US Stocks Watchlist – 29 May 2022

The full post is available to view by members only. For immediate access:

There were 36 stocks for the US stocks watchlist today.

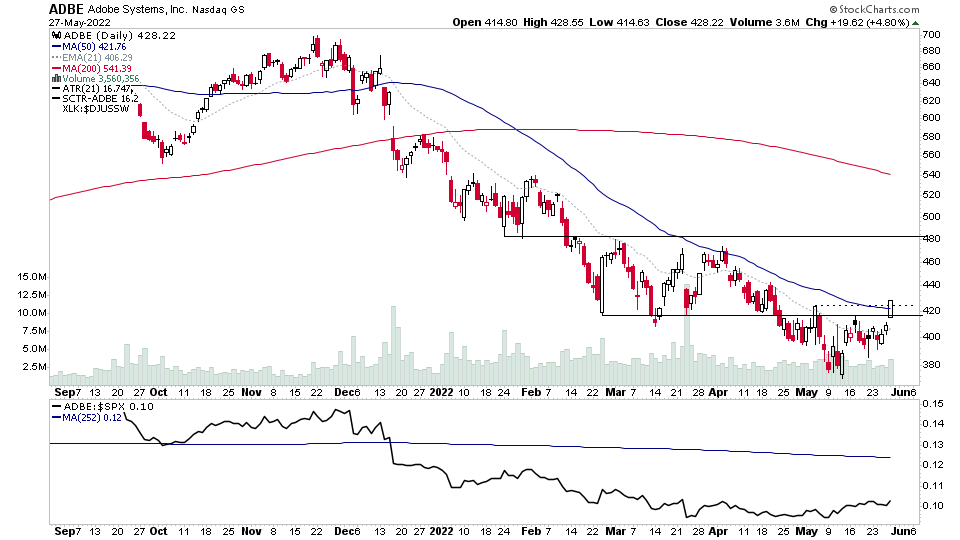

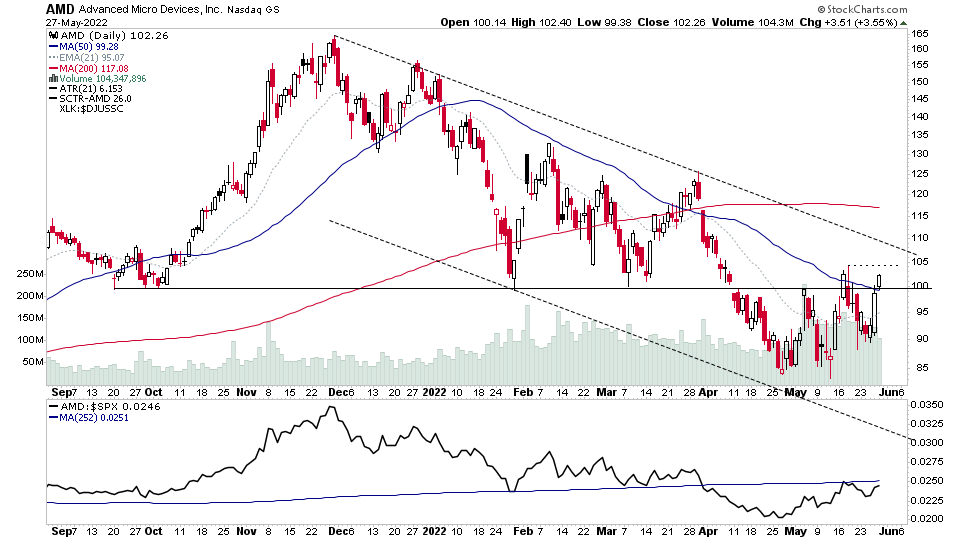

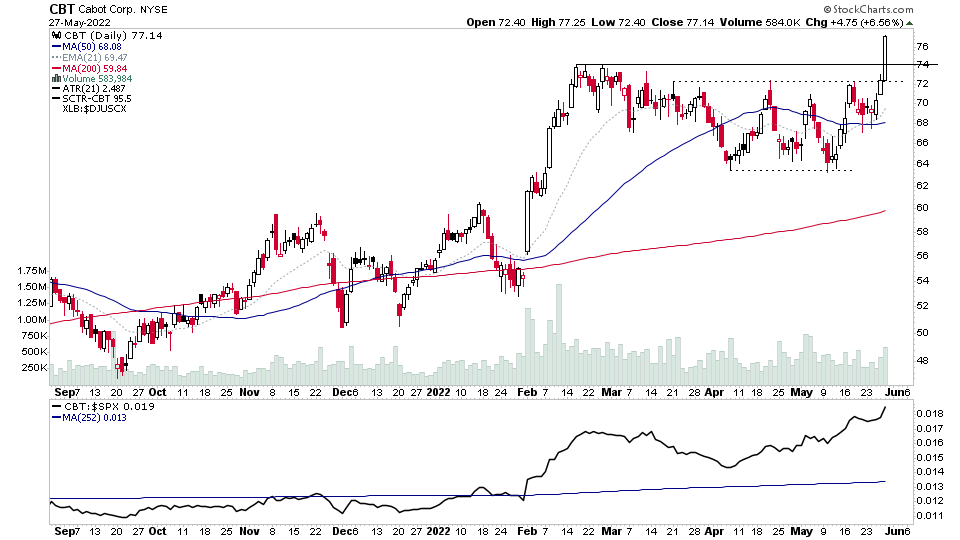

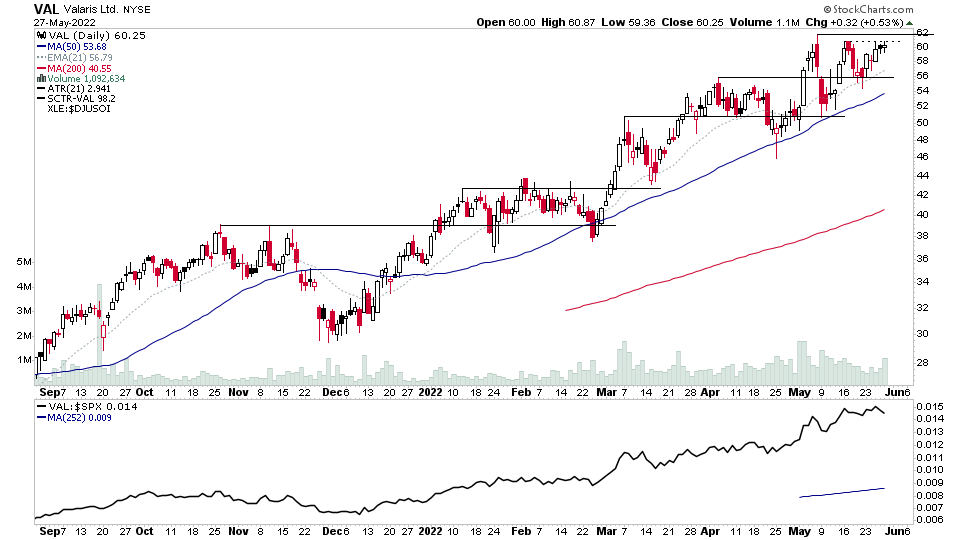

ADBE, AMD, CBT, VAL + 32 more...

Stage 2 Breakouts on Strong Relative Volume + Some Springs on Volume

Each week I run scans looking for moves of more than 2x the average weekly volume and a number of postive attributes to look for potential Stage 2 breakouts on strong relative volume. Often there is very few of the A+ quality breakouts, but strong volume moves at points in the four Stages can also be worth taking note of for changes of behaviour that might lead to future Stage 2 advances. So here's a few strong relative volume Stage 2 breakouts as well a few other stocks of interest getting strong volume that aren't in Stage 2.

