Fed Decision Impact and the US Stocks Watchlist – 4 May 2022

The full post is available to view by members only. For immediate access:

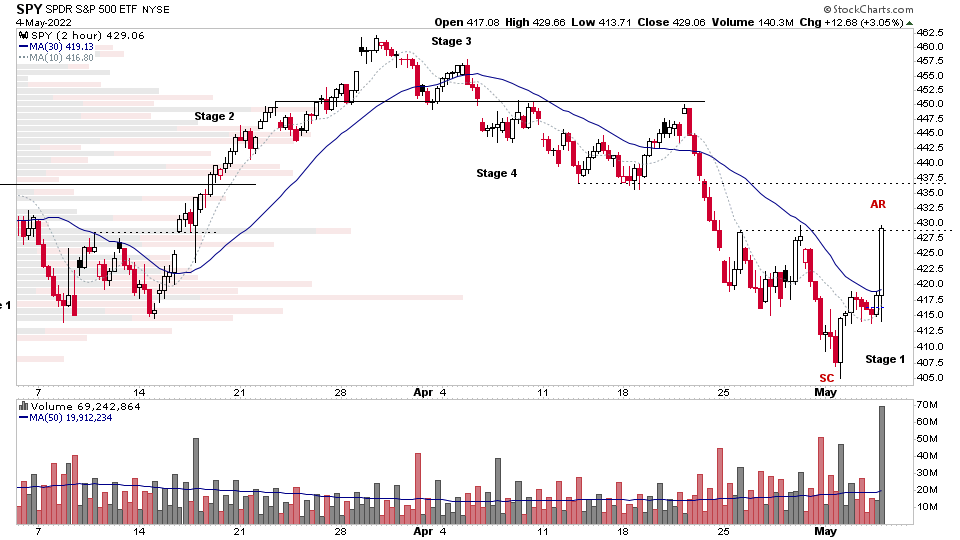

The Fed decision to raise rates by 0.5% sent the major indexes – such as the large cap S&P 500 index – sharply higher in the final hours of the trading day, and continued the three day move that began with the Spring Attempt on Monday, and is now showing as a potential Change of Character over what we've seen from the previous rally attempts over the last month or so.

And hence, if we use a multi-time frame approach and drop down to the 2 hour timeframe for example (see above chart). We can see the potential beginnings of new Stage 1 base, which in the Wyckoff method is called Phase A. So when combining Stan Weinstein's Stage Analysis with the Wyckoff method, I refer to this as potential Phase A of a Stage 1 base on this lower timeframe and forming the Automatic Rally (AR) event.

Once the AR peaks, the expectation would be for a Secondary Test (ST) to develop of the move (pullback) – which if it forms, the move out of completes Phase A. So it remains a fair way from a potential entry point that I'd consider if the the intraday Stage 1 base develops. As the earliest entry points in the methods are in Phase C and Phase D in the later part of the Stage 1 base.

I talk more about this in the Stage Analysis Members Midweek Video.

US Stocks Watchlist – 4 May 2022

There were 32 stocks for the US stocks watchlist today.

