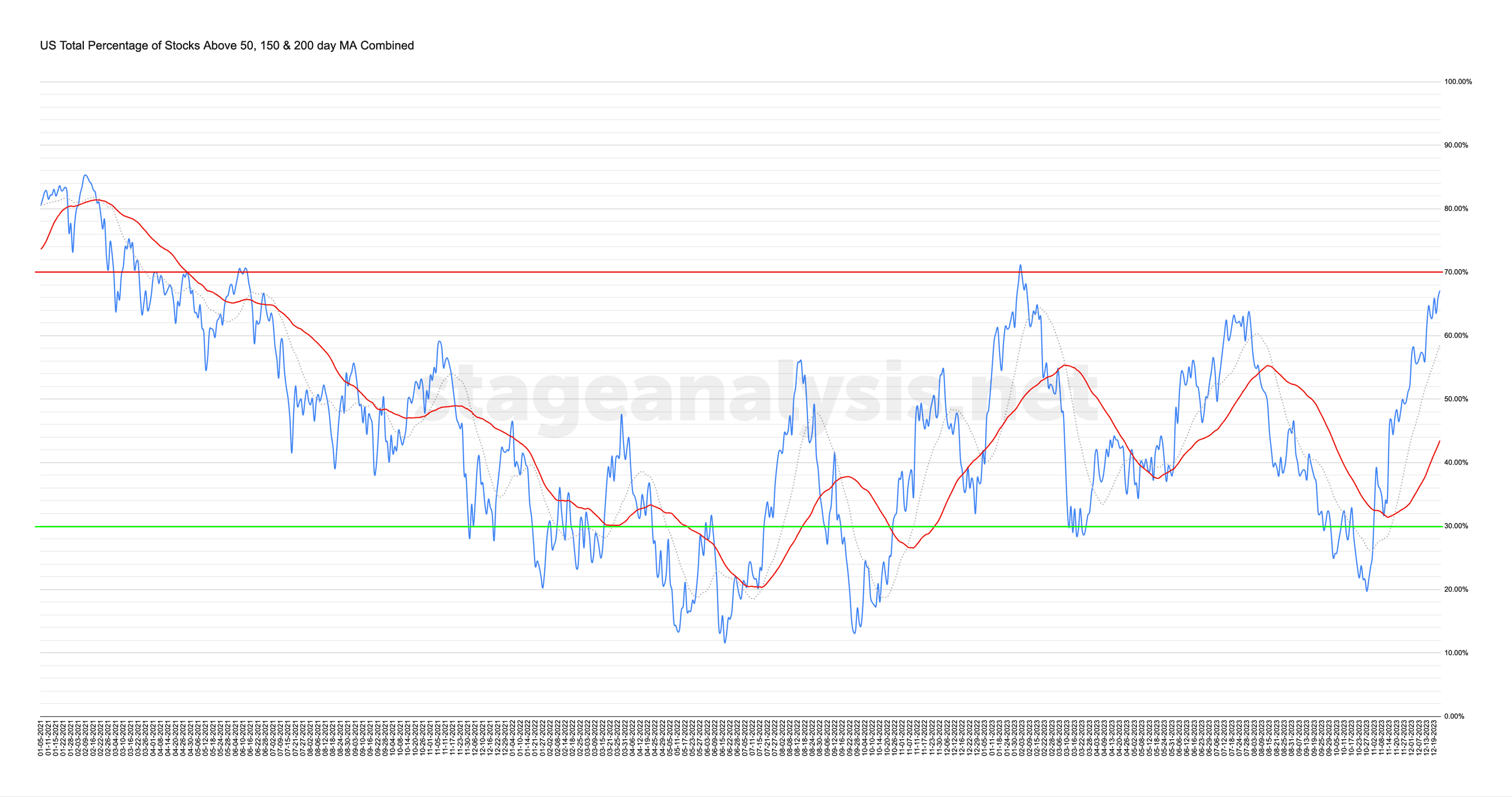

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

67.11% (+4.09% 1wk)

Status: Positive Environment

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +4.09% this week.

Therefore, the overall combined average is at 67.11% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Additional gains for the combined average this week, moving it further into the "Stage 2 zone" for the broad market, with it making a higher high compared to the 31st July peak, and approaching the 2nd February high for the year of 71.15%. In previous years when the broad market has been in a Stage 2 advance, the combined average of the Percentage of Stocks has held up in the upper half of the range for the majority of the time. So a potential warning sign to look out for as we go into early 2024, is if it starts to drop back below 60% level, but especially the 50% level into the lower half, as happened multiple times during 2023. As it's not the kind of behaviour that you see in strong bull market, as the strength should be sustained. So something to keep in mind.

