Biotech and Solar Stocks Continue To Be In-Focus and the US Stocks Watchlist – 4 August 2022

The full post is available to view by members only. For immediate access:

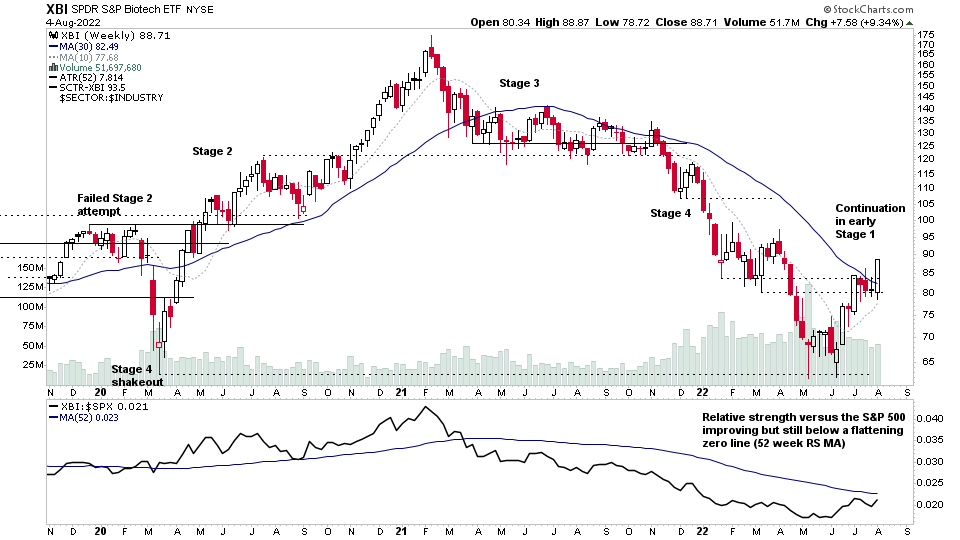

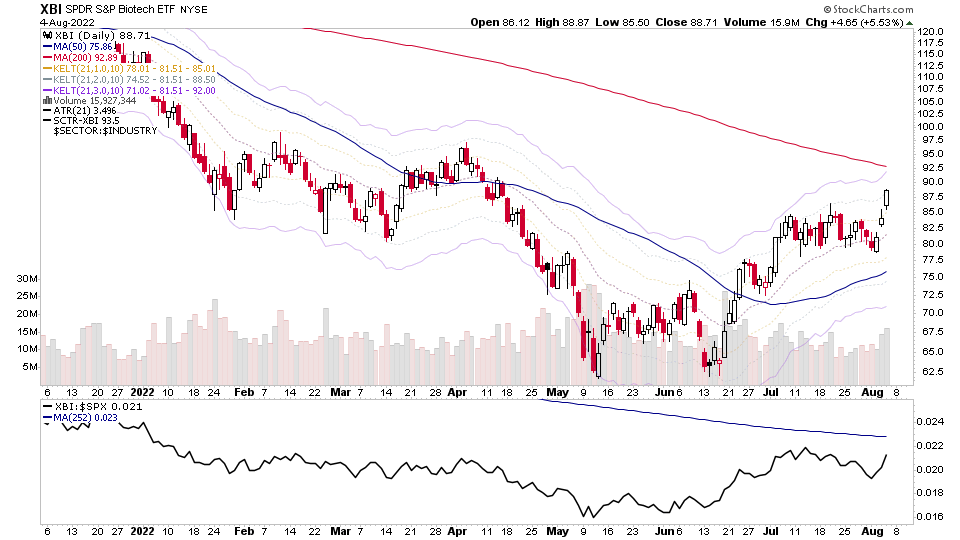

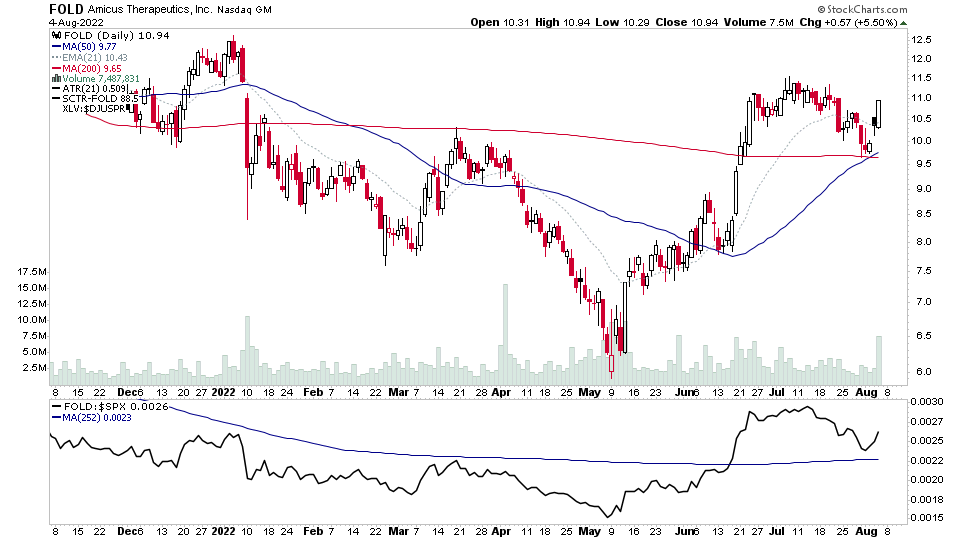

Biotechnology stocks group ETFs (XBI and IBB) made a continuation breakout today after a three week consolidation / shallow pullback within their early weekly Stage 1 advance – which has been one of the strongest group moves since the markets June swing low. So there were a notable number of Biotech stocks in tonights watchlist scans, making similar moves and developing Stage 1 bases. So it continues to be one of the key groups in-focus.

