Stock Market Update and US Stocks Watchlist – 25 July 2022

The full post is available to view by members only. For immediate access:

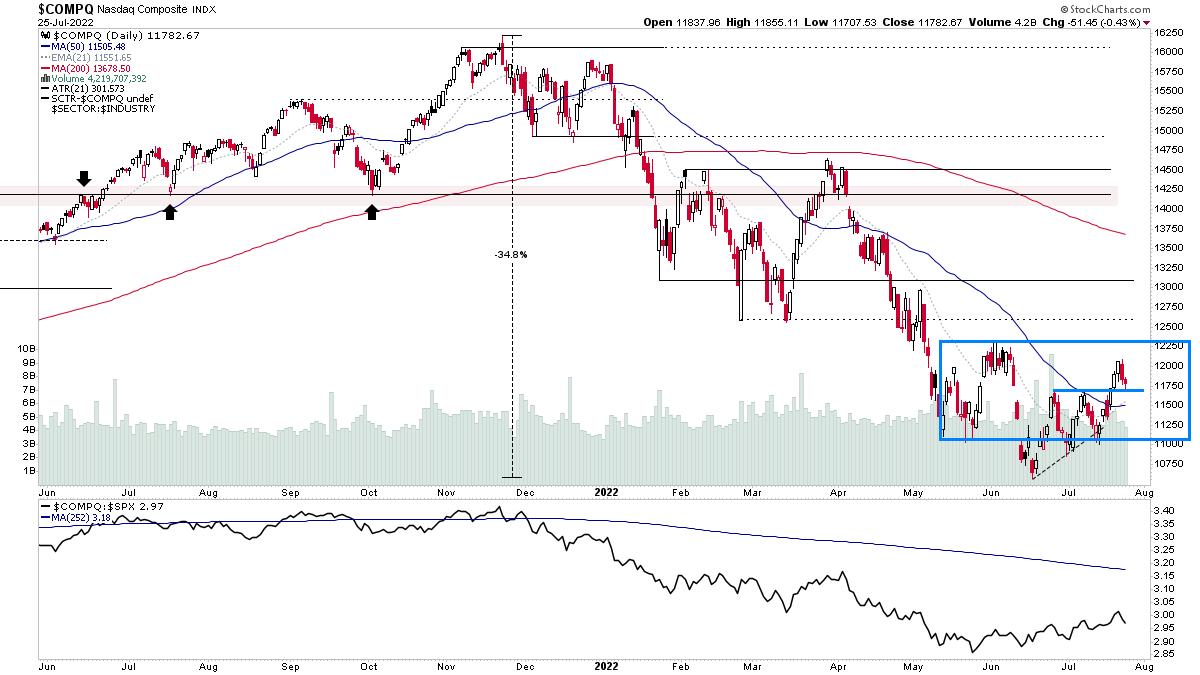

The Nasdaq Composite pulled back and closed lower for a second day into the prior two short-term pivot highs, which turned support today and formed a tight candle with a small demand tail (lower wick).

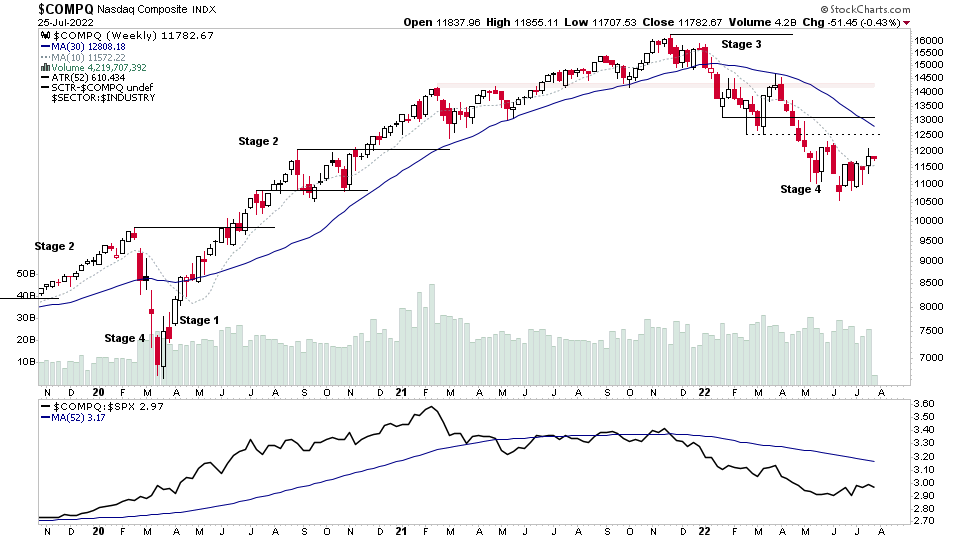

The Nasdaq remains in a weekly Stage 4 declining phase – so the major trend is down. However, there has been an attempt to base over the last three months, with a double bottom type pattern developing and the price action has managed to hold above the 50 day MA for 5 days now, which is starting to flatten / turn slightly up.

