US Major Stock Market Indexes Reach Pivotal Points as Mega Cap Stocks Begin Reporting Earnings

The full post is available to view by members only. For immediate access:

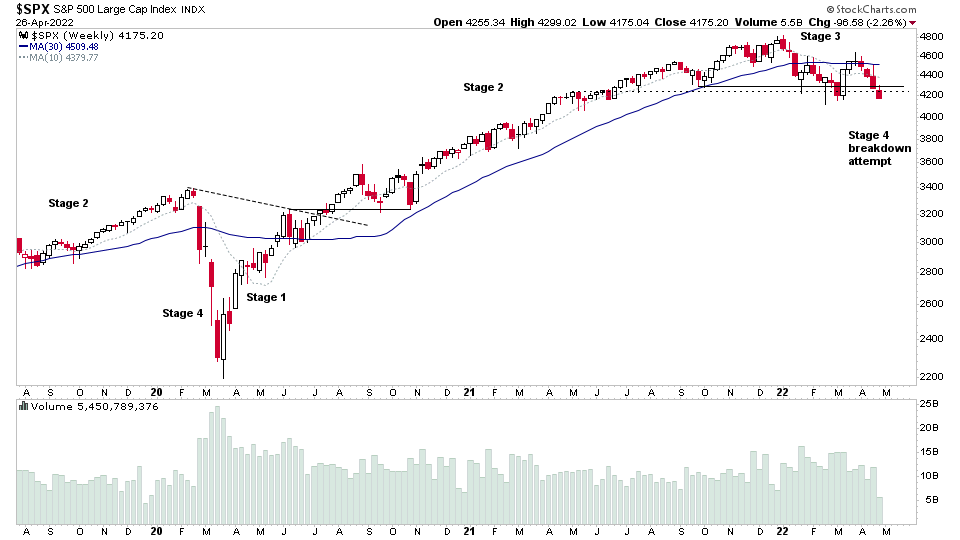

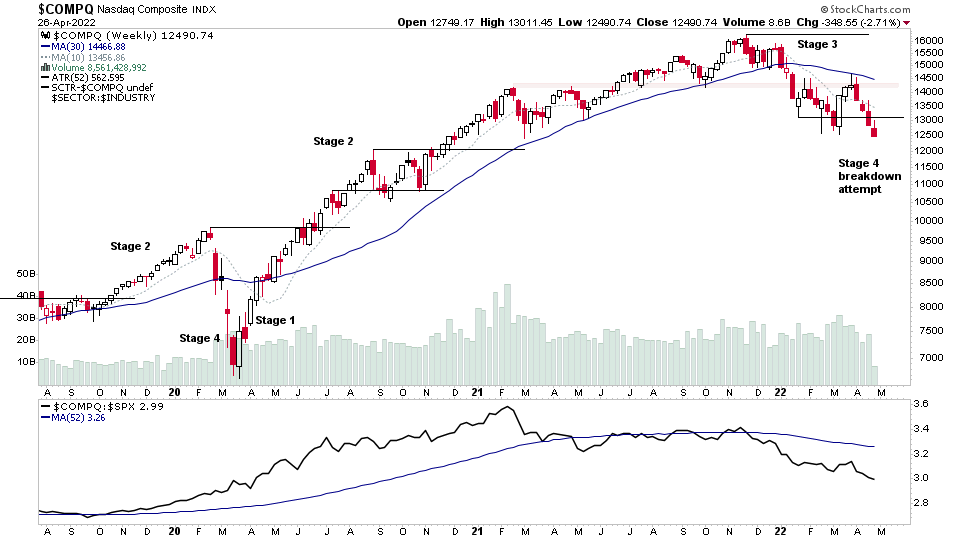

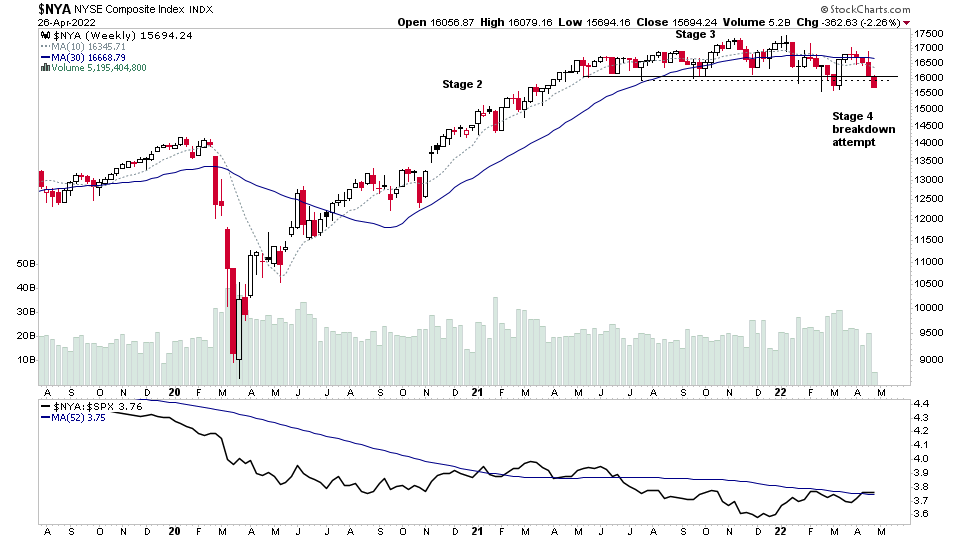

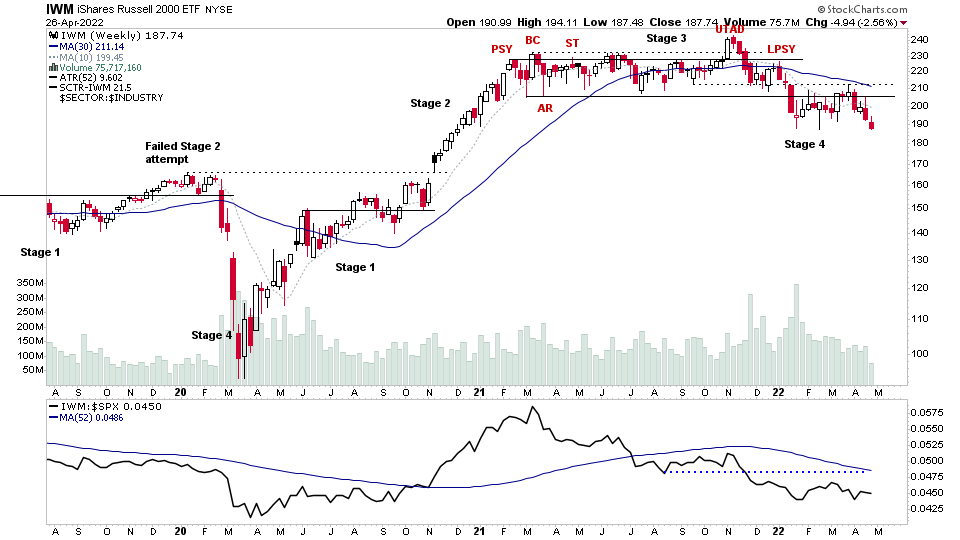

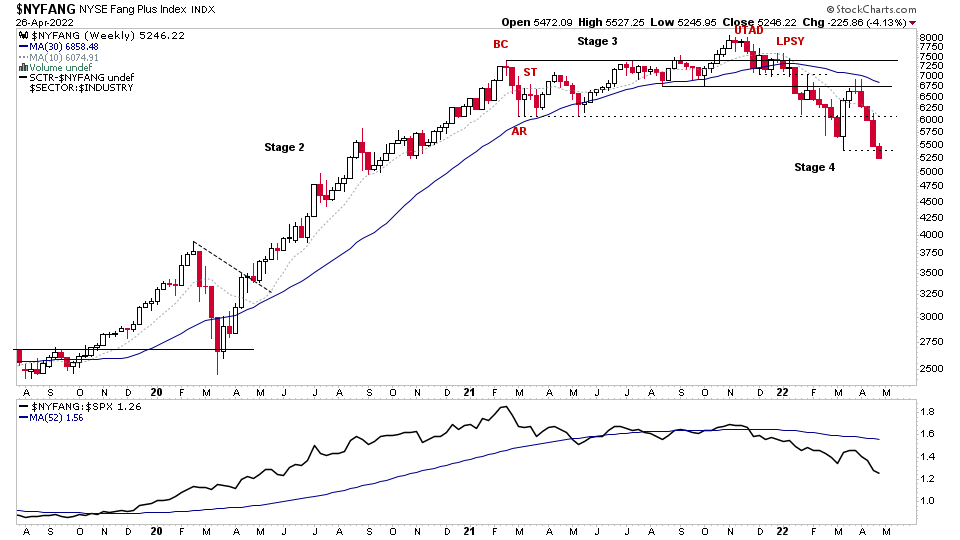

The major indexes – S&P 500, Nasdaq Composite, NYSE, Russell 2000 and the FAANG stocks index – are all at pivotal points, with weakest already in Stage 4 declines. But now the stronger areas of the S&P 500 and NYSE are also testing their own Stage 4 breakdown levels.

Mega Caps Begin Reporting Earnings

The mega cap stocks have begun reporting this week, which I talked previously about in the weekend post: Earnings Watchlist – 25 to 29 April 2022

