Earnings Season Continues to Provide Opportunity and the US Stocks Watchlist – 3 May 2022

The full post is available to view by members only. For immediate access:

Tuesday was a heavy day for earning results with 118 before the open and a further 280 after the close (Data from Earnings Whispers).

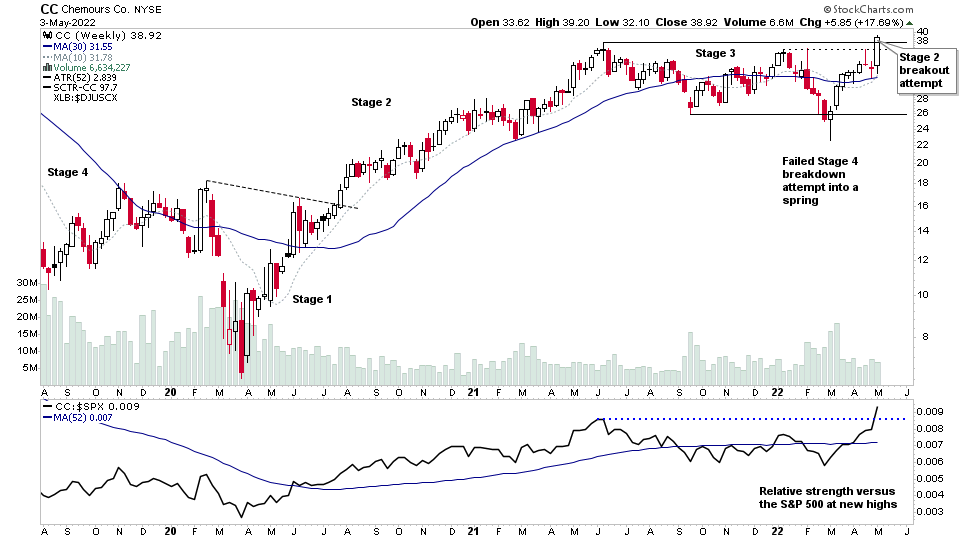

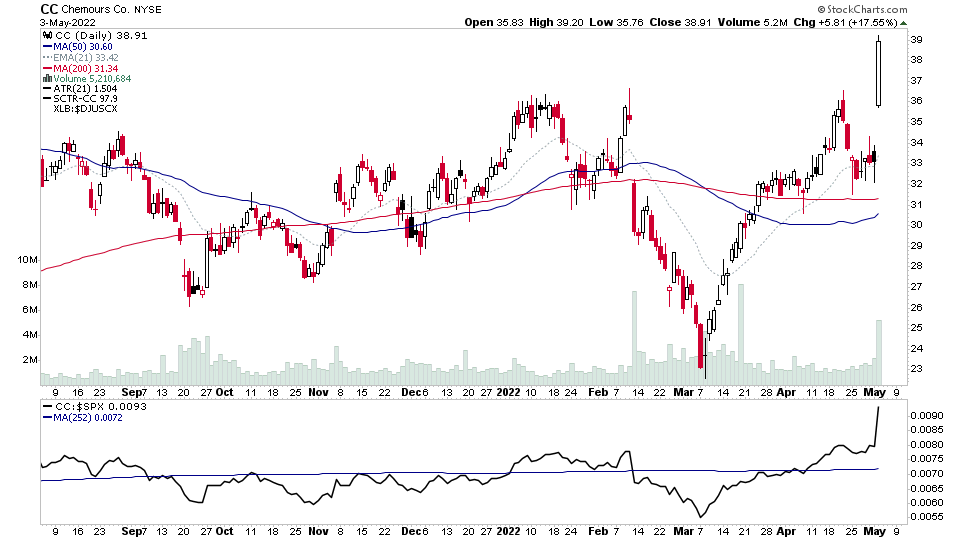

Of note from the previous days earnings was CC (Chemours) – which gapped up at the open and then traded steadily higher throughout the day to make a new Stage 2 breakout attempt.

