Stock Market Update and the US Stocks Watchlist – 5 October 2022

The full post is available to view by members only. For immediate access:

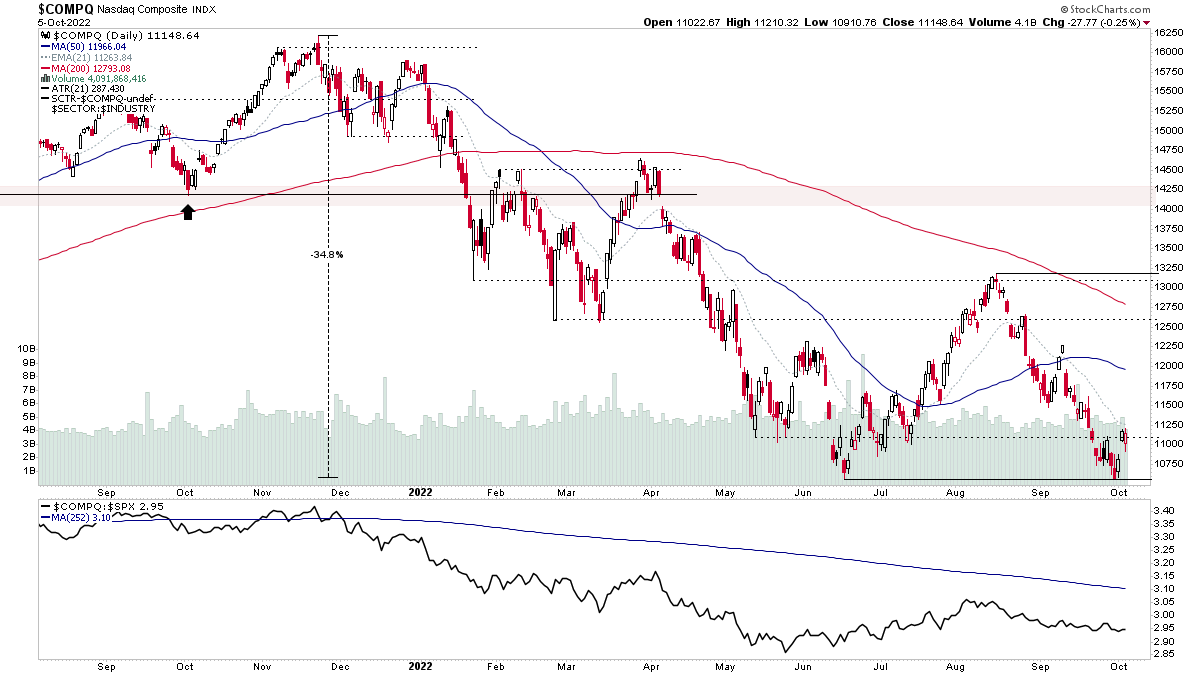

I've led with the Nasdaq Composite in todays post as the watchlist is once again dominated by Software stocks, as numerous stocks in the group continue to develop Stage 1 base structures, and the majority of Software/Technology stocks are listed in the Nasdaq.

Also, with three days up off of the low in the Nasdaq, and it sitting just under the 21 day EMA. It's now in position for a potential Follow Through Day (FTD) attempt – which is from the CAN SLIM method and looks for a +1.2% or greater move in the Nasdaq Composite (or sometimes other major indexes), on the fourth day or later following a swing low. Plus it also needs to be on greater than the previous days volume and above average. If this occurs then IBD (Investors Business Daily) changes its status to a Confirmed Uptrend.

Those that have been reading the Stage Analysis blog for a while, will know that I don't value the FTD concept as a standalone market breadth measure like the CAN SLIM method followers do. But instead treat it as a secondary indicator, as its reliability, especially during bear markets is questionable. However, I do add it to the overall Weight of Evidence as a positive when it occurs.

