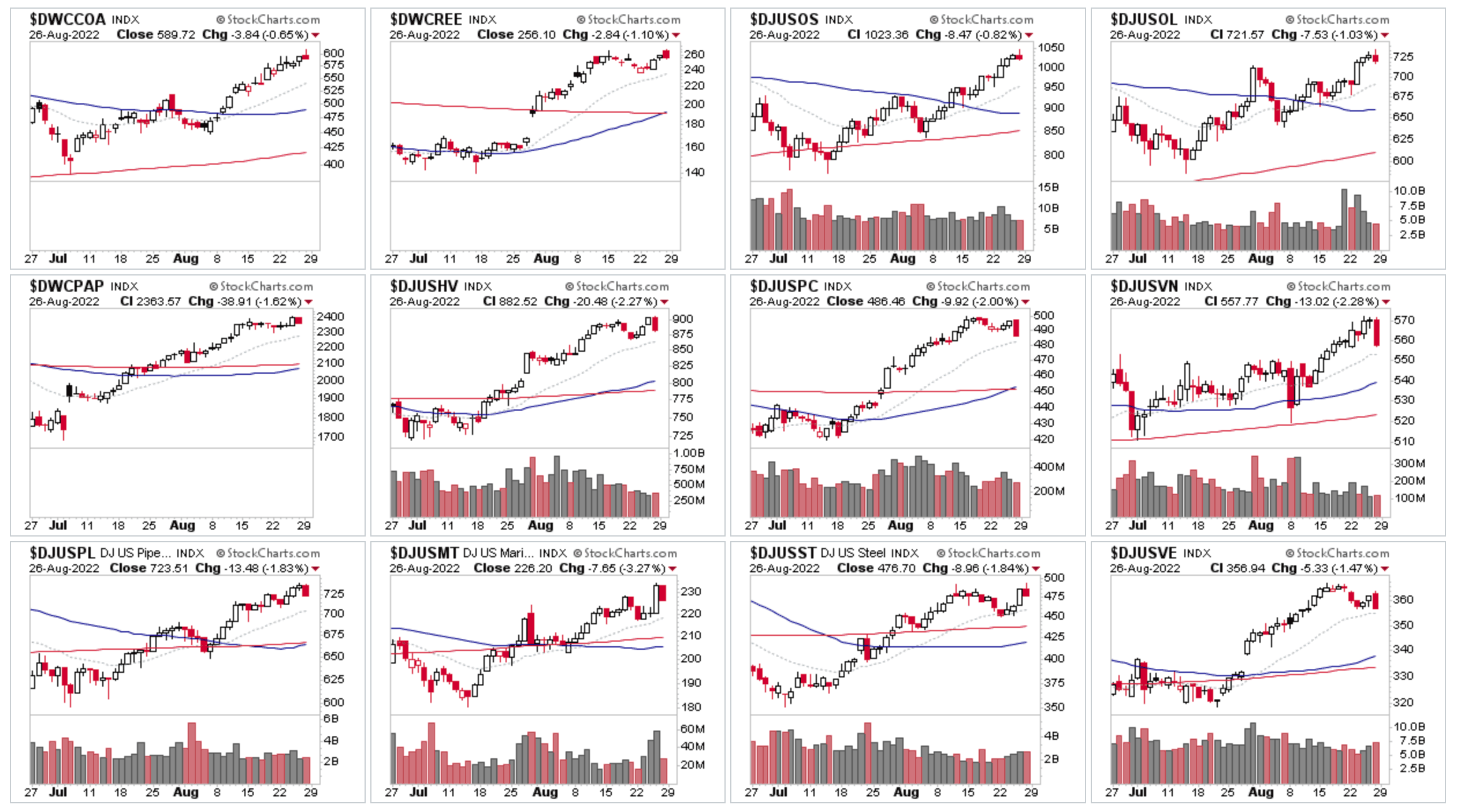

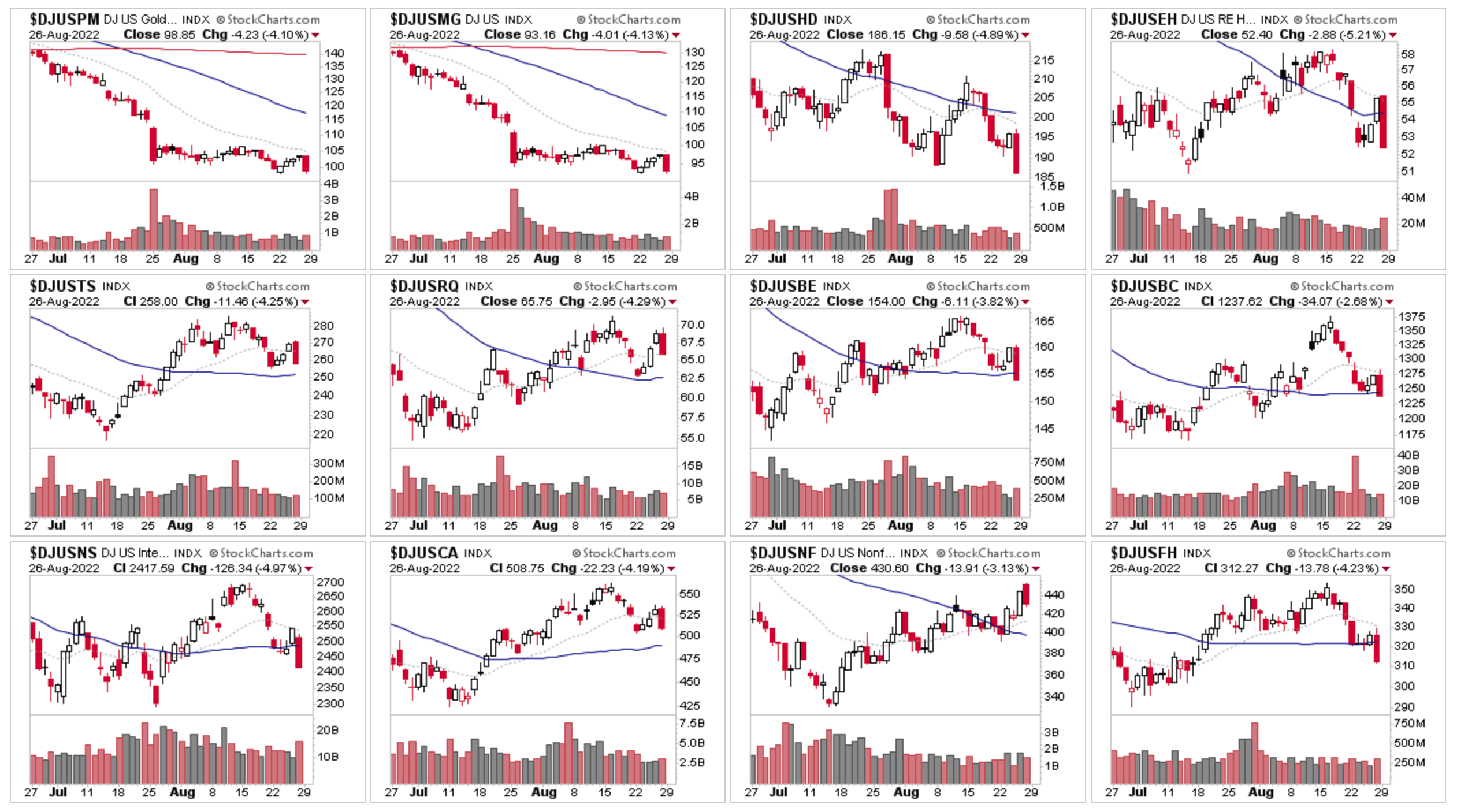

This week saw a change at the top of the RS rankings with the Coal group retaking the top spot once more immediately at the start of the week on the 22nd, and the Renewable Energy Equipment dropping back to 2nd place overall, and both showed strong RS during the market selloff on Friday (26th), with much smaller declines than the major market averages. Which we also saw in the Oil Groups as well, which remain in 3rd and 4th position overall.