But for now, its entering the eighth week of being on a Positive Environment status and currently is +8.59% above its 20 day MA, and +23.64% above its 50 day MA (signal line). So remains in healthy position currently.

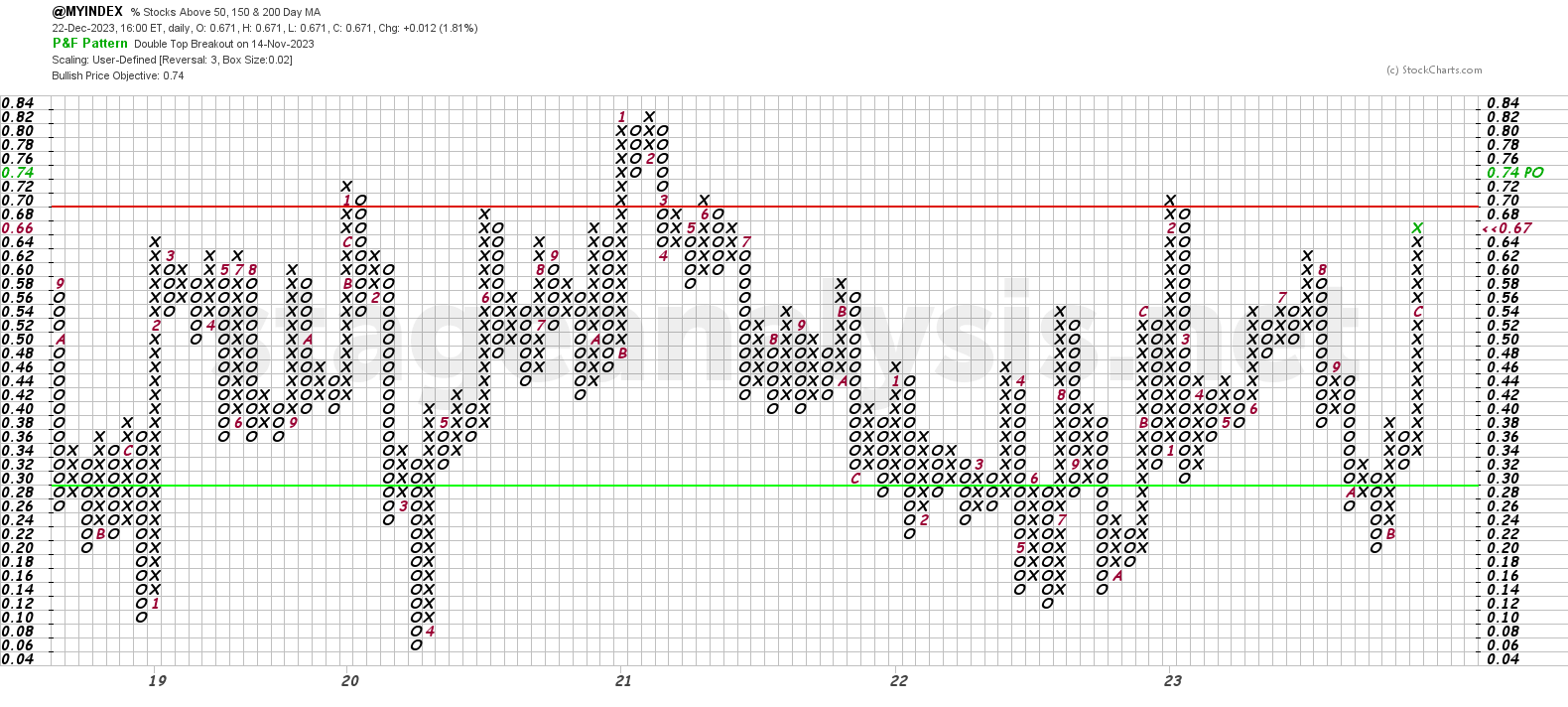

The Point and Figure (P&F) chart (shown above) added a further 1 X to its column of Xs this week, and so the P&F strategy remains on Offense (as it is in a column of Xs), and the P&F status continues on Bull Confirmed status in a Strong field position in the upper-middle range.

See the Bullish Percent article for more information on the P&F statuses.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.