Stage 2 Breakout Attempt in SE and the US Stocks Watchlist – 8 March 2023

The full post is available to view by members only. For immediate access:

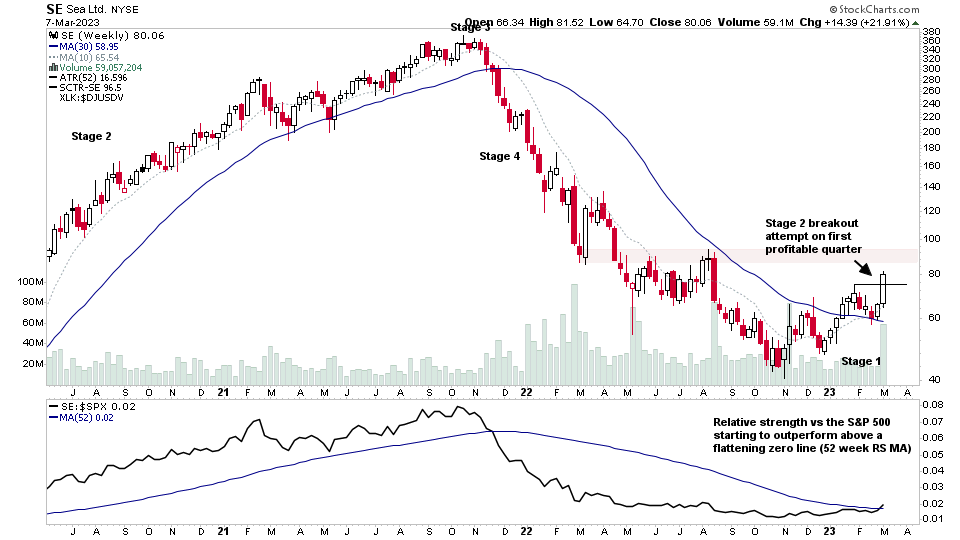

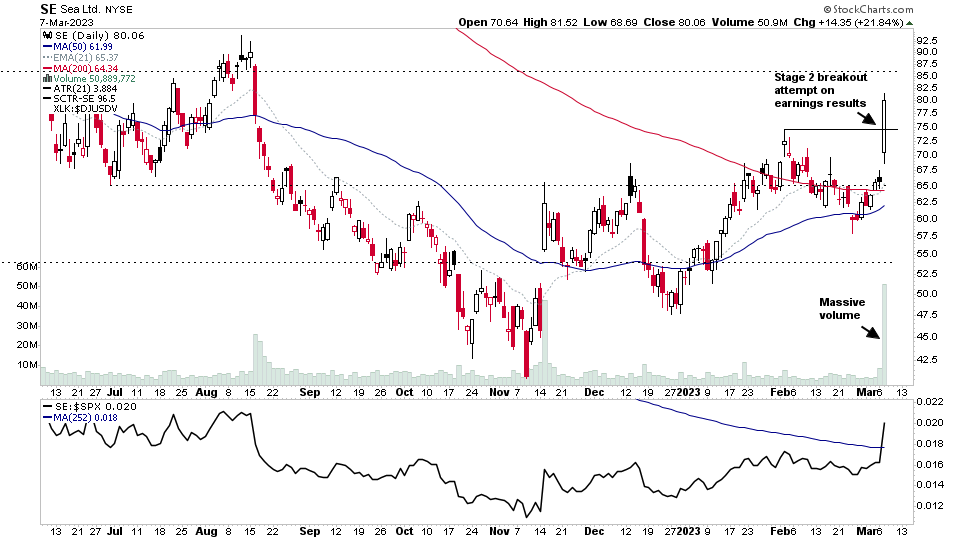

SE (Sea Ltd) is in focus today with a strong Stage 2 breakout attempt following earnings results before the open, in which it had its first profitable quarter, which was a significant surprise over the analyst estimates, and so is a potential change of character for the stock.