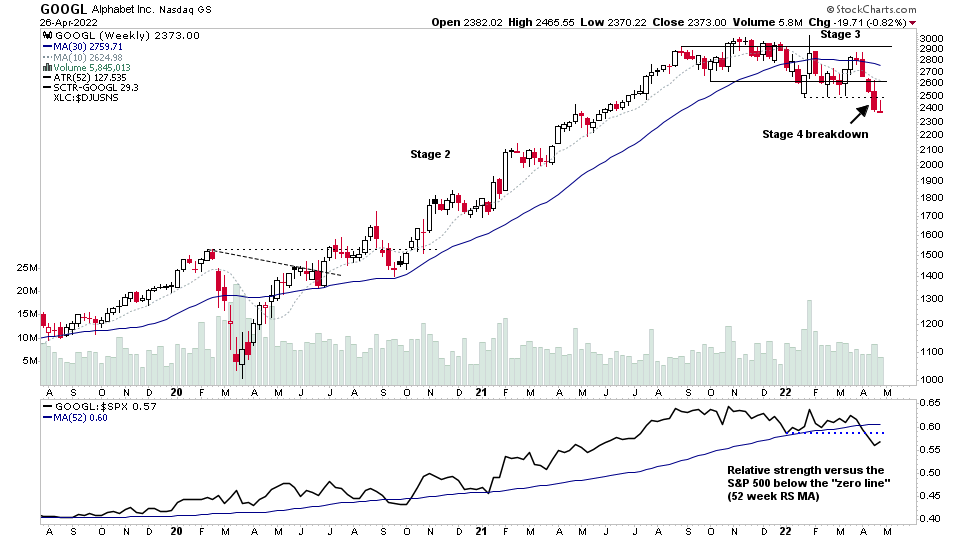

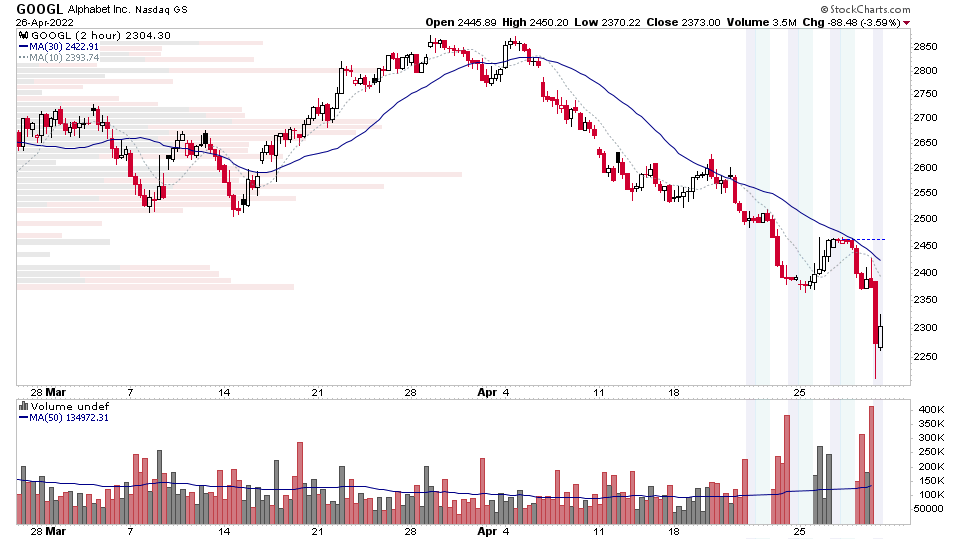

GOOGL, MSFT, V, GM and others reported tonight, with the initial reaction in GOOGL dropping it another 5% or so, and further into its fledgling Stage 4 breakdown attempt. However, it is showing some weak signs of a reversal attempt as I write in the after hours trade, and it remains on watch – as it is in position for a potential Spring attempt if the demand comes back in strongly here, and the breakdown attempt fails. But, currently it is in Stage 4 on multiple timeframes, and so would need a strong reversal to change that.

