Major Indexes Shakeout at the Lows in Stage 4 and the US Stocks Watchlist – 22 May 2022

The full post is available to view by members only. For immediate access:

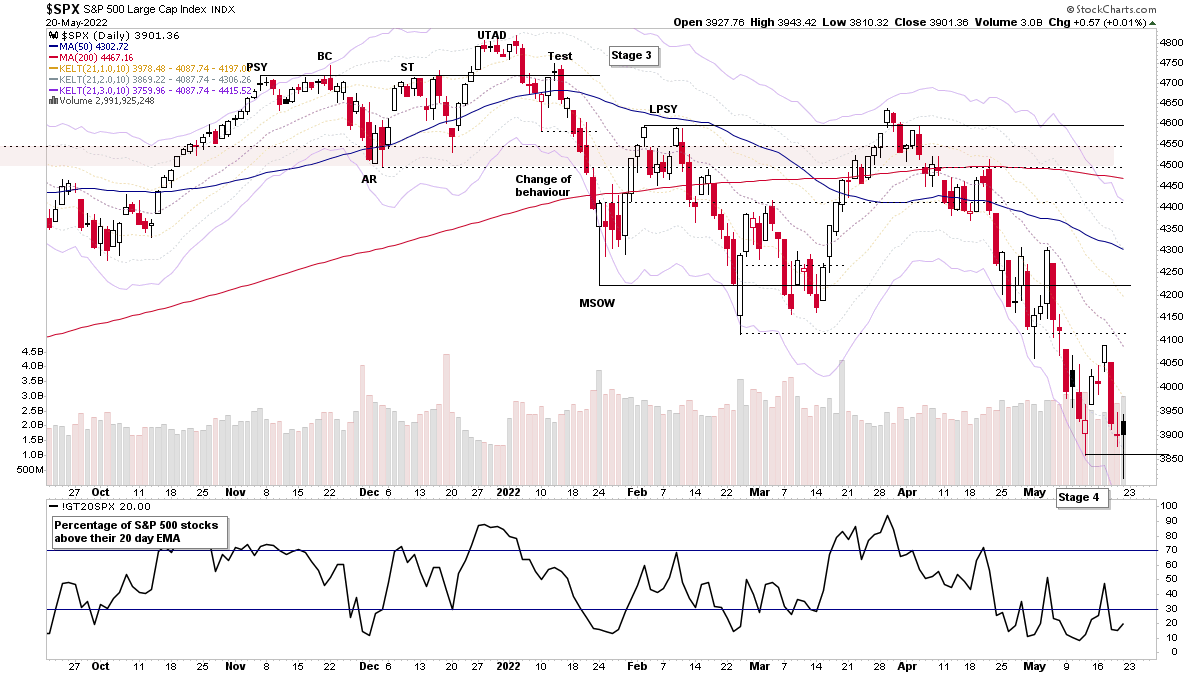

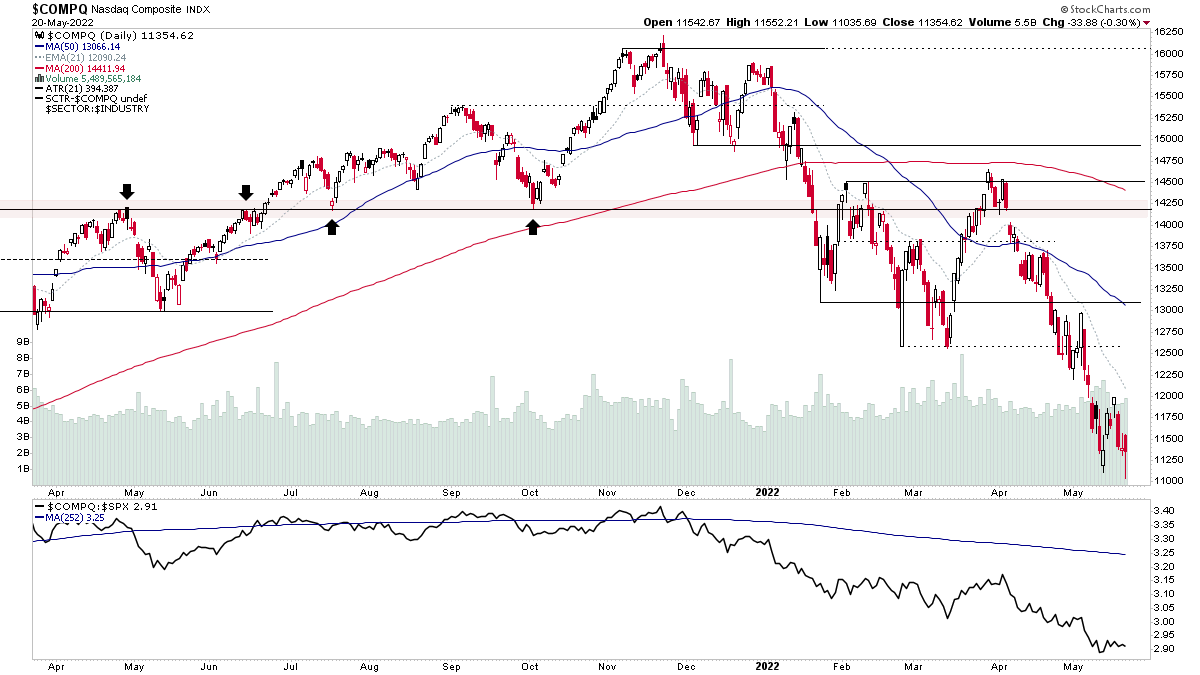

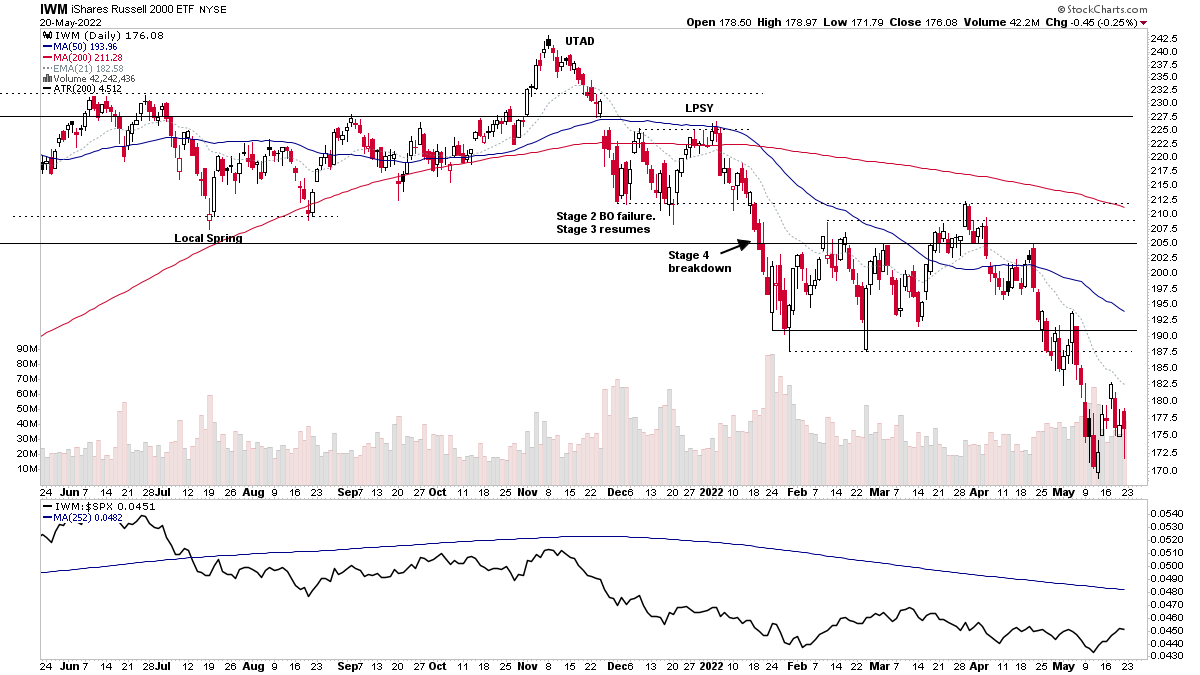

Friday produced a potential shakeout move in the major US stock markets (i.e. the S&P 500, Nasdaq Composite and Russell 2000) with a failed breakdown attempt and monthly options expiry potentially playing a role, with the price action closing between the maximum pain levels for both puts and calls. See http://maximum-pain.com/option... for reference on the SPY etf for example. But options is not an area that I dabble in. So I'd recommend further research from expert sources on the subject.

