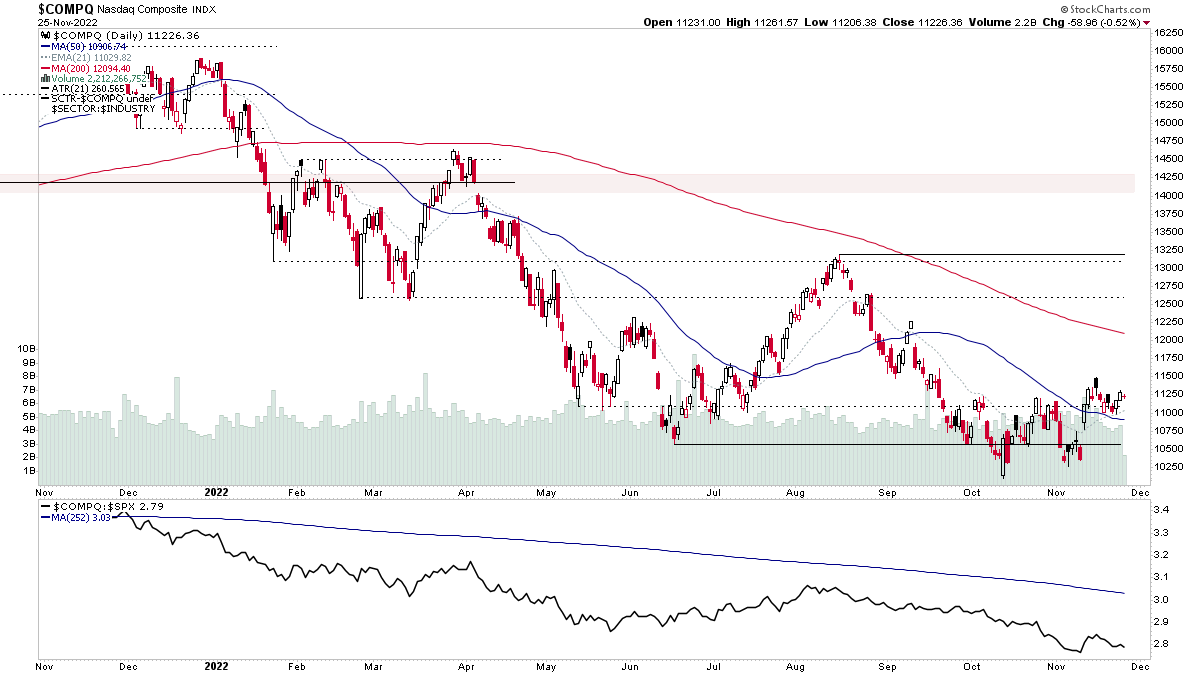

The Stage Analysis members weekend video discussing the market indexes, Dollar index, commodities, industry groups relative strength, IBD industry group bell curve – bullish percent, market breadth charts to determine the weight of evidence, this weeks Stage 2 breakout attempts and the US watchlist stocks in detail on multiple timeframes.

Read More

Blog

27 November, 2022

Stage Analysis Members Video – 27 November 2022 (1hr 24mins)

20 November, 2022

Stage Analysis Members Video – 20 November 2022 (1hr 32mins)

The members weekend video discussing the market indexes, industry groups relative strength, IBD industry group bell curve – bullish percent, market breadth charts to determine the weight of evidence, Stage 2 breakout attempts in multiple stocks and the US watchlist stocks in more detail.

