Stock Market Update and US Stocks Watchlist – 16 August 2022

The full post is available to view by members only. For immediate access:

US Stocks Watchlist – 16 August 2022

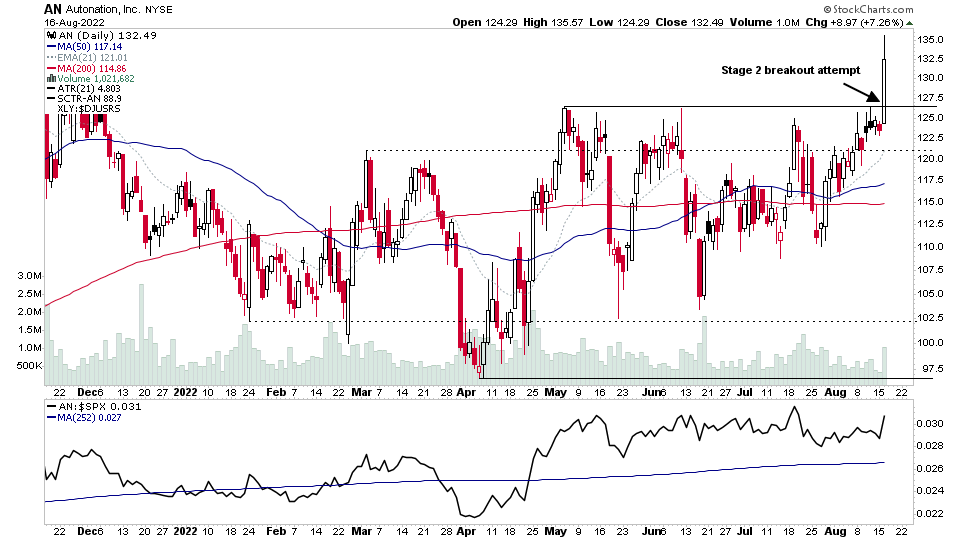

