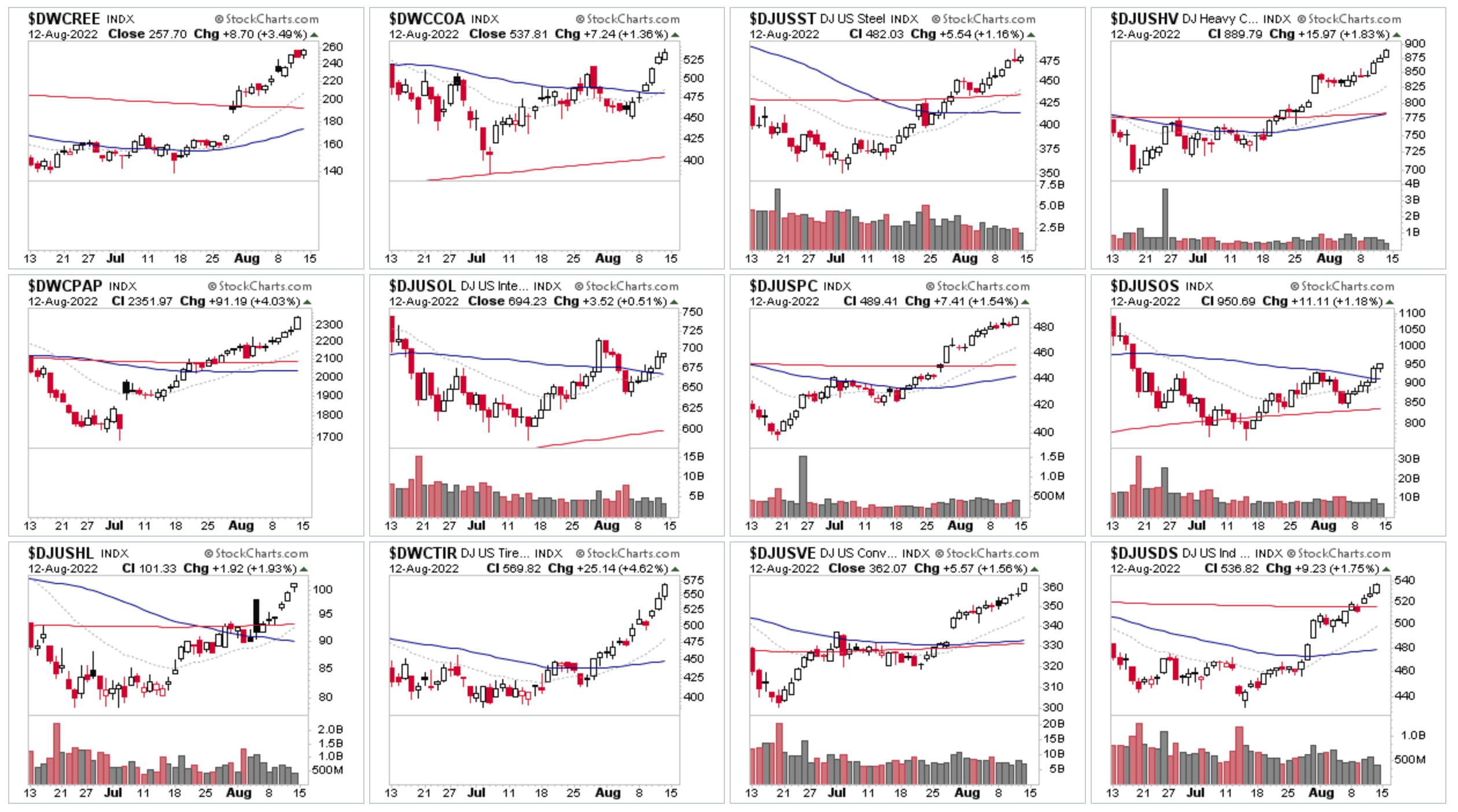

US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

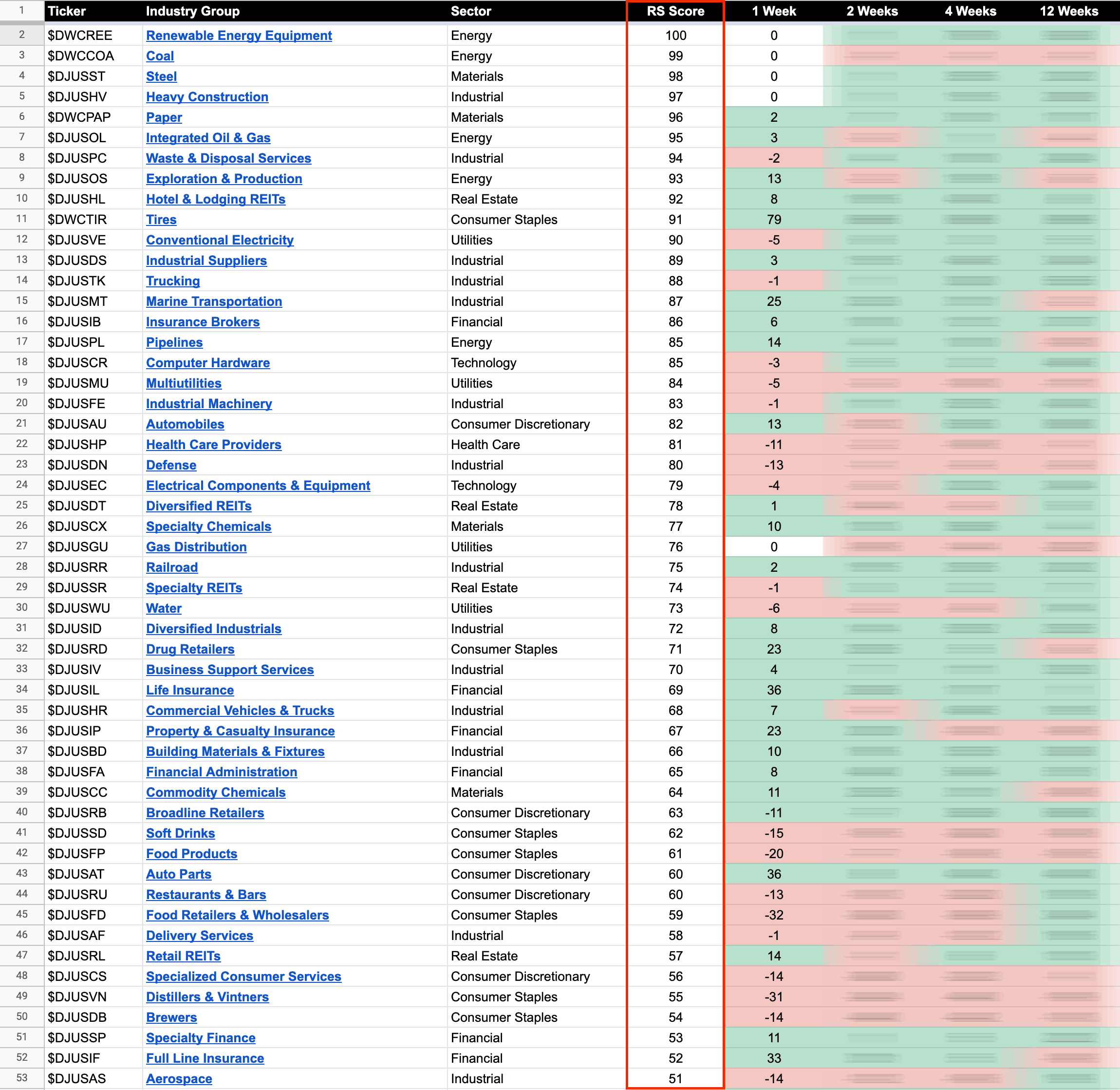

US Industry Groups by Highest RS Score

No change in the top 4 groups this week, with Renewable Energy Equipment and Coal battling it out for the top spot, with both having extremely strong weeks, topping the weekly percentage moves also. But Renewable Energy Equipment remains in the overall No.1 Relative Strength position.

One of the tiny groups – Tires moved 79 RS points this week. But with only 3 stocks in the group, it's much more volatile with its moves, so the strong week in GT, which is shaping up in potential late Stage 1, is the cause of the move in that group.

Marine Transportation was another big mover near the top of the RS rankings, rising 25 RS points to 14th overall position, and has a number stocks in Stage 2.

However, a more interesting group further down the RS rankings, is the Auto Parts group. As it moved 36 RS points to 42nd place overall. So it moved out of the lower rankings and I'm noticing multiple Stage 2 breakouts in the group on an initial overview, with some strong volumes coming in on the breakouts. So it is definitely a group to do some further investigation on the individual stocks that make up the group, as it could move rapidly up the RS rankings if the Stage 2 breakouts hold and follow through.

