US Stocks Watchlist - 15 December 2021

There were 29 stocks for the US stocks watchlist today. Here's a small sample from the list:

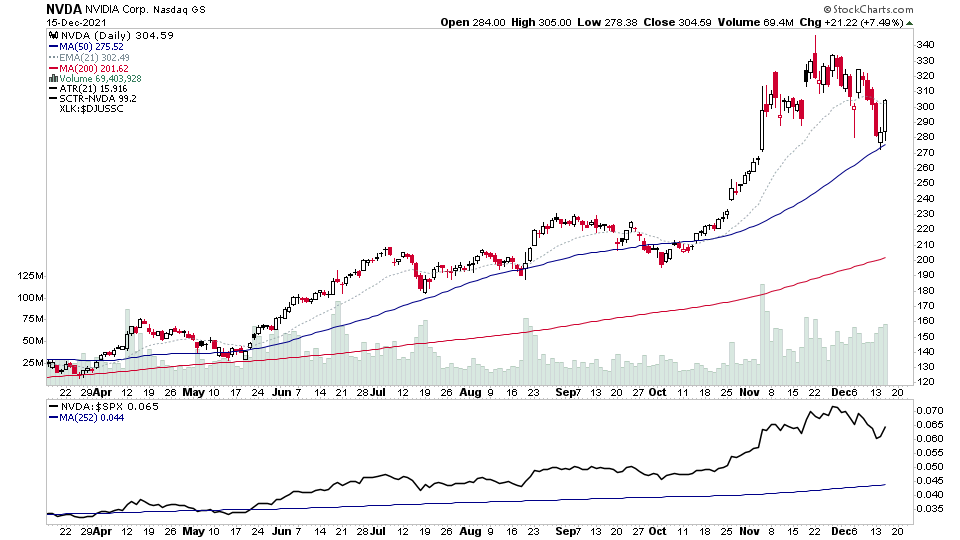

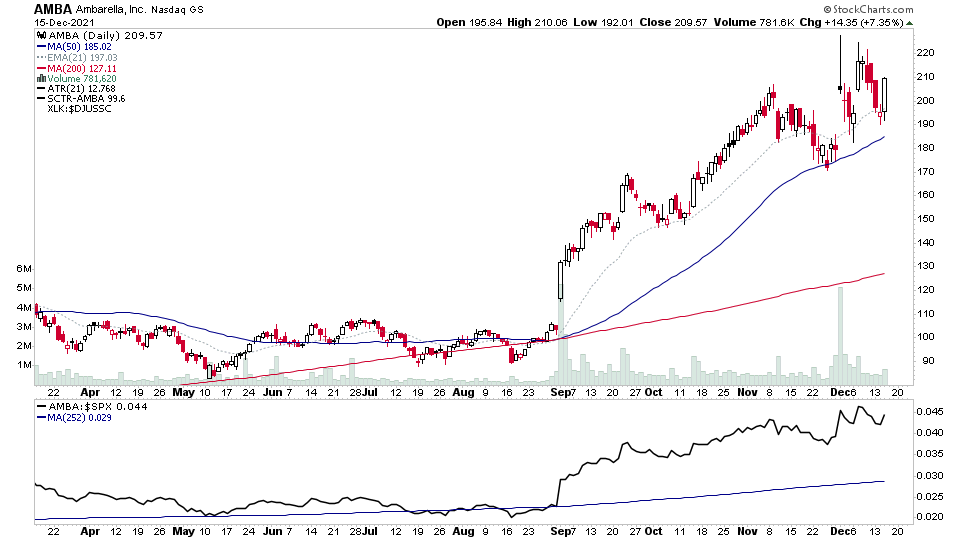

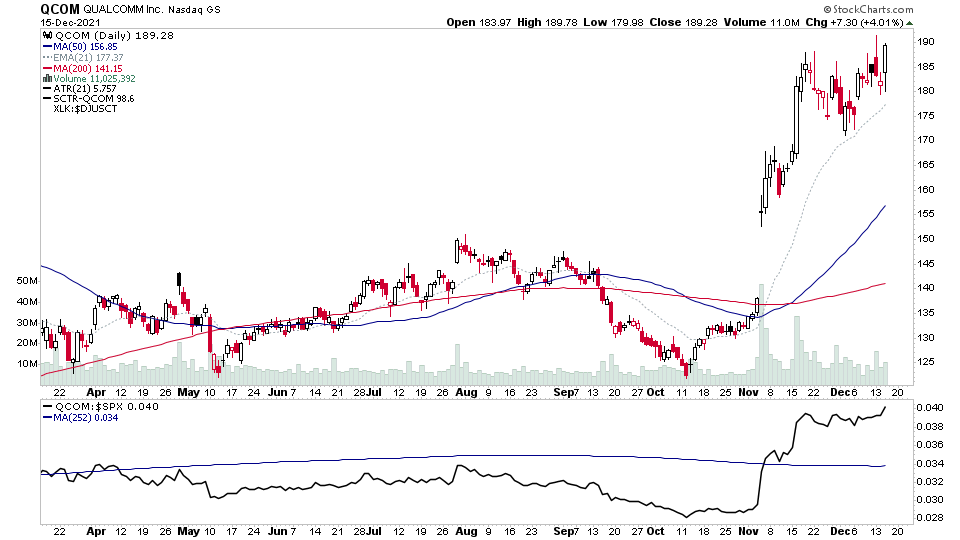

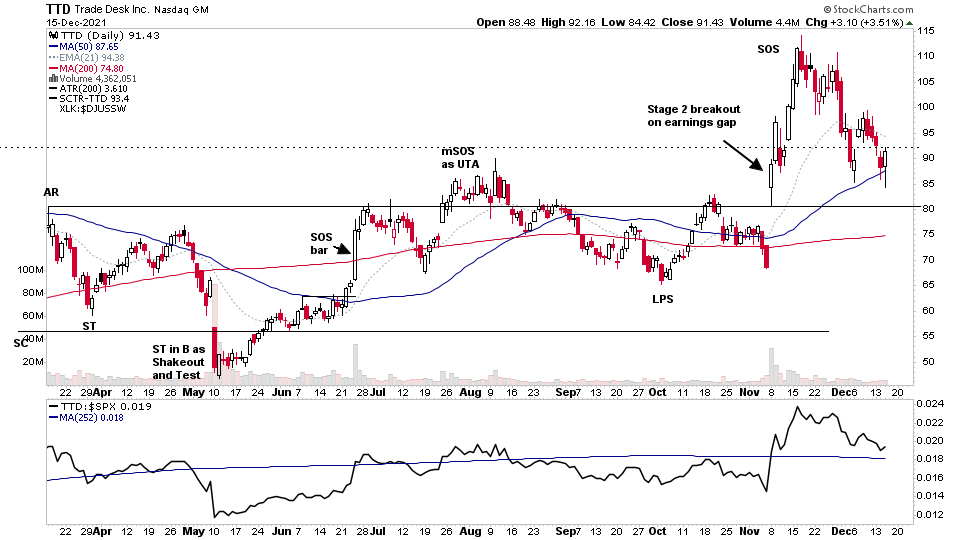

NVDA, QCOM, AMBA, TTD, + 25 more...

Non-members

To see all the watchlist posts and other premium content, such as regular detailed videos and exclusive Stage Analysis tools, become a member