There were 26 stocks for the US stocks watchlist today

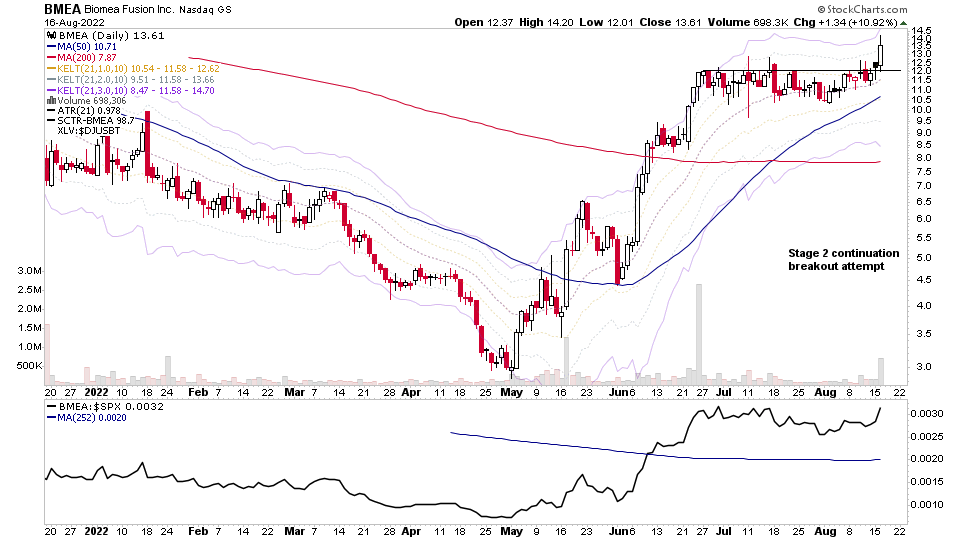

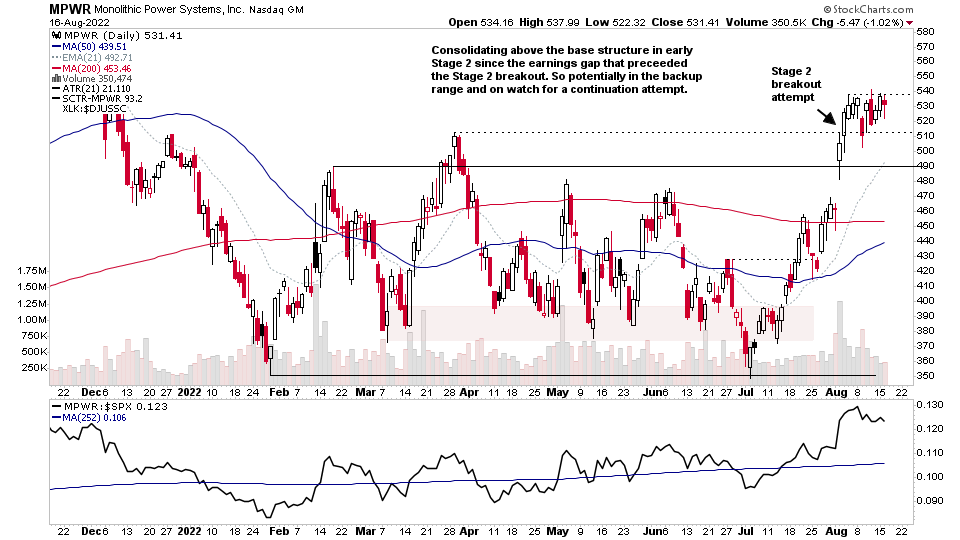

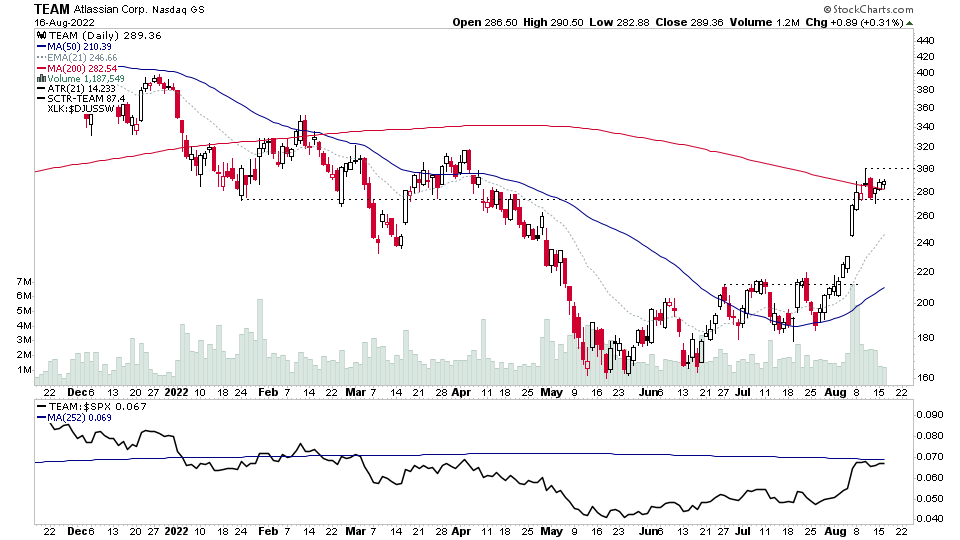

AN, BMEA, MPWR, TEAM + 22 more...

