Stock Market Update and the US Stocks Watchlist – 9 October 2022

The full post is available to view by members only. For immediate access:

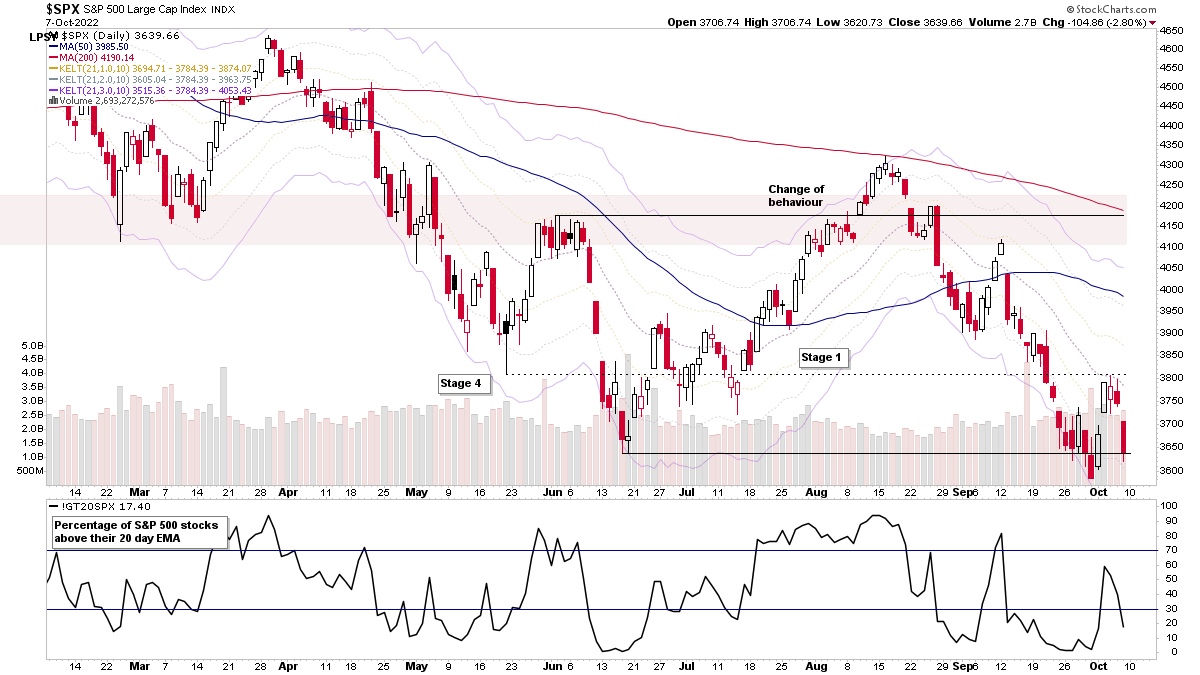

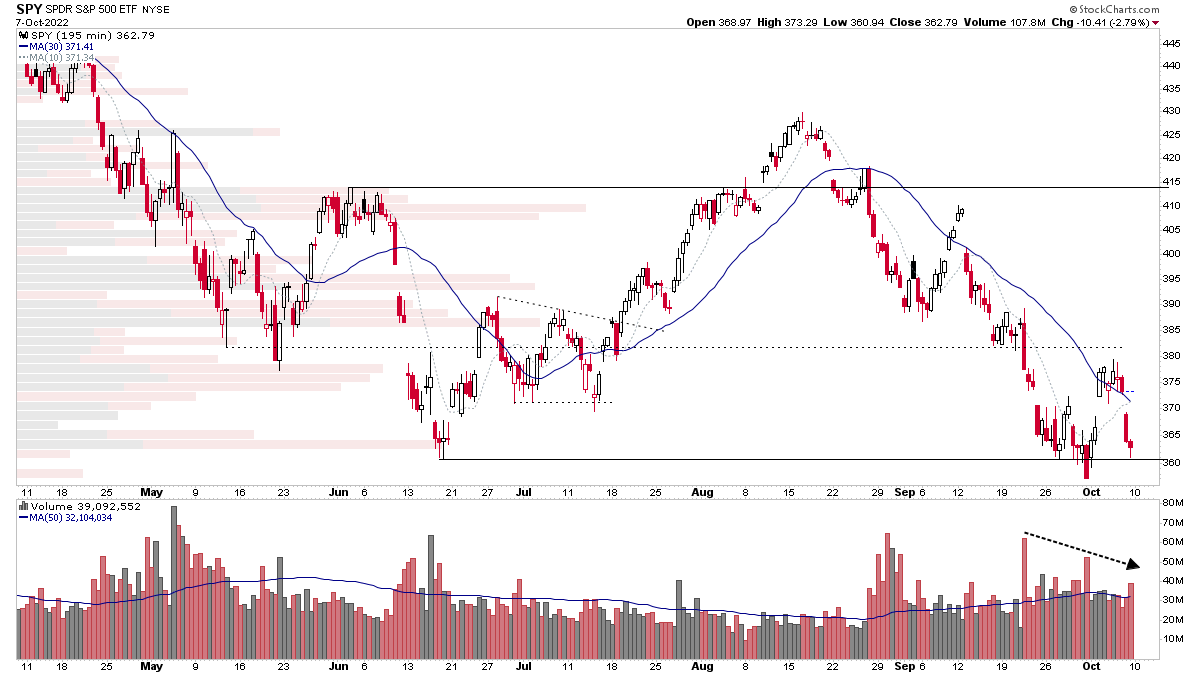

The S&P 500 made a Spring attempt on Monday and surged higher with a short-covering rally for a few days, but stalled at the declining 21-day EMA on Wednesday and Thursday and begin the Test on Friday (which often follows a Spring attempt if supply is still present) – which saw a strong reaction lower with an increase in supply over the prior days of the week. One minor point was that the volume was lower than the recent swing low, but remained fairly strong regardless. So there's a good chance that the recent swing low will be tested in the coming week, and if it closes strongly below, then it would be a Stage 4 continuation and sign of weakness.

A potential bullish scenario would be if it forms a higher low and completes the Spring and Test, and then manages to breakout above the 3807 level, which would then make the Spring and Test area a potential Phase C of the base structure. At which point the expectation would shift towards a test of the upper part of the range.

So it could be a pivotal week, as the strength of the supply is tested at the lows of the 4-month range.

