Nasdaq 100 Tests Its Stage 2 Breakout Level and the US Stocks Watchlist – 30 March 2023

The full post is available to view by members only. For immediate access:

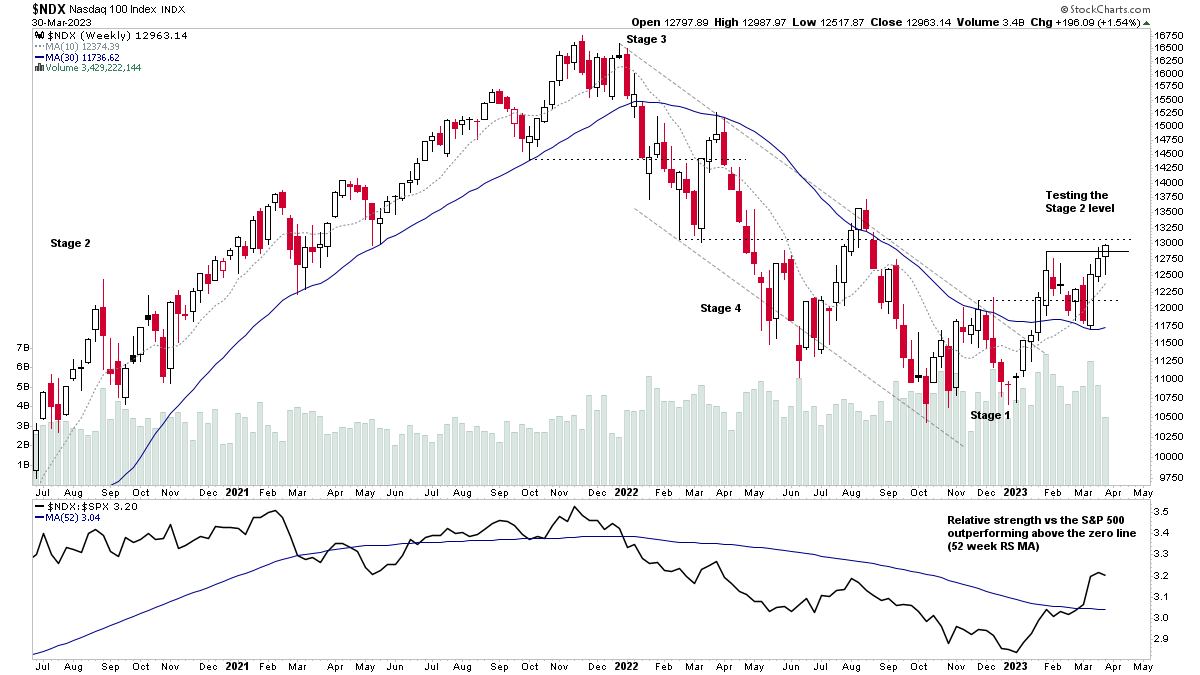

The Nasdaq 100 tested its weekly Stage 2 breakout level today, which increased the Stage Analysis Technical Attributes (SATA) score to a 9 of 10, as it still remains under a significant zone of resistance from 2022 ranges which it needs to clear in order to achieve the maximum SATA score.

