US Stocks Watchlist – 30 January 2023

The full post is available to view by members only. For immediate access:

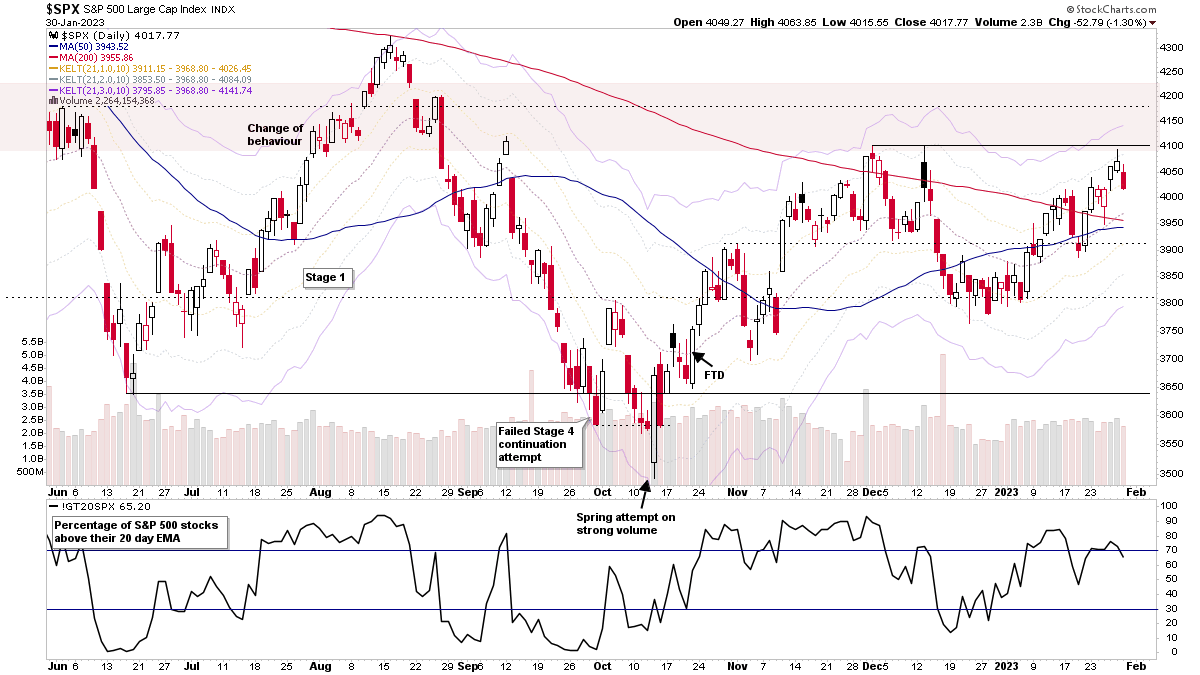

The market pulled back today at key resistance, with multiple market indexes testing their Stage 2 levels at the end of last week. The Fed meeting looms over the market this week, which will be a key driver as to whether the market breaks out into a potential early Stage 2 environment or fails once more and reverses lower – which was the pattern through 2022. So it could be a pivotal week.

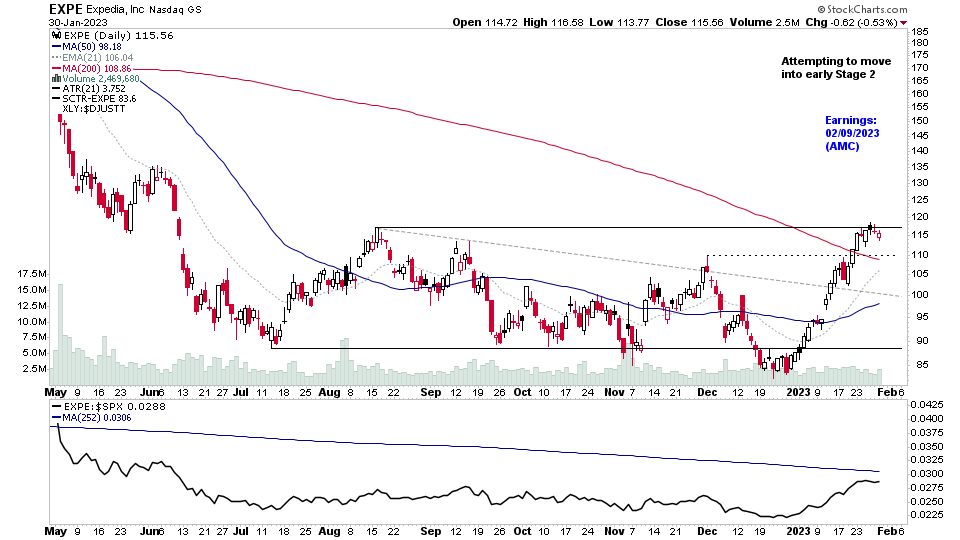

Earnings season also picks up more speed this week, with hundreds of stocks reporting, but then gets going in full from next Monday 6th February.