US Stocks Watchlist – 9 October 2022

There were 24 stocks highlighted from the US stocks watchlist scans today

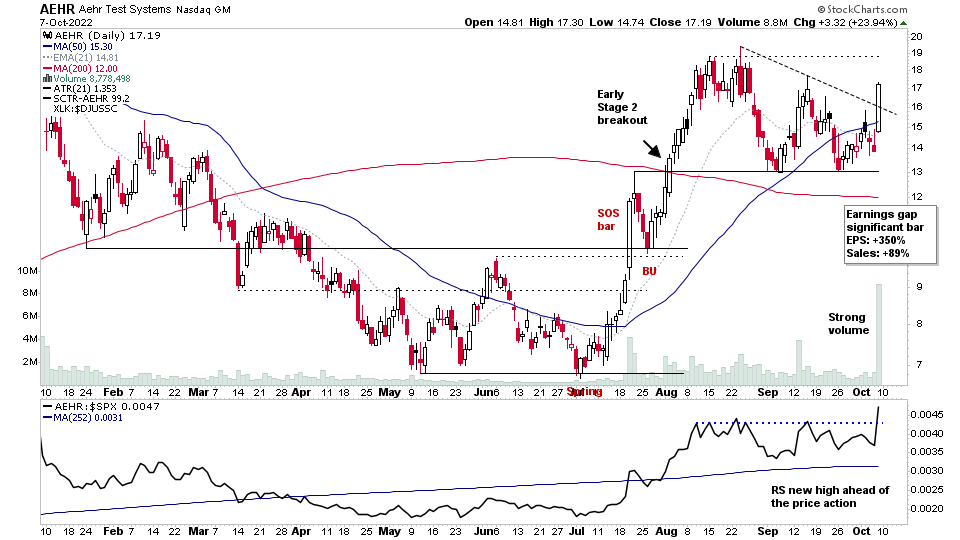