Join Today

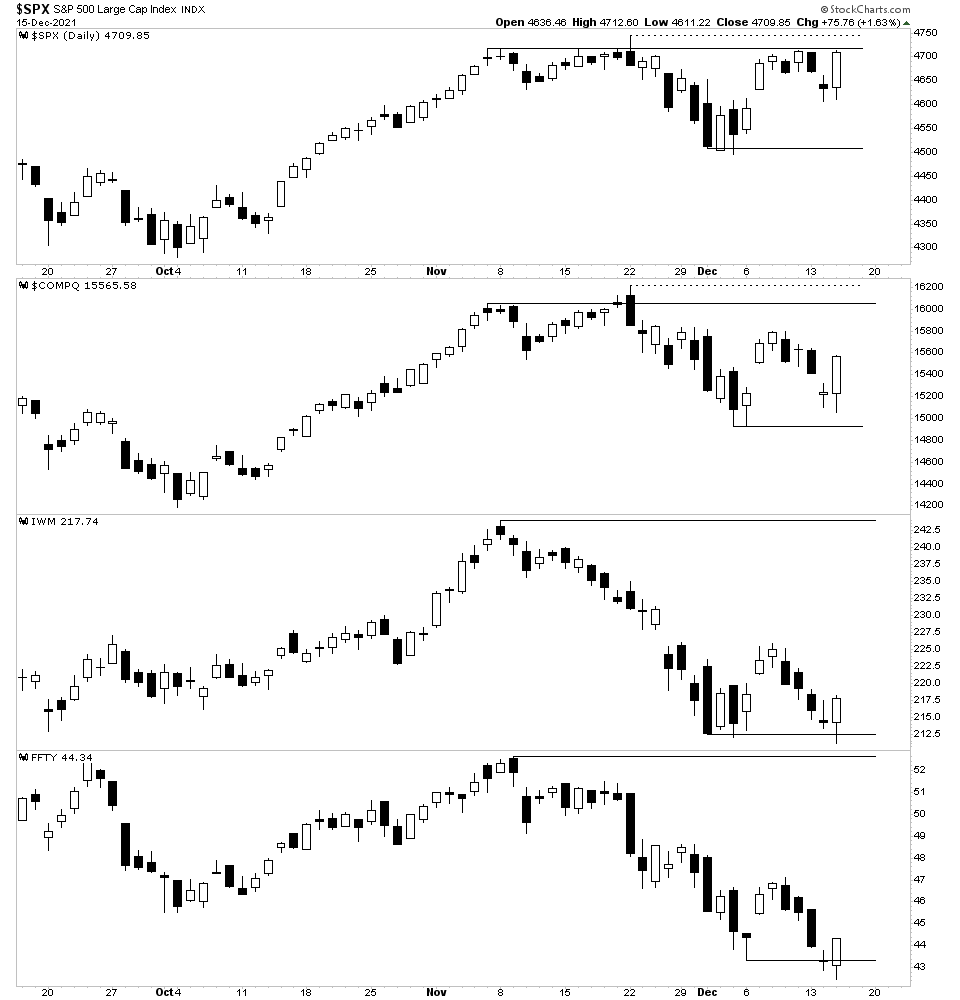

Major Indexes - S&P 500, Nasdaq, Russell 2000 and IBD 50

Major Indexes comparison chart - Spring type action in the Russell 2000 and IBD 50, and higher lows in the S&P 500 and Nasdaq with a Day 8 Follow Through Day for CAN SLIM method fans.

Potential for a new high attempt in S&P 500 tomorrow.

