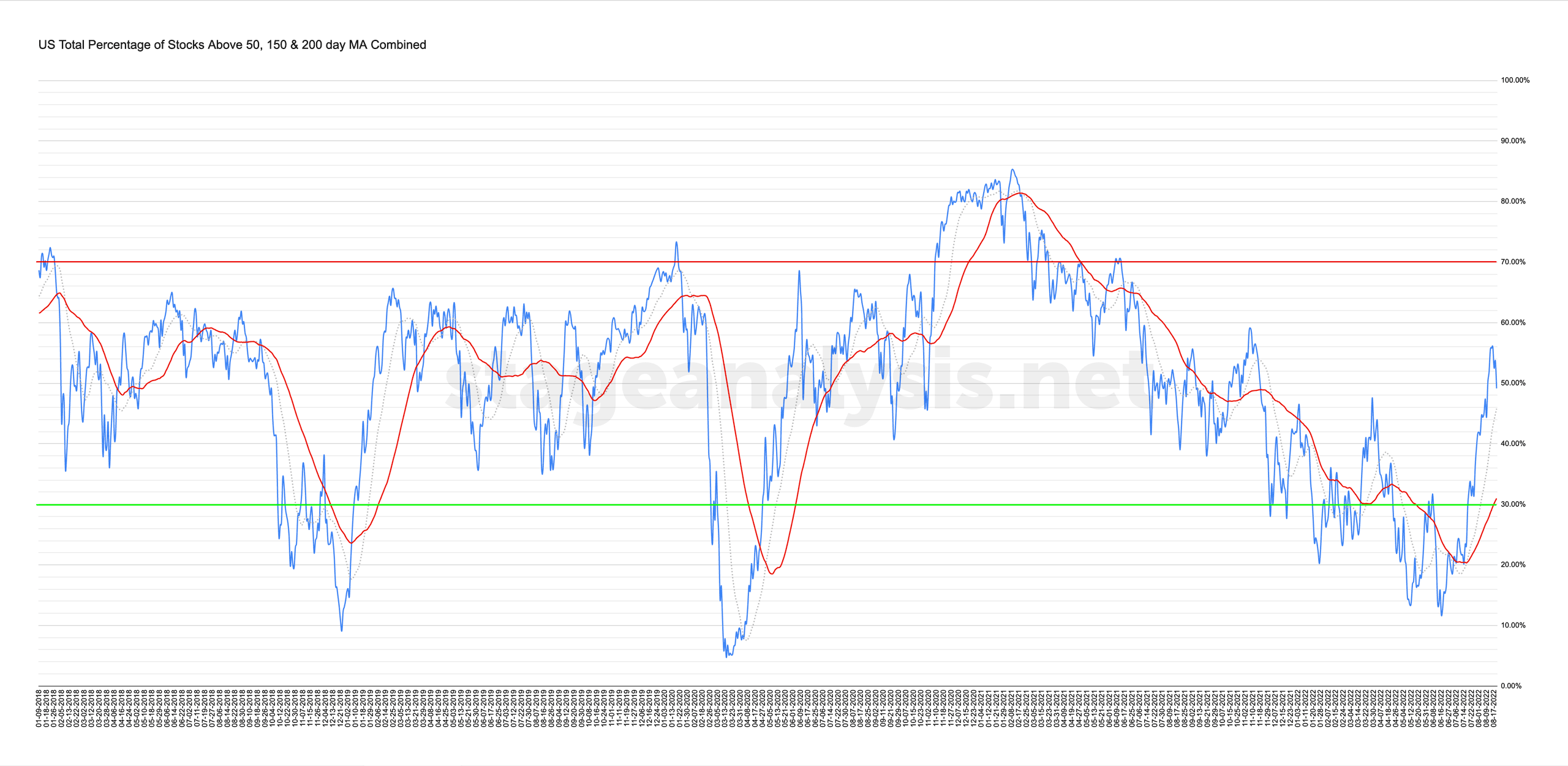

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

49.14% (-6.35% 1wk)

Status: Positive Environment in the Stage 1 zone

The US Total Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages had the biggest one week pullback since the June low with a the overall average at 49.14%, which is a decline of -6.35% over the prior week. But it remains right on the middle of the Stage 1 zone (40% to 60%), and so it has plenty of scope to pullback further without reentering the Stage 4 zone. Although that remains a possibility of course, as it's in a very neutral position, and so there's no guarantee that the Stage 1 behaviour we've been seeing will necessarily transition to Stage 2. But as long as the combined breadth average remains above its own rising 50 day MA – which its currently 18% above – then it will remain on positive environment status. Although if it starts falling back into the Stage 4 zone below 40%, while still above the rising 50 day MA, then that would signal more caution again.