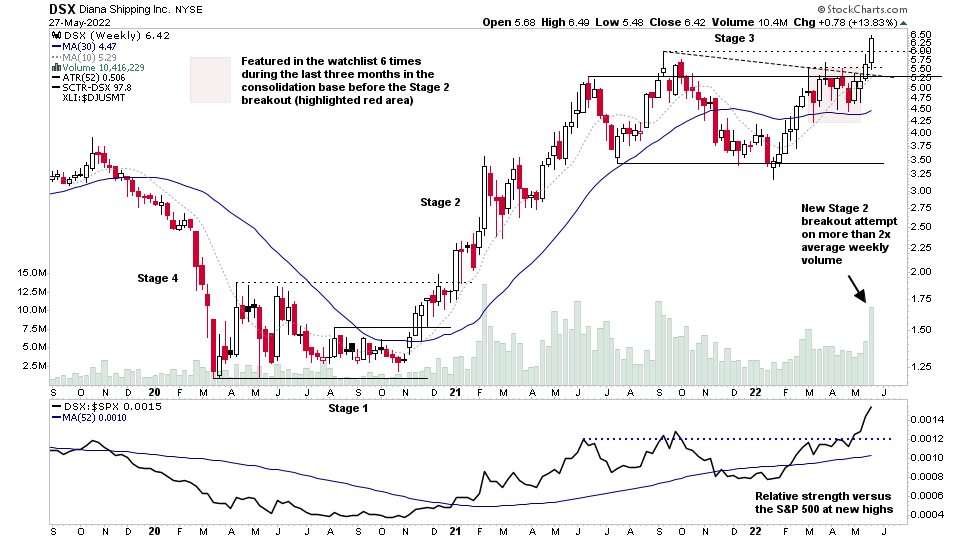

DSX – Stage 2 breakout attempt on more than 2x average volume & RS at new highs this week.

Featured in the Stage Analysis watchlist 6 times during the last three months, while in the consolidation base before the Stage 2 breakout.

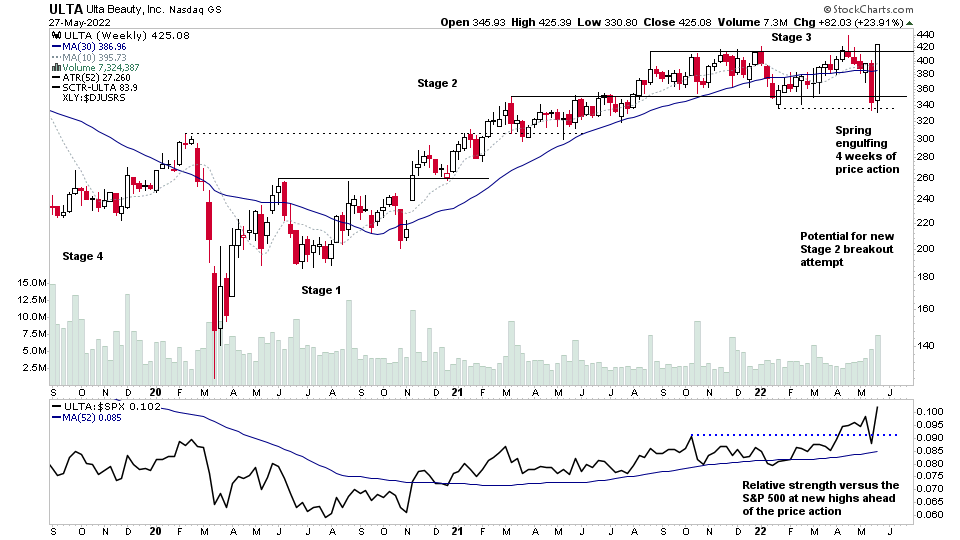

ULTA – Spring engulfing 4 weeks of price action back to the top of the large Stage 3 range with relative strength versus the S&P 500 at new highs ahead of the price action. So potential for a new Stage 2 breakout attempt.

