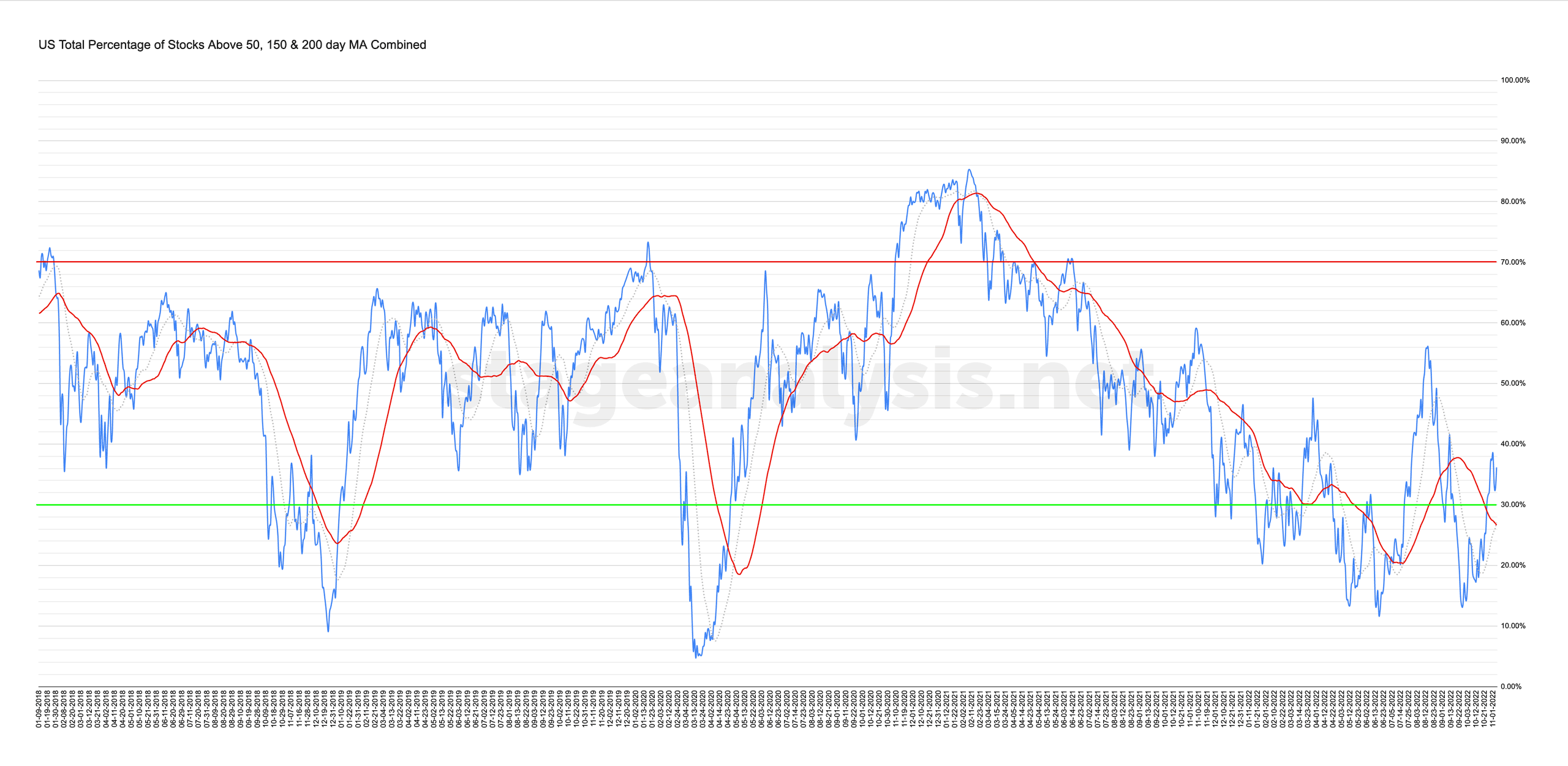

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

36.18% (-1.01% 1wk)

Status: Tentative Positive Environment in the Stage 4 zone

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) ended the weekly slightly lower by -1.01% following the strong +19% advance higher over the prior two weeks, which took it out of the lower zone and through its key 50 day MA signal line. The overall average did pullback by just under -5% until Thursday, but held above its 50 day MA and then recovered the majority of that decline on Friday to end the week at 36.18%.