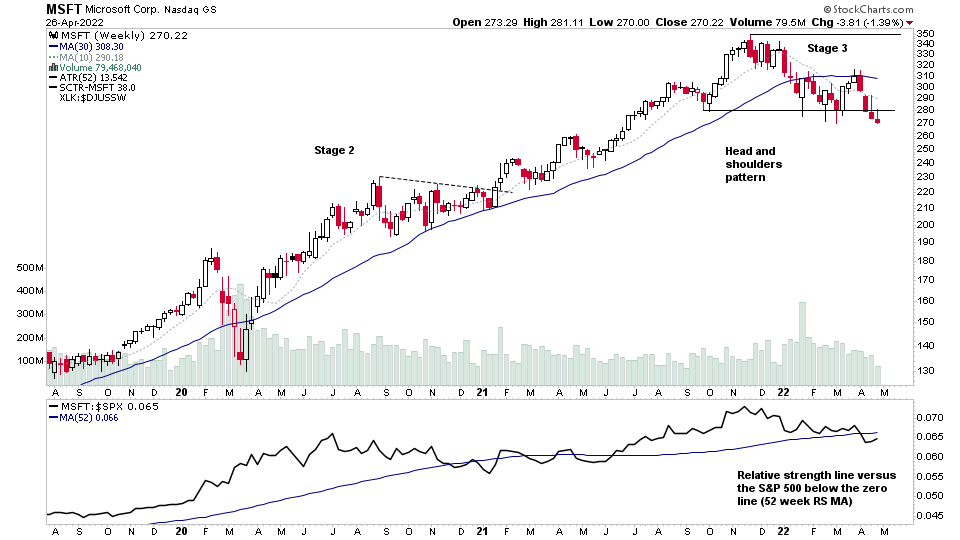

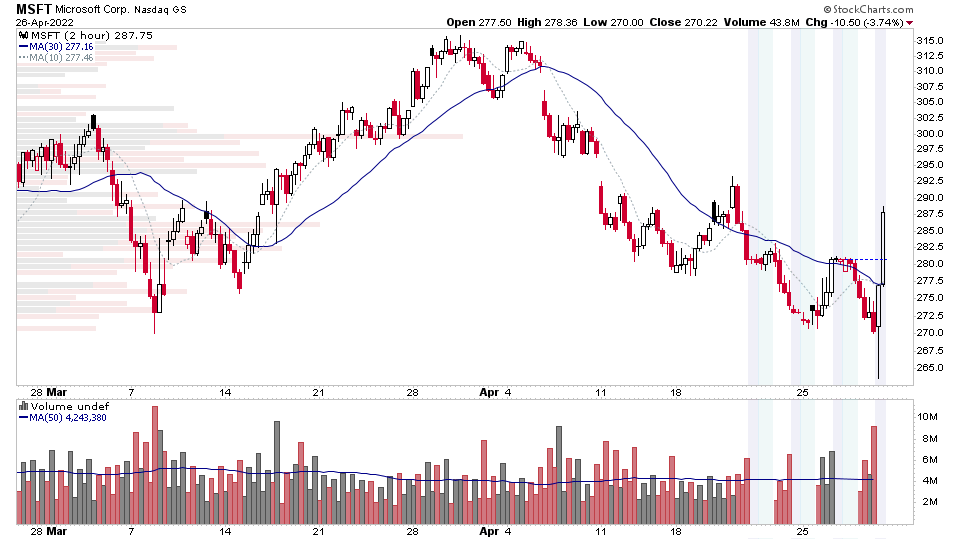

MSFT was the other major stock reporting tonight, and its reaction has been much more postive than GOOGL with a 6% rally so far, after an initial decline.

Overall MSFT is in a fairly similar position to GOOGL, but with a bit more strength, on the borderline of Stage 3 and Stage 4. So it too is in position for spring attempt if the demand is present. But if the after hour bounce falters and it starts moving lower again tomorrow. Then it would likely move into Stage 4.