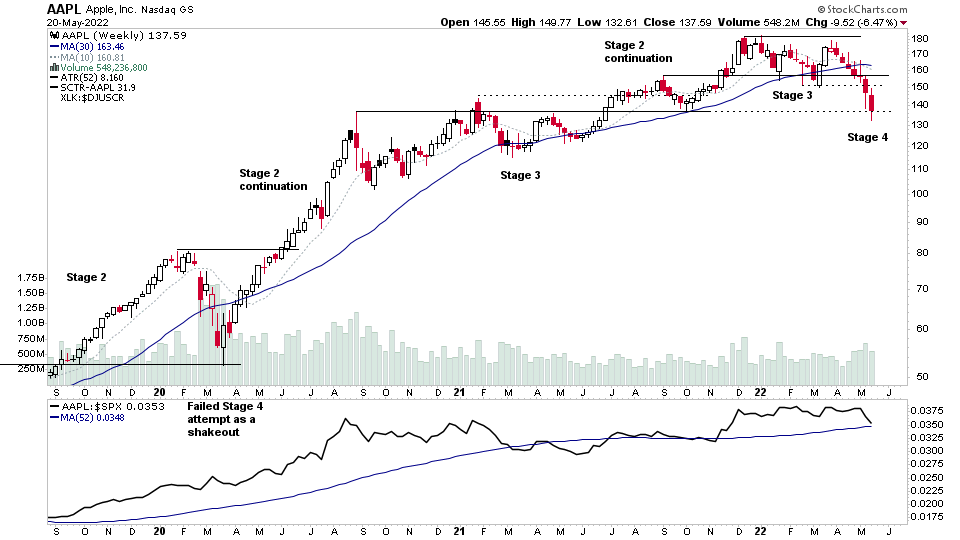

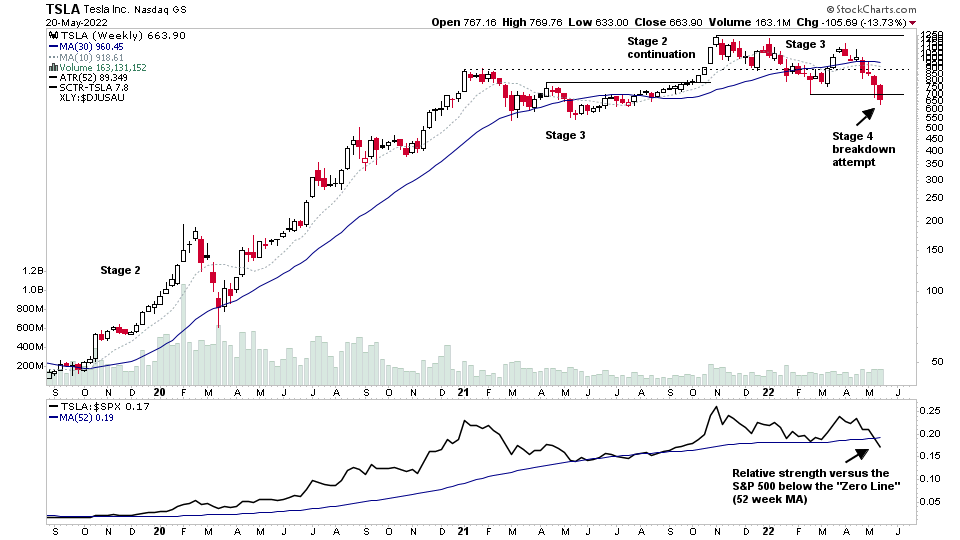

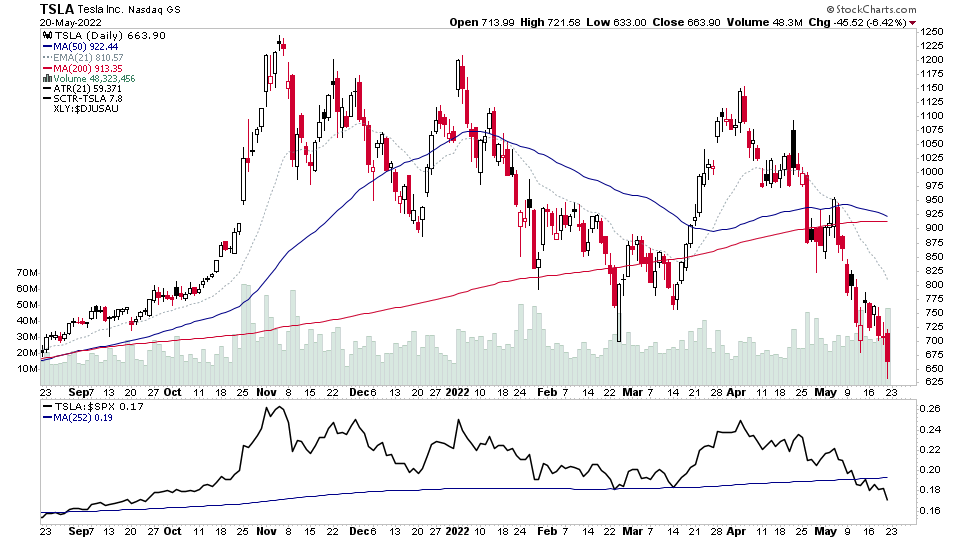

So although all the major markets remain in Stage 4 on the weekly timescale. We have the first few events of a new potential base structure developing in many, with Fridays action as a potential Secondary Test (ST). So short term expectation would be for a bounce within the range into Phase B of the structure. But if that fails to materialise. Then the Stage 4 decline could move into deeper territory. So extreme caution remains prudent on any rally attempt.

US Stocks Watchlist – 22 May 2022

There were 17 stocks for the US stocks watchlist today.