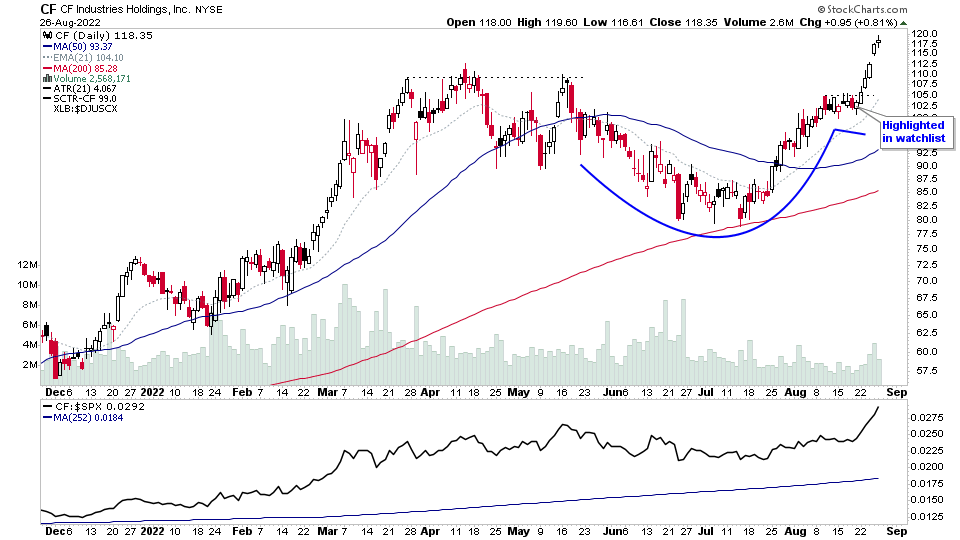

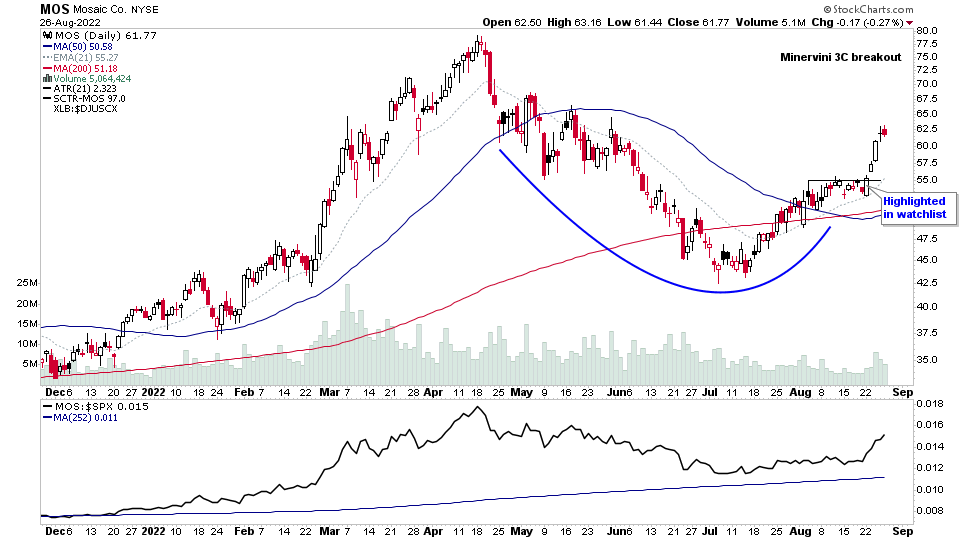

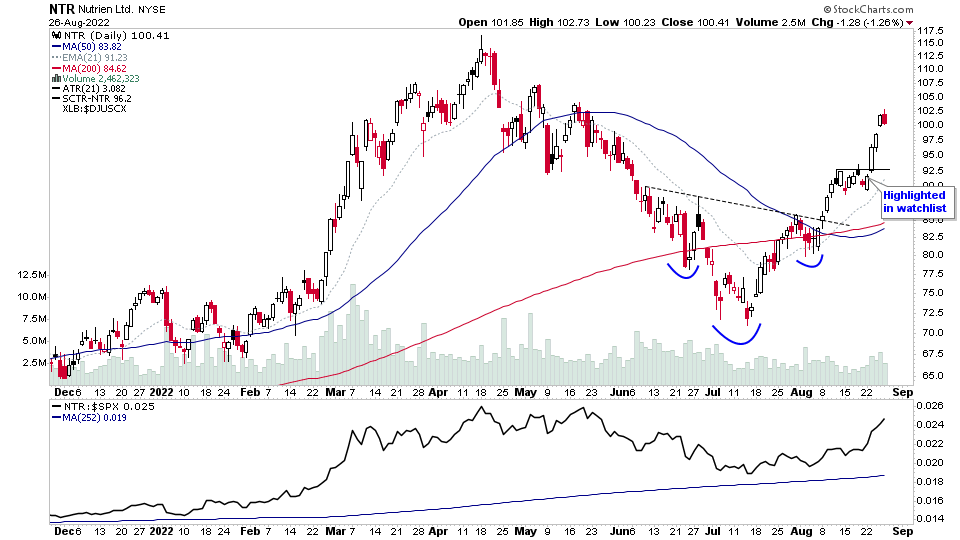

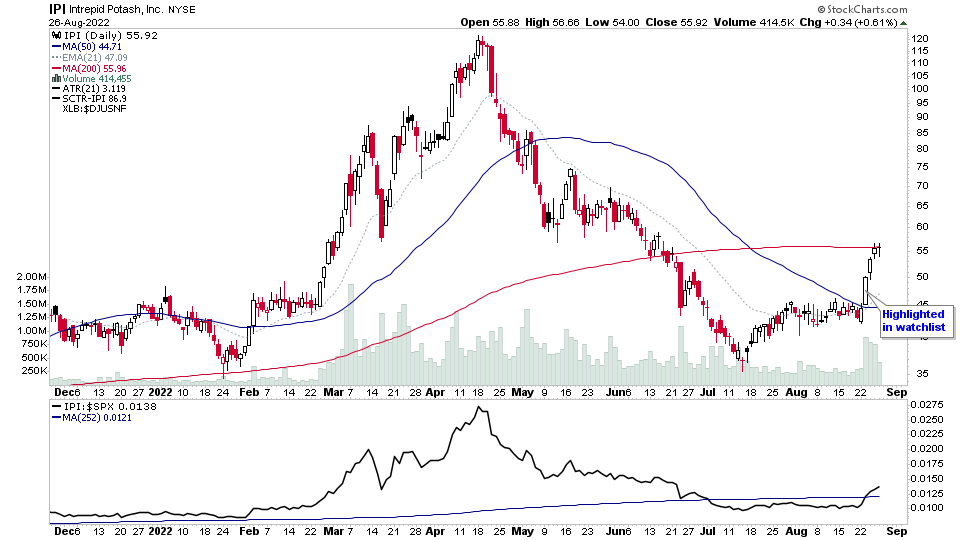

Fertilisers Stocks

One of the standouts this week was the Specialty Chemicals group, which moved 25 RS points up the rankings to 15th and was mainly due to the Fertilisers sub-group with stocks like CF, MOS, NTR & IPI (daily charts shown below) breaking out from various sub-structures and moving strongly through the rest of the week. The overall group had a strong double top reversal to end the week on the market weakness. But the Fertilisers stocks continued to show strong relative strength with tight bars on Friday.