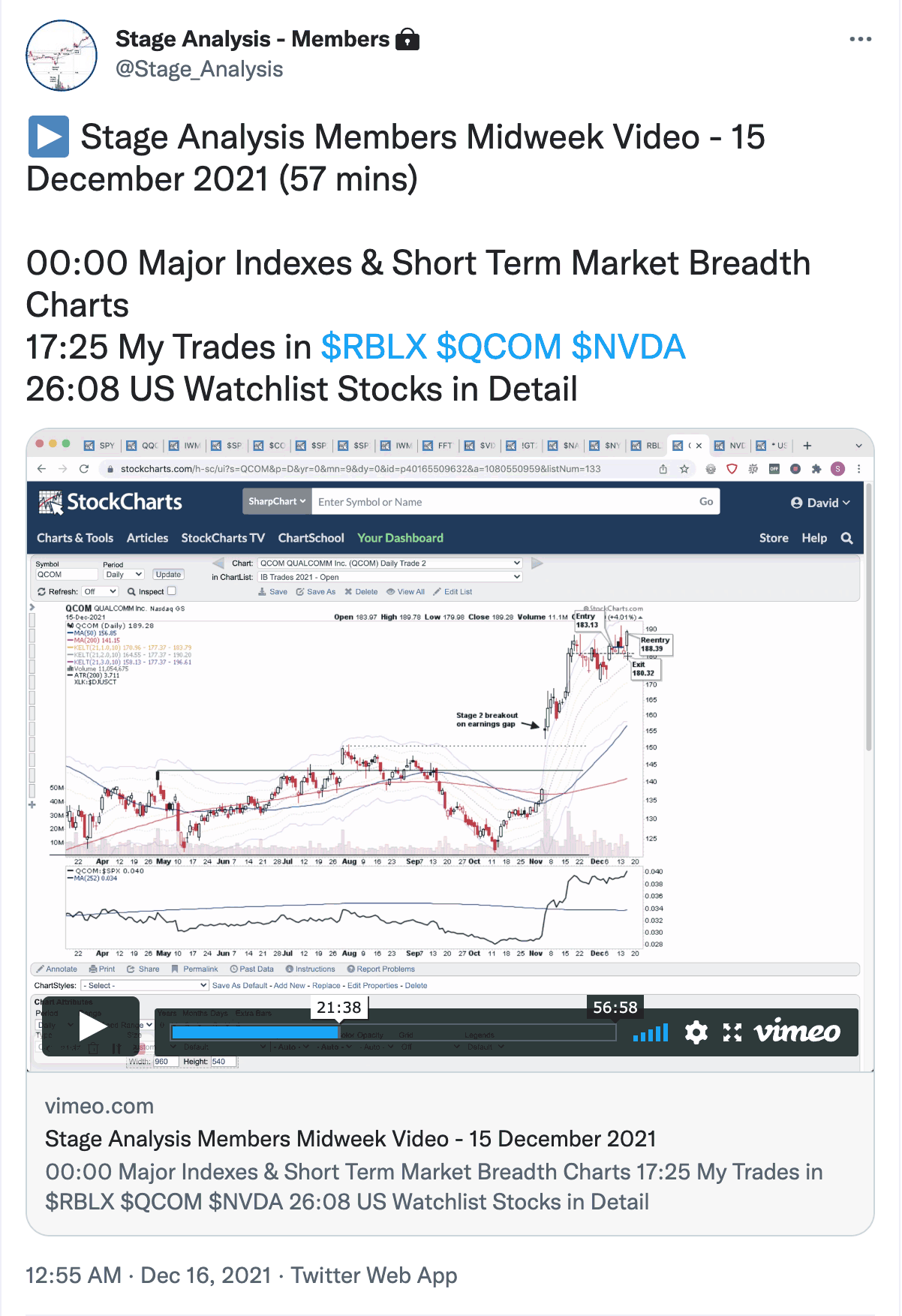

Stage Analysis Members Midweek Video - 15 December 2021 (57 mins)

➜ Members login to the forum or private twitter to view

00:00 Major Indexes & Short Term Market Breadth Charts

17:25 My Trades in $RBLX $QCOM $NVDA

26:08 US Watchlist Stocks in Detail

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.