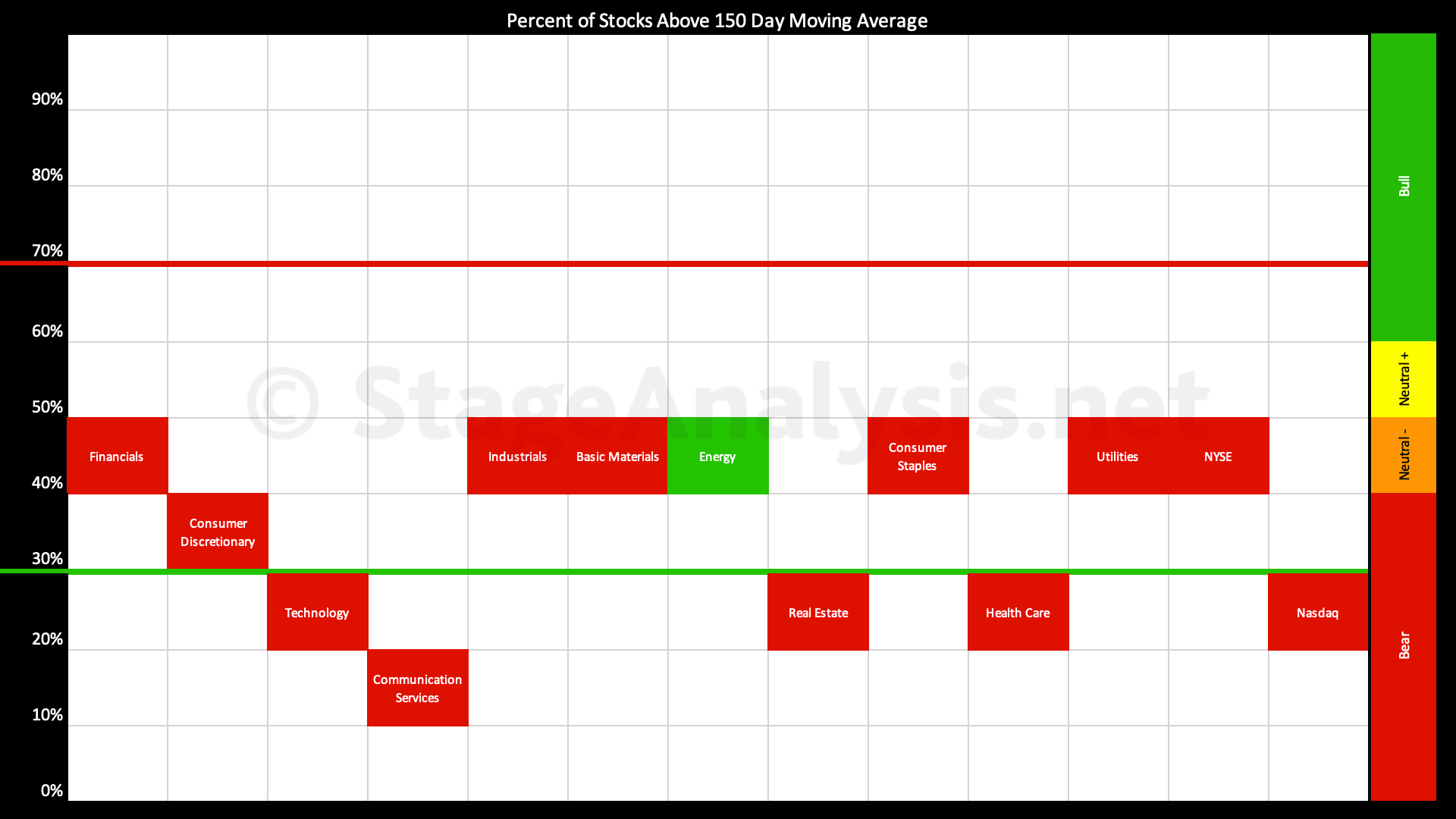

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The full post is available to view by members only. For immediate access:

Average: 36.48% (-9.72% 3wks)