Read More

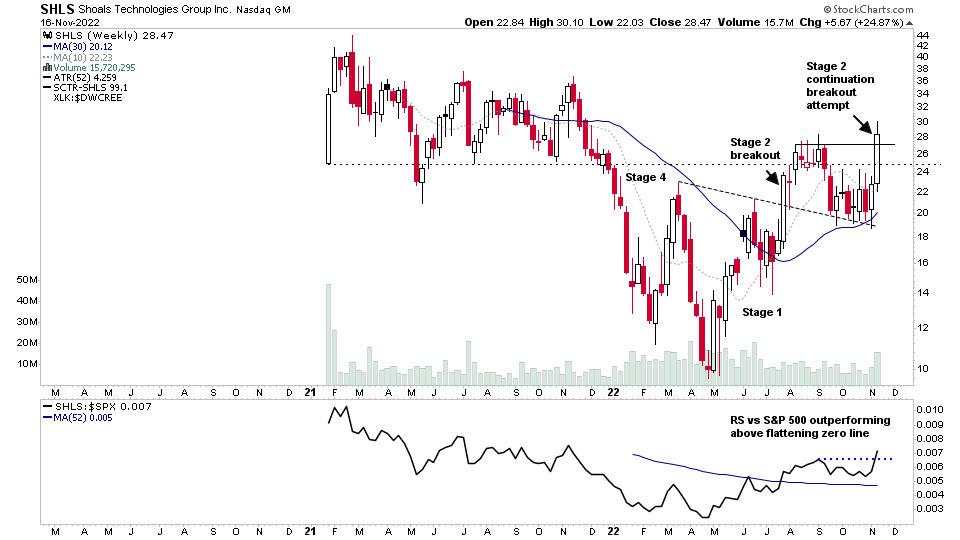

16 November, 2022

Stage Analysis Members Video – 16 November 2022 (30mins)

The members midweek video discussing the market and US watchlist stocks in more detail.