It's been highlighted in the Stage Analysis Watchlist three times since the November earnings results signalled its first change of behaviour and moved it into Stage 4B-, and then as it developed in Stage 1. The latest of which was on the 2nd March at 63.56 ahead of the earnings results, as it sat just under its 200 day MA. Todays earnings saw it test the Stage 2 breakout level (74.68) in the first 10 mins (which was highlighted on twitter https://twitter.com/SE...), but it pulled back in following Fed chairman's Powell's testimony initially, but then rallied strongly for the rest of the day, finishing up +21.84% and on exceptional volume, which was almost 10x the average daily volume, and its already more than 2x the average weekly volume, and hence with three trading days left it could potentially have one of its largest ever weeks for volume.

So it's having a strong Stage 2 breakout attempt on a daily basis, but it's not confirmed yet on the weekly chart, as to move into Stage 2 it needs to confirm the daily breakout attempt, by closing above the breakout level the weekly chart on Friday, and ideally with a strong weekly closing range near to the top of the weekly candle. Hence a potential change of character for the stock, however a major negative is that the prior Stage 4 decline was long and deep, and thus significant overhead resistance is a potential headwind to be aware of, and also the relatively small size of the base means that the 30 week MA is still declining (one of Stan's Don't commandments). However, with todays move, the daily proxy of the 30 week MA – the 150 day MA – did turn up slightly, and the longer term 200 day MA is also flattening, and so the 30 week MA is likely to turn up in the coming weeks if the breakout attempt holds.