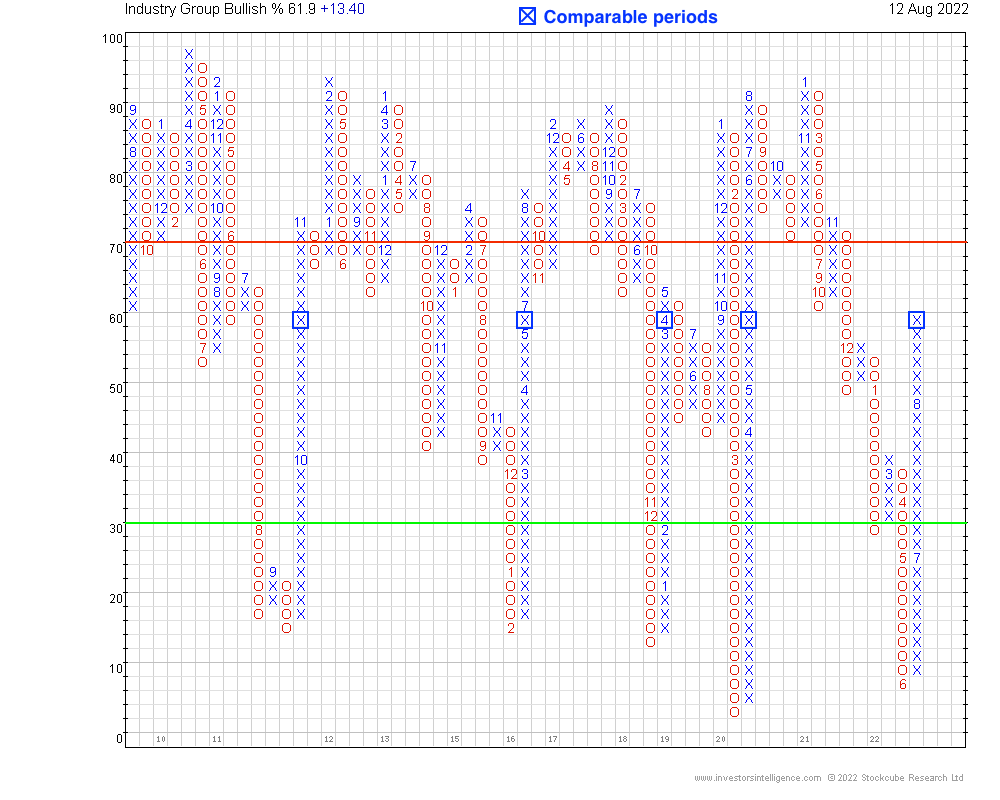

Market Breadth: Industry Group Bullish Percent

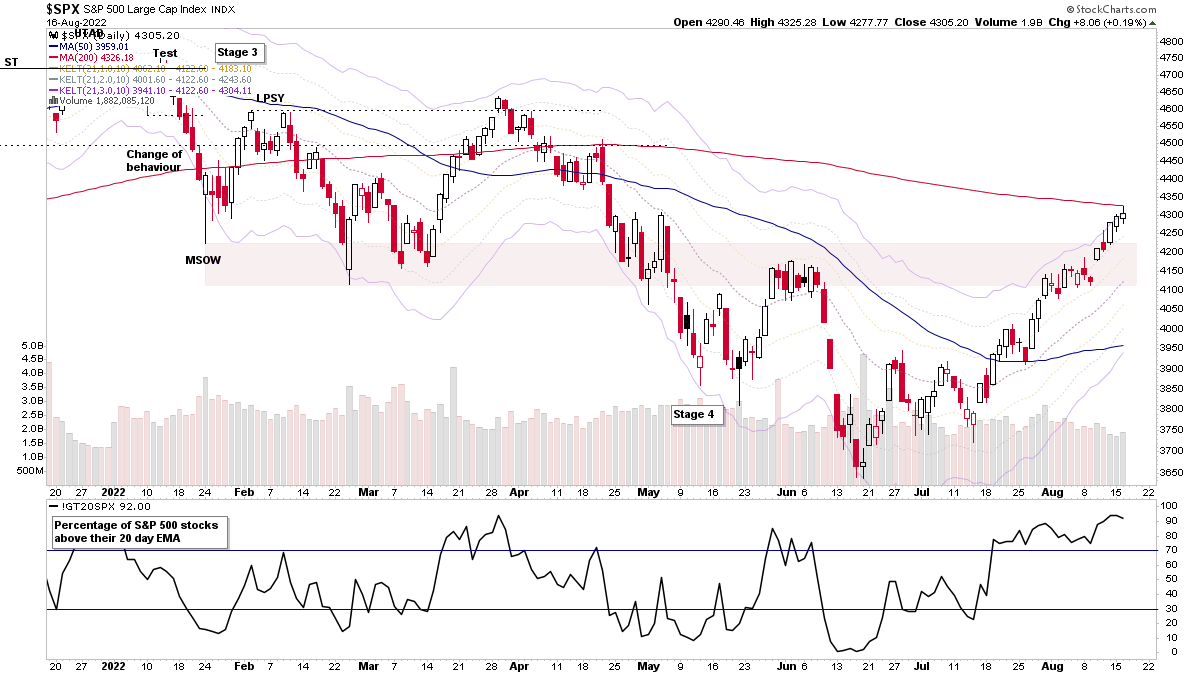

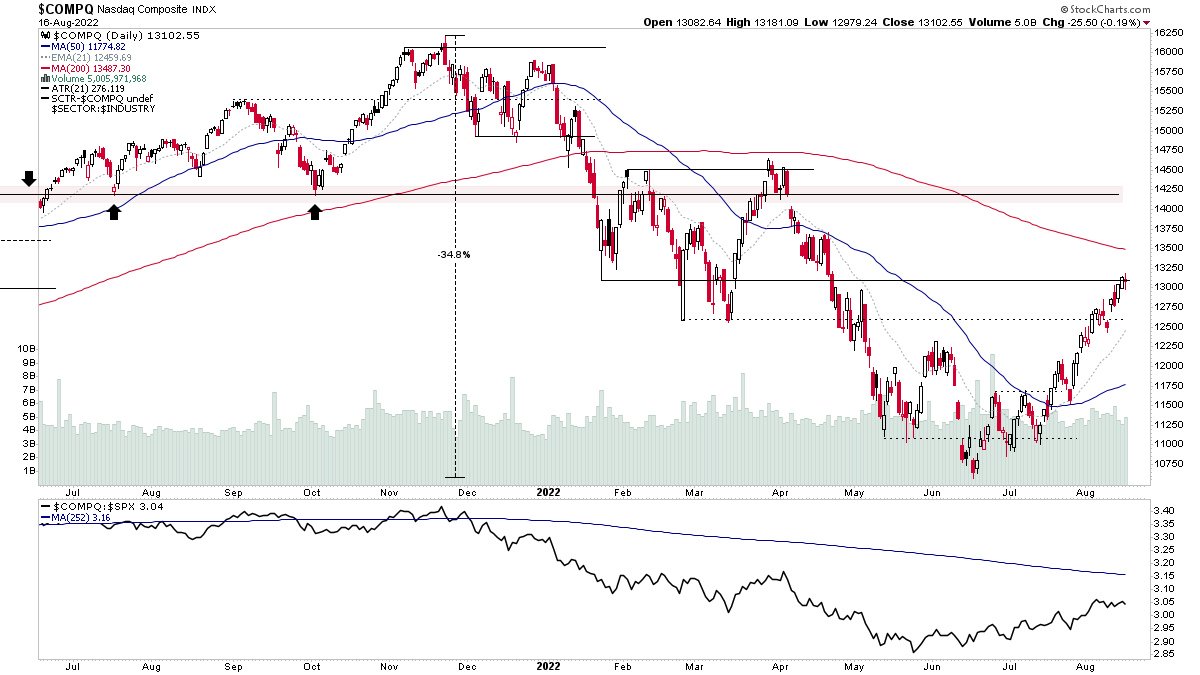

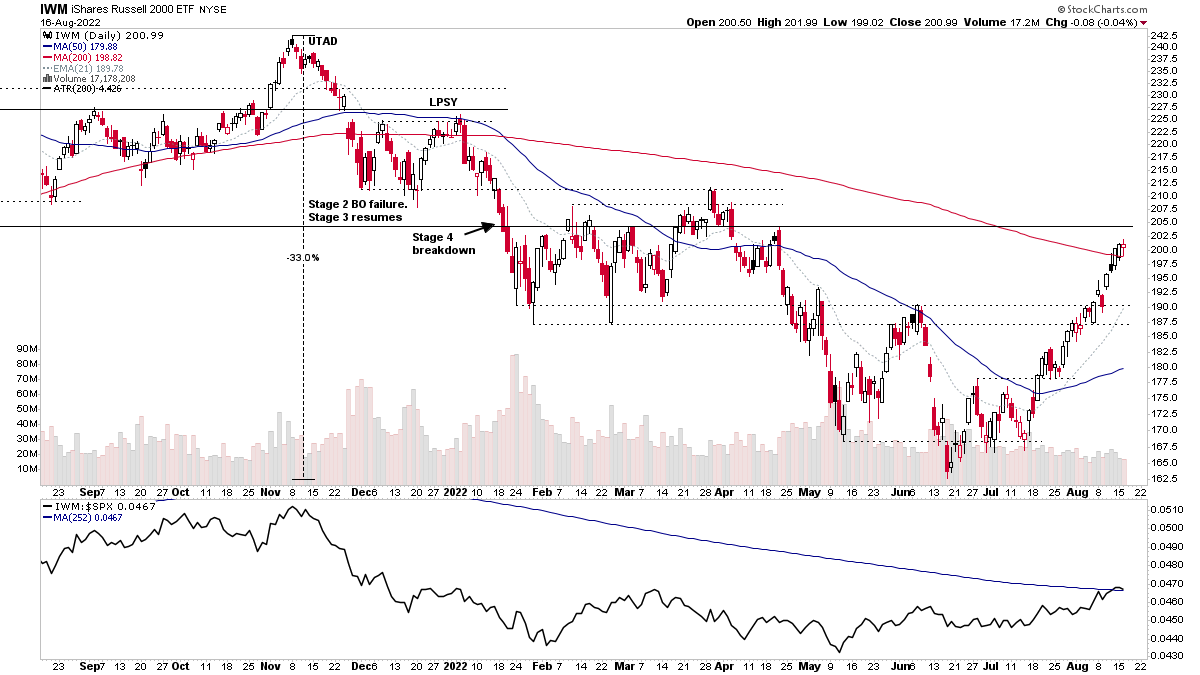

With the S&P 500 testing the 200 day MA today and Dow Industrials closing above it, the IBD Industry Group Bullish Percent Index has moved above the 60% level, which is the level that I use to determine the Stage 2 zone. 60%+ is considered in the Stage 2 zone. So although the majority of the major market indexes are only in Stage 1, the Industry Group Bullish Percent breadth data is moving into a tentative Stage 2 zone position.

However, I've marked up the Industry Group Bullish Percent chart at the points when it's reached this level from being in the lower zone (i.e. a major Stage 4 decline) in the past. This chart only goes back to 2010, but the dates that it correlates with are:

- October 2011

- May 2016

- April 2019

- May 2020

- August 2022

If you look back on the major indexes to those periods, then you'll see similar price action to what we've seen recently as each was a strong counter-trend rally following a Stage 4 decline. However, you'll note that they were very close to a short-term swing high, where the market then pulled back / consolidated for a number of weeks / months. Before then continuing on into a major Stage 2 advance. So, this suggests potential medium to longer term bullishness, as with some of the other breadth indicators that have had breadth thrusts recently. But potential for short-term weakness ahead first. So continue to ride the short-term bull, but stay alert for signs of weakness as it could be a bumpy road ahead before the market can reach Stage 2.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.