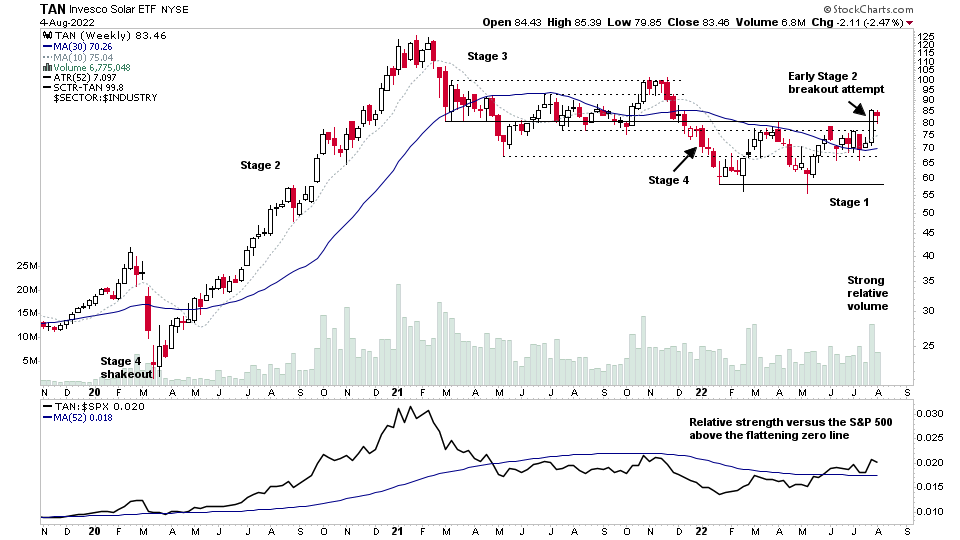

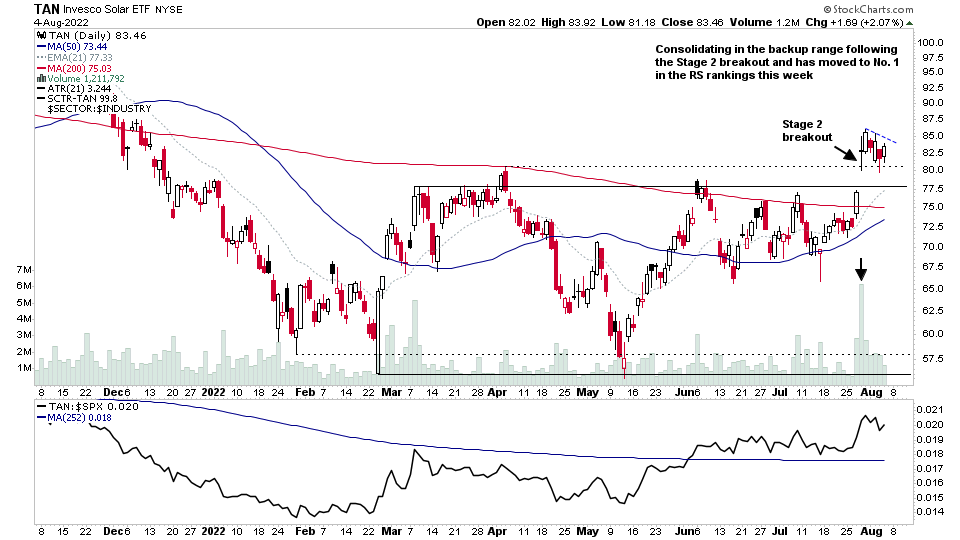

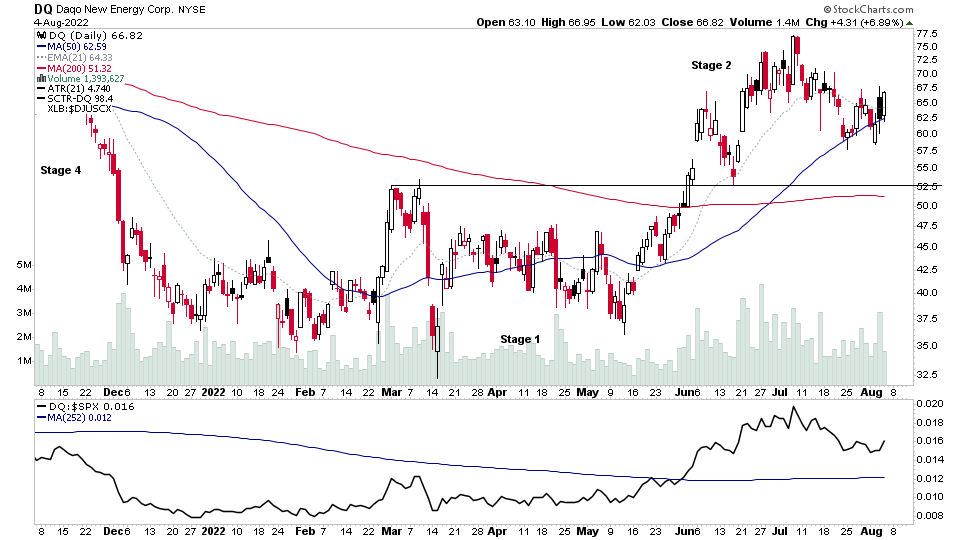

Solar stocks group ETF (TAN) continues to consolidate in a tight flag pattern since last weeks early Stage 2 breakout attempt on strong relative volume, which included many stocks in the Solar group also moving into Stage 2 – ENPH, ARRY, FSLR, MAXN, SHLS, TPIC and a few borderline at the top of Stage 1 ranges – RUN, NOVA etc.