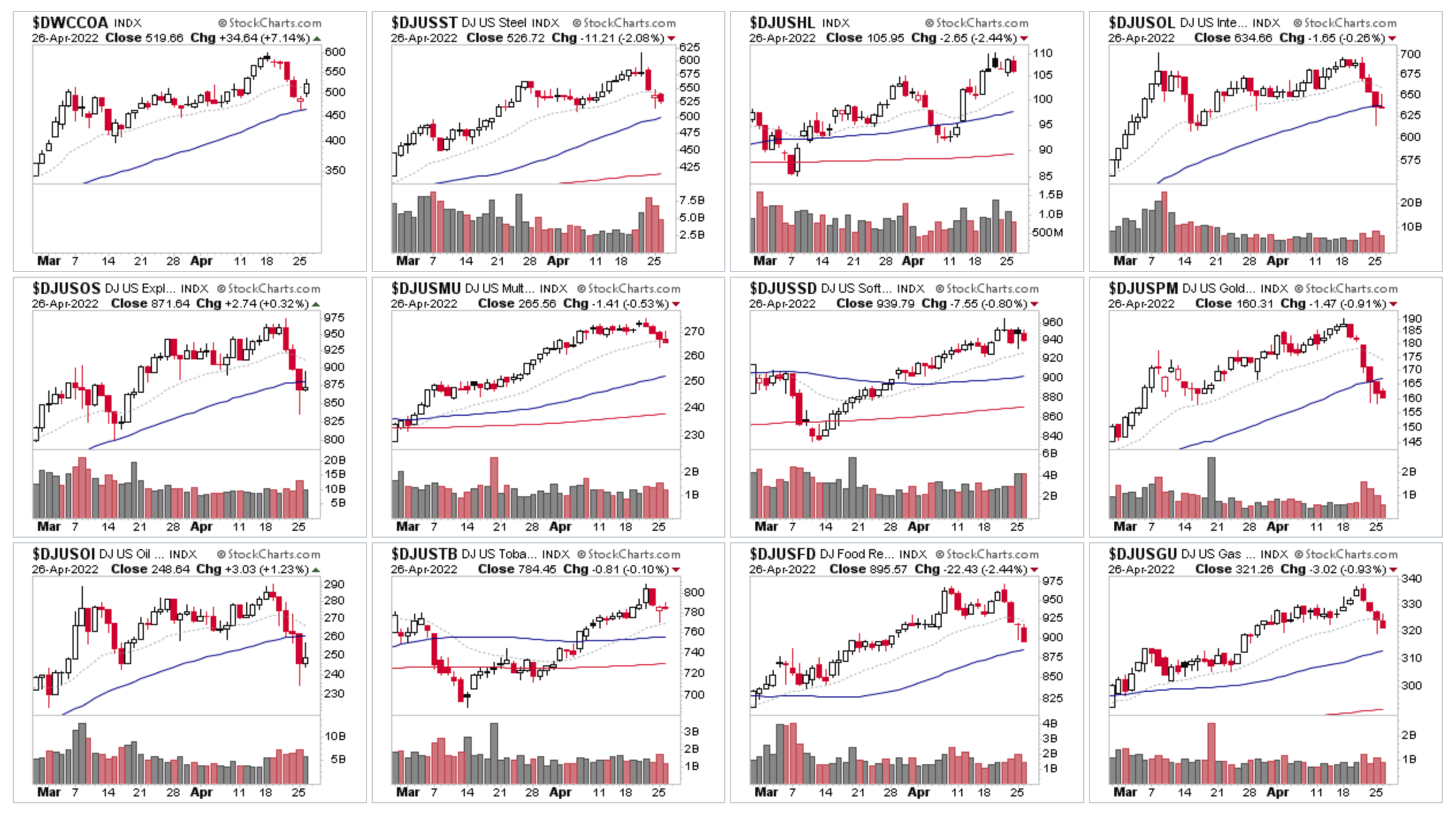

Strongest US Industry Groups by RS Score

The top RS groups continued to show relative weakness today with only the strongest Coal group able to muster some strength following strong earnings in ARCH, which moved it higher by over 20%, and the other stocks in the group in sympathy. However, the majority are set to report their own earnings in the coming week. Hence it's a dangerous area of the market in the short term, as profit taking could be rapid if the upcoming results are not well received, and also would make the group a target for the shorts. So, extreme caution would seem to be prudent.

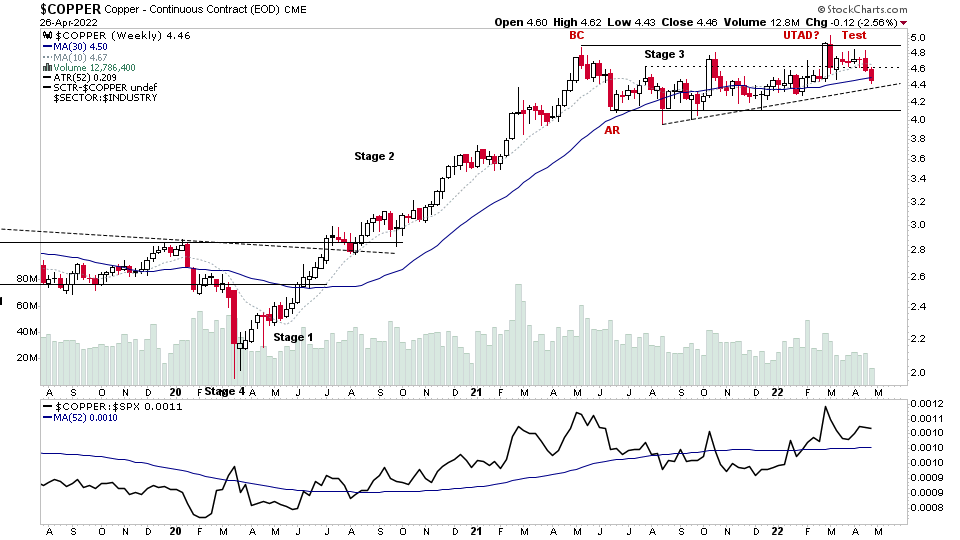

Copper forming UTAD and Test?

Copper also at a critical point as it sits right at its 200 day MA, and has this week moved below the 30 week MA, after forming a lower high following a potential Upthrust After Distribution (UTAD) in late Stage 3.

So another major factor to consider, as Copper is said to be a way to forecast the economy, and is know as Dr Copper. Hence if it continues to falter and drops below the 200 day MA, then it could test the lows of the range and also potentially move into Stage 4.