Watchlist Stocks

There were 23 stocks highlighted from the US stocks watchlist scans today

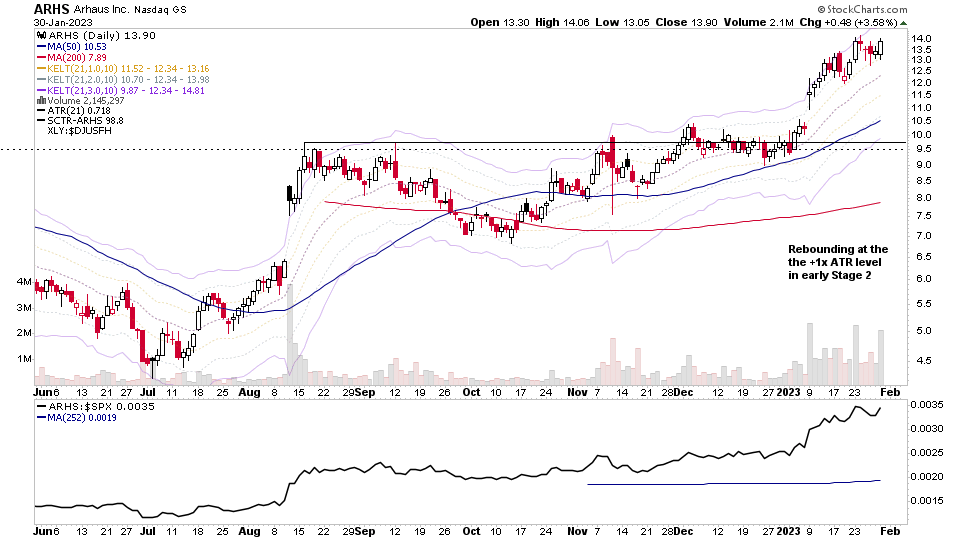

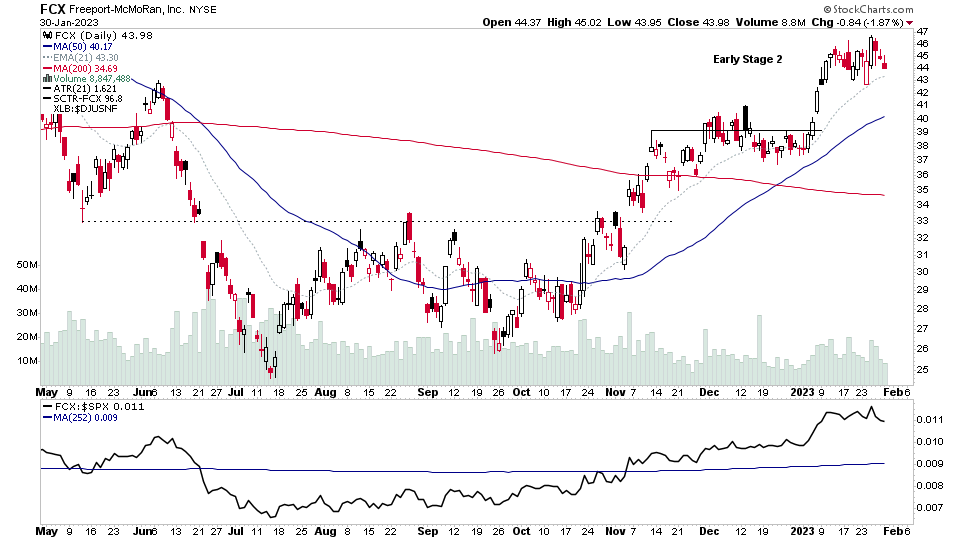

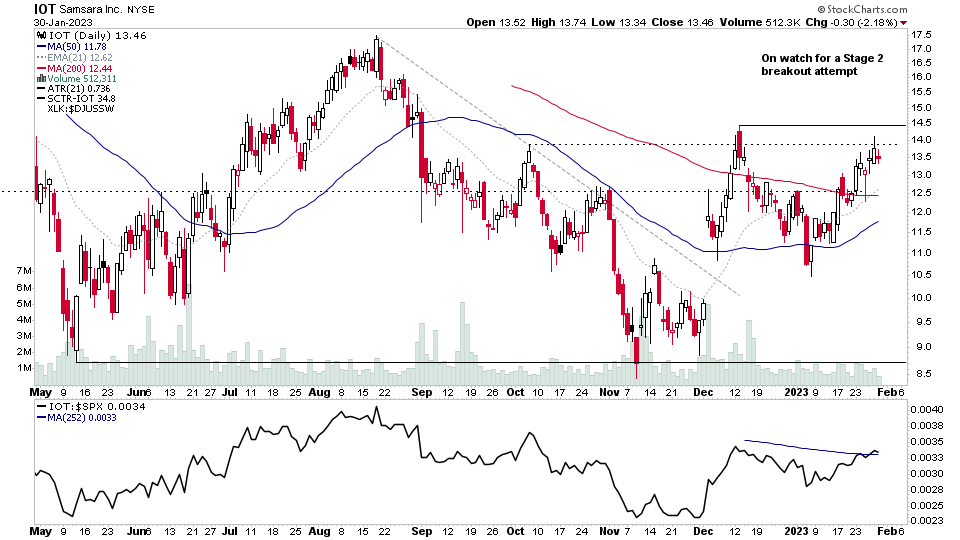

ARHS, EXPE, FCX, IOT + 19 more...

Market Breadth*

*Breadth data and charts were posted earlier in the day before the market open on the Private Twitter