Therefore the status remains unchanged this week as a Tentative Positive Environment in the Stage 4 zone as the overall average is still +9.53% above its 50 day MA, and so it is on the positive side of the 50 day MA signal line, but it still needs more confirmation in order to declare it as a Postive Environment outright. So the Tentative rating remains for the time being. i.e. proceed with caution.

A strong weekly close back above the 40% level would move it back into the Stage 1 zone. But at the current 36.18% level, it remains in the Stage 4 zone.

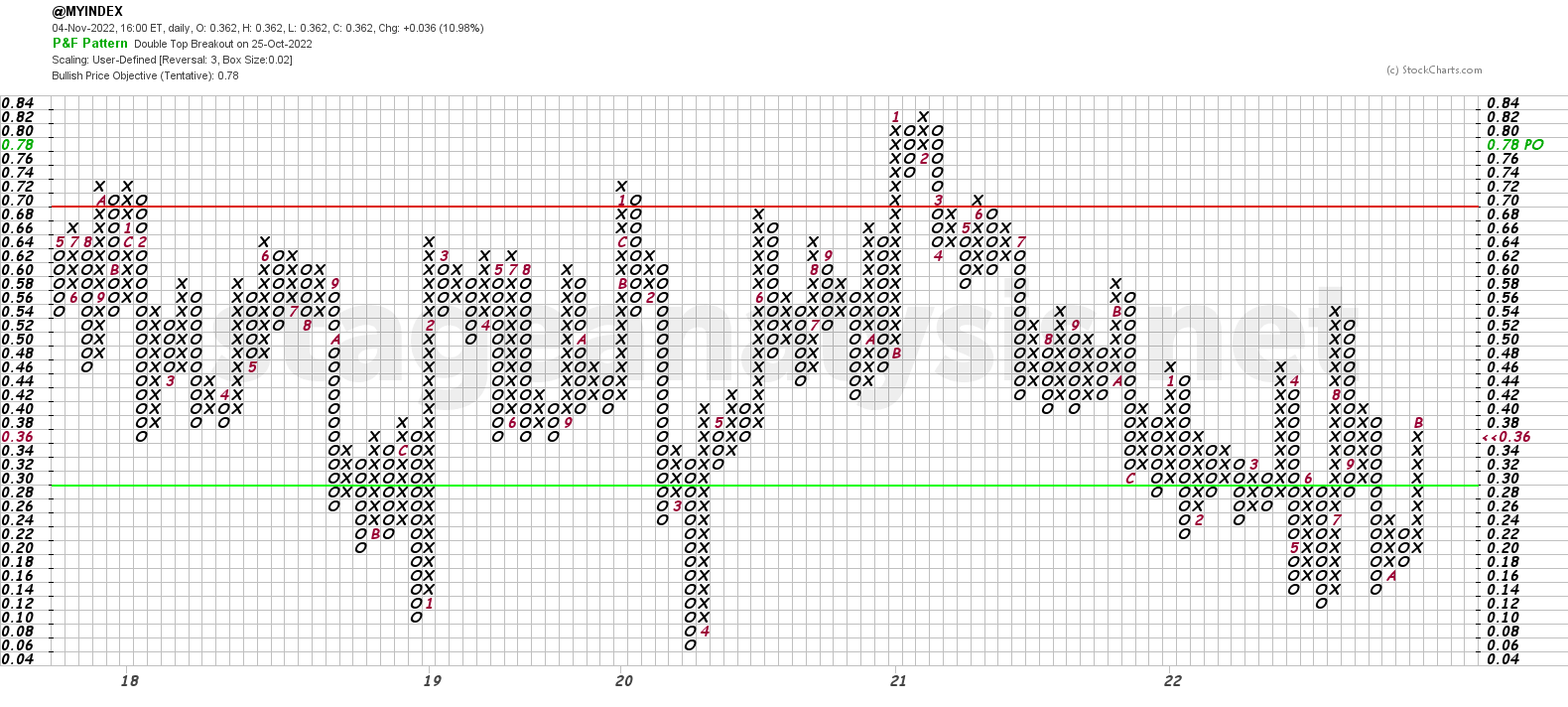

The Point and Figure chart (shown above) added a further X to the column during the week, but the pullback during week almost changed it back to Os. But we use close only data for the point and figure chart and so although the intraday moves were much larger, the closes didn't reach the -6% reversal threshold needed to change columns, and thus it remains on a point and figure Bull Confirmed status.

To learn more about the point and figure statuses. See the Bullish Percent post, which details all of the different statues with examples.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.