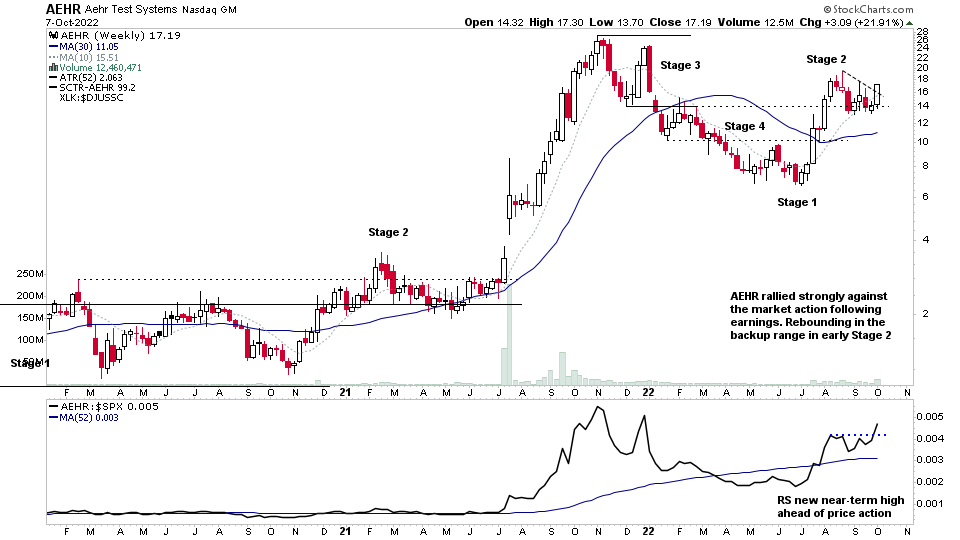

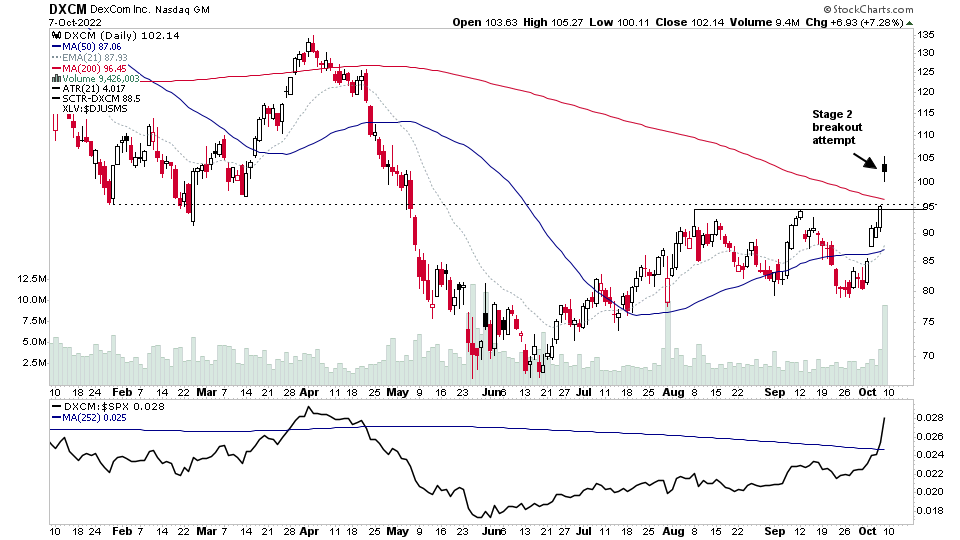

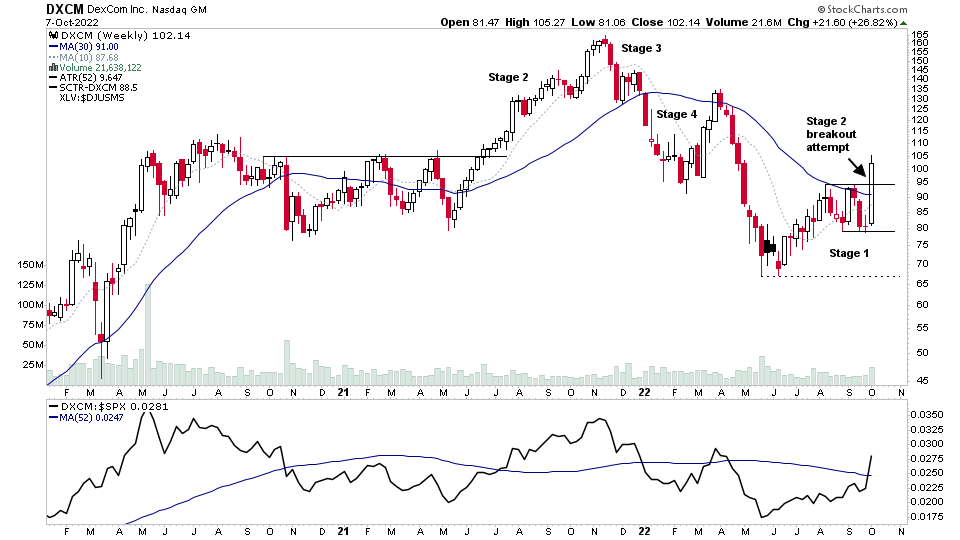

