Major Commodities and Market Breadth Update

The full post is available to view by members only. For immediate access:

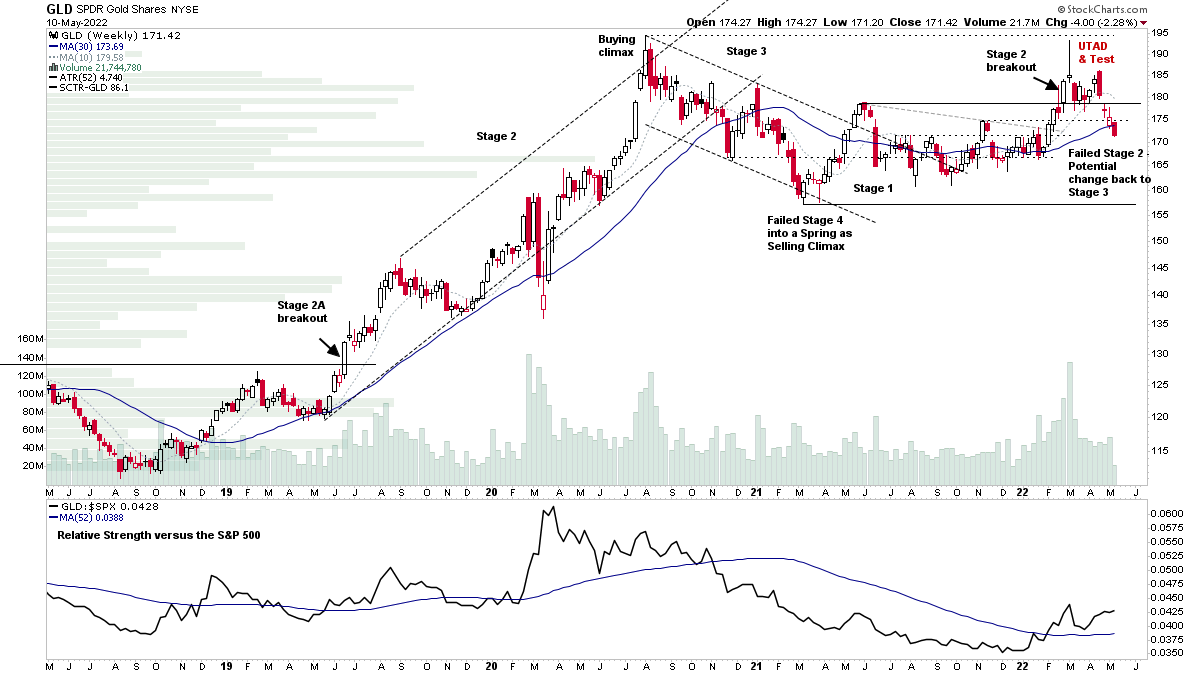

Gold – Potentially back in Stage 3

Golds brief move into Stage 2 in February and March looks to have failed with it moving strongly back into the previous Stage 1 base and through two support levels, and looks to have formed potential UTAD and Test events, which could shift the interpretation of the broader base structure from an Stage 1 accumulation structure to still being in a Stage 3 distributional structure.

But whether it's in Stage 1 or Stage 3, the current pattern is that of a UTAD and Test, and hence using the Wyckoff method for analysing the base structure it's potentially now in Phase D of a distribution structure, as it has moved through some initial short entry areas which occurred in the UTAD and Test, but extended on the downside in the short term and closed right at the 200 day moving average.

So if it has an oversold bounce I'll be watching to see if it is weak and forms an LPSY (Last Point of Supply), as that's a potential Wyckoff short entry zone. Or whether it manages to overcome the recent pivot high and starts to form a higher range – which would then potentially be more bullish again.