So the group remains in the Backup range following the Stage 2 breakout and which potentially is a secondary entry zone in early Stage 2 in Stan Weinstein's Stage Analysis method as well as the Wyckoff method, and the Solar group has also moved to the No.1 spot at the top of the Industry Group Relative Strength (RS) Rankings table which I post each weekend for the members, with the changes and groups of interest moving up or down the RS rankings. So is the key group in the market right now.

US Stocks Watchlist – 4 August 2022

There were 44 stocks for the US stocks watchlist today

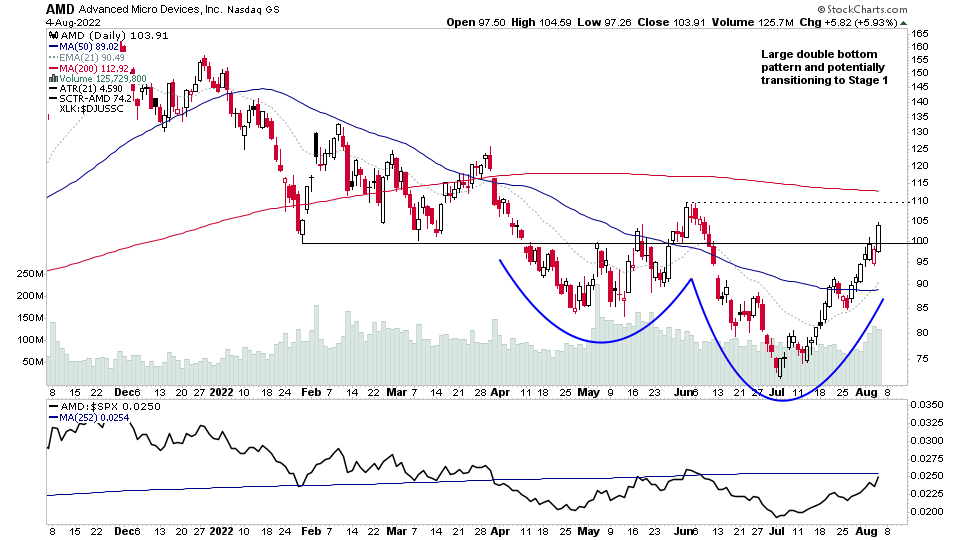

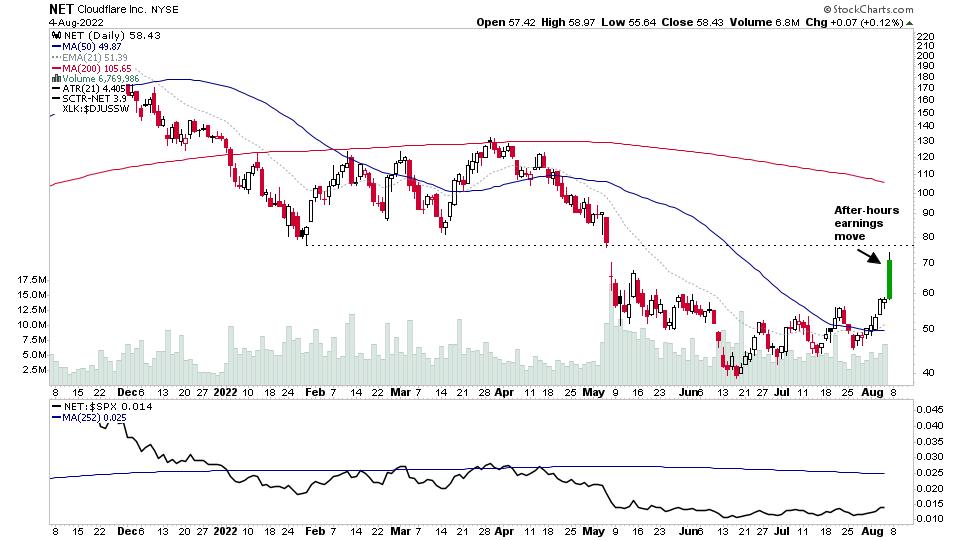

AMD, DQ, FOLD, NET + 40 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.