- 0 sectors in the Stage 2 zone

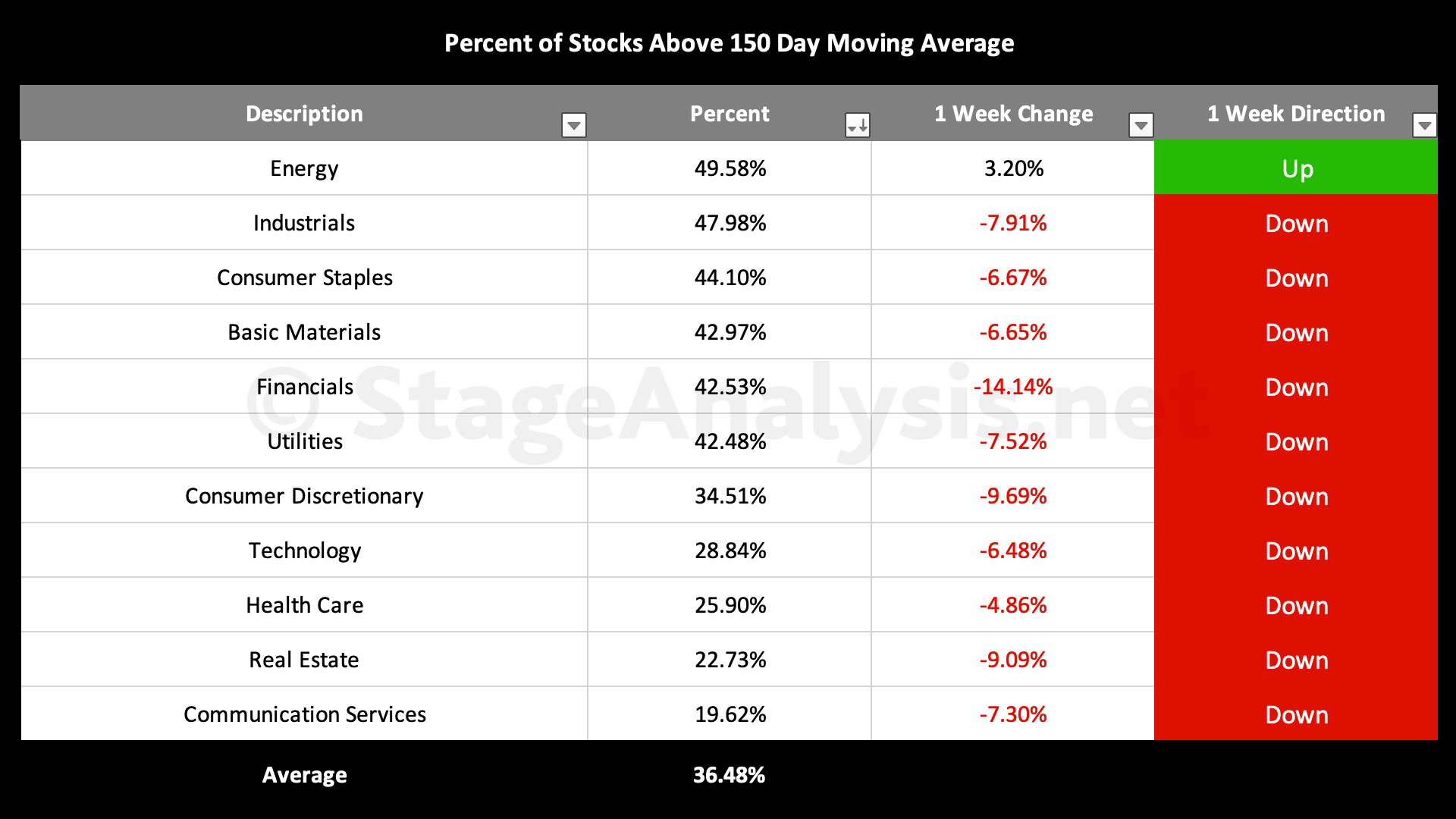

- 6 sectors in Stage 1 / 3 zone (Energy, Industrials, Consumer Staples, Basic Materials, Financials, Utilities)

- 5 sectors in Stage 4 zone (Consumer Discretionary, Technology, Health Care, Real Estate, Communication Services)

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has declined by -9.72% since the previous post on the 28th November, and so the overall average is now at 36.48% which is tipping it back into the Stage 4 zone once more, which it's spent the majority of 2022 in.

Overall there are six sectors in the Stage 4 zone, five sectors in the Stage 1 or Stage 3 zone, and zero sectors in the Stage 2 zone. Therefore the market is in the neutral/negative position in the lower-middle of the range.

Sector Breadth Table – Ordered by Relative Strength

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.