Stock Market Update and US Stocks Watchlist – 11 August 2022

The full post is available to view by members only. For immediate access:

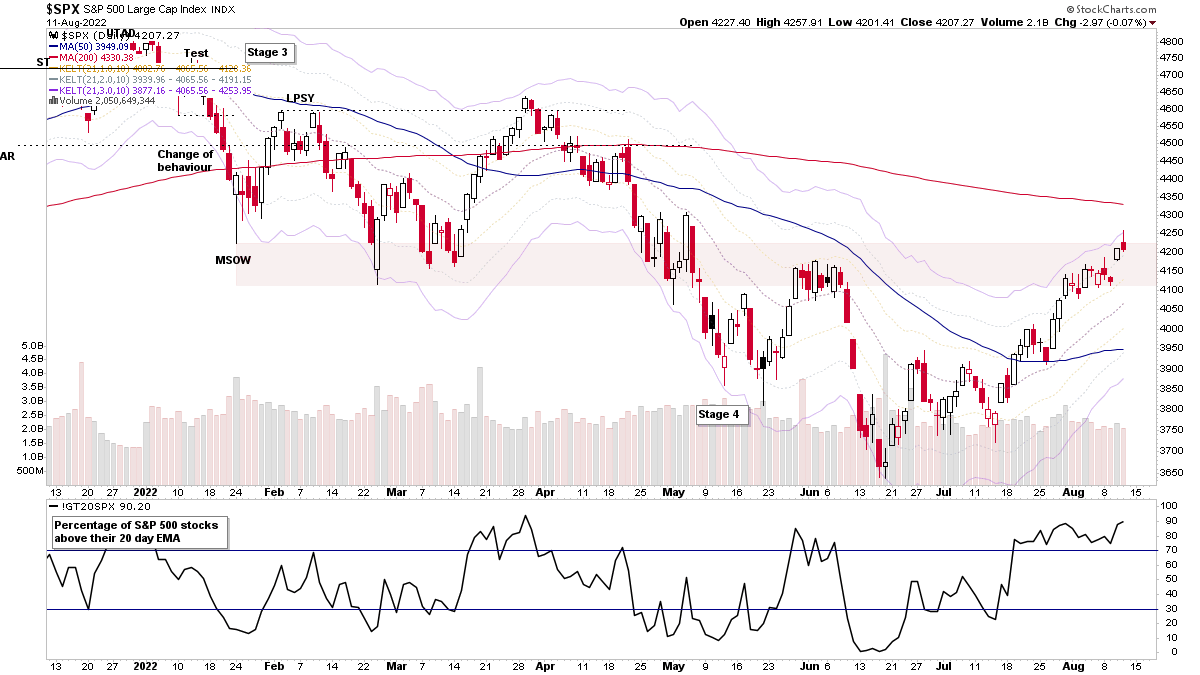

The S&P 500 gapped higher at the open, but spent the majority of the day pulling back, as multiple major indexes (i.e the S&P 500, Nasdaq Composite, Nasdaq 100 etc) all tested their year to date Anchored Volume Weighted Average Price (Anchored VWAP) and reversed back through to close the day negative. However, none broke the prior days lows and they all remain above their +1x ATR levels currently.

But as you can see on the S&P 500 chart above. The price touched the +3x ATR level, which is the first time that it's had the strength to do so this year, and the Percentage of Stocks Above Their 20 Day EMAs remains in the upper zone at 90.20% currently. So, it is exceptionally strong, but it is clearly in an extended position, as it rarely goes above 90%. But when the trend is strong it can stay extended for a while in the upper zone. So, until it starts dropping back below the 70% level once more and continuing lower, it remains on positive status with what Mark Minervini called in his excellent books – a Lockout Rally.