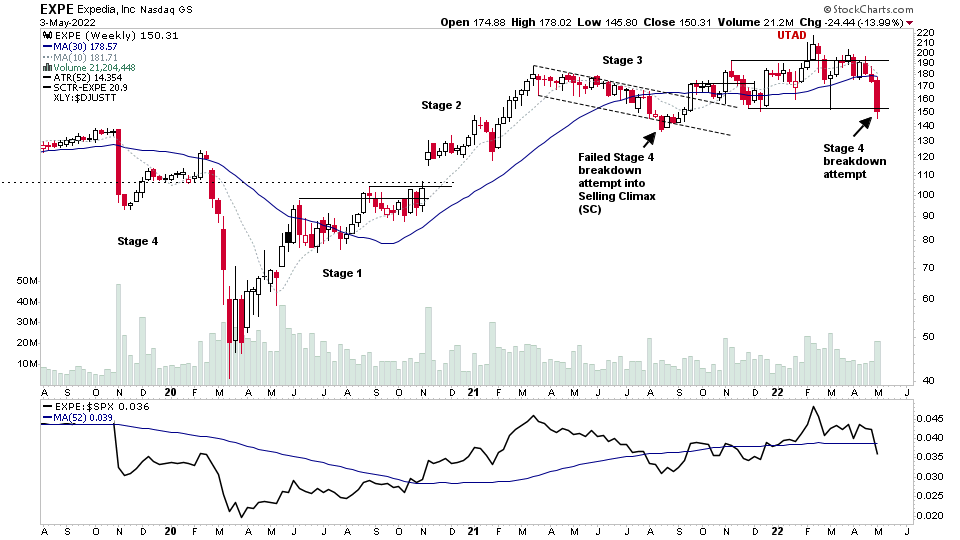

EXPE (Expedia) also reported on Monday after the close but reacted poorly to its results and then fell heavily through its Stage 3 range during the day to make a Stage 4 breakdown attempt.

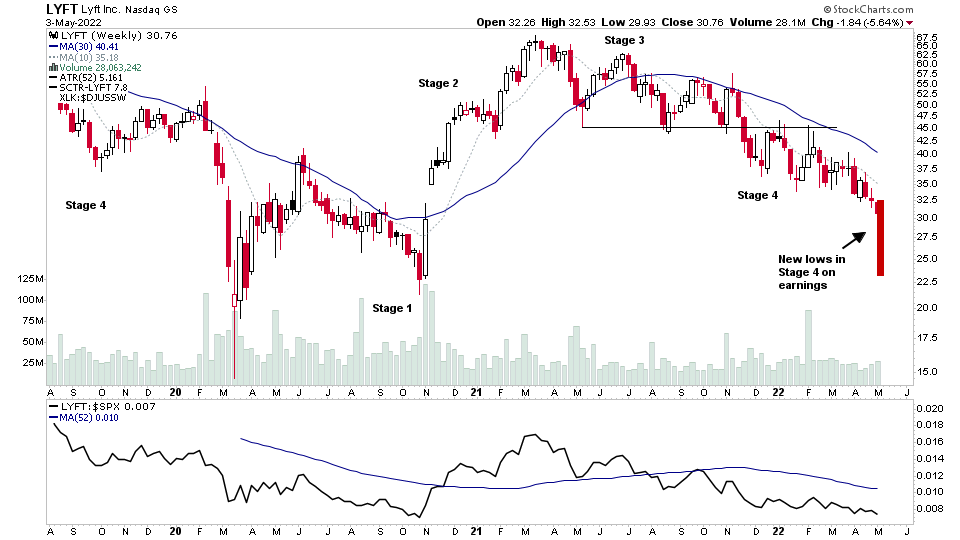

LYFT reported earnings this evening and reacted badly collapsing further into Stage 4, and has now wiped out the entire previous Stage 2 advance and more.

US Stocks Watchlist – 3 May 2022

There were 26 stocks for the US stocks watchlist today.