Read More

15 November, 2022

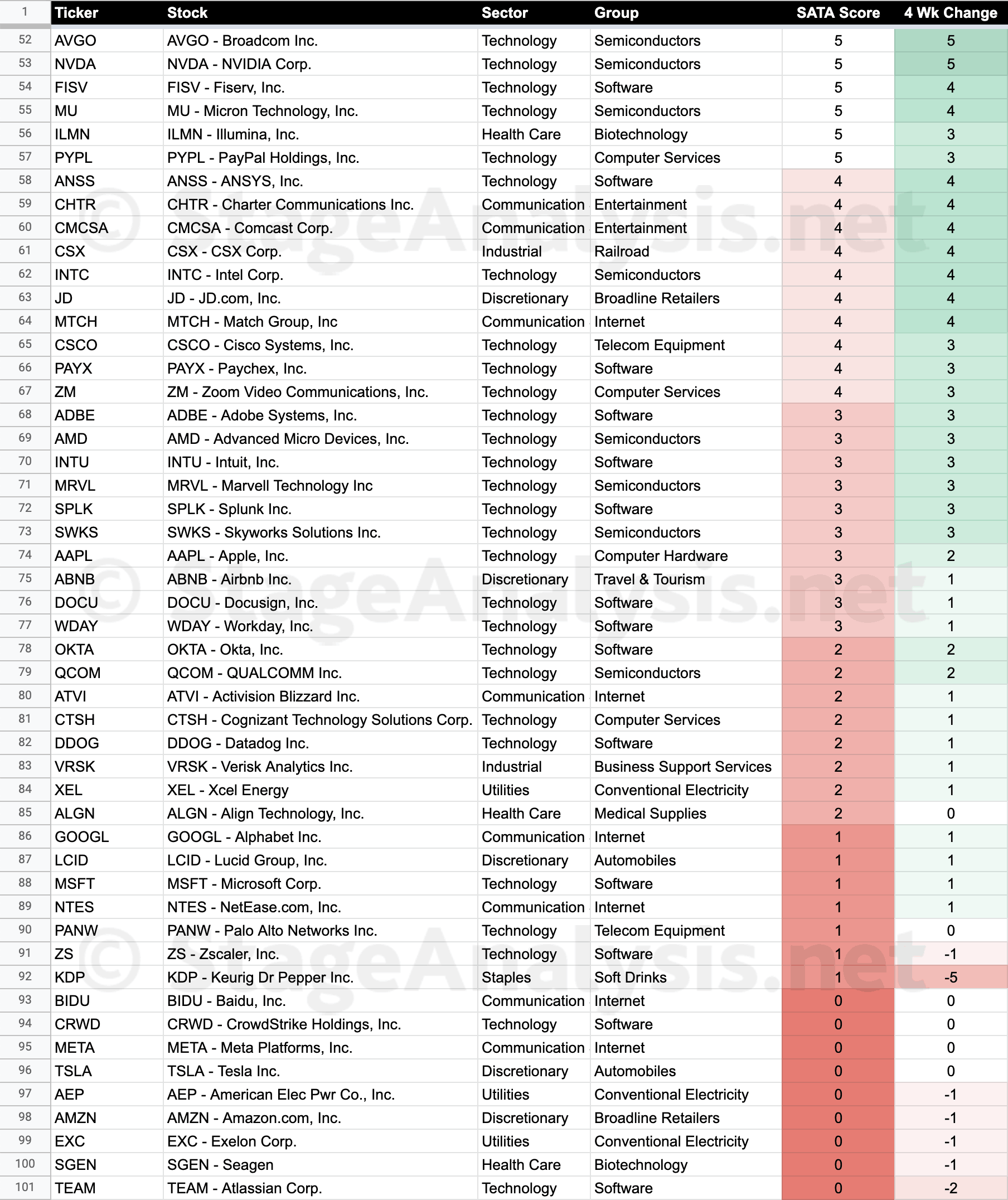

Stage Analysis Technical Attributes Scores – Nasdaq 100

It has been a month since I analysed the Stage Analysis Technical Attributes weekly scores for the Nasdaq 100. So I thought it might be a useful regular feature for the Stage Analysis members, as it shows a rough