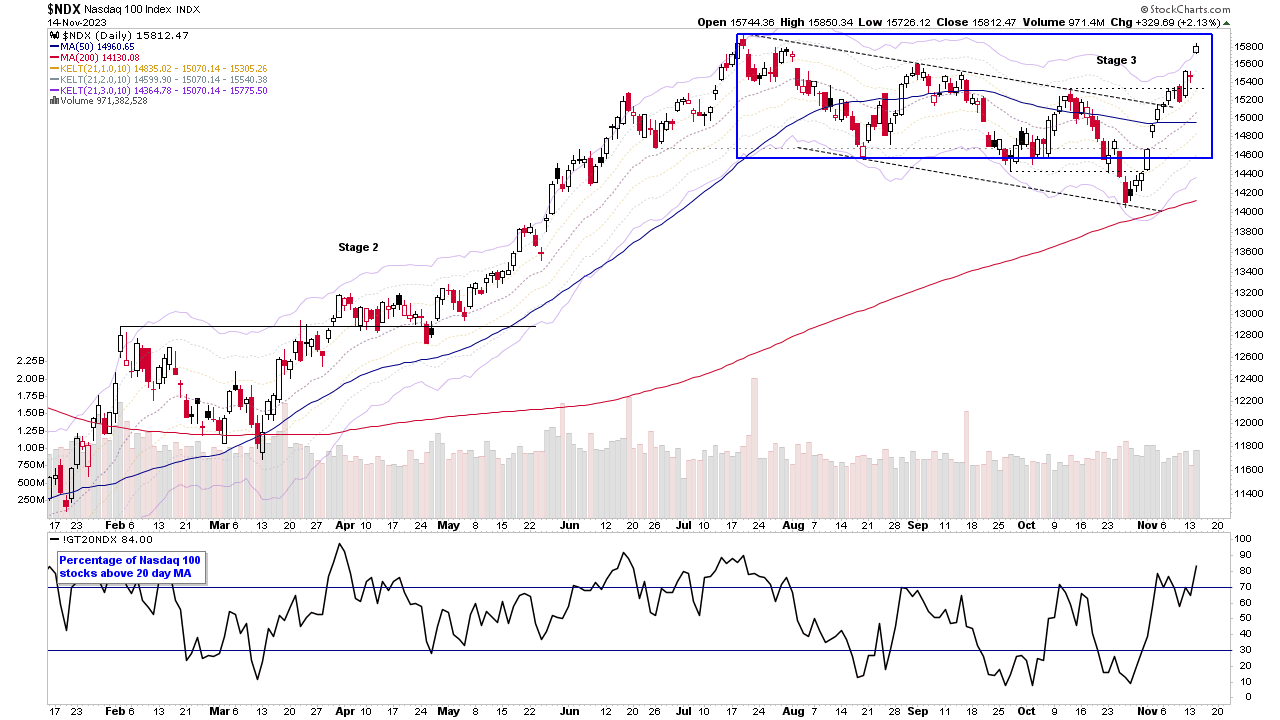

Nasdaq 100 Approaching 2023 Highs and the US Stocks Watchlist – 14 November 2023

The full post is available to view by members only. For immediate access:

The US stock market exploded higher today, as Small Caps surged over +5%, with the Russell 2000 moving back to within -1% of its 200 day MA. But, the small caps weren't the only strong movers, as the rest of the major indexes all had strong follow through days, and the Nasdaq 100 (shown above) has moved within -1% of its 2023 highs (set on the 19th July) and so is approaching the top of its Stage 3 range. And hence the question is, whether it will have the strength to breakout to new 52 week highs, and make a new Stage 2 continuation breakout attempt, or will it fail and fall back into the Stage 3 range.