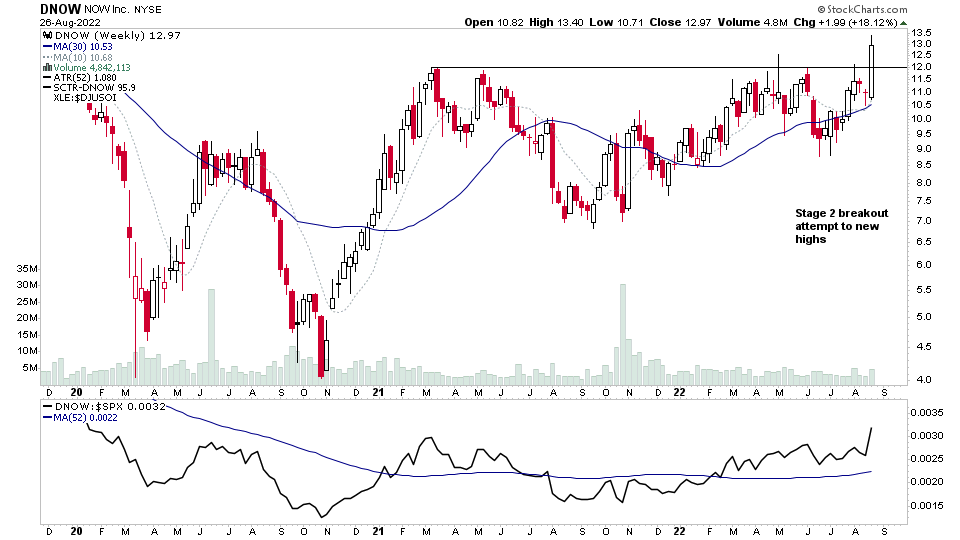

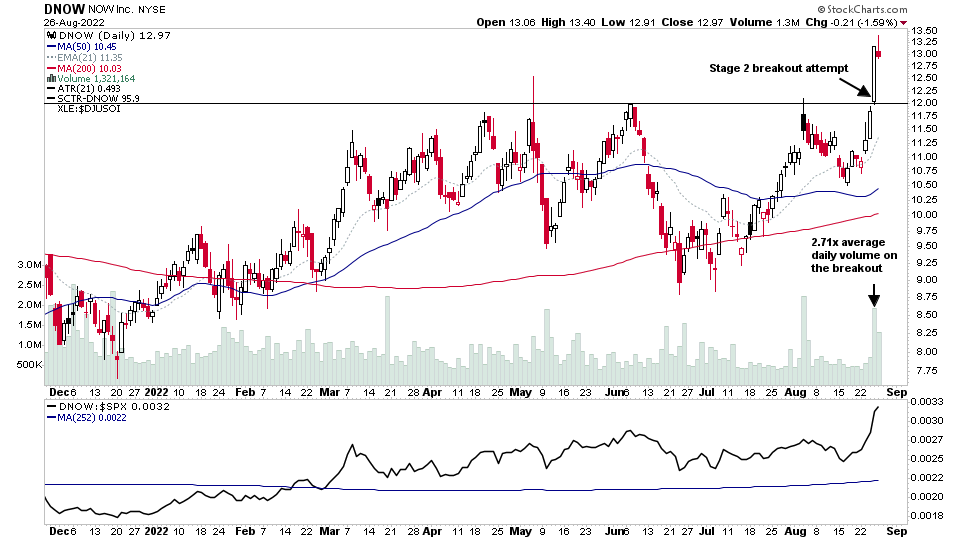

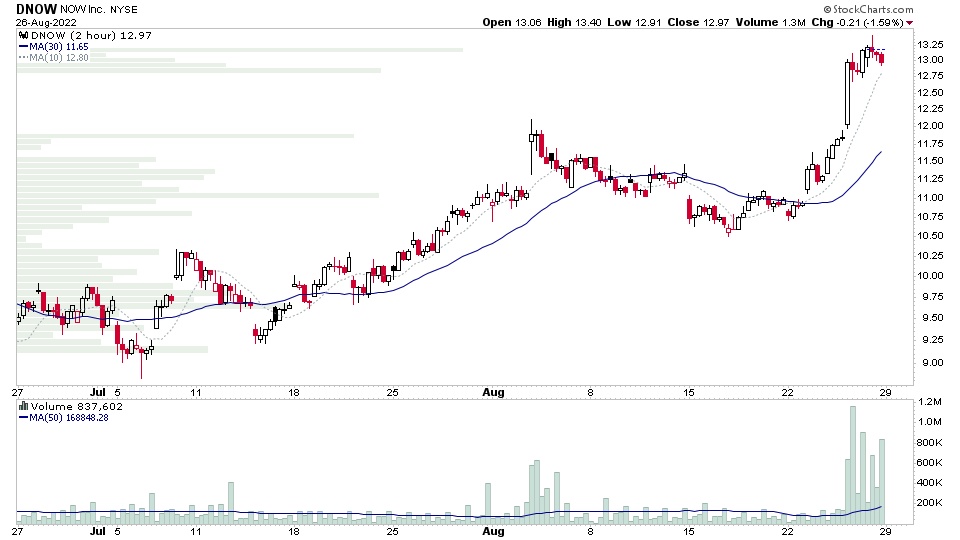

Oil Equipment & Services

Another standout group this week was another of the Energy groups – Oil Equipment & Services ($DJUSOI) – which had the strongest RS gain of the week, moving up 44 RS points to 24th place overall. A standout from the group was DNOW, which made a strong Stage 2 breakout attempt on Thursday that I highlighted on the public Twitter feed.

The breakout was late in the week, and so the volume can be deceptive. But if you were taking note of the intraday volume you could see that it would have very strong relative volume by the end of the breakout day, as was tracking at around 3 times the average early in the trading session, and closed the day at 2.71x the average daily volume. So, being a late in the week breakout, we need to focus more on the daily volume than the weekly volume when accessing the breakout volume quality.