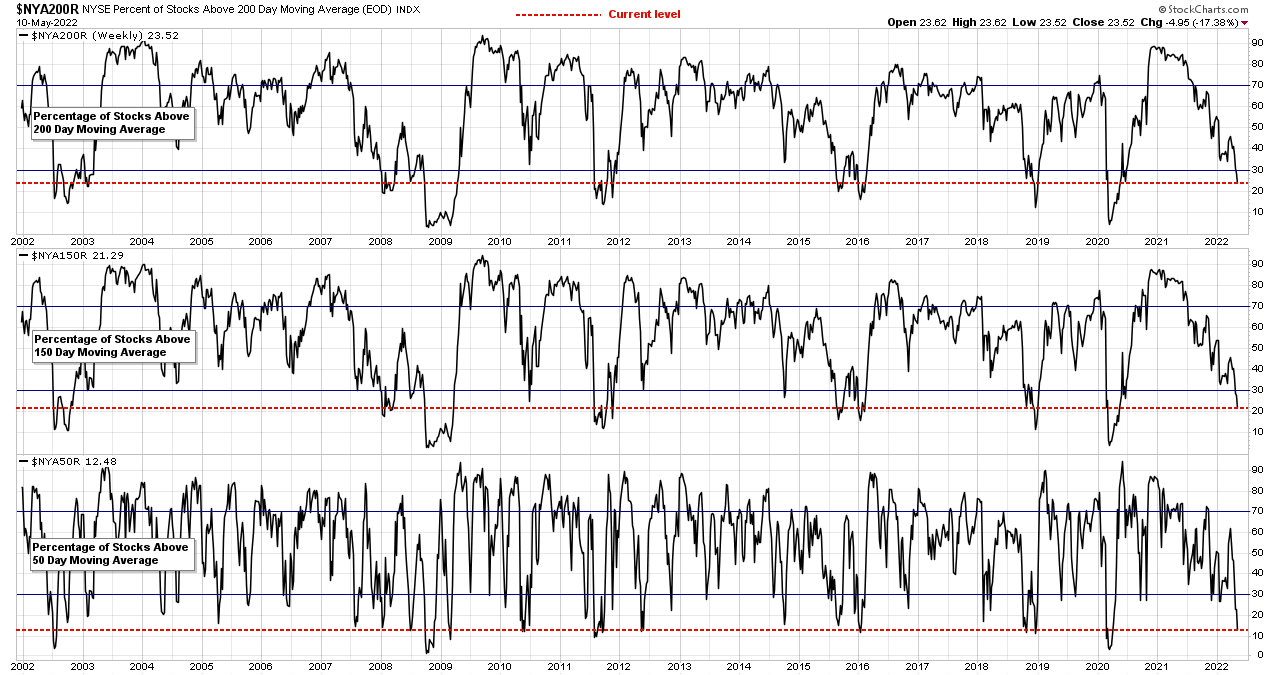

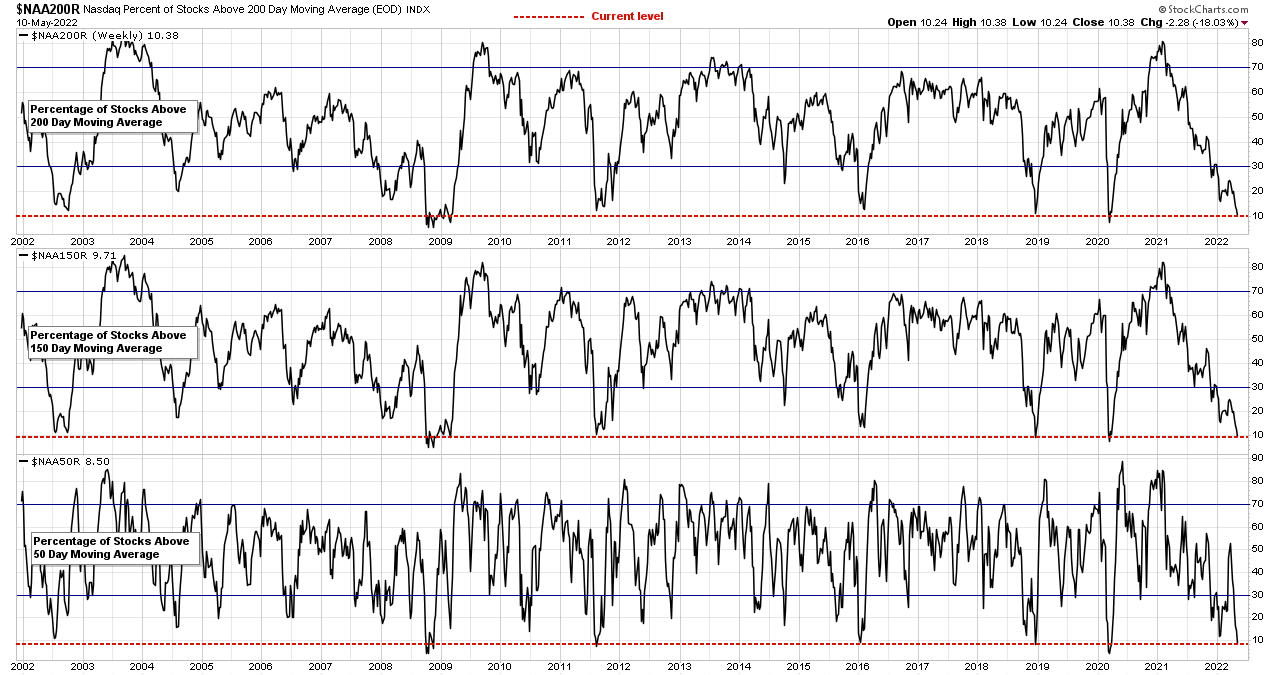

Market Breadth

NYSE Percentage of Stocks Above Their 200 Day, 150 Day and 50 day Moving Averages

Nasdaq Composite Percentage of Stocks Above Their 200 Day, 150 Day and 50 day Moving Averages

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.