Stock Market Update and the US Stocks Watchlist – 19 September 2022

The full post is available to view by members only. For immediate access:

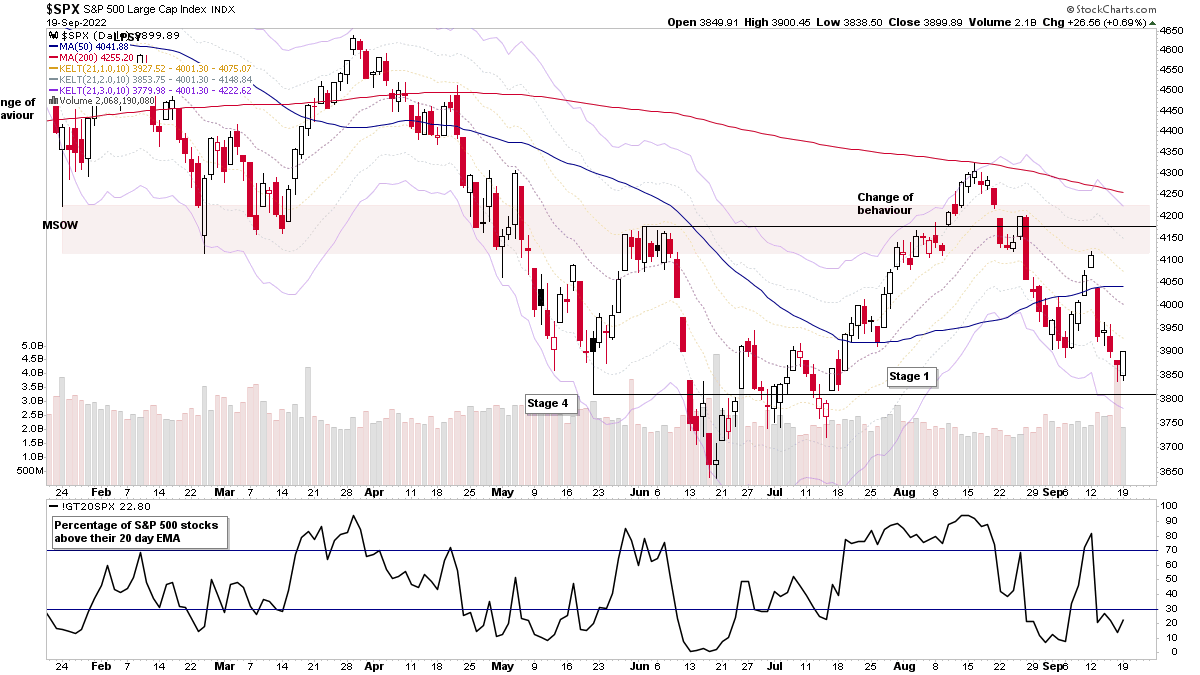

The S&P 500 attempted to begin to reverse from last weeks sharp decline, with an engulfing candle from Fridays undercut of the recent swing low within the broader range. So there is potential for a local spring, but only if it can follow through strongly.

There is some evidence of a small divergence in the percentage of stocks above their 20 day EMA, which can be seen at the bottom of the chart. As it is making a potential higher low, relative to the price action. So if that can breach the key 30% level strongly and move out of the lower range, then that would be a potential short-term positive.

But there are multiple ifs in the above comments. As for now, the S&P 500 and other major indexes, such as the Nasdaq, Russell 2000 etc, all still remain in the short-term downtrend that they've been in for over a month now, but still within the broader base structure that's been developing for the last 4 months, which has potential to be Stage 1, due to the large amount of individual stocks forming Stage 1 bases, with some of the strongest already moving out in early Stage 2. However, the attempted Stage 1 structure could still fail if the recent weakness continues, as the new lows has been expanding once more.

So we are approaching a pivotal point, which the Fed rate decision on Wednesday could potentially be the deciding factor to whether we continue lower in Stage 4 once more, or continue building out the bases in Stage 1. Hence a crucial week in the market.