guide of the Stages of the individual stocks within the Nasdaq 100, as everything above a 7 would be considered in the Stage 2 zone, 4-6 in the Stage 1 or Stage 3 zone, and 3 or below is the Stage 4 zone.

Read More

13 November, 2022

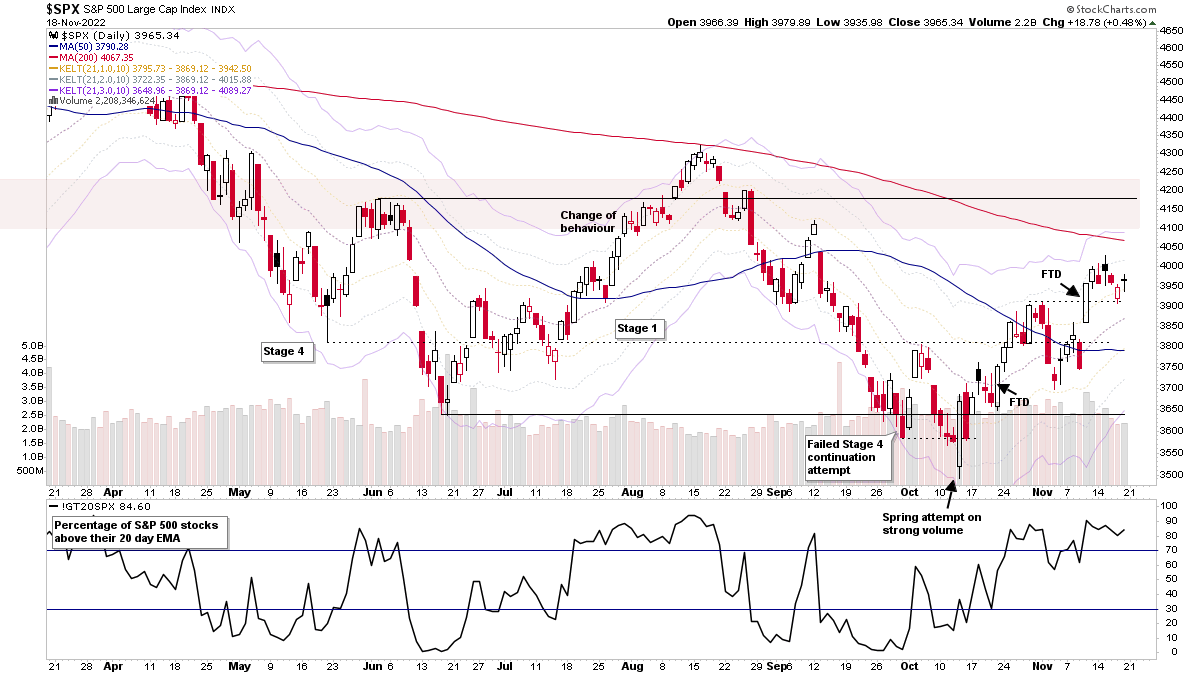

Stage Analysis Members Video – 13 November 2022 (1hr 21mins)