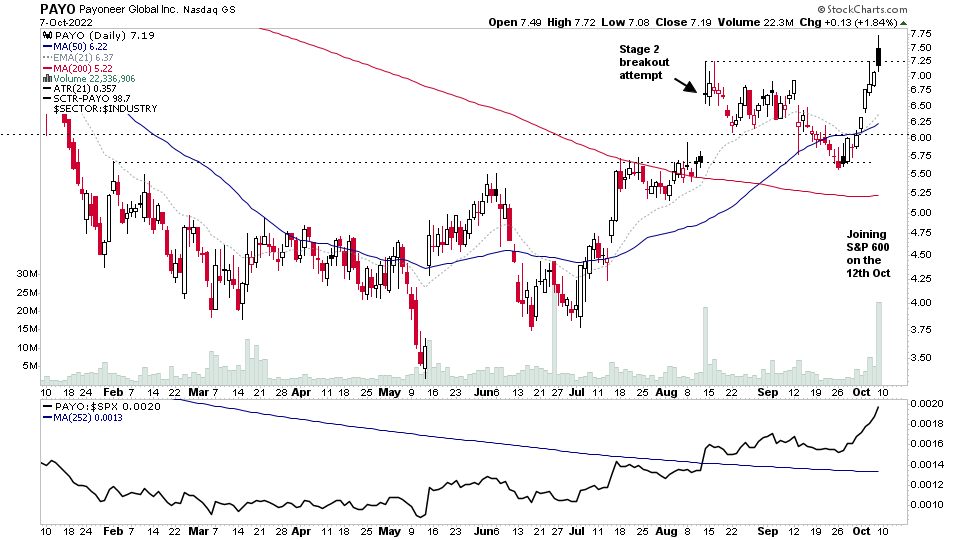

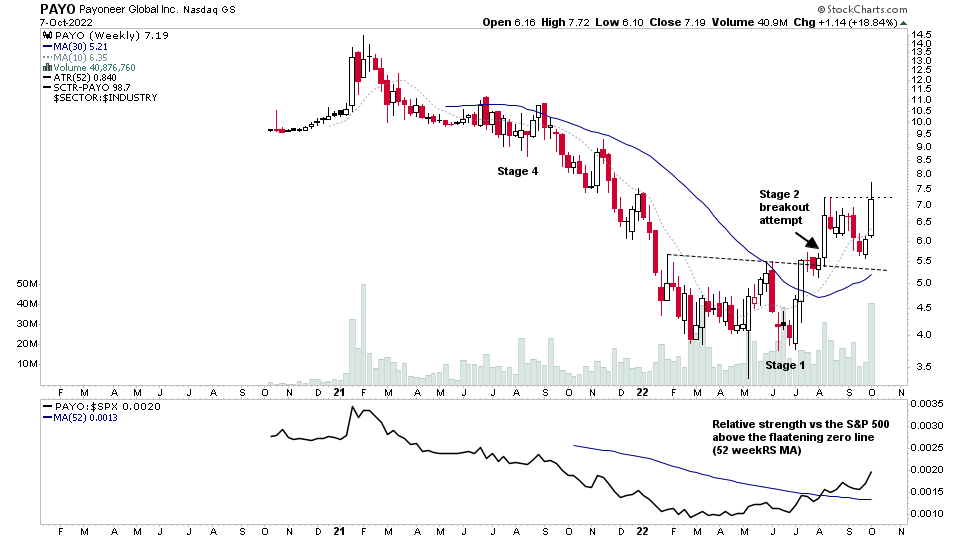

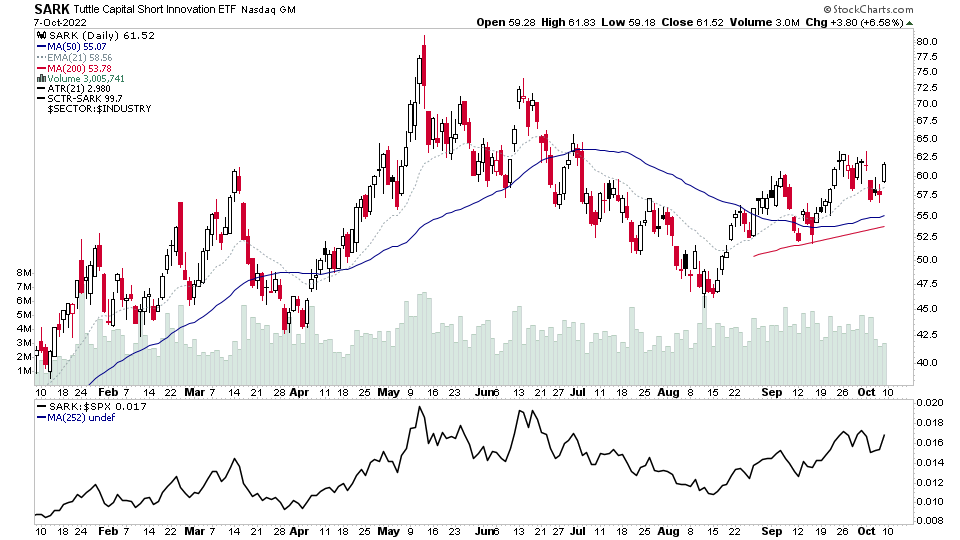

AEHR, DXCM, PAYO, SARK + 20 more...