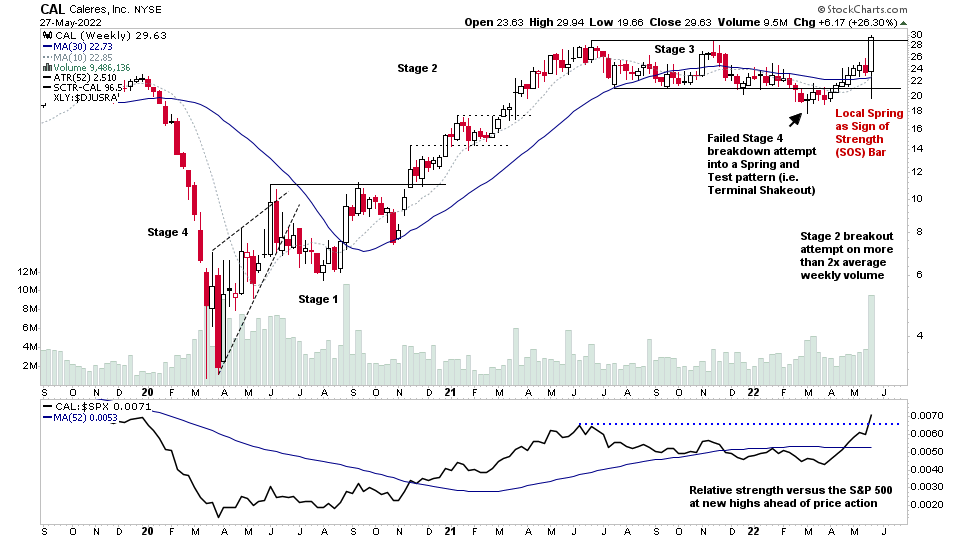

CAL – new Stage 2 breakout attempt on more than 2x average volume from a local Spring / LPS engulfing the broader one year range and RS versus the S&P 500 at new highs.

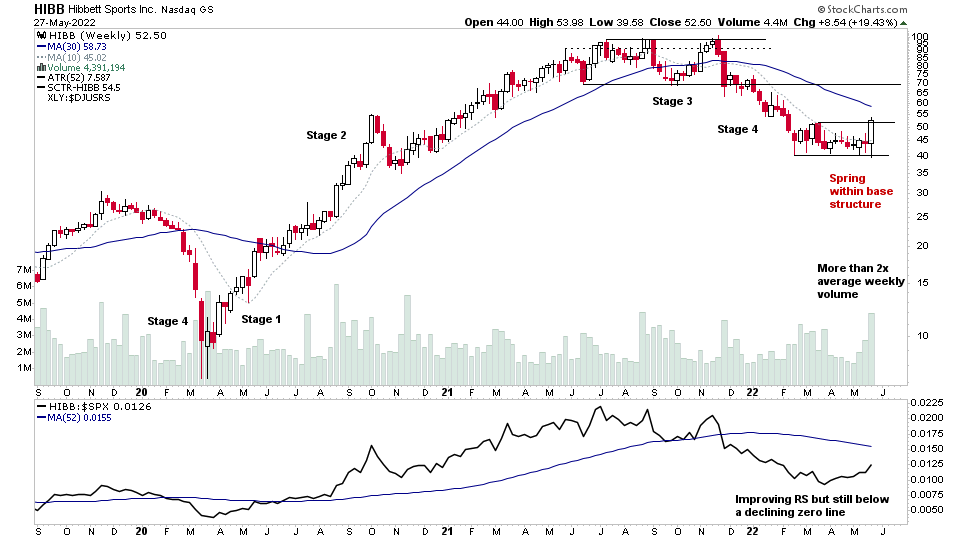

HIBB – 5 months into a Stage 4 decline with a change of behaviour this week as it formed a spring on more than 2x the average weekly volume, engulfing the last three months of price action. RS is improving also, so potentially could be moving back towards Stage 1