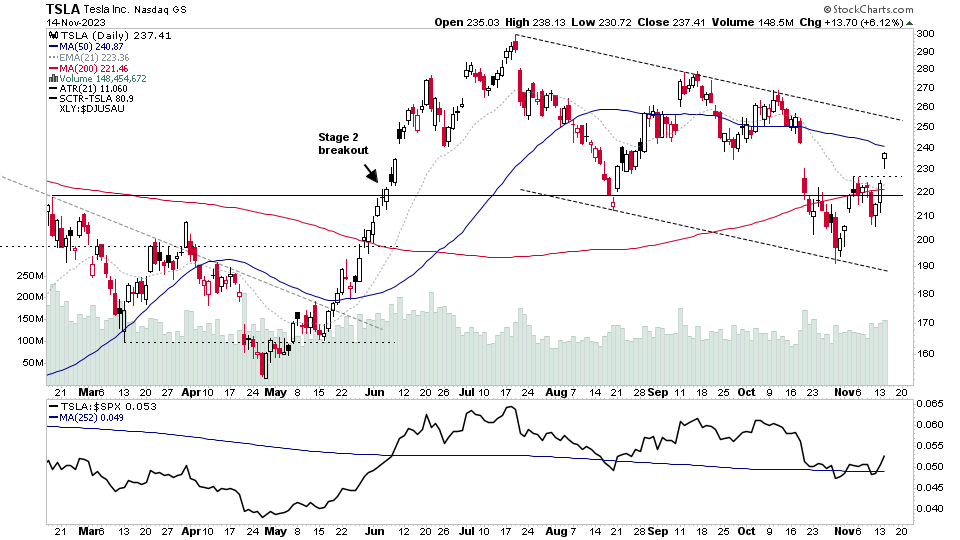

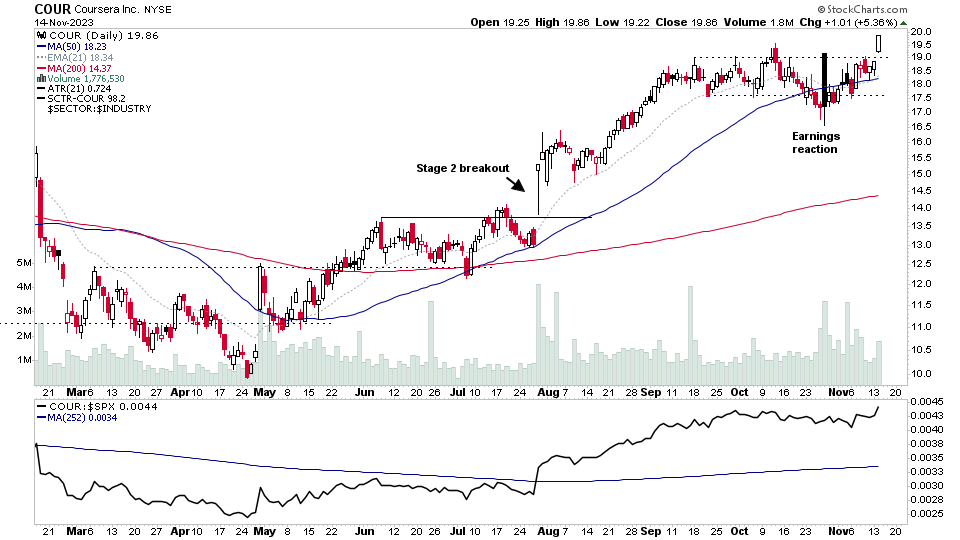

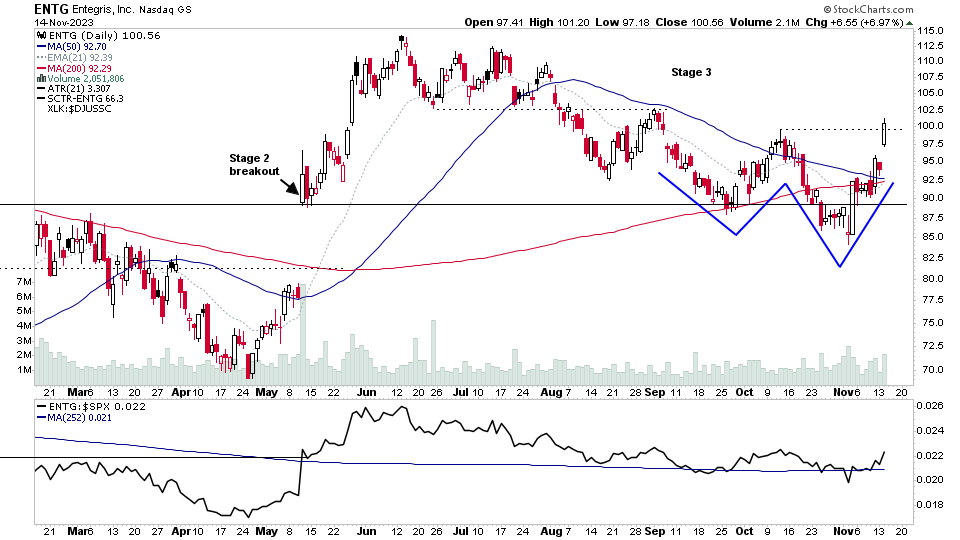

Watchlist Stocks

There were 26 stocks highlighted from the US stocks watchlist scans today

TSLA, COUR, ENTG + 23 more...

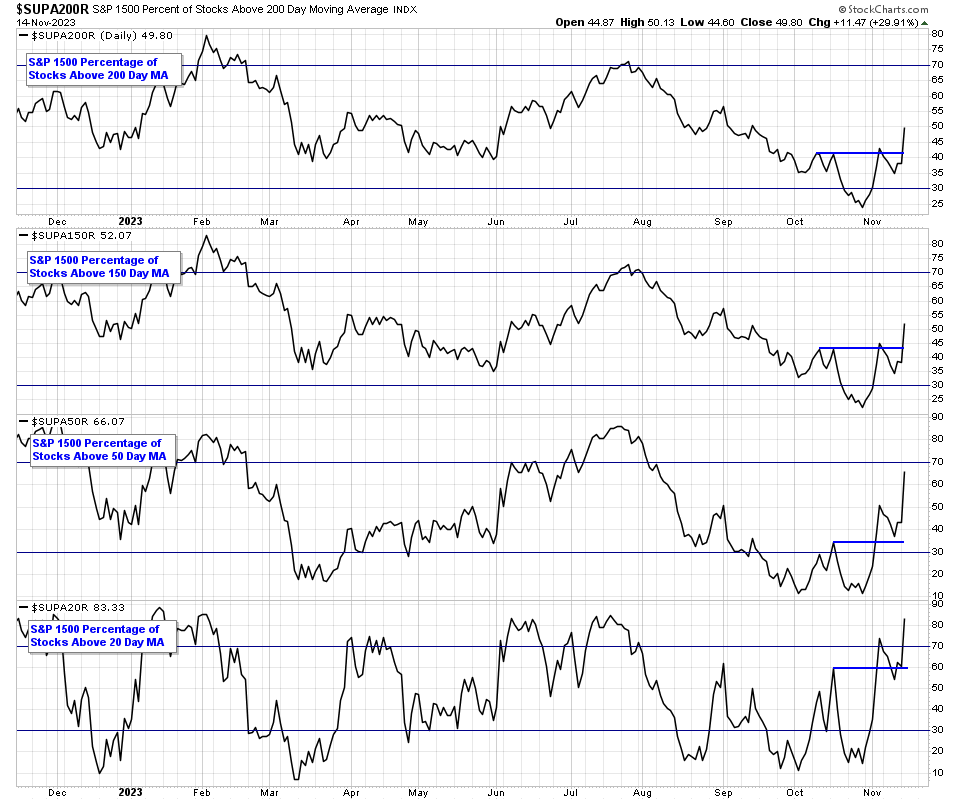

Market Breadth: S&P Composite 1500 Moving Average Breadth

A follow up on the S&P Composite 1500 moving average breadth, as it's seen some strong improvements since last week.

- 49.80% > 200 day MA (Long-term)

- 52.07% > 150 day MA (Medium-term)

- 66.07% > 50 day MA (Short-term)

- 83.33% > 20 day MA (Very Short-term)

Combined Average: 62.82% (Strong)

Therefore, the combined average has improved by +22.72% since Thursdays post, which is a significant change, and moves it into the Strong zone (60%+) for this market breadth measure.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.