Market Breadth

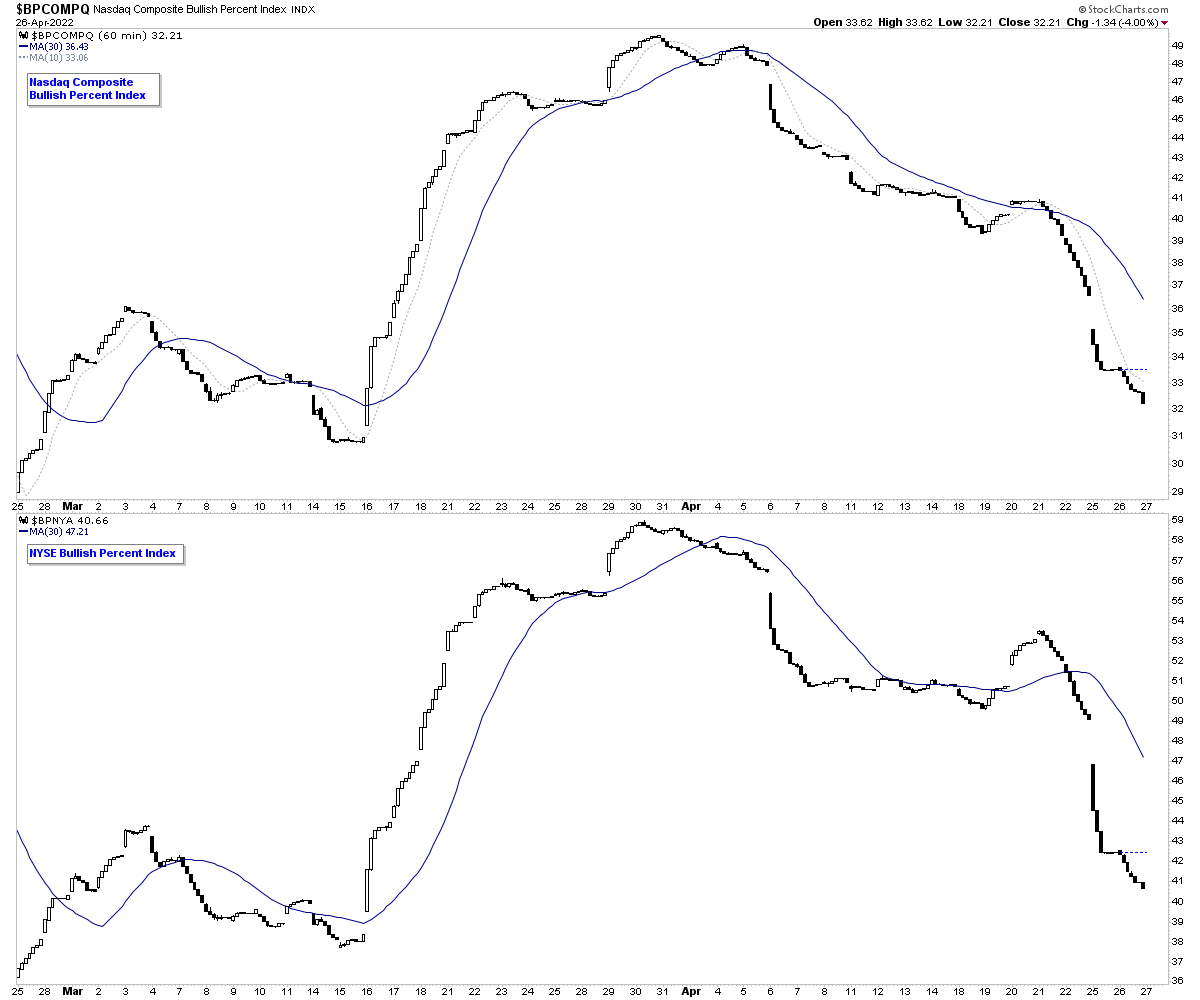

Bullish Percent Index – Nasdaq & NYSE

The short term version of the Nasdaq Composite and NYSE Bullish Percent Index continued lower today, below its declining MA. So remains on a negative status.

