Stock Market Struggling to Find Direction and the US Stocks Watchlist – 18 April 2022

The full post is available to view by members only. For immediate access:

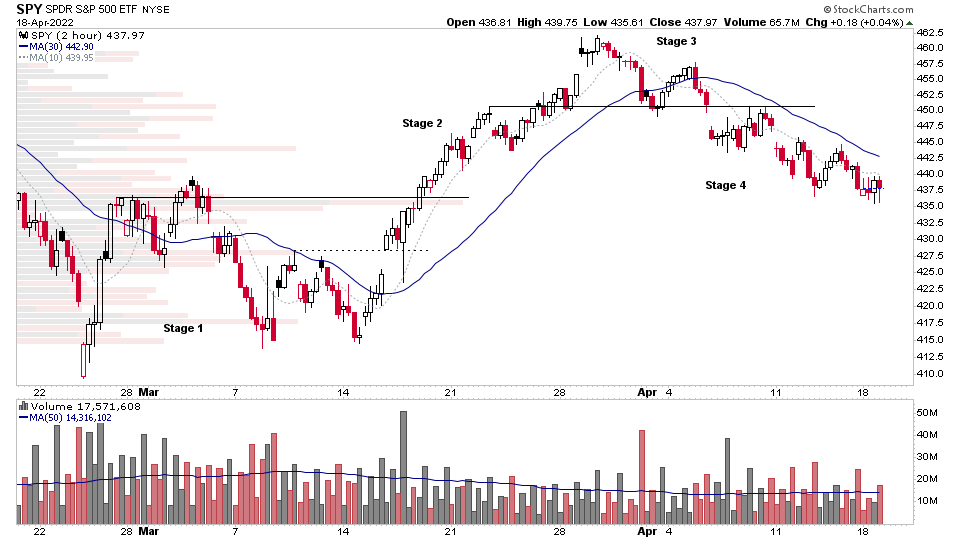

Stage Analysis can be used on multiple timeframes. So one of the best uses of that is to use it to help to determine the short term trend, which can be useful for swing trading purposes, or for fine tuning entry points, as well as general risk management uses.

If you look at intraday (2 hour) chart of the S&P 500 (SPY etf) above. You can see that remains in an intraday Stage 4 decline currently, and so using the combination of Stan Weinstein's Stage Analysis and Wyckoff Phase Analysis it suggests that there's no entry point to be had on the long side currently, as entry points for the Wyckoff method begin in Phase C and Phase D of the Stage 1 base, and the Stage Analysis entry points begin at the Stage 2 breakout and the lower risk Backup to the breakout level – which is also a major Wyckoff entry point, as it moves from Phase D to Phase E.

So using this approach it keeps you out of the trade until the Stage 1 base has almost fully developed, or an early Stage 2 breakout with strong relative volume occurs. As until then the intraday trend remains weighed to the downside. So suggests caution on the long side still.