Watchlist Stocks

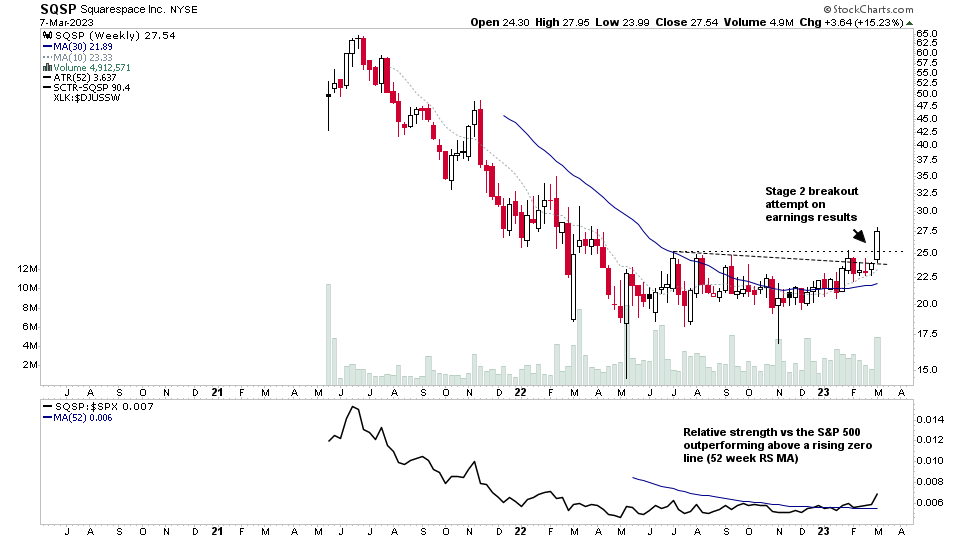

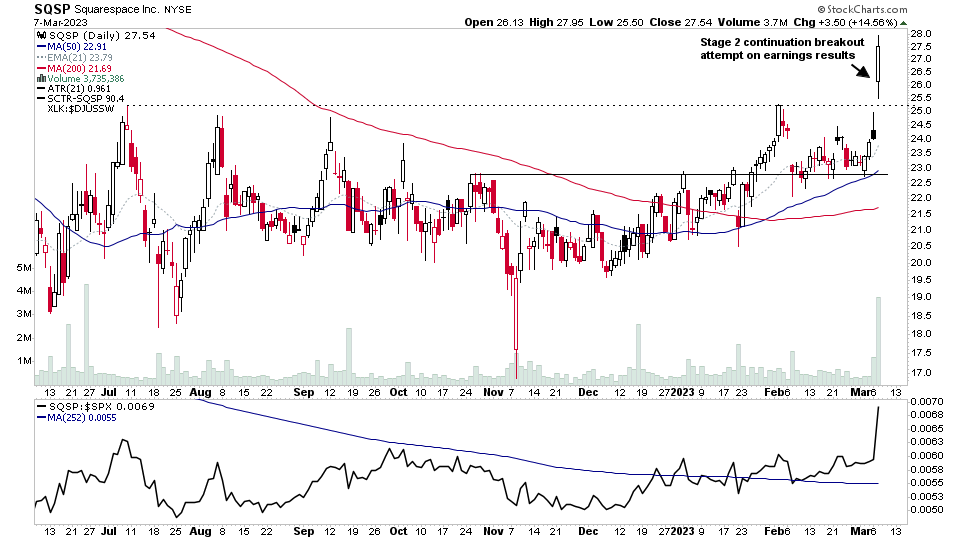

There were 30 stocks highlighted from the US stocks watchlist scans today

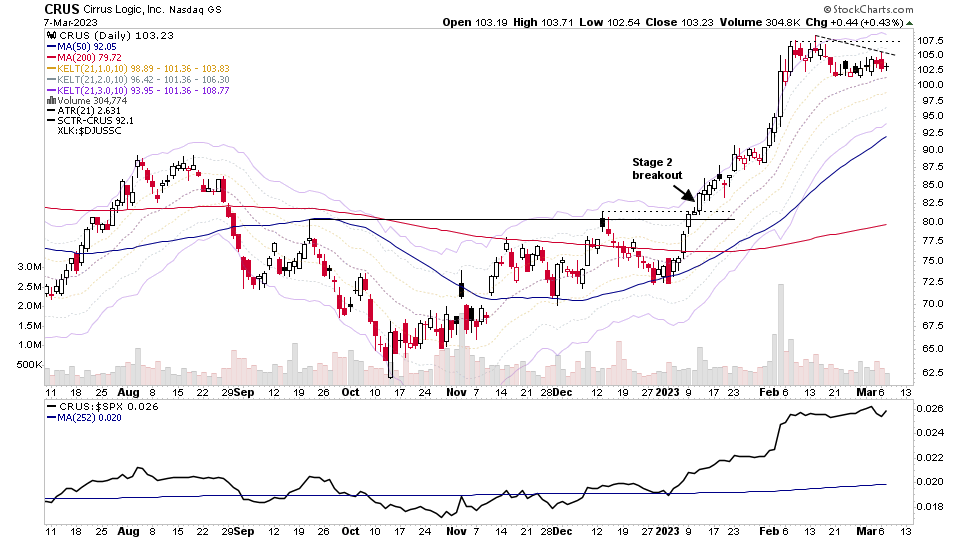

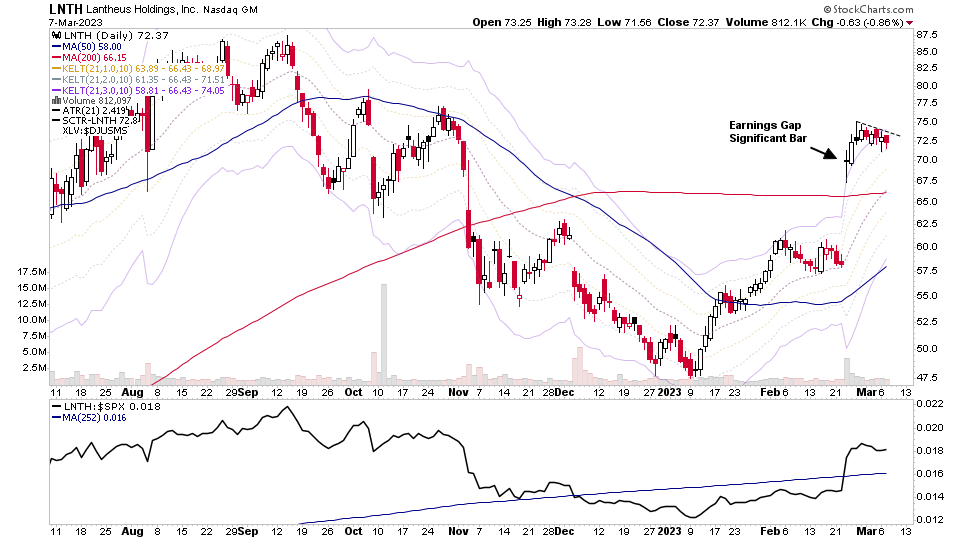

SE, SQSP, CRUS, LNTH + 26 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.