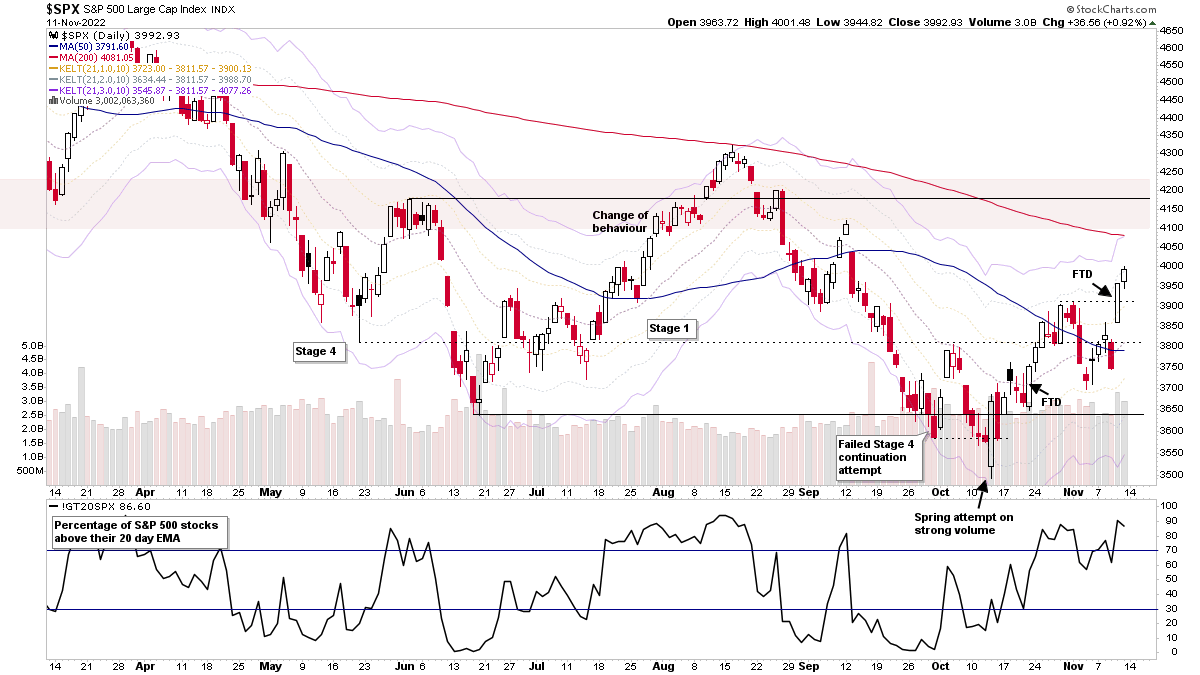

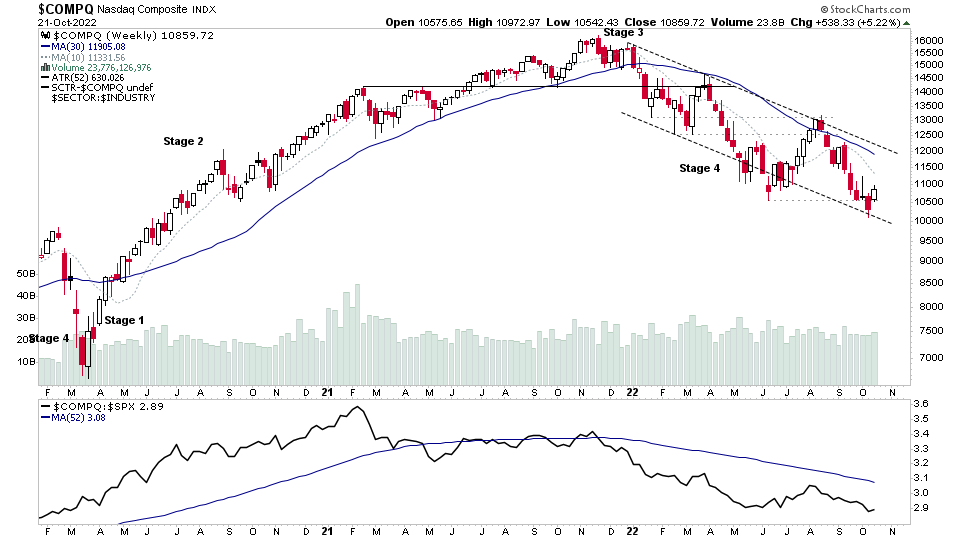

The Stage Analysis members weekend video, this week discussing the significant bar in the US Dollar Index and price and volume action in the major stock market indexes. Plus Stage Analysis of the individual sectors and the Industry Groups Relative Strength Rankings, with a look in more depth of some of the groups making the strongest moves. Also discussion of the strong shift in the IBD Industry Groups Bell Curve – Bullish Percent data, and the Market Breadth Update to help to determine the current Weight of Evidence. And finishing with live markups of the weekends US Stocks Watchlist.

Read More

06 November, 2022

Stage Analysis Members Video Part 1 – 6 November 2022 (59mins)