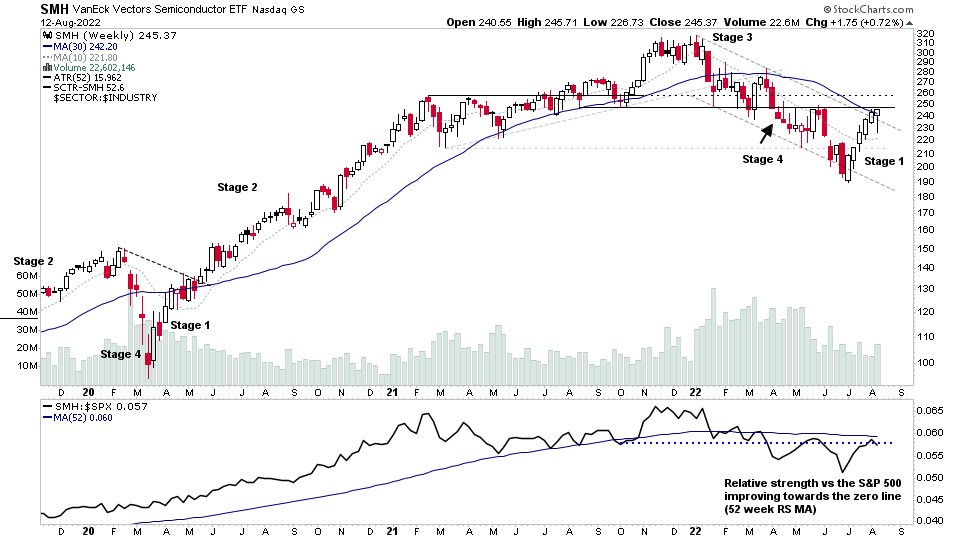

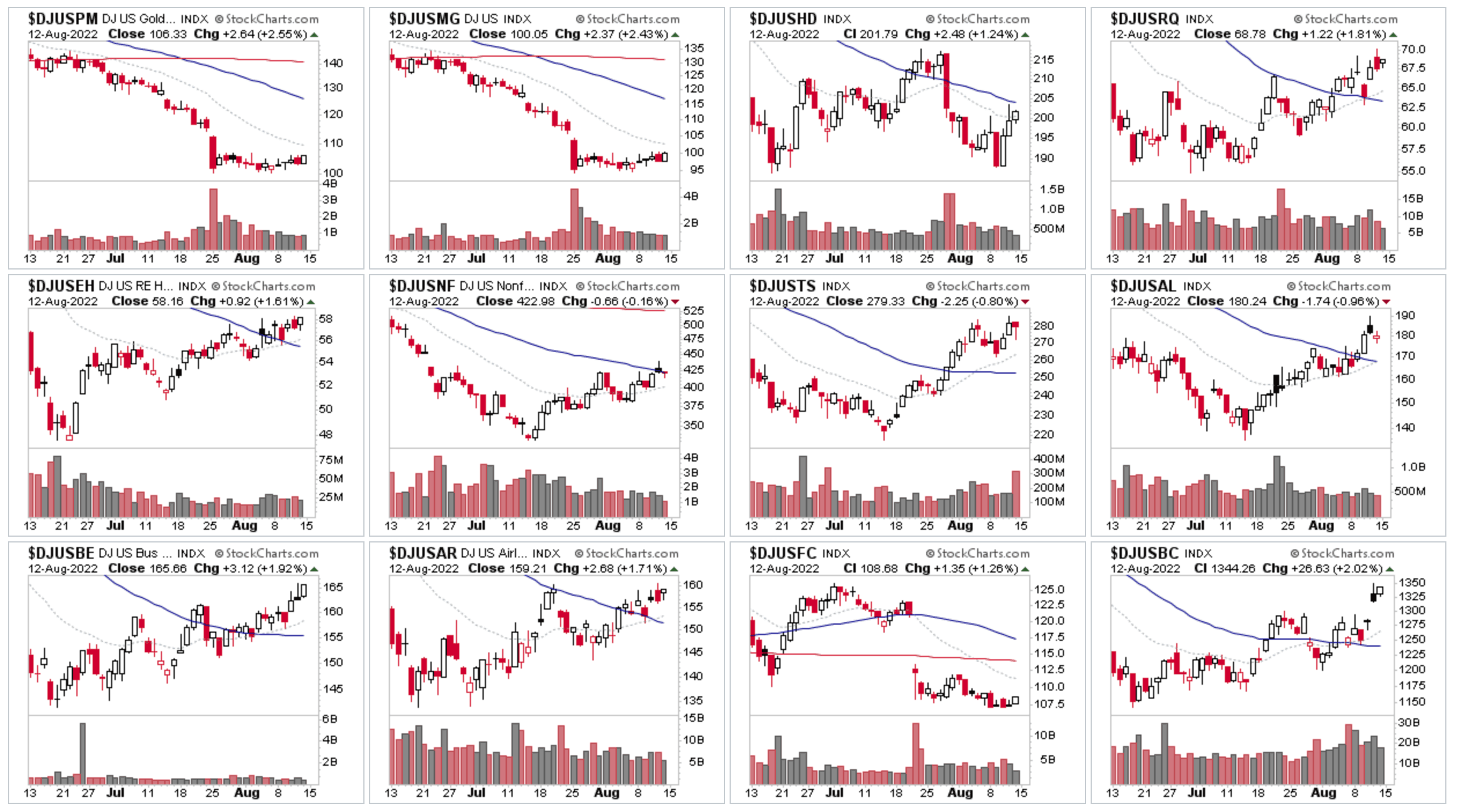

Group Focus: Semiconductors

The Semiconductors group is this weeks in focus group, as although it fell -28 RS points over the week. The group chart and the individual stocks that make it showed strong resilience after NVDA released weak preliminary results for its second quarter earnings data ahead of their full earnings later in the month. Which caused the group chart to pullback from the original Stage 4 breakdown level, that it had managed to reach, and fall back towards the 10 week MA / 50 day MA. However, by the end of the week the group had managed to recover the loss and the weekly candle formed a hammer