But for short-term market timing signals, I prefer to use the combination of the Nasdaq Composite and NYSE Bullish Percent 1-hour intraday chart, and the Nasdaq Composite and NYSE Percentage of Stocks Above 20 Day EMA charts, plus whether price is above the S&P 500 5-day Moving Average to determine if the environment is positive or negative. Which happened yesterday (Tue 4th), as they all moved to a positive environment status in the short-term. That could easily change again as the long-term status remains on a negative status, which I refer to as a difficult environment, as it is the most important, as it's the major trend.

So status currently is on short-term positive environment, but long-term difficult/negative environment.

Note: the members midweek video will be posted tomorrow on Thursday instead this week, due to the previous video being on Monday. But will go back to the normal weekly schedule from the weekend.

US Stocks Watchlist – 5 October 2022

There were 20 stocks highlighted from the US stocks watchlist scans today

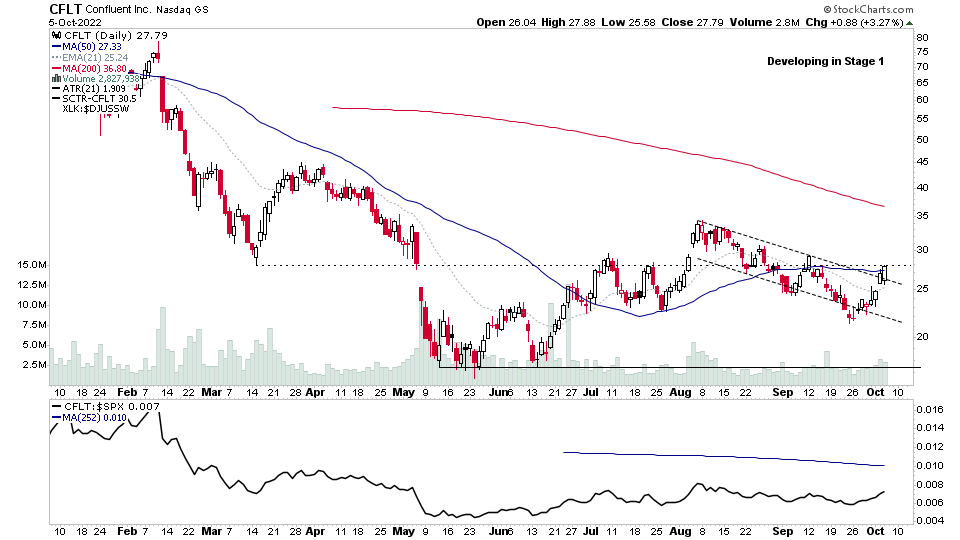

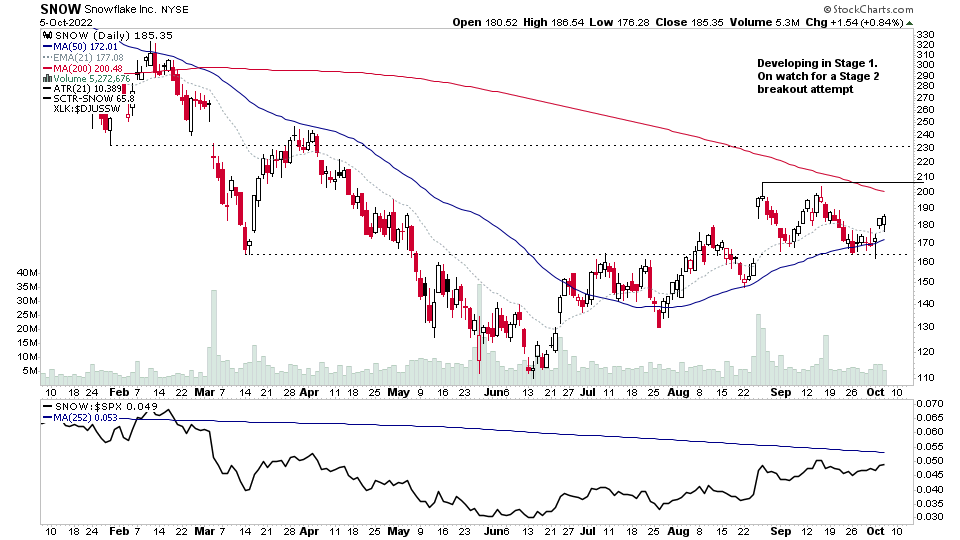

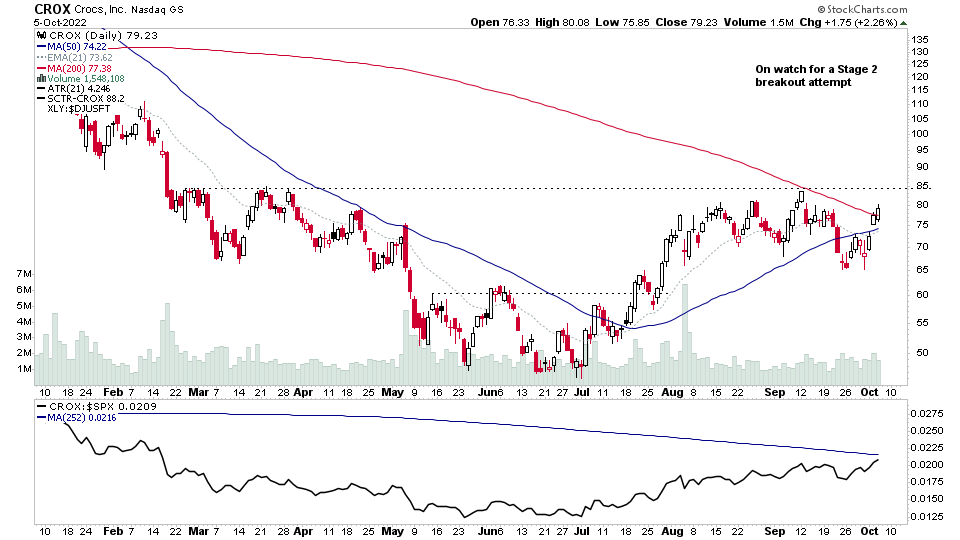

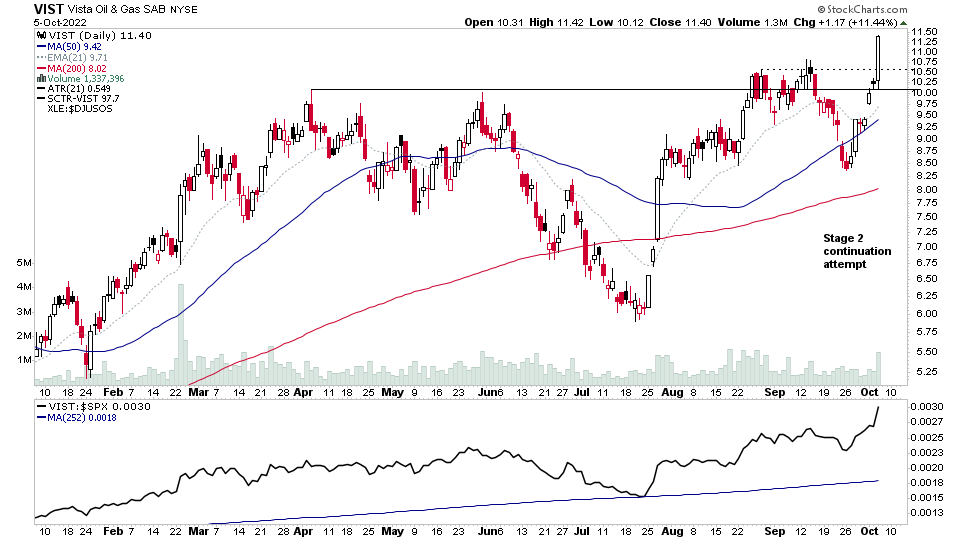

CLFT, SNOW, CROX, VIST + 16 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.