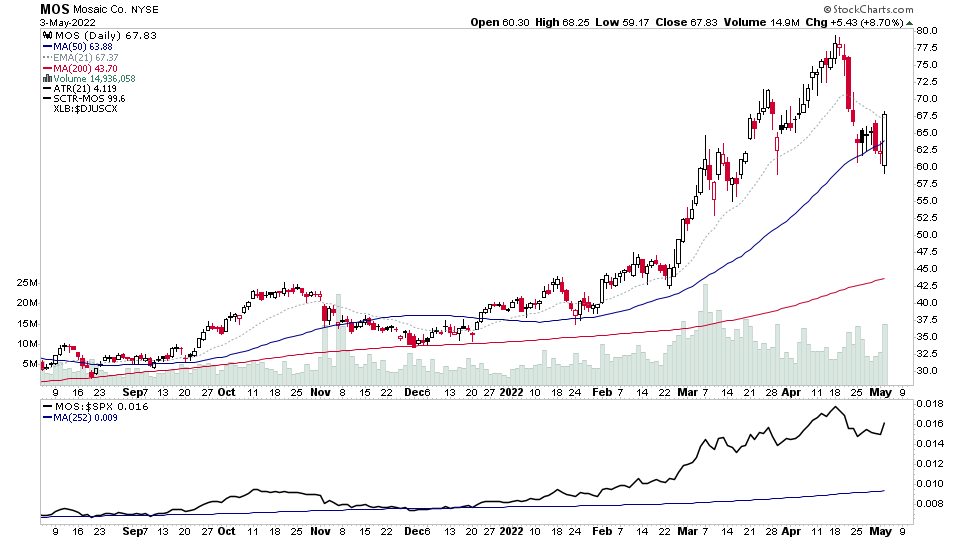

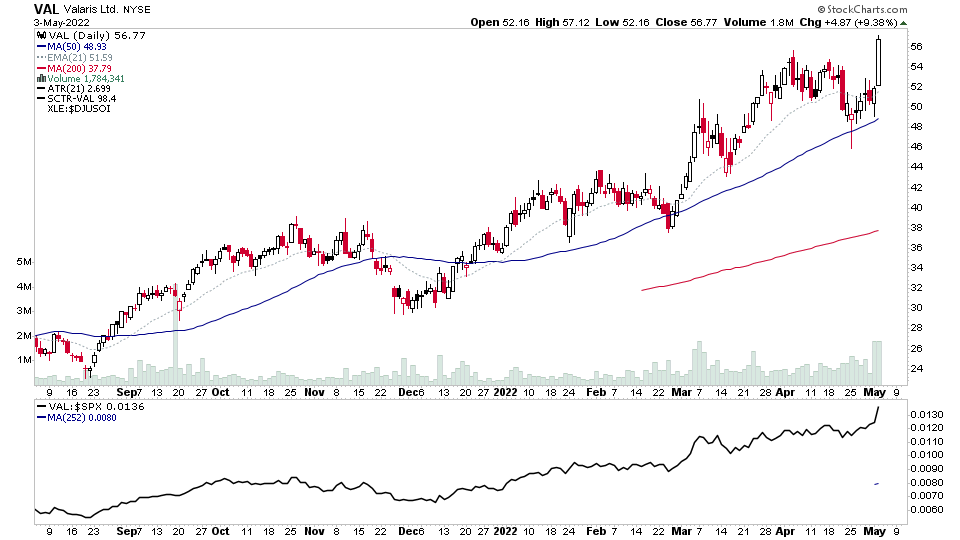

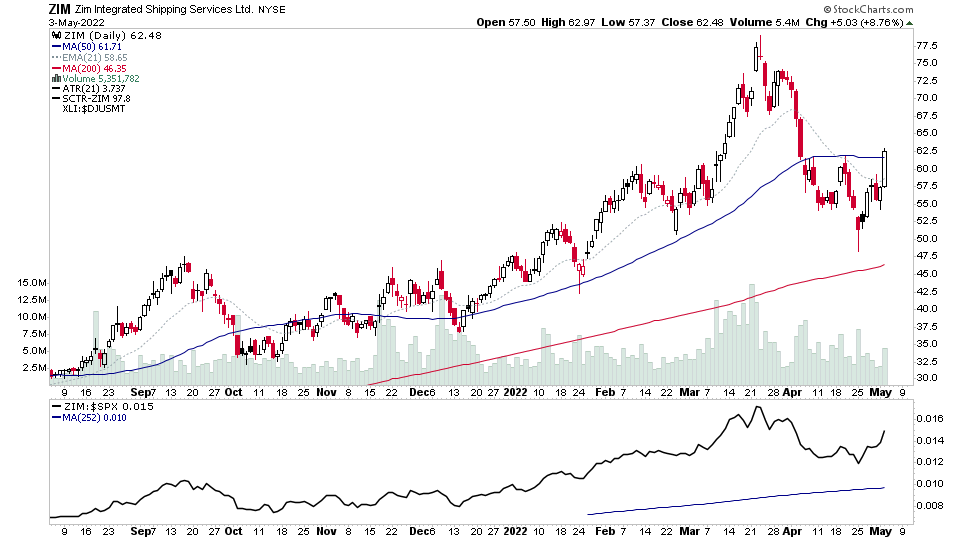

CC, MOS, VAL, ZIM + 22 more...