candlestick. Closing up slightly higher on the weekly, and testing that Stage 4 breakdown level once more.

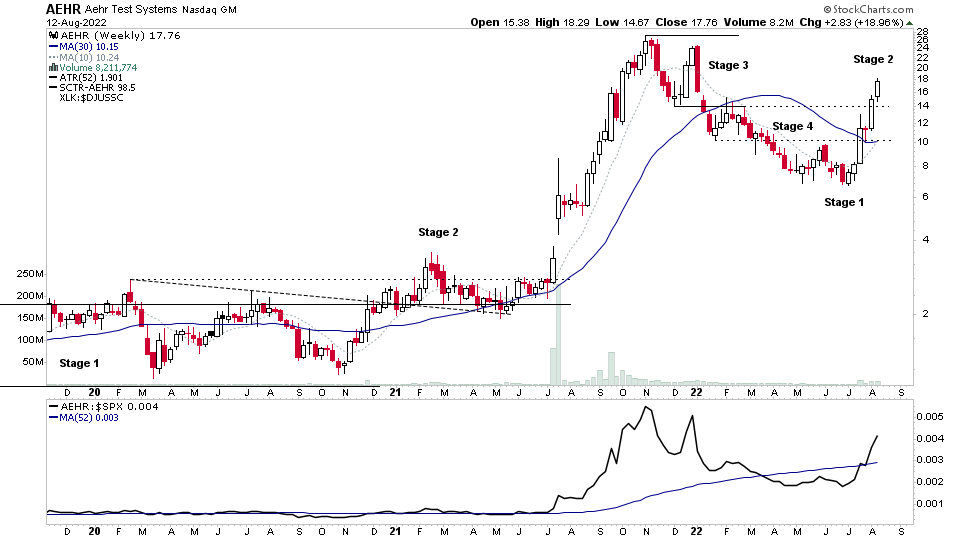

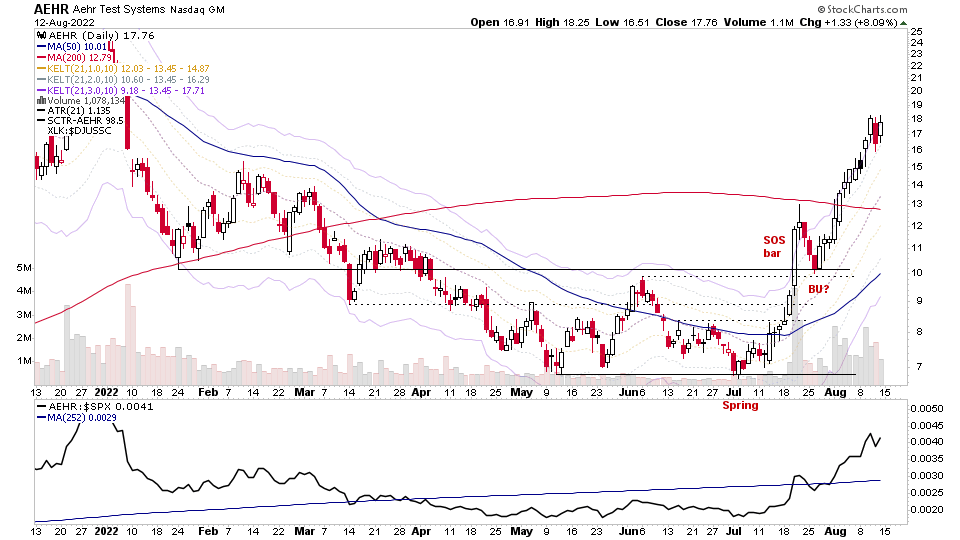

Multiple stocks in the group have been very strong over the last six weeks, with some potential leading stocks candidates emerging, such as AEHR, which has blasted into early Stage 2 on massive volume since the breakout from the lower small base structure that was forming a fledgling Stage 1, but caused it to move quickly into Stage 2. So it will definitely be high on the watchlist to analyse the price and volume behaviour when it next has a substantial consolidation or pulls back towards the short-term MAs.