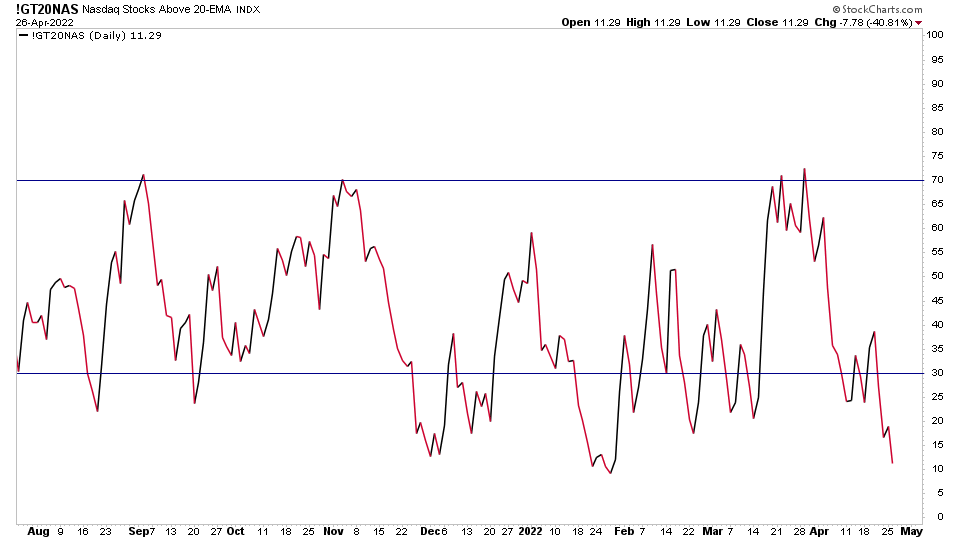

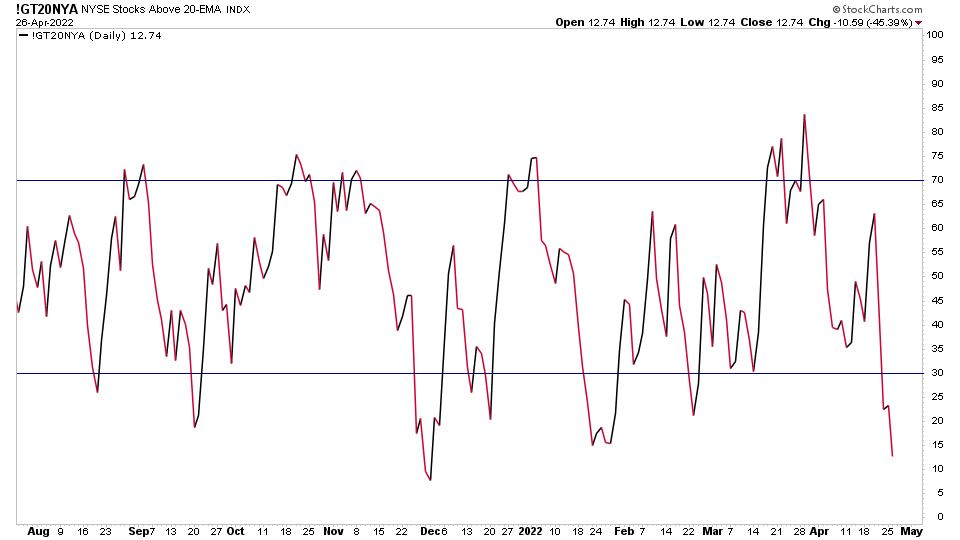

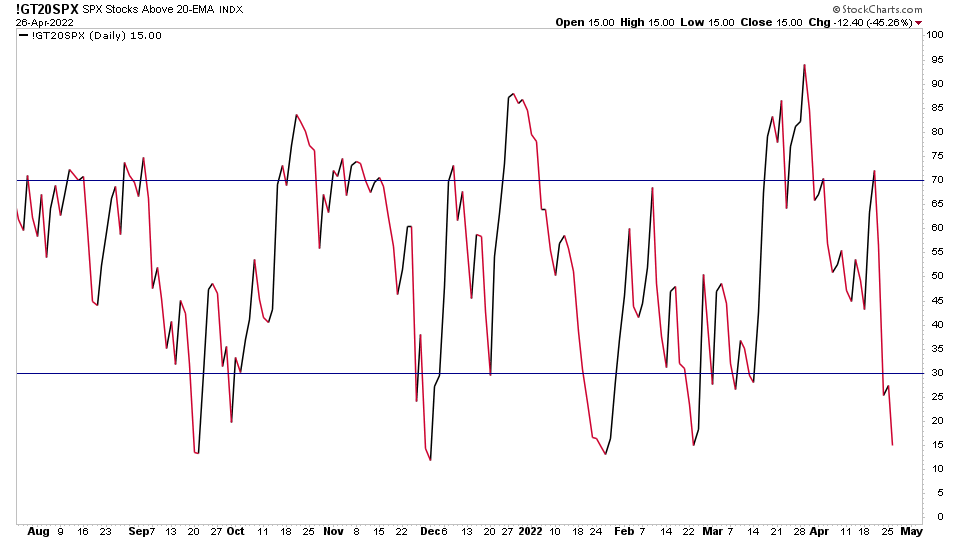

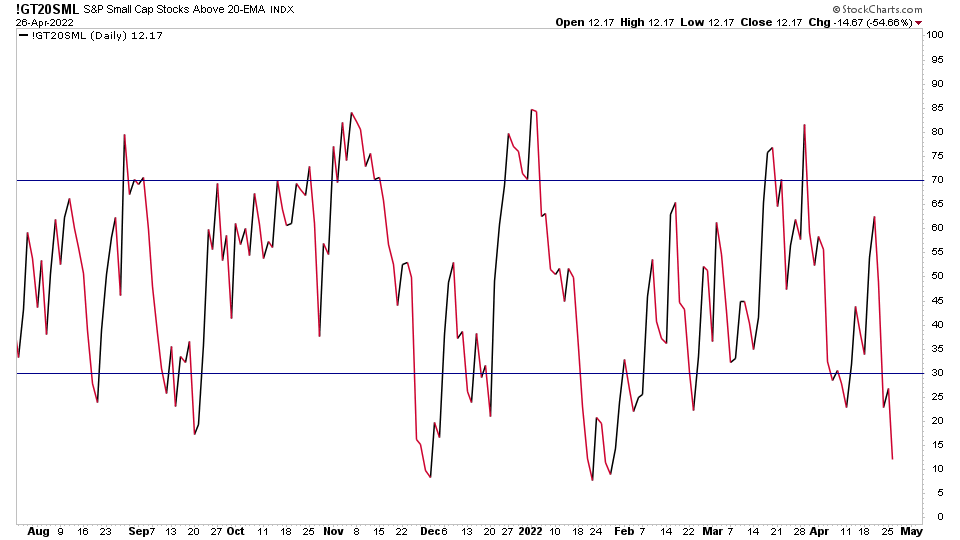

Percentage of Stocks Above Their 20 Day EMA - Nasdaq Composite, NYSE, S&P 500 and Small Caps

Continuation moves in the short term moving average breadth pushing all the major markets deeper into the lower zone. Hence, approaching the extremes with all under 15% now.