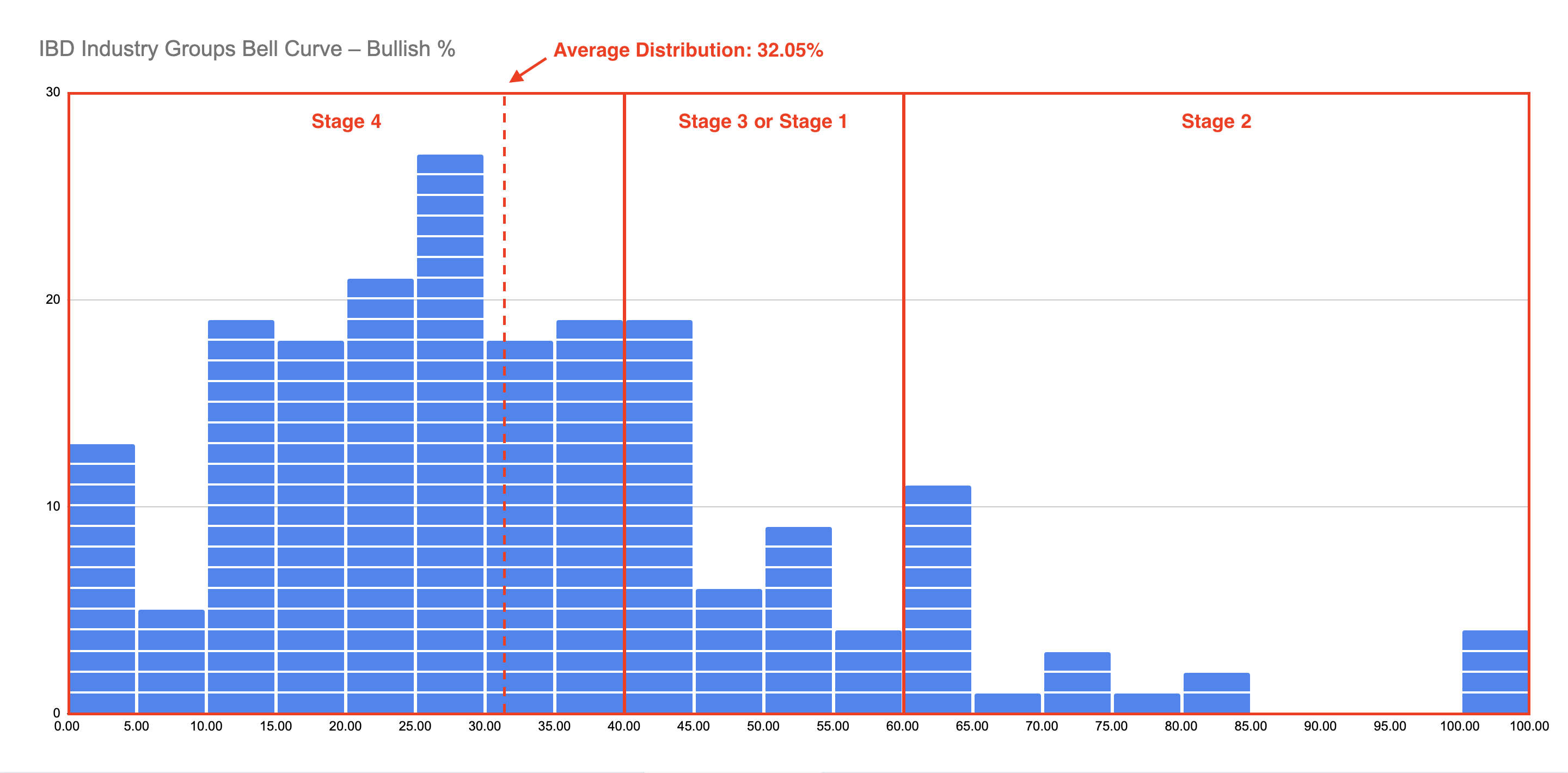

Market Breadth: IBD Industry Groups Bell Curve – Bullish %

The majority of the 200 IBD Industry groups remain in the lower zone in Stage 4 currently with the Average Distribution at 32.05%.

The bell curve is a contrarian indicator, and so when the bell curve is heavily weighted in the lower zone, it is a good time for investors to begin to monitor stocks and groups from that zone that are starting to build Stage 1 bases and show relative strength versus the market. So that you are ready in the months ahead, once they start to reach potential entry zones in late Stage 1 and early Stage 2.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.