However, with the Fed latest rate decision coming up at 2pm (EST) on Wednesday. Further consolidation is likely until then, except in stocks reporting earnings and those related to them.

US Stocks Watchlist – 25 July 2022

There were 32 stocks for the US stocks watchlist today

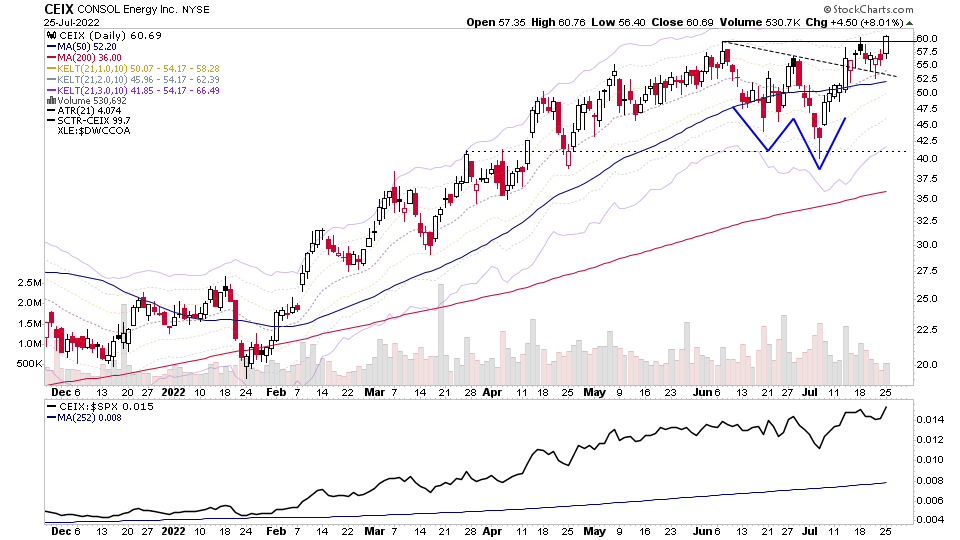

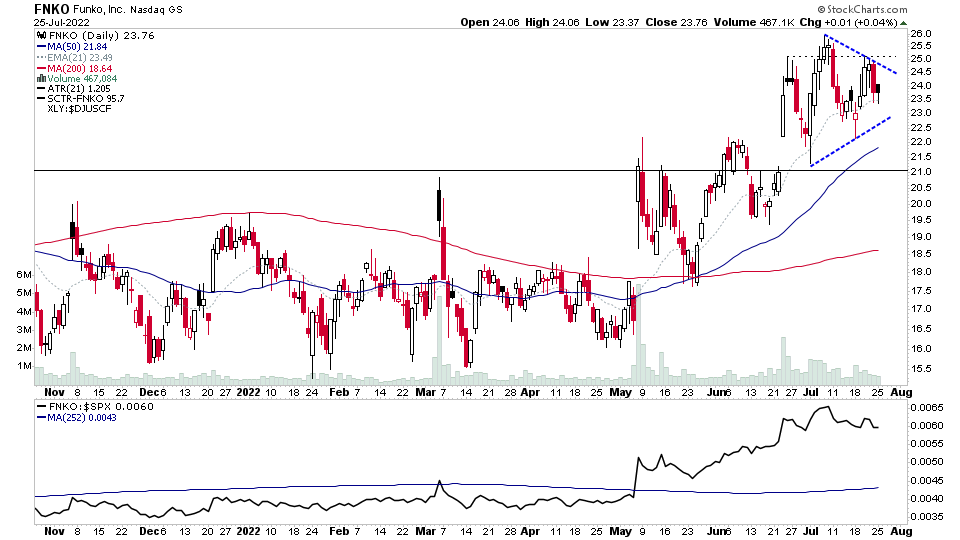