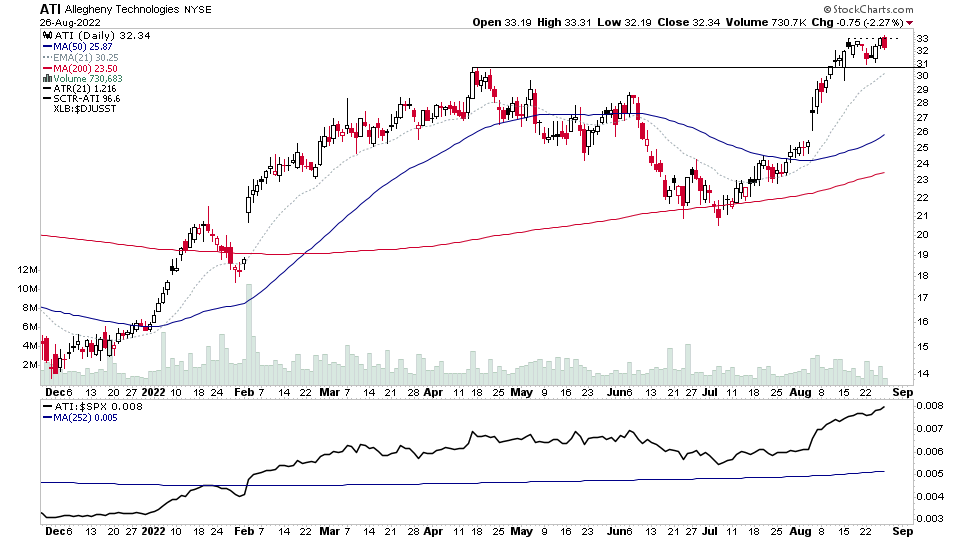

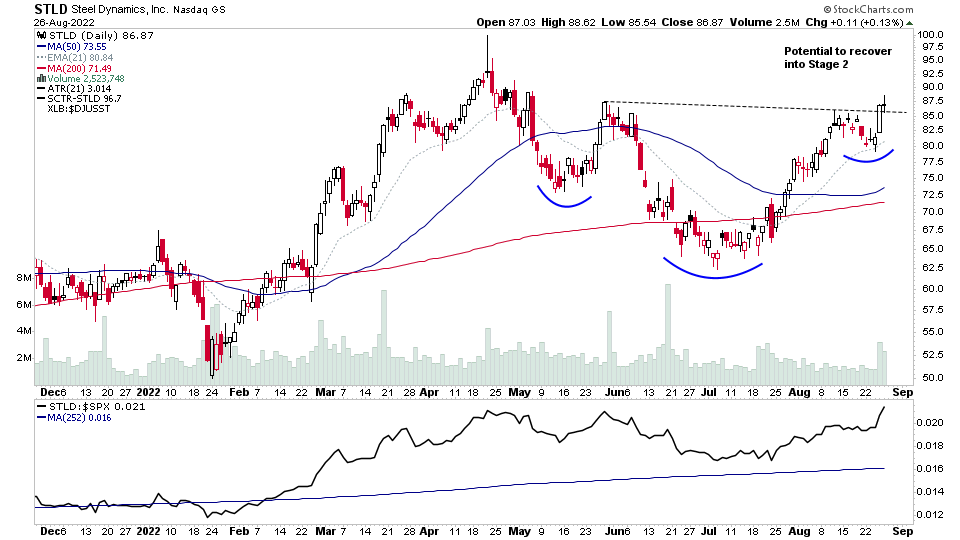

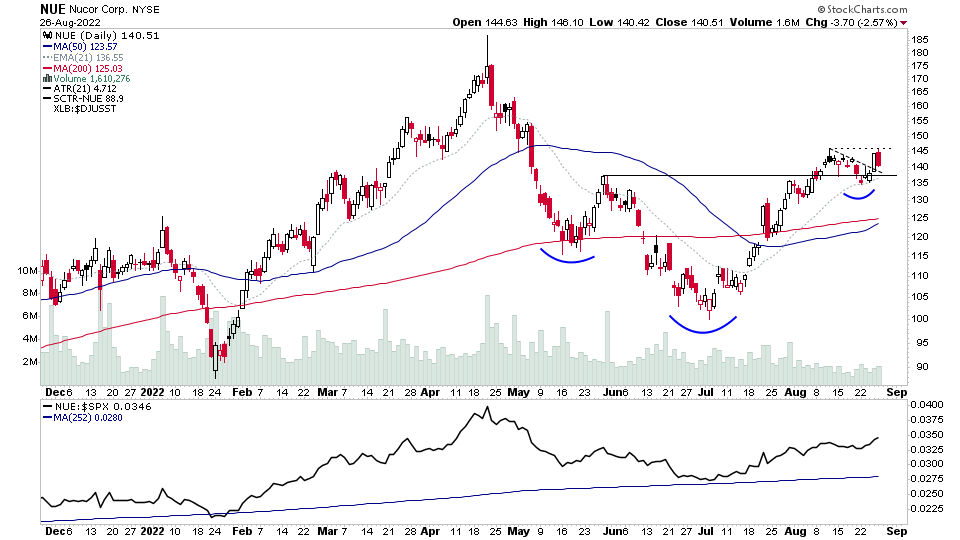

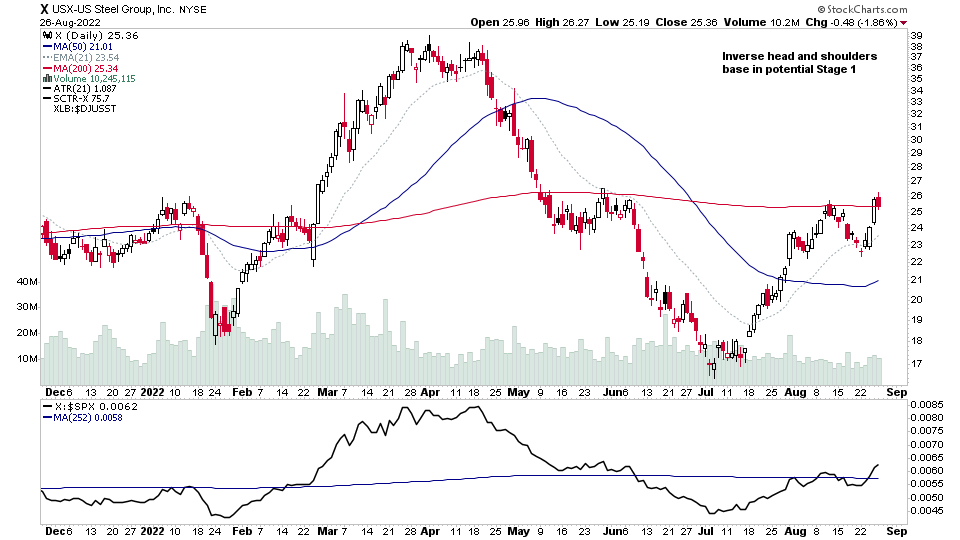

Steel

The Steel group was another strong area this week up closing up +3.33% on the week – only 14 groups were positive this week – and a number of steel stocks came up in the watchlist during week, some with distinctive inverse head and shoulders patterns. A few stocks from the group highlighted included: ATI, STLD, NUE, X