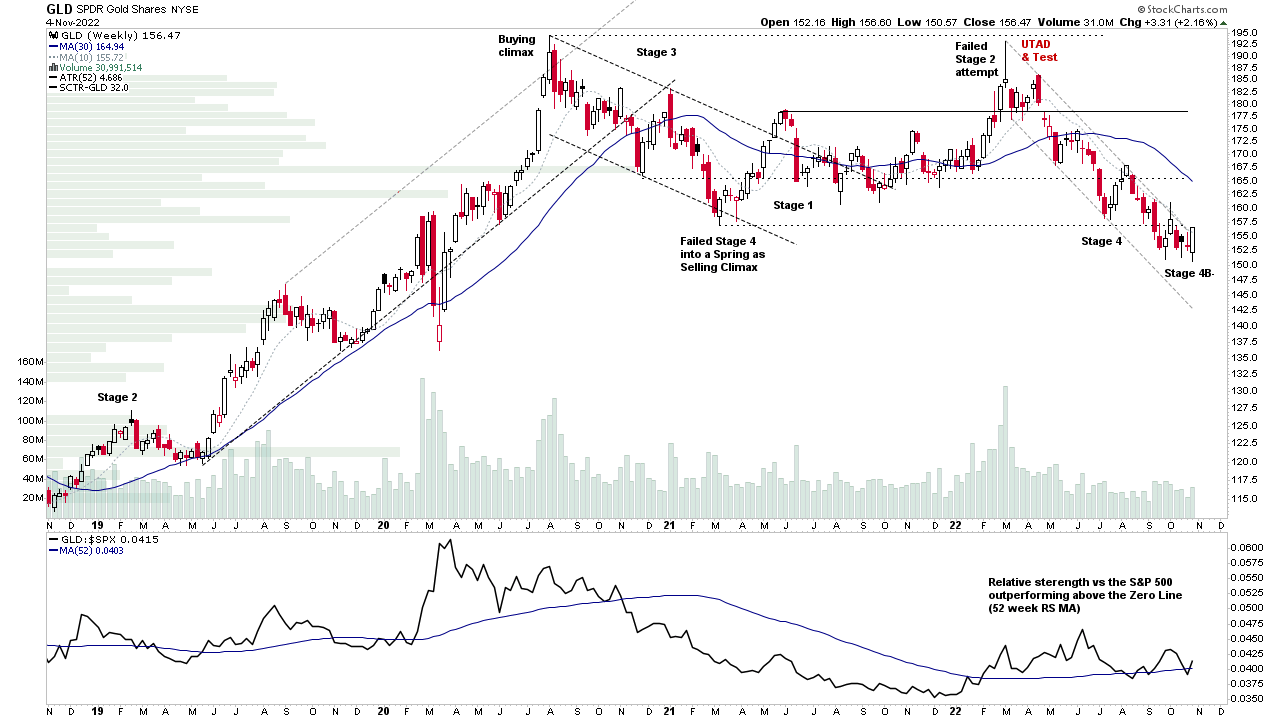

Part 1 of the regular members weekend video beginning with a special focus on Gold and Silver, and the Gold Miners group. Following that we discuss the Stage Analysis of the Major Indexes, and the Industry Groups Relative Strength Rankings, with a look in more depth of some of the groups making the strongest moves. Plus a look at the IBD Industry Groups Bell Curve – Bullish Percent and finally the Market Breadth Update to help to determine the current Weight of Evidence.

Read More

31 October, 2022

Monthly Charts Review – 31 October 2022

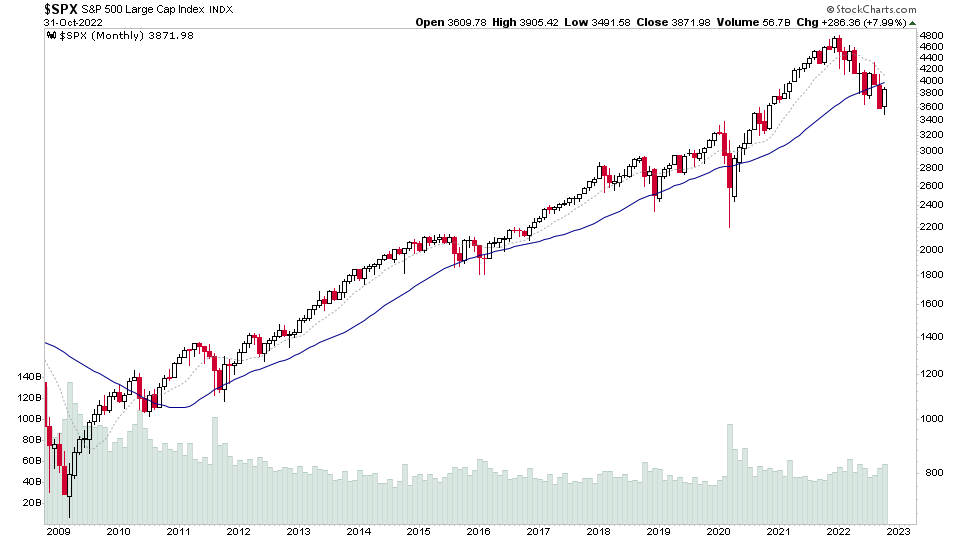

As we come to the end of October, it's worth zooming out from your regular chart timescales and taking a look at the bigger picture across different areas of the markets for some perspective.

Read More

30 October, 2022

Stage Analysis Members Video Part 2 – US Market Review – 30 October 2022 (28 mins)