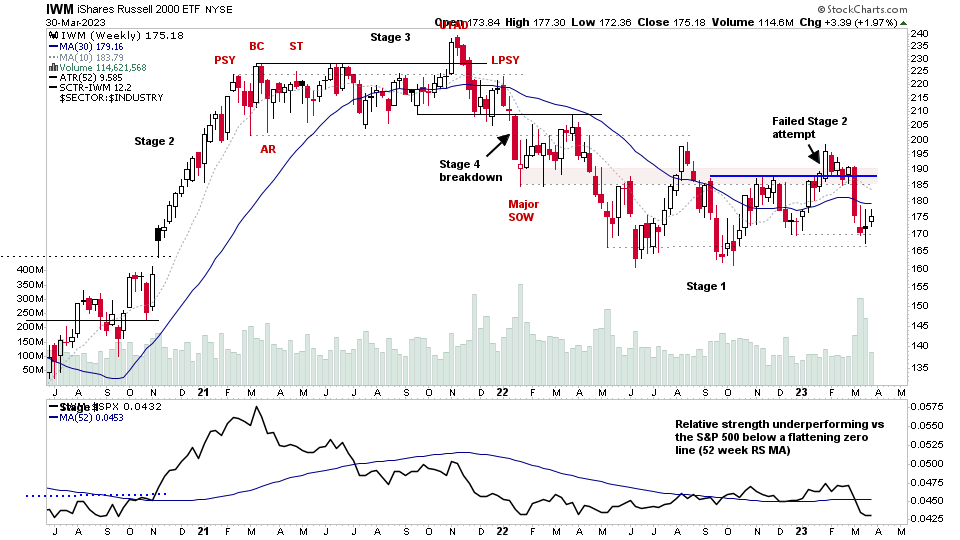

The Nasdaq 100 move to test its Stage 2 level is at odds with the other major indexes and broad market breadth data though, which are all in weaker positions technically. Especially the Russell 2000 Small Caps index (IWM), which is more than -10% below the top of of its Stage 1 base structure, and is lingering near the lows of the range, and hence there's a possibility that it may fall back into Stage 4 once more, if the current rebound attempt fails to make much progress higher.

With the end of the first quarter upon us, will Large Cap tech stocks lead us higher into early Stage 2, or are the Small Caps signalling a potential return to Stage 4 in the months ahead, with the tech rally just exit liquidity for the larger players?

A pivotal point for the market.