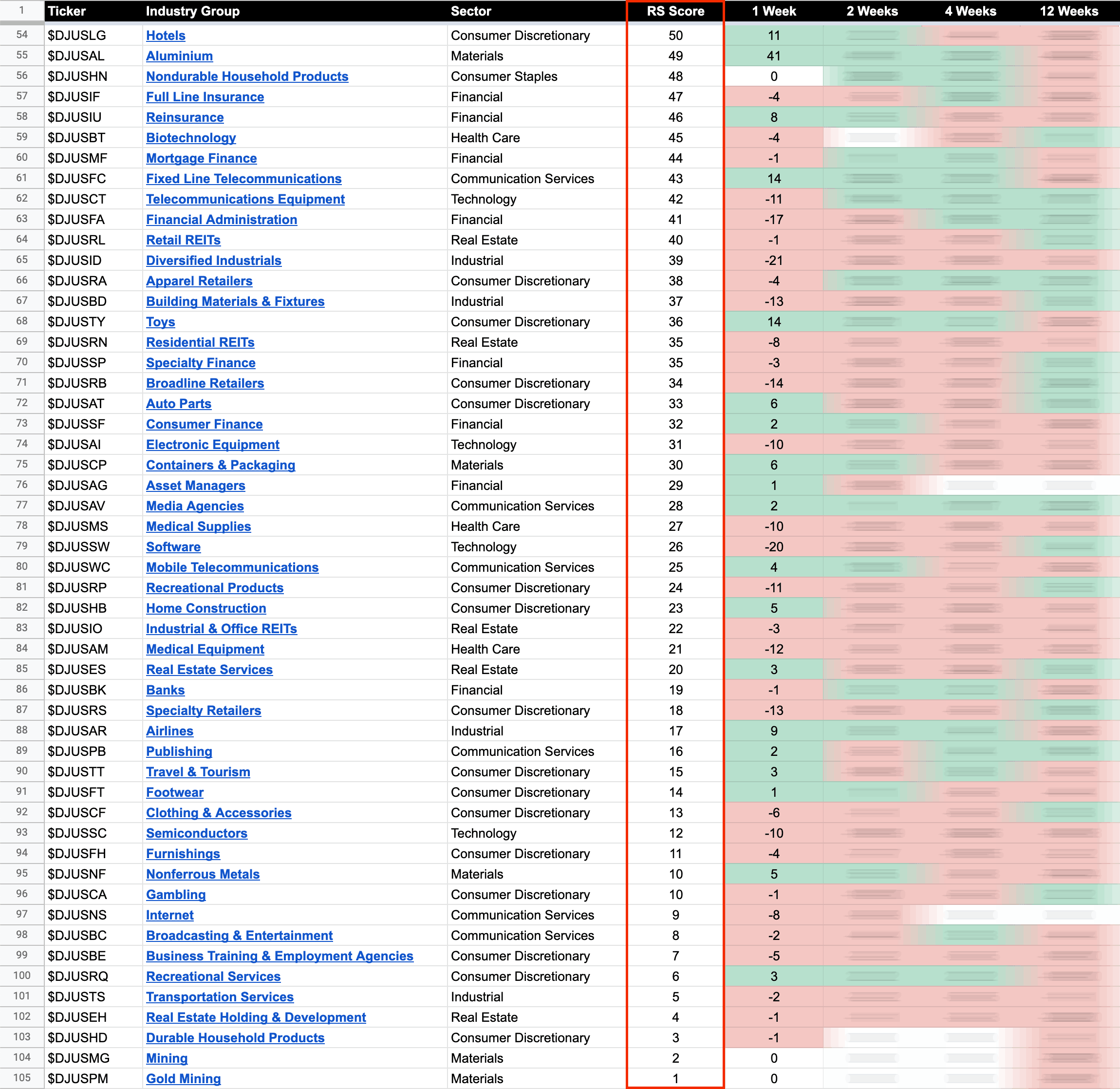

US Industry Groups by Weakest RS Score

104 Dow Jones Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.