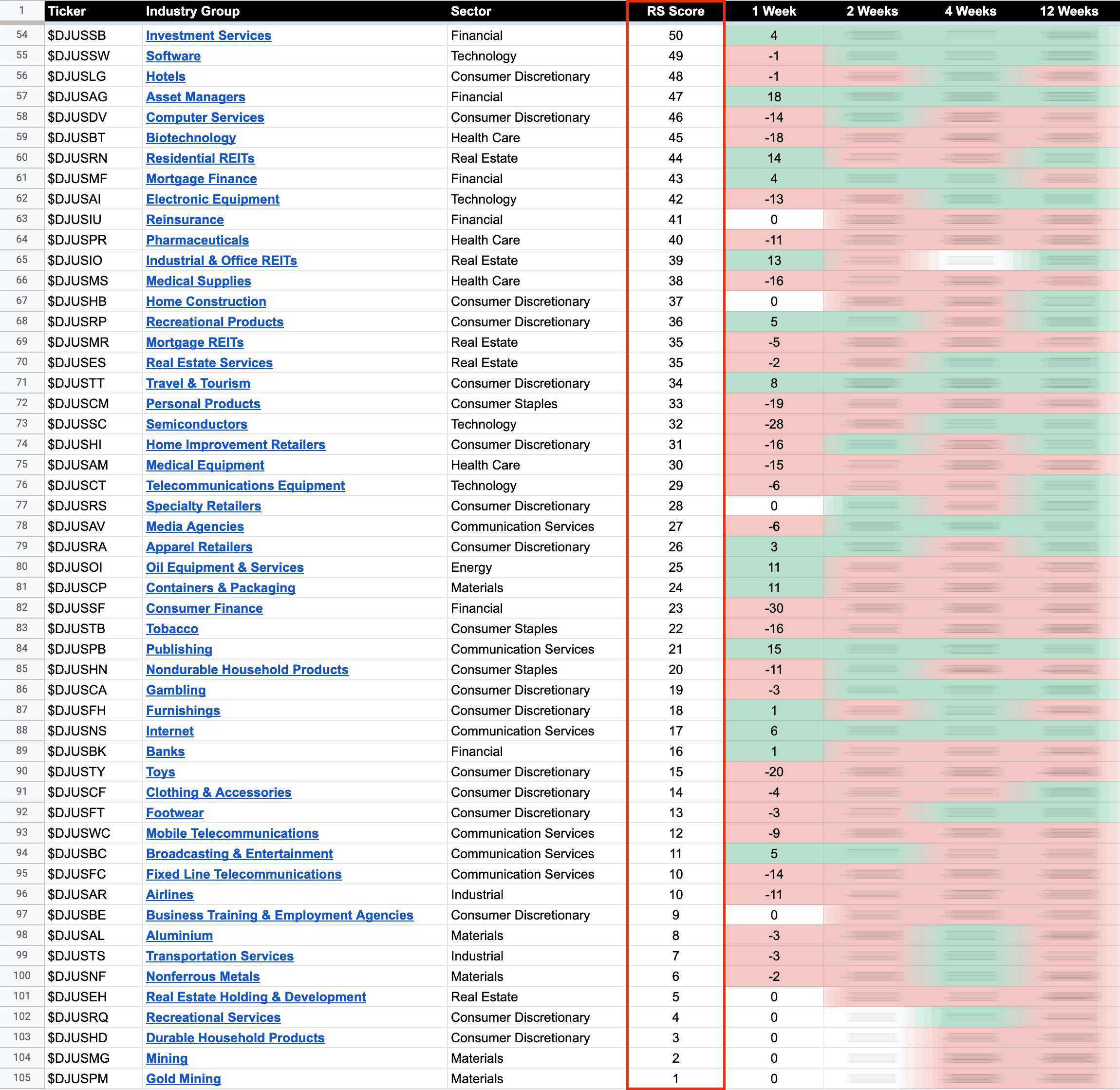

US Industry Groups by Weakest RS Score

Very little change at the bottom of the RS rankings again, with Gold Mining and Mining continuing to be the weakest groups.

104 Dow Jones Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.