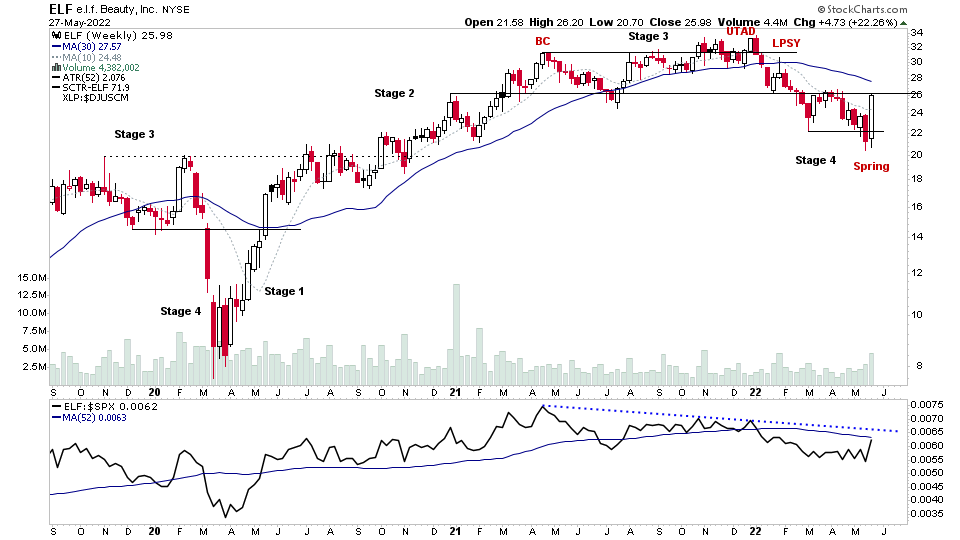

ELF – spring attempt in Stage 4 with an engulfing candle of over 4 weeks price action on more than 2x average weekly volume. So a change of behaviour which could potentially move it back towards Stage 1 in the coming weeks.

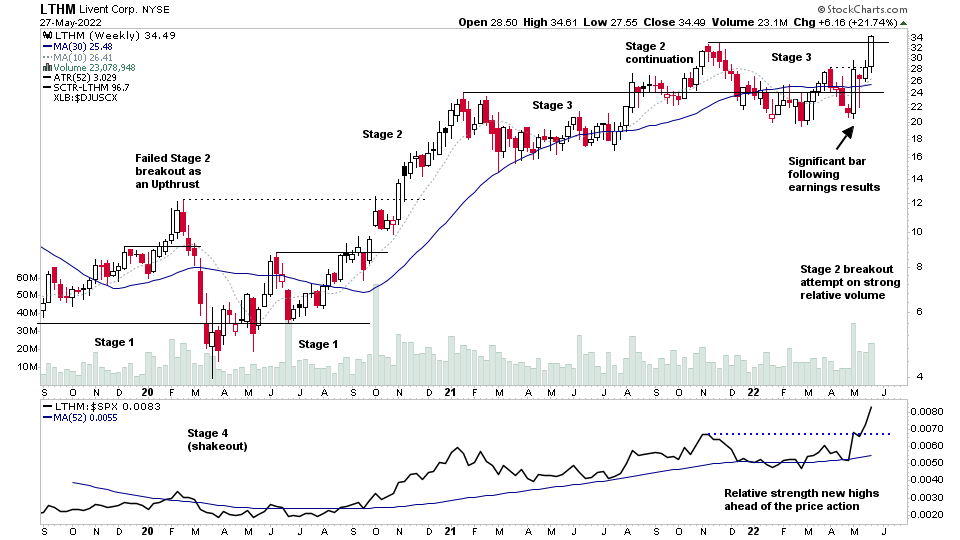

LTHM – with a strong follow through to new highs and now potentially moving back into Stage 2. But a good example of why the watchlist stocks are highlighted mostly in the base, as this has appeared consistently for the last few months in the 20s due to its RS versus the market.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.