US Stocks Watchlist – 11 August 2022

There were 16 stocks for the US stocks watchlist today

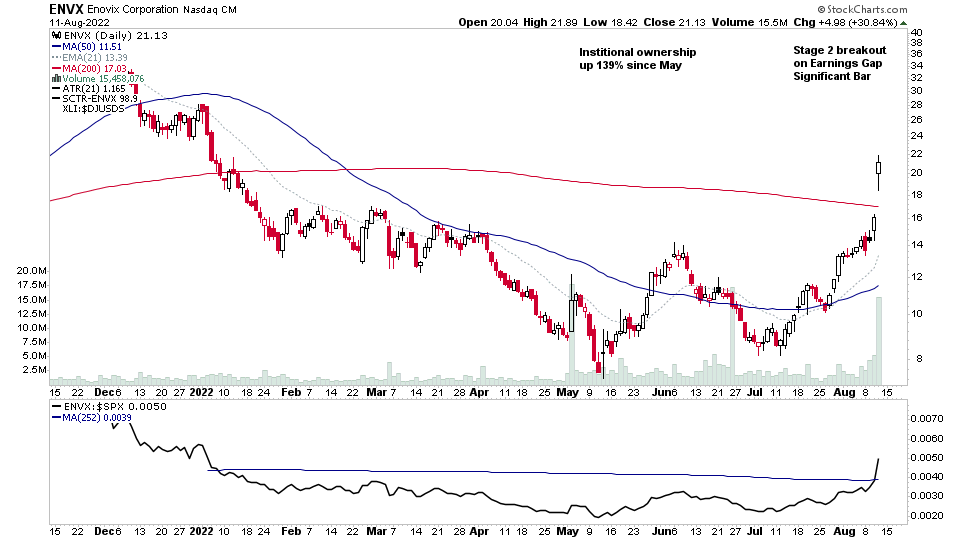

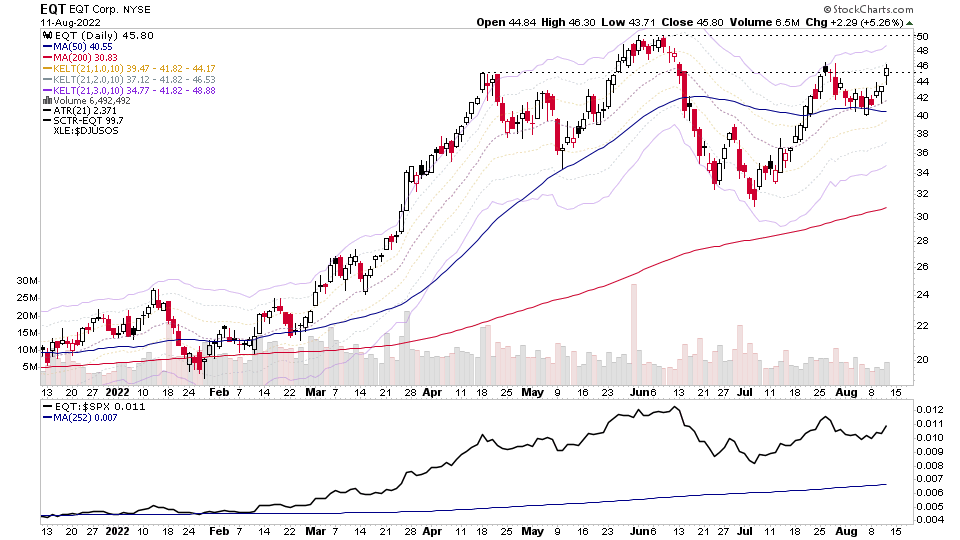

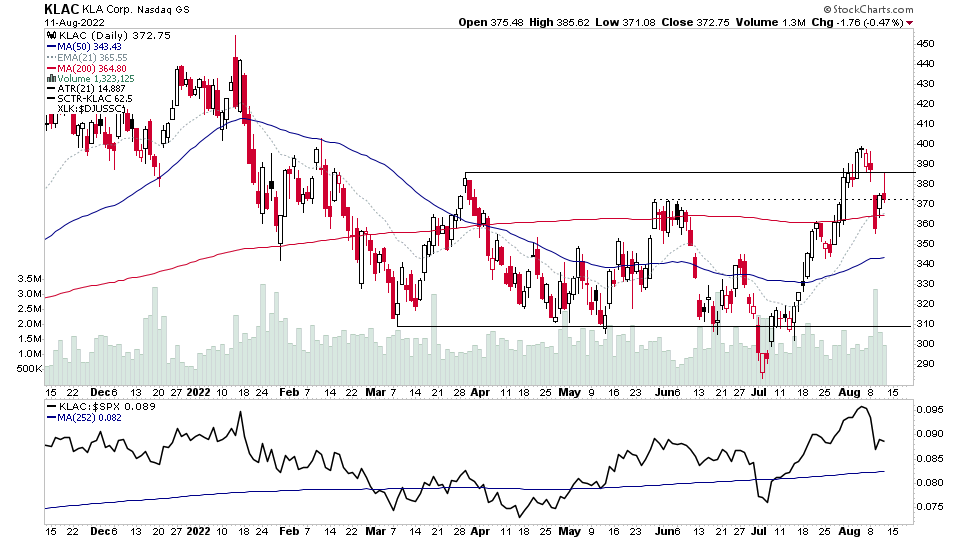

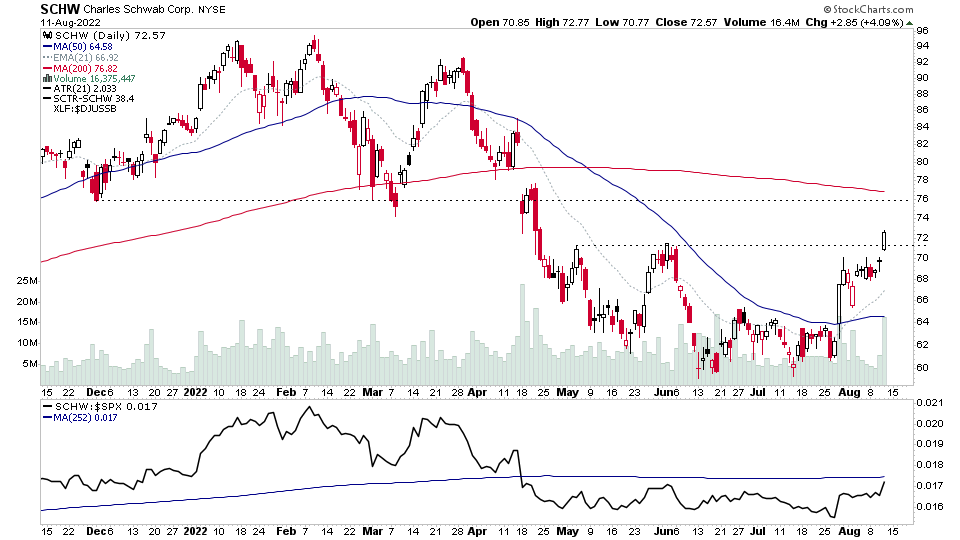

ENVX, EQT, KLAC, SCHW + 10 more...

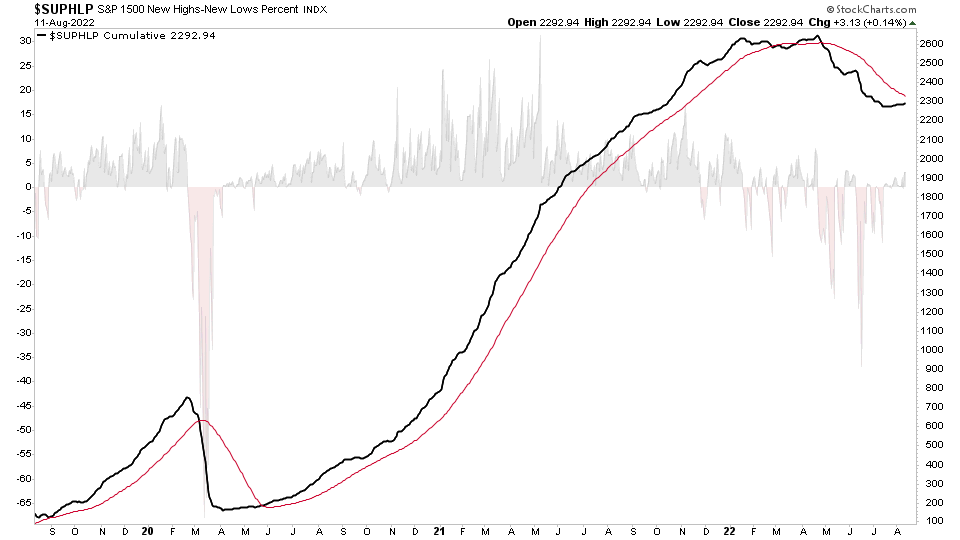

Market Breadth: S&P 1500 Cumulative New Highs - New Lows

The S&P 1500 is a much smaller sample size than the US market Cumulative New Highs - New Lows that I show most often, which covers over 7000 stocks. But it does cover 1500 stocks from the major US markets and includes the S&P 500 large caps, S&P 400 mid caps and S&P 600 small caps, and so is a fairly broad measure nonetheless.

The recent short-term rally off the June lows has started to turn the cumulative line back up, and the still declining 50 day MA – which is used as the signal line – but they are getting closer, and so could crossover in the near future. Which would change the negative signal that it's been on since 28th April to postive once more.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.