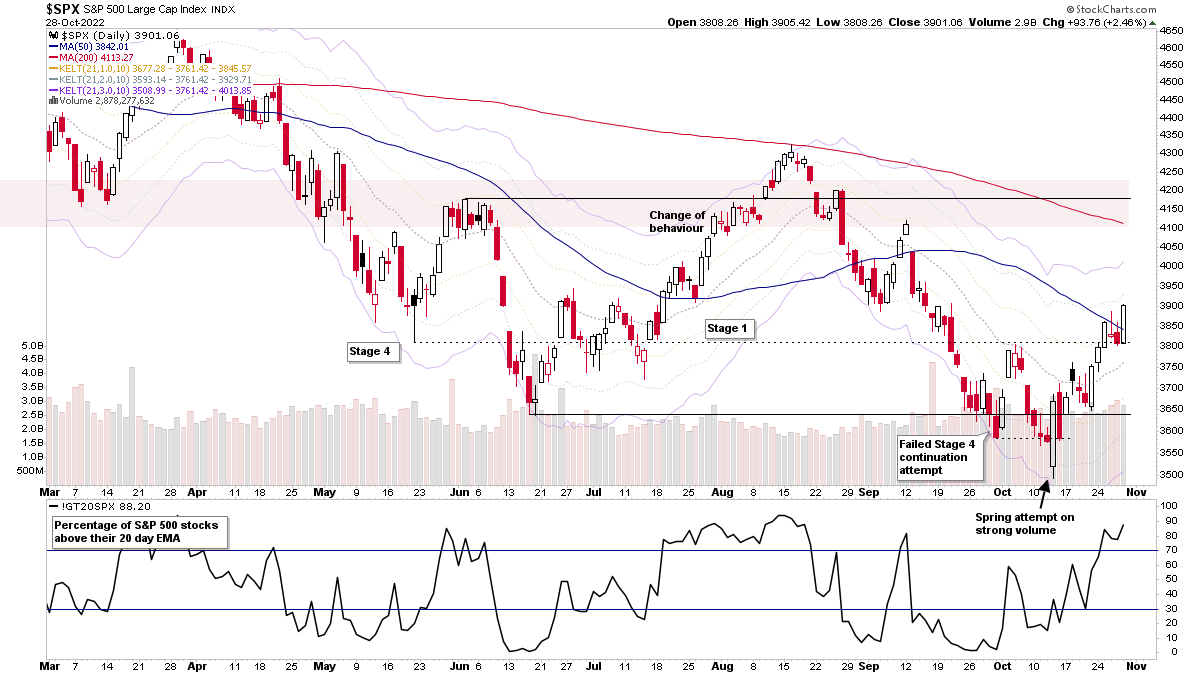

Part 2 of the regular members weekend video discussing the market, industry groups and market breadth to determine the weight of evidence.

Read More

26 October, 2022

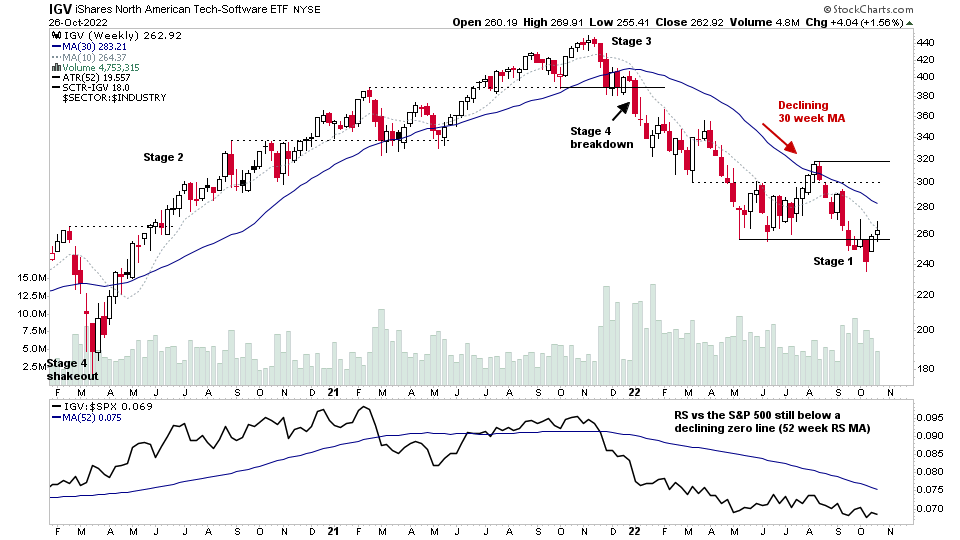

Stage Analysis Members Midweek Video | Group Focus: Software – 26 October 2022

The members midweek video this week begins with a special group focus on the Software group, which I've talked about in the Stage Analysis videos a number of times over the summer months, as the stocks in the group have gradually moved towards Stage 1 type behaviour...

Read More

23 October, 2022

Stage Analysis Members Video Part 2 – 23 October 2022 (58 mins)

Part 2 of the regular members weekend video discussing the market, commodities, industry groups and market breadth to determine the weight of evidence.

Read More