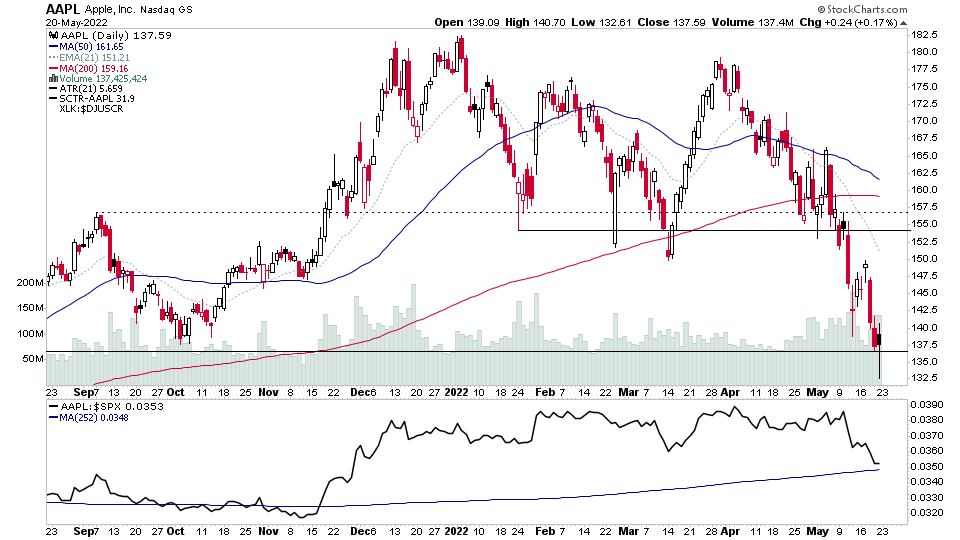

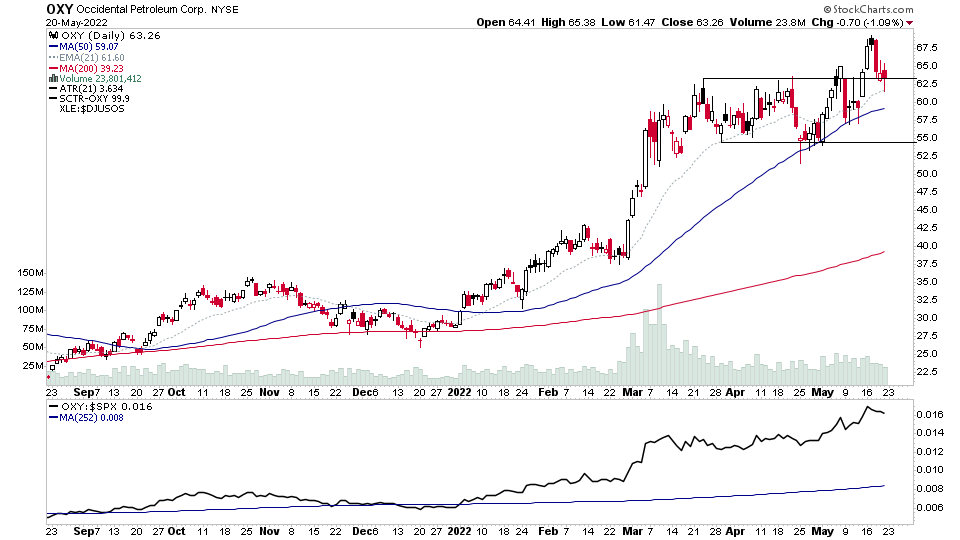

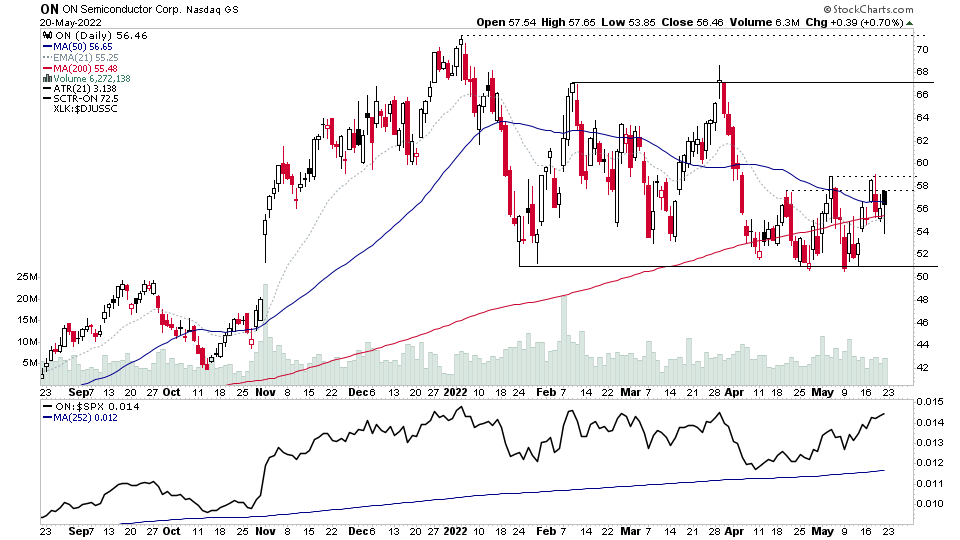

AAPL, TSLA, OXY, ON + 13 more...