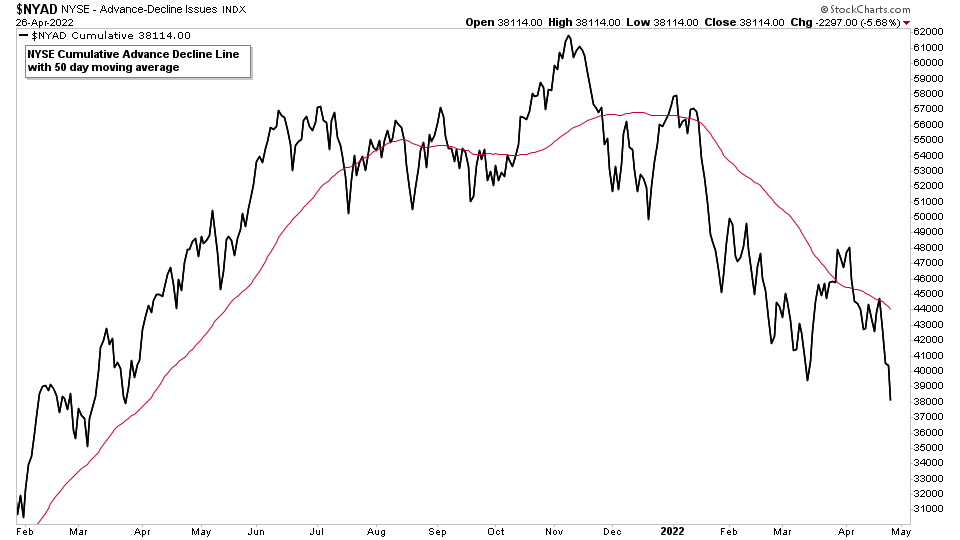

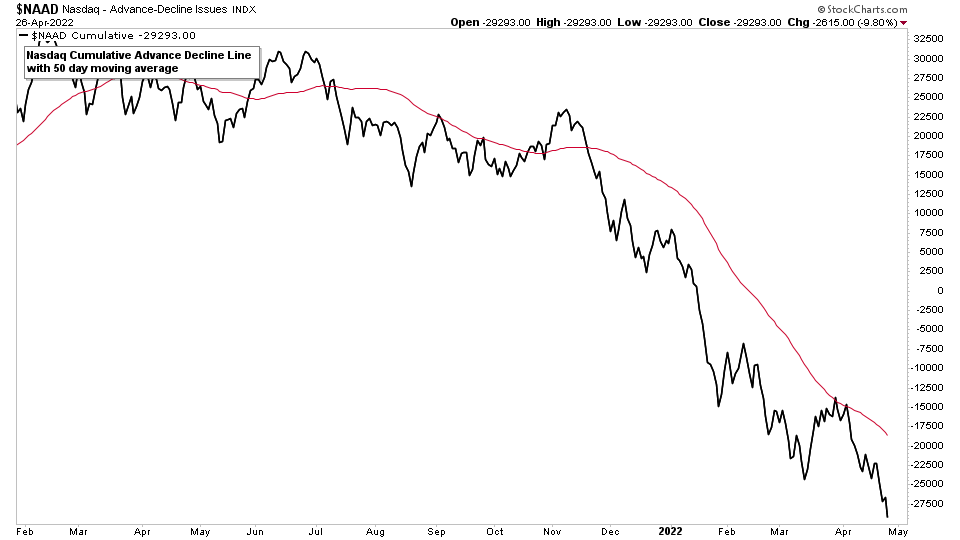

Advance Decline Line – Nasdaq Composite and NYSE

Both made a new low today, as they continue in their own Stage 4 declines.

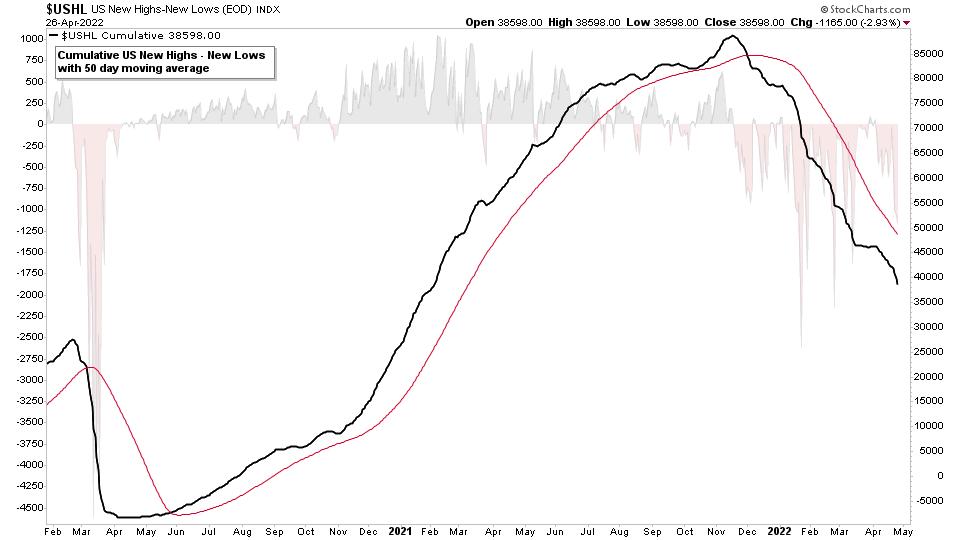

US New Highs - New Lows (Cumulative)

The amount of new lows continued to increase today for the 5th day, which can be seen very clearly in the cumulative new highs - new lows below, which remains strongly below its own 50 day MA in a deep Stage 4 decline.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.