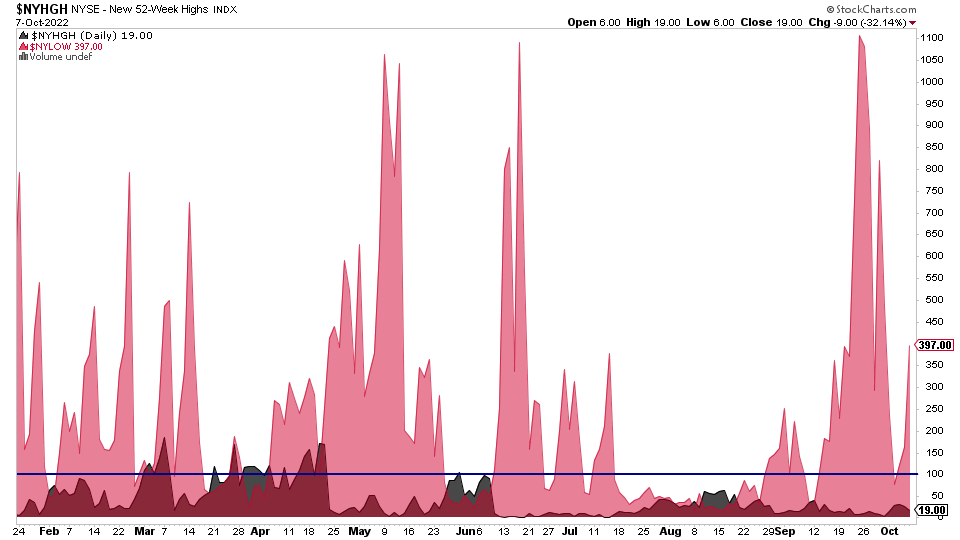

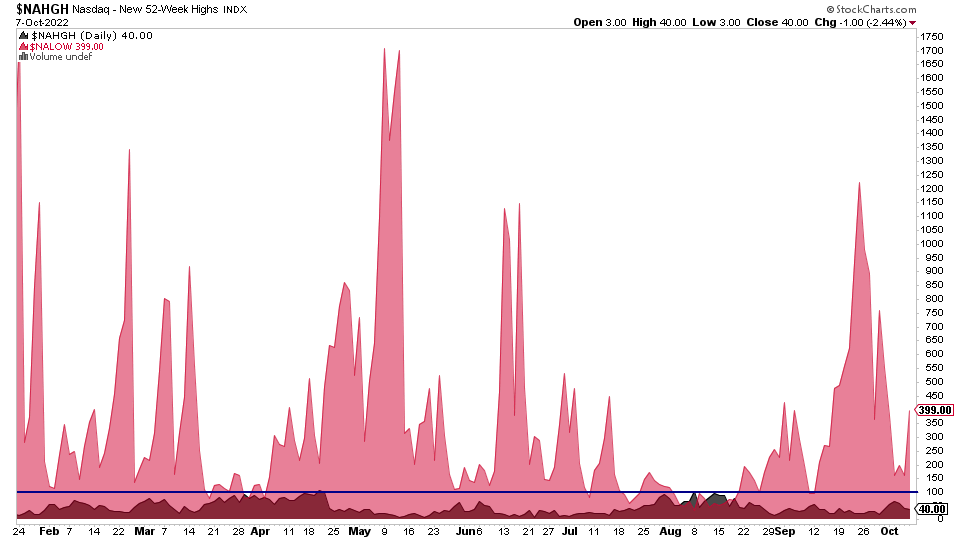

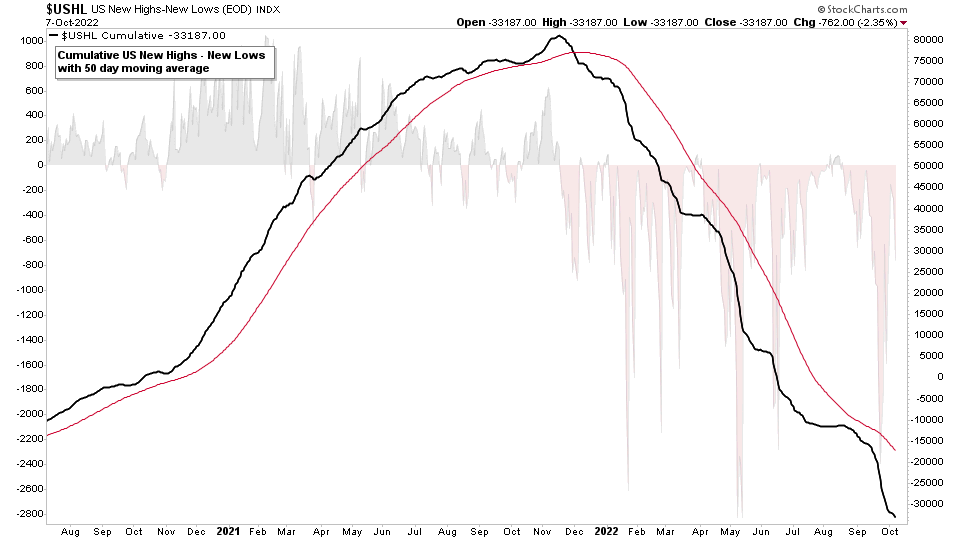

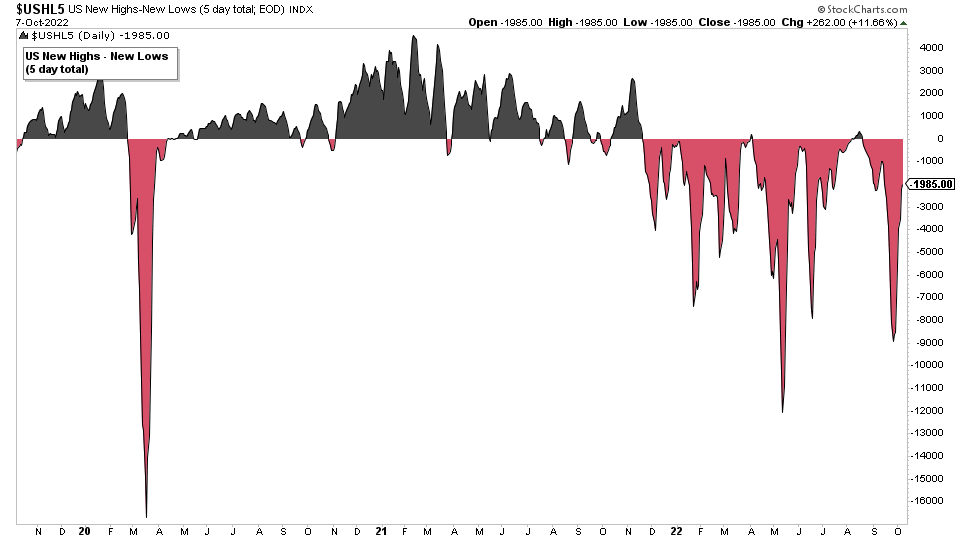

Market Breadth: New Highs - New Lows

New lows continued to outpace new highs by a large margin in both the NYSE and Nasdaq Composite markets, pushing the cumulative US New Highs - New Lows chart to further new lows in the Stage 4 decline that it's been in since early December. However, one minor point to note, is that both markets are showing a slight divergence, with fewer new lows than were seen at the recent September peak. But there's no change in status, with all four adding negatives to the overall Weight of Evidence.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.