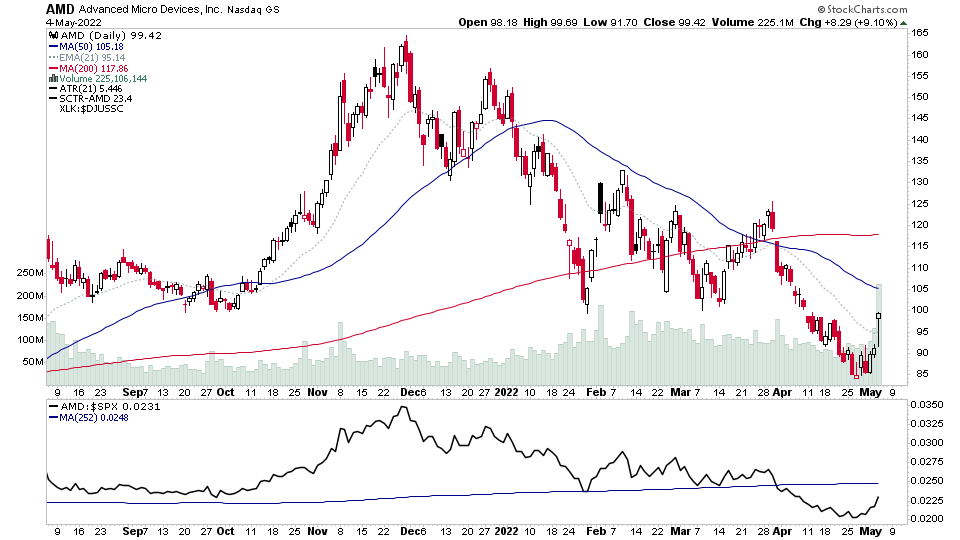

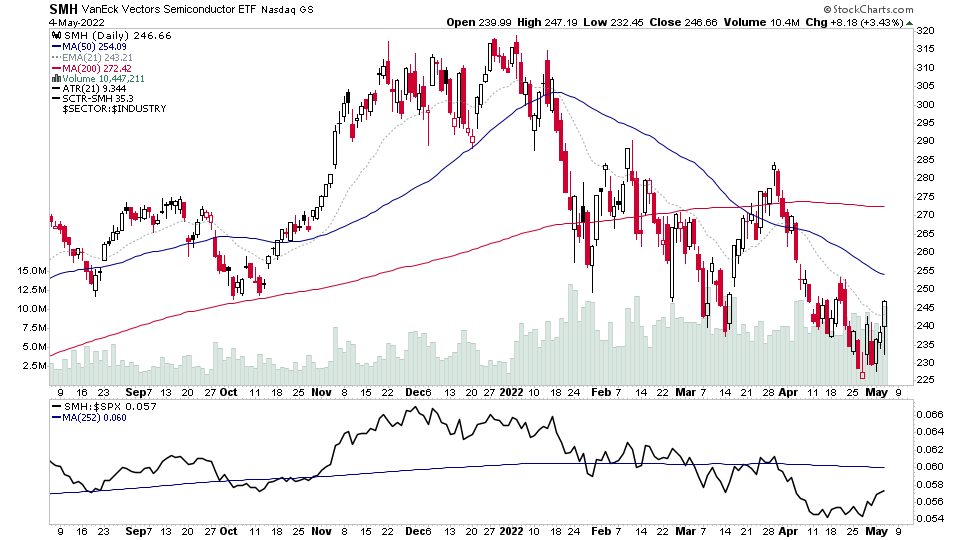

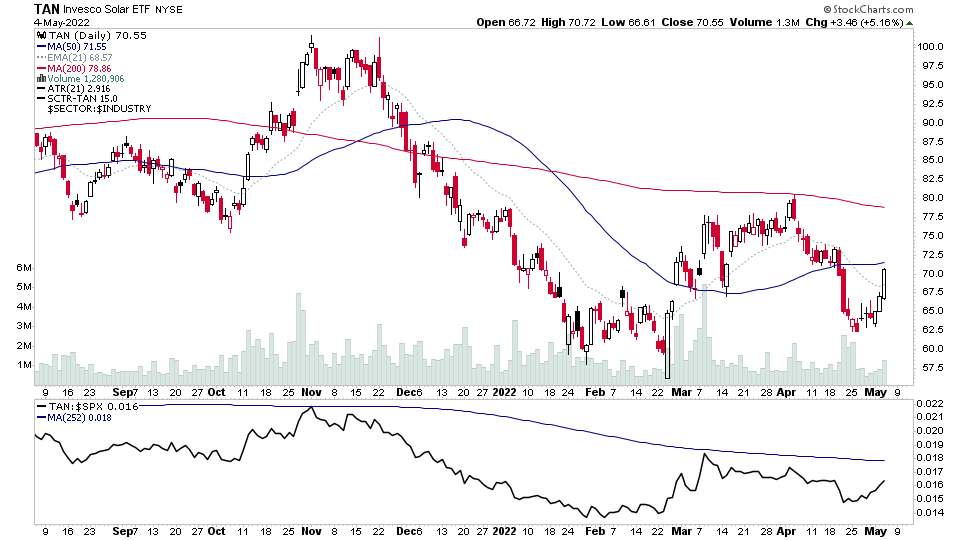

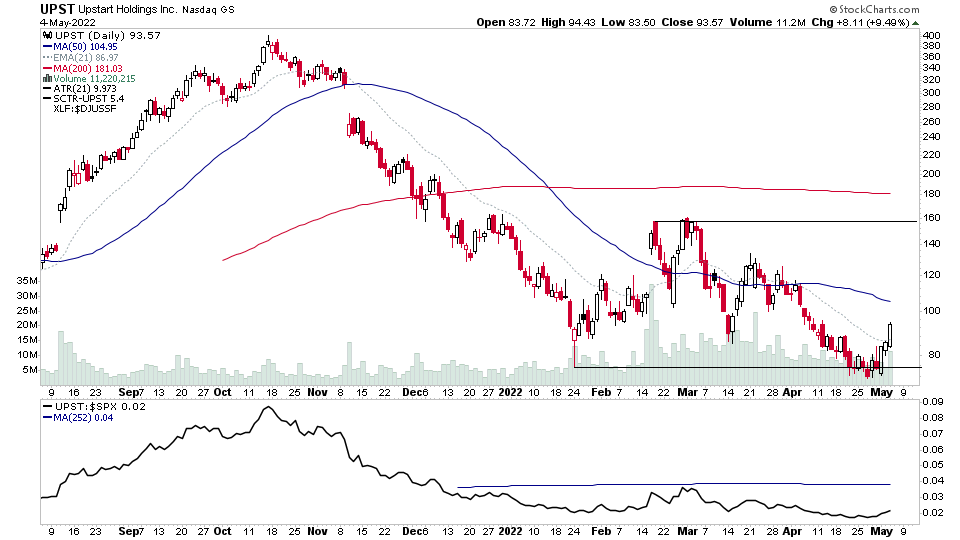

AMD, SMH, TAN, UPST, + 28 more...

Market Breadth: Percentage of Stocks Above Their 20 Day EMA

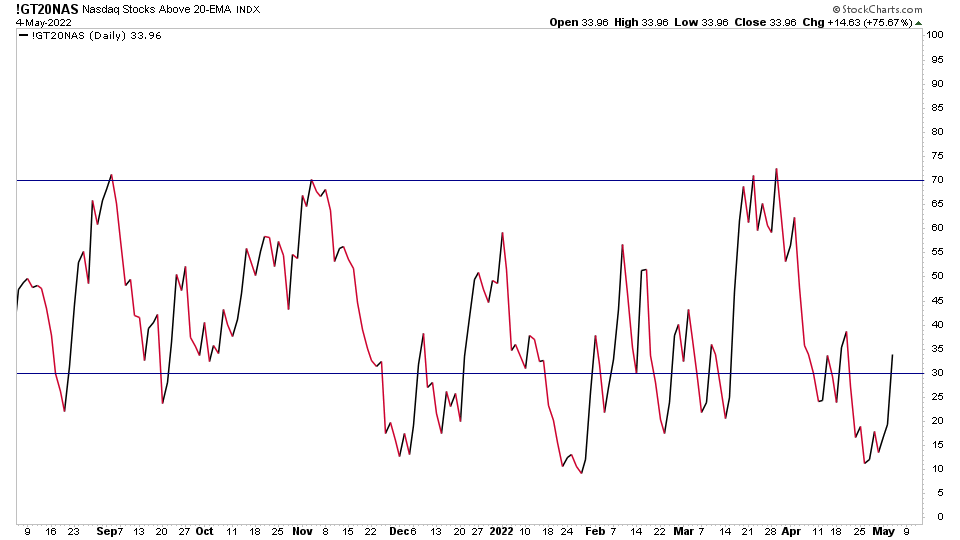

The Nasdaq Composite, Nasdaq 100, NYSE, S&P 500, and S&P 600 Small Caps Percentage of Stocks Above Their 20 Day EMA all moved strongly out of the lower zone and through their key 30% level. And hence this breadth indicator also moves to a tentative short term postive status.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.