I go through the weekend watchlist, the indexes, market breadth charts and more in the Stage Analysis Members Weekend Video. But you can also view past videos in the Video section of the website.

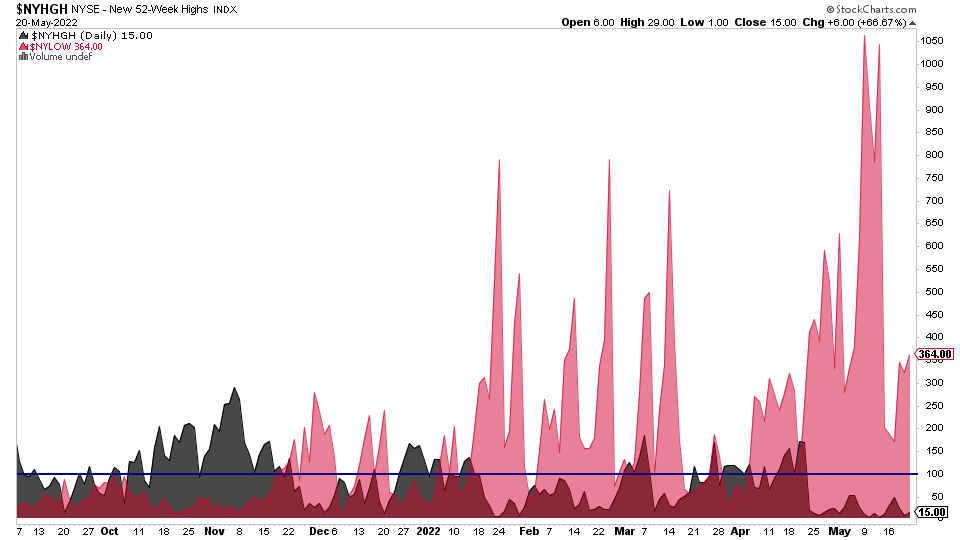

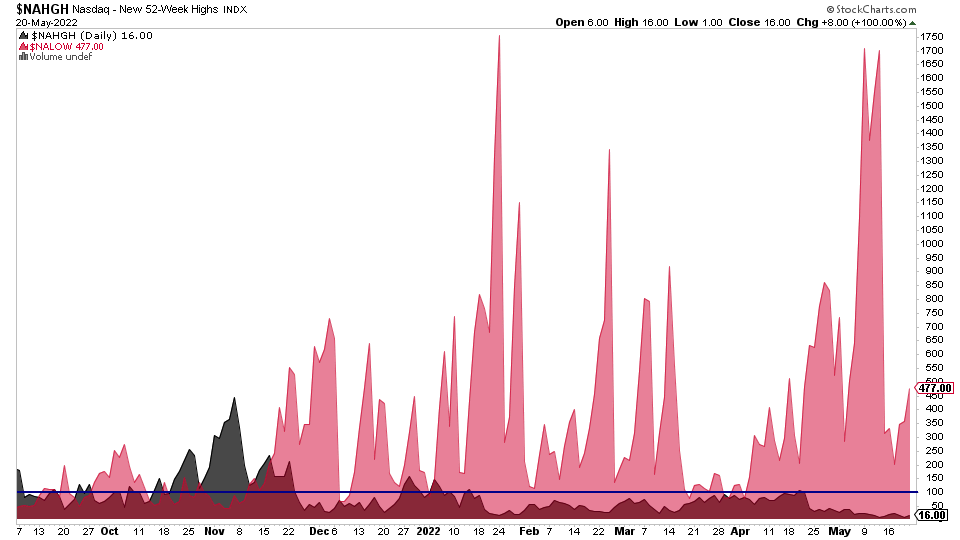

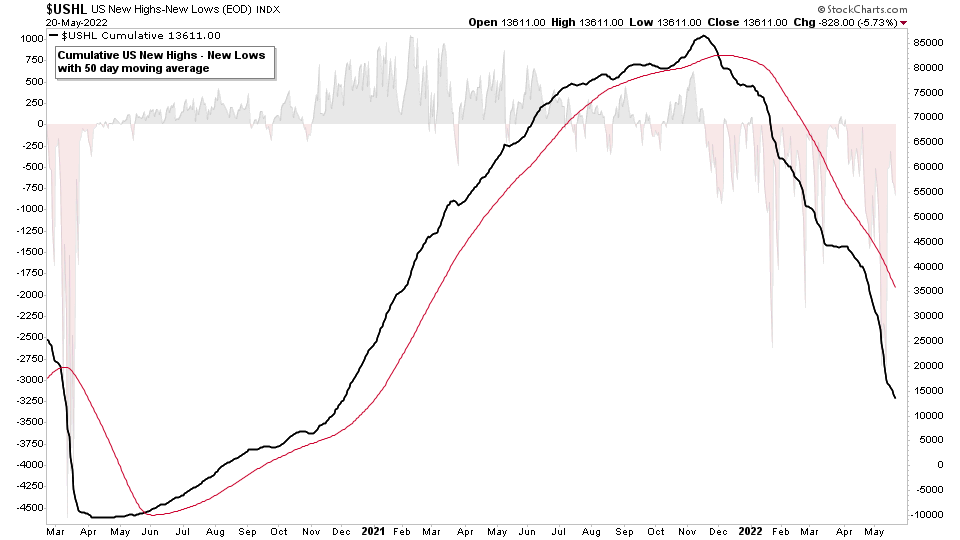

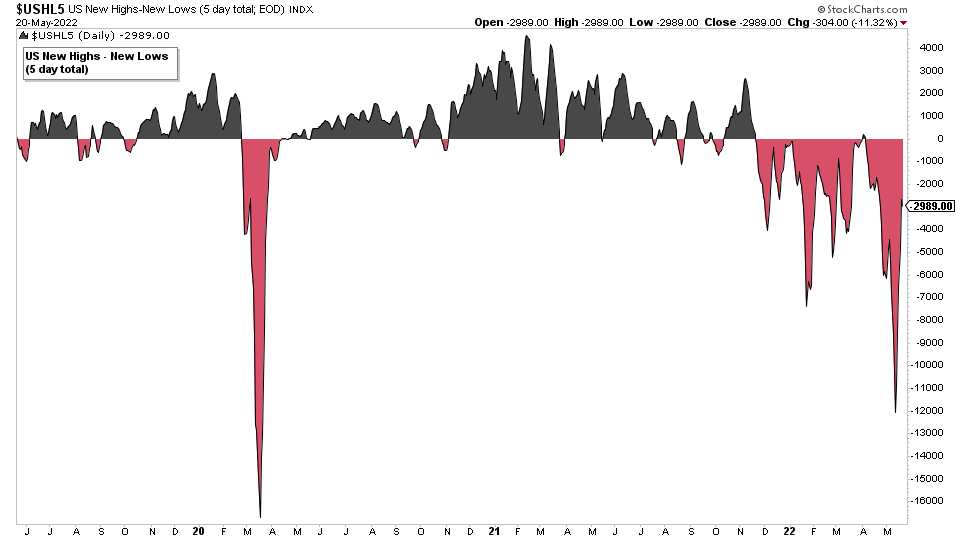

Market Breadth: New Highs - New Lows

The new lows levels in the NYSE and Nasdaq Composite remain elevated and the New Highs - New Lows cumulative chart remains in a strong Stage 4 decline since early December 2021, and is a long way below its own 50 day MA which is used as the signal line, and hence could take many months change back to a postive status – which would take a dramatic uptick in the amount of new highs and relative drop off in new lows back below the 100 level on each individual chart – which it's only been below a few times since November 2021.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.