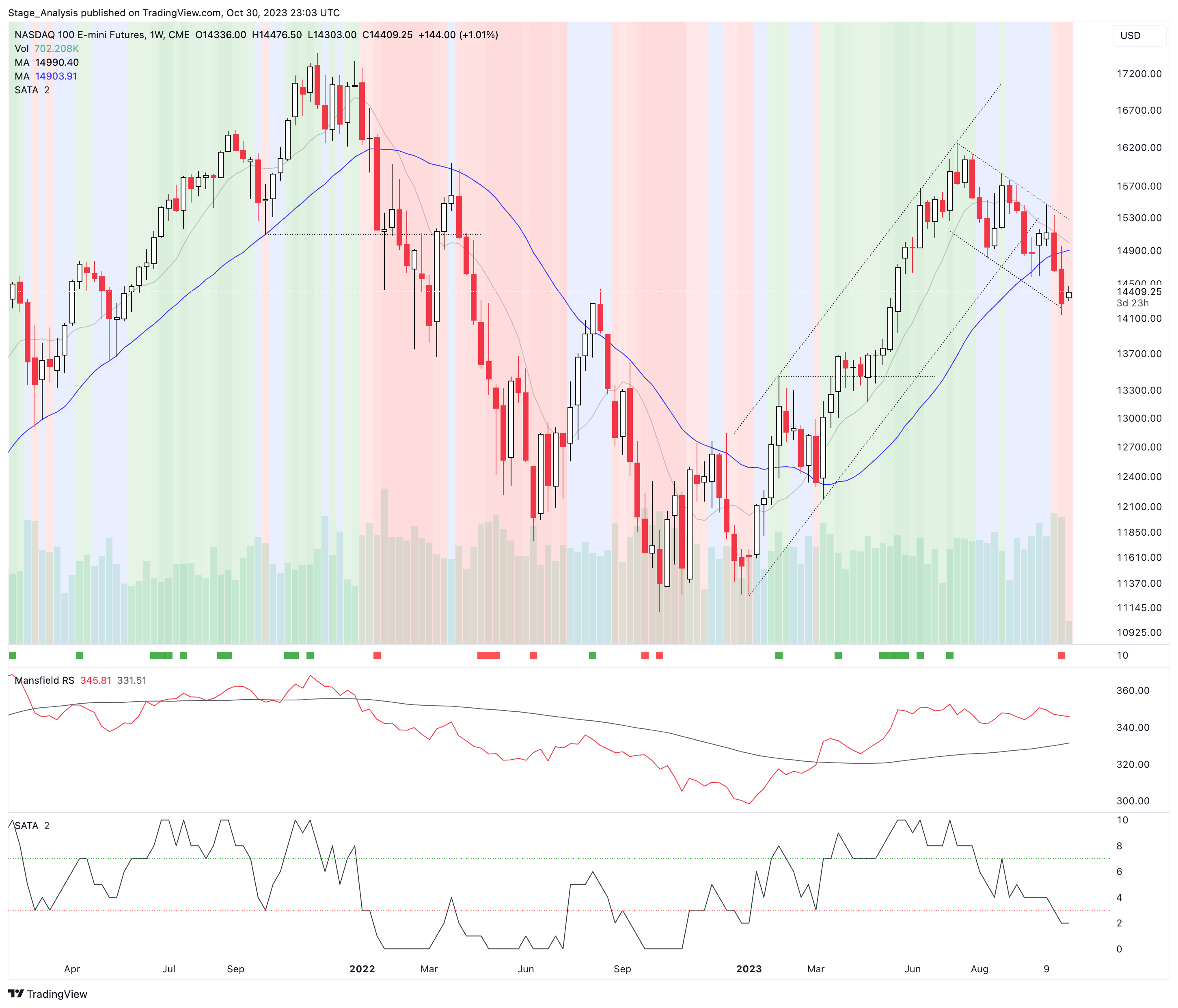

Stage Analysis Technical Attributes Scores – Nasdaq 100

The full post is available to view by members only. For immediate access:

The Stage Analysis Technical Attributes (SATA) score is our proprietary indicator that helps to identify the four stages from Stan Weinstein's Stage Analysis method, using a scoring system from 0 to 10 that rates ten of the key technical characteristics that we look for when analysing the weekly charts.

We last covered the weekly SATA scores for the Nasdaq 100 back on 16th October, which gives a rough guide of the Stages of the individual stocks within the Nasdaq 100. i.e. everything above a 7 would be considered in the Stage 2 zone (Strong), 4-6 in the Stage 1 or Stage 3 zone (Neutral), and 3 or below is the Stage 4 zone (Weak).

This weeks full length post is for Stage Analysis Members only, but you can see a full, unlocked post from early October as an example if you are interested in seeing this very useful data regularly. Go to: Stage Analysis Technical Attributes Scores – Nasdaq 100 – 2nd October 2023

Update: SATA Screener for the Website

It's been 10 months since we began the project to add the SATA scores and associated data onto the Stage Analysis website. It's been a considerably more difficult and timely process than we initially anticipated, but our software developer hit another milestone last week – which was the data accuracy part of the project on a small sample of stocks.

So we now have accurate weekly SATA scores and Mansfield RS data, with fully adjusted data for dividends and splits that matches the Tradingview SATA scores and Mansfield RS closely, and so we are now moving onto the next phase of the project, which is to expand the amount of stocks for testing up to the Nasdaq 100. Following that, we will then will expand to cover the broader US market, via the NYSE and Nasdaq Composite Indexes, which at current count is 1909 NYSE stocks and 3462 Nasdaq Composite stocks. Hence a total of 5371 stocks at the moment.

Getting the US market SATA data up and running for the members is the first priority. But once that is through its beta stage, we also aim to expand to cover a number of other international markets including: India, UK, Canada, Europe, Australia and potentially other markets if there is demand from members.

The timescale until the SATA screener is live for members remains an unknown factor unfortunately. But our hope is that we'll be able to start to integrate some initial parts of it into the Stage Analysis member service in the coming months.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.