But I will talk more about this and all of the other combined moving average breadth charts from the full members post in detail during the Stage Analysis Members weekend video – which is scheduled for later on Sunday afternoon EST.

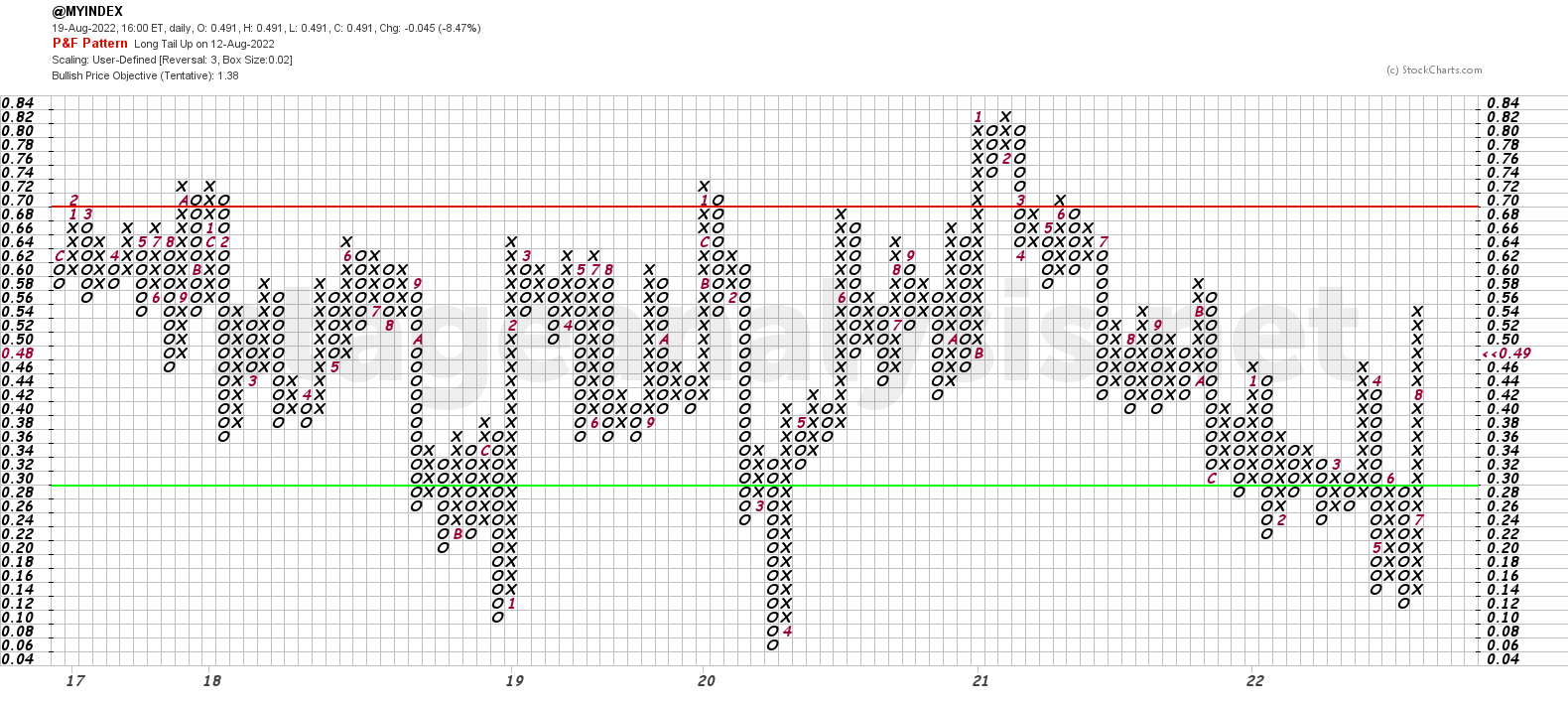

The Point & Figure chart saw no box or column change this week, although it's very close to a potential reversal to a column of Os, which would be a break below 48%. If it does reverse to a column of Os, then that would change the strategy to defense. But currently it remains in a column of Xs, and so is on offense until the column changes.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.