Watchlist Stocks

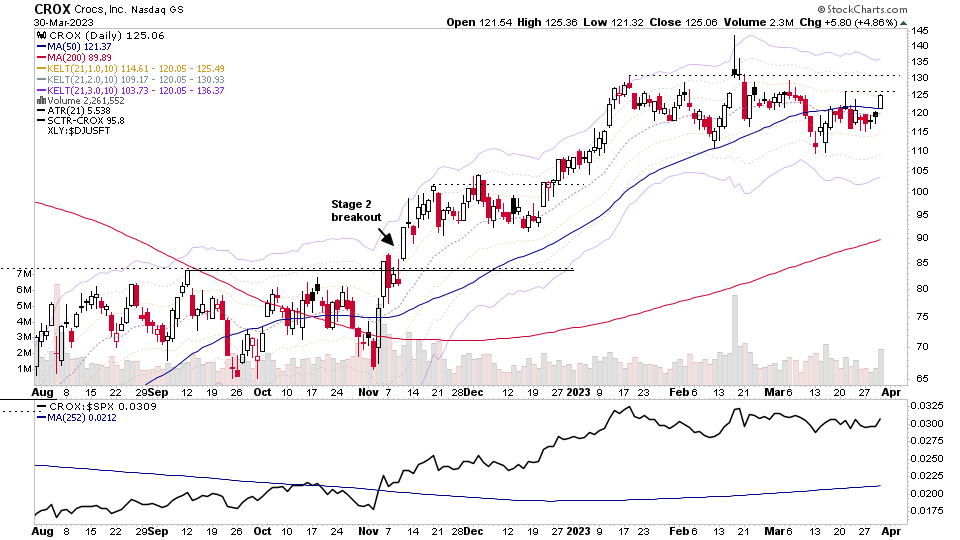

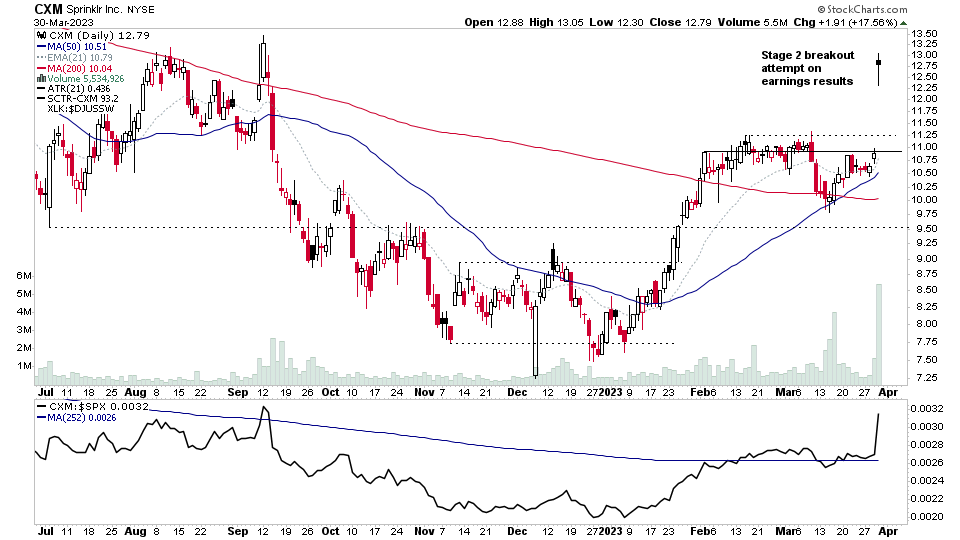

There were 28 stocks highlighted from the US stocks watchlist scans today

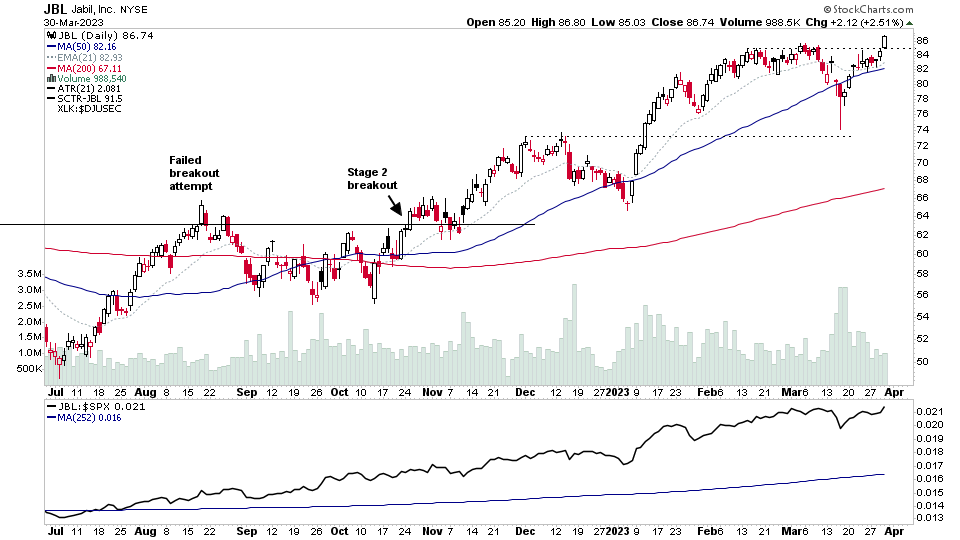

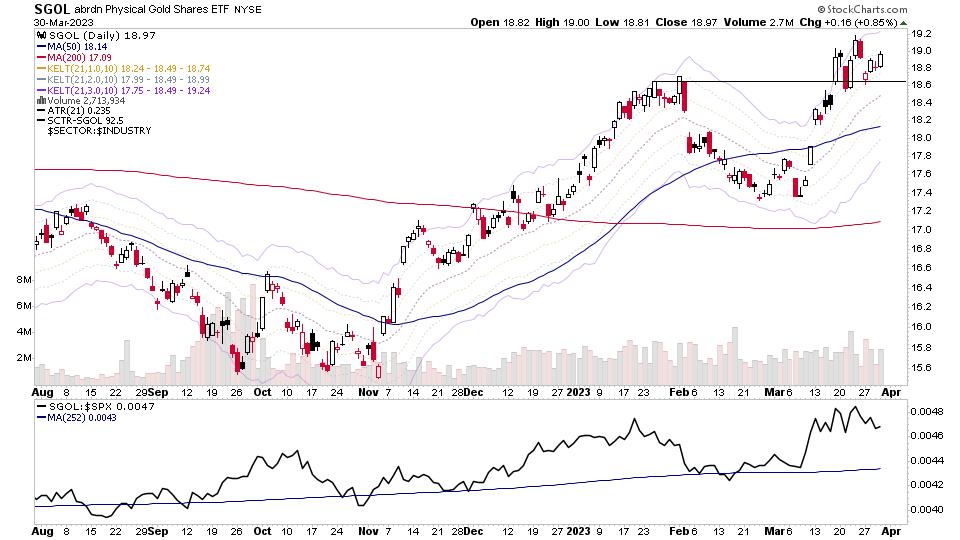

CROX, CXM, JBL, SGOL + 24 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.