US Stocks Watchlist – 19 September 2022

There were 29 stocks highlighted from the US stocks watchlist scans today

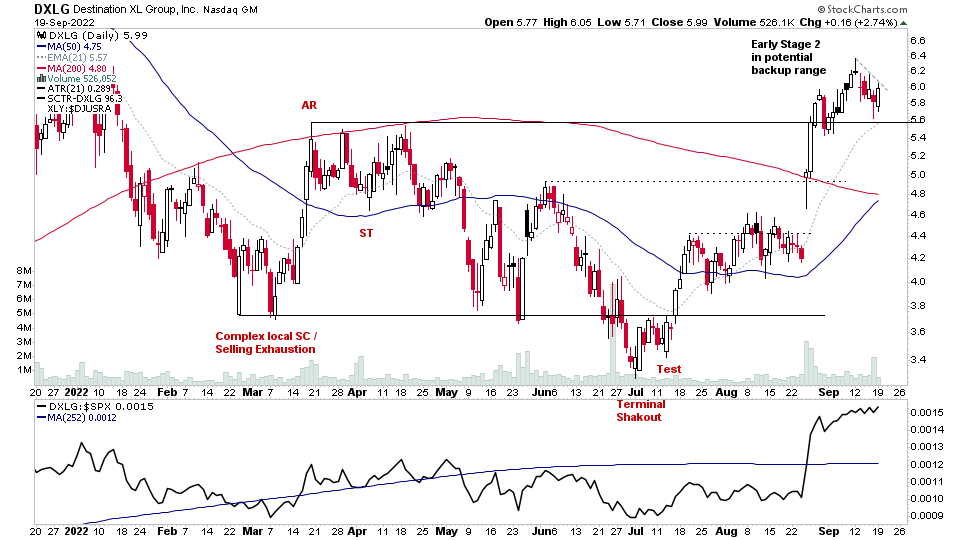

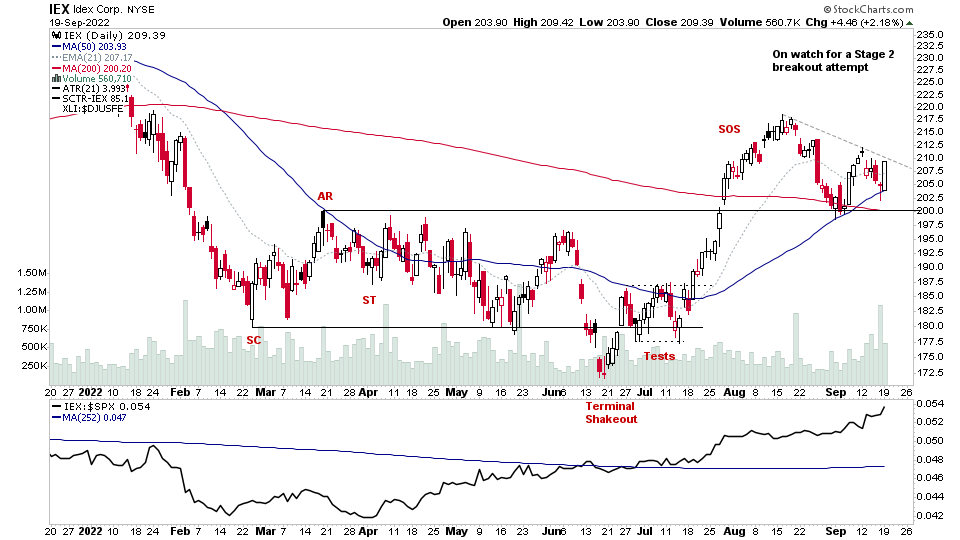

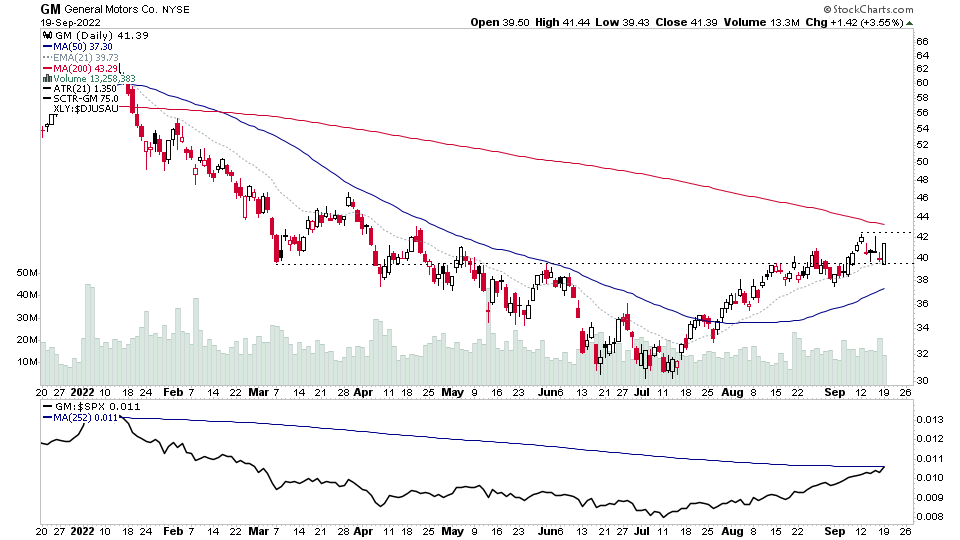

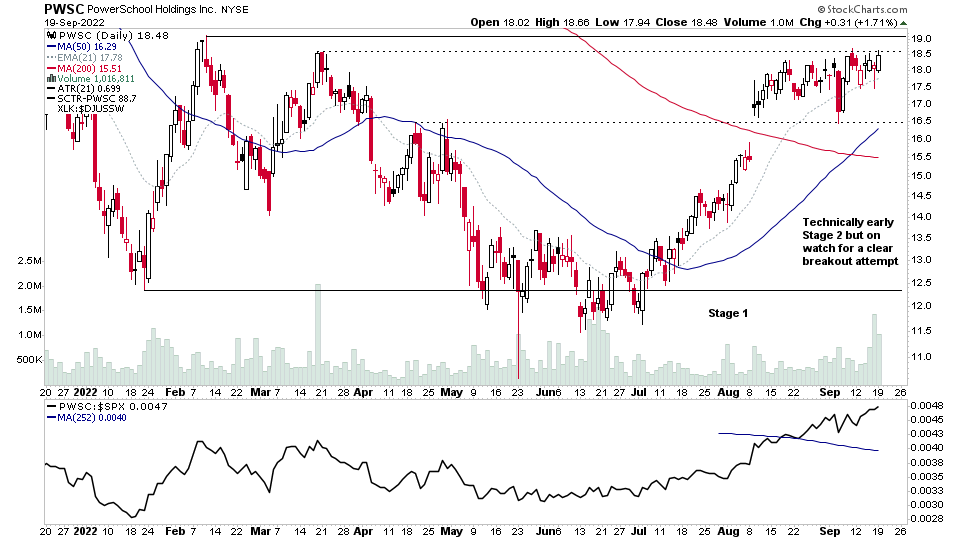

DXLG, IEX, GM, PWSC + 25 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.