Stage Analysis Members Midweek Video – 15 June 2022 (1hr 4mins)

15 June, 2022The full post is available to view by members only. For immediate access:

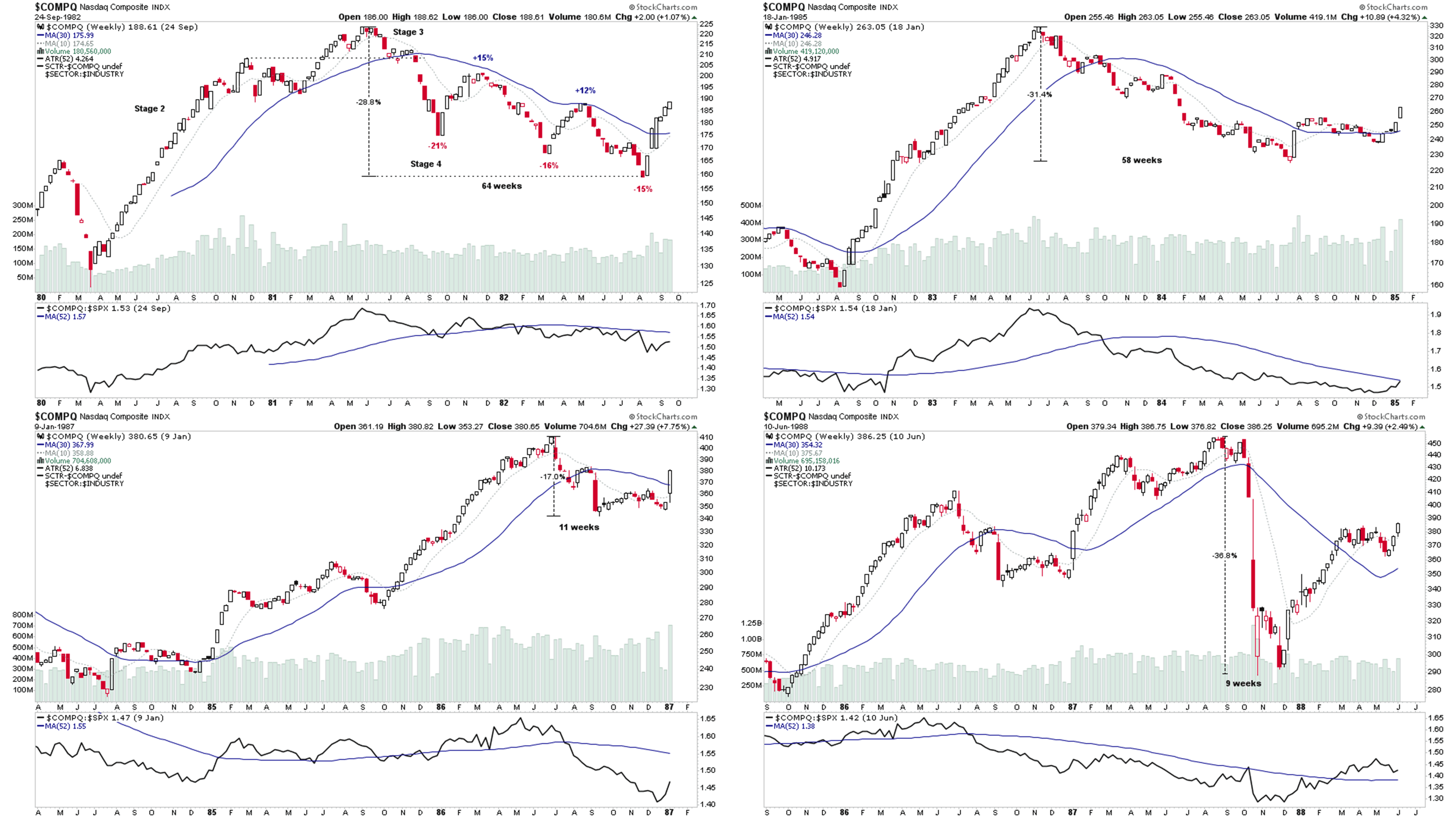

A packed schedule on todays Stage Analysis Members Midweek Video, with a brief overview of historical Stage 4 declines in the Nasdaq to start, looking at how the 15 previous significant Stage 4 declines since the early 1980s ended – capitulation or not? And the depth of the declines. As I've started a new series of posts where I'm going to look back at the significant Stage 4 declines in more detail and on multiple timeframes to help to get a better understanding of how Stage 4 plays out in the major indexes compared to individual stocks.

Following that I talk through how the major indexes have reacted to the Fed rate hike today, plus a review of the Mega Cap stocks positions, that make up a large percentage weighting of the Nasdaq 100 and S&P 500.

The shorter term Market Breadth indicators positions are also covered to see if there has been any status changes, and then I talk through and mark up live on screen, some of the recent watchlist stocks. Before finishing the video with a discussion of the heavy Stage 4 declines in Bitcoin and Ethereum this week, which may be reaching a short term Selling Climax (SC) as both reached significant dollar levels with Bitcoin reaching 20k and Ethereum 1k.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.