US Stocks Watchlist – 23 March 2023

The full post is available to view by members only. For immediate access:

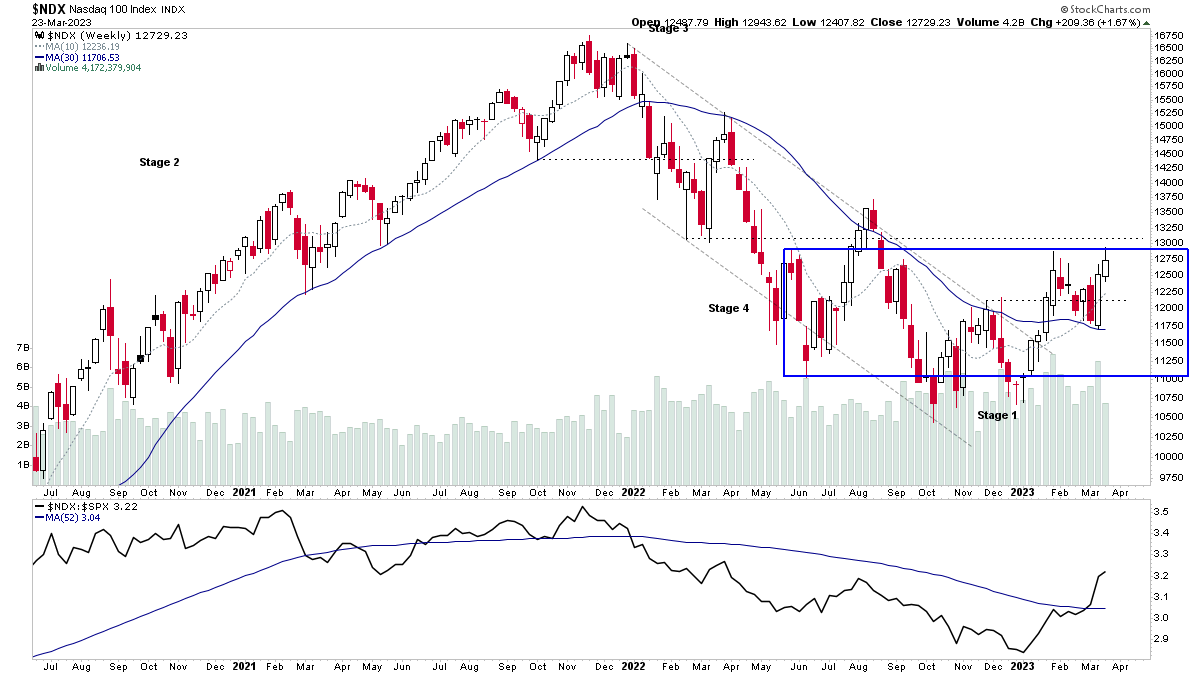

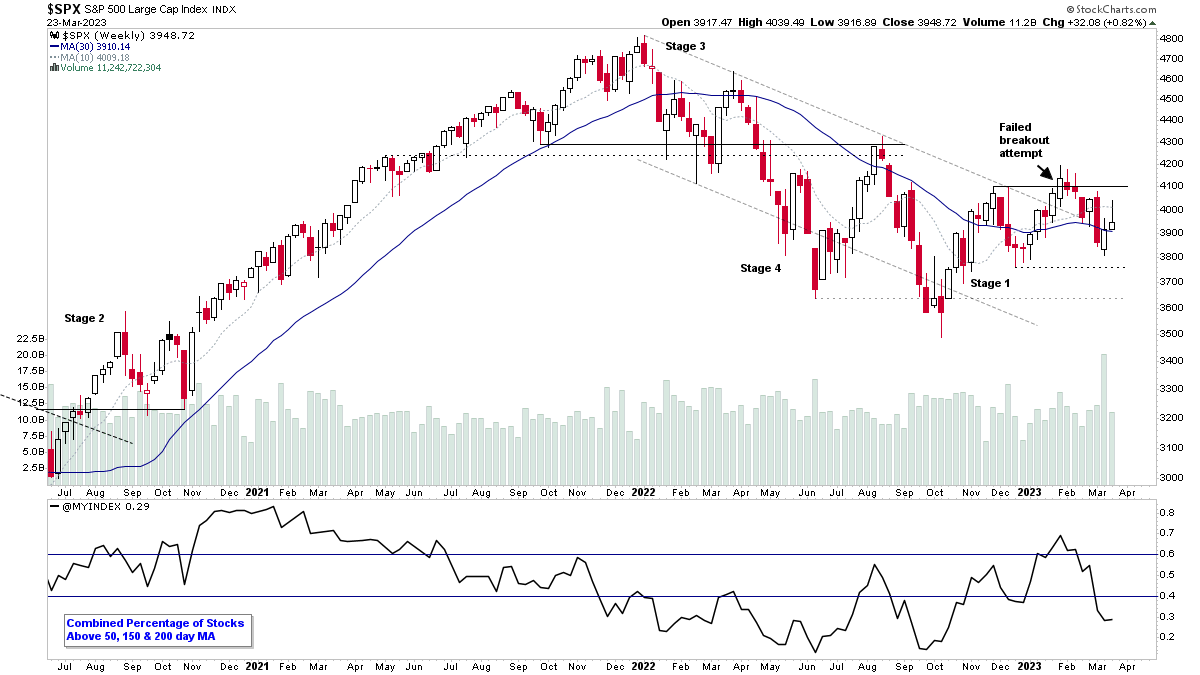

One of the primary purposes of the daily watchlist scans is as alternative form of market breadth, as by scanning the market daily and looking for stocks displaying the characteristics of Stage 1 and Stage 2. It gives a really good idea of the overall market health.

With that in mind, we've been on defensive posture from the market breadth charts for almost seven weeks now and there was very few charts worth highlighting from todays scans. So I thought it would be useful to take a broader look back over the watchlist stocks since the start of the year, and discuss the areas of the market that are holding up and showing relative strength.

Overall, the weak market breadth situation and deterioration in the watchlist stocks since the start of the year is of concern, and continues to suggest the caution is prudent, as the market is only displaying isolated areas of strength, which would need to broaden out in order to move into Stage 2. But if those areas start to fade, then chances of a Stage 4 continuation breakdown increase, which the small caps are testing at the moment.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.