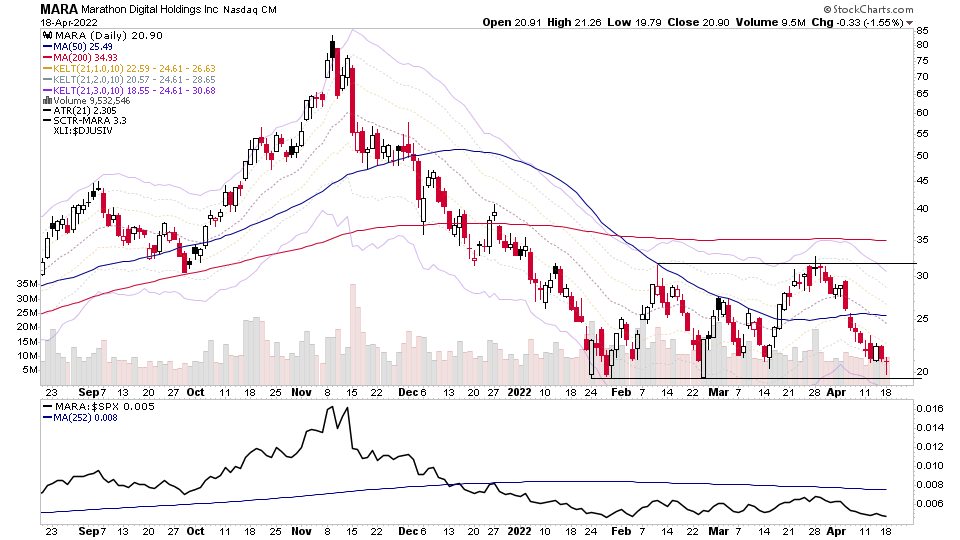

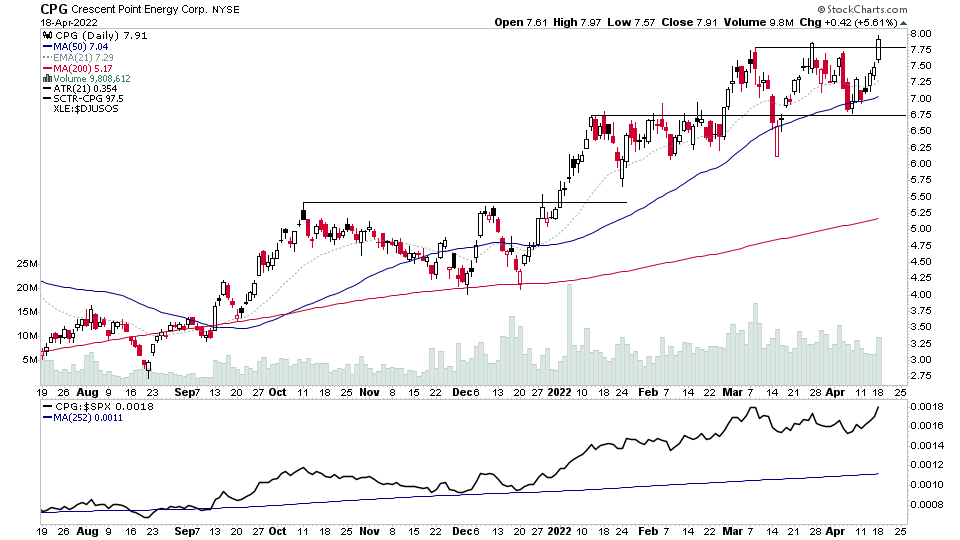

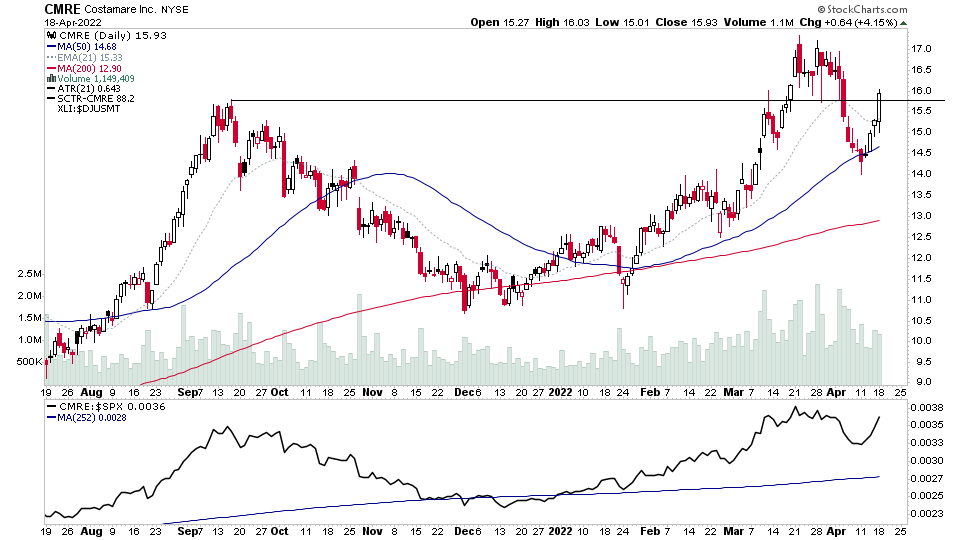

US Stocks Watchlist – 18 April 2022

There were 16 stocks for the US stocks watchlist today.

MARA, CMRE, CPG + 13 more...

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.