Feed, as I was away over the weekend. But I thought it would be useful to post a couple of the key charts here too as not all members access the Private Twitter Feed.

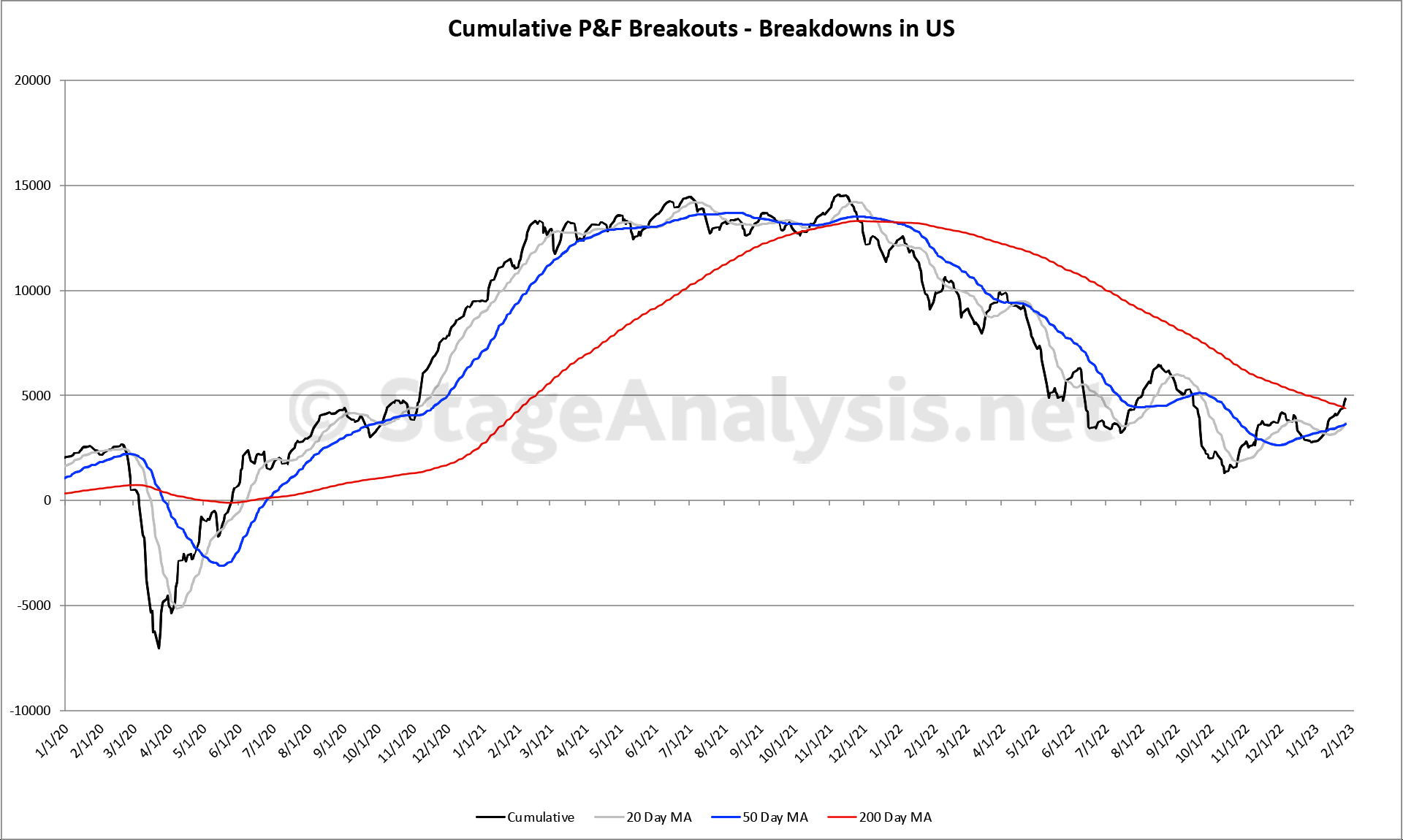

Cumulative Point and Figure Breakouts - Breakdowns

Note: The cumulative line moved above the 200 day MA for the first time since December 2021 last week.

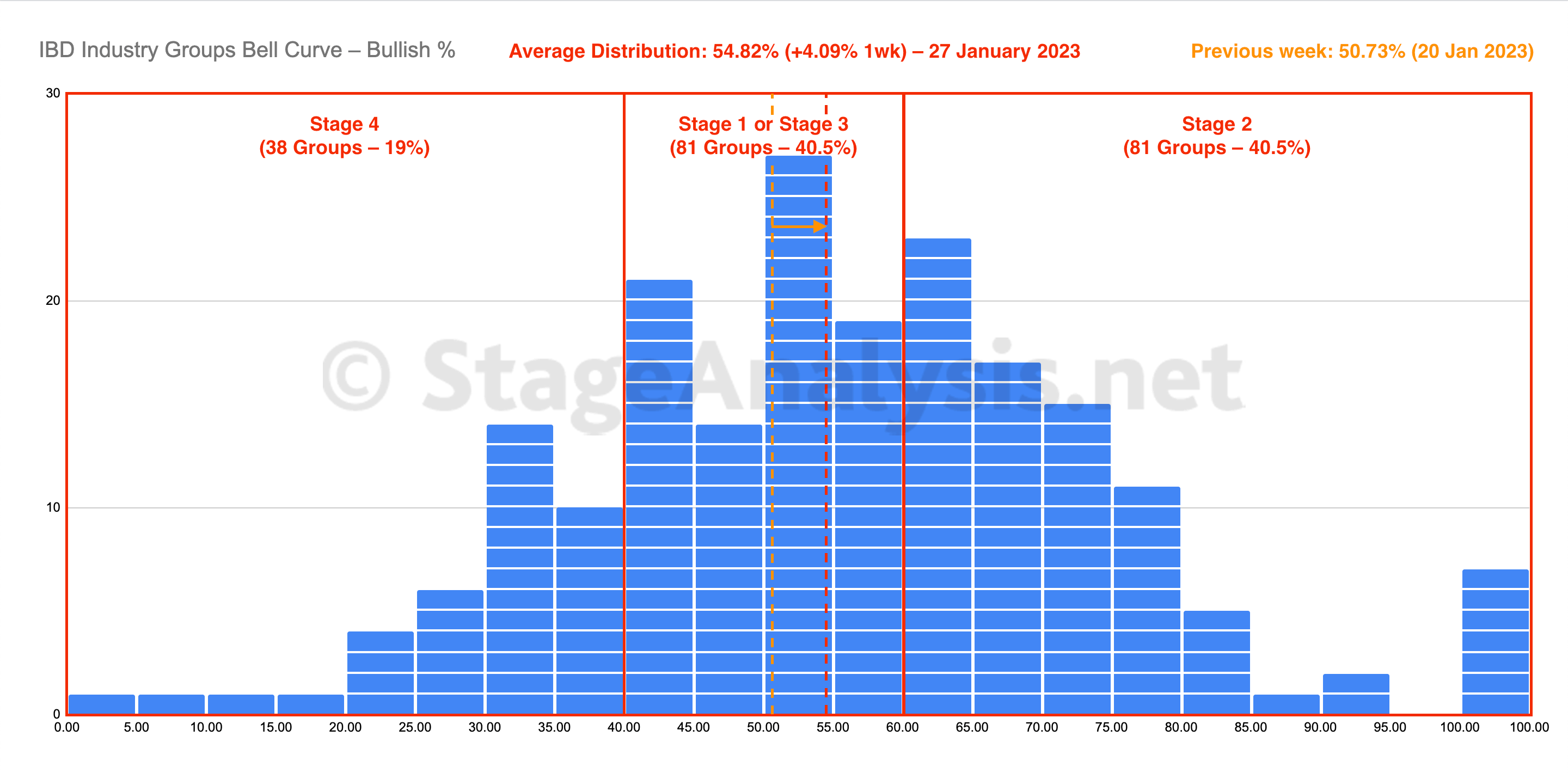

IBD Industry Groups Bell Curve – Bullish %

Average Distribution: 54.82% (+4.09% 1wk)

- 38 Groups (19%) in Stage 4 zone

- 81 Groups (40.5%) in Stage 1 or Stage 3 zone

- 81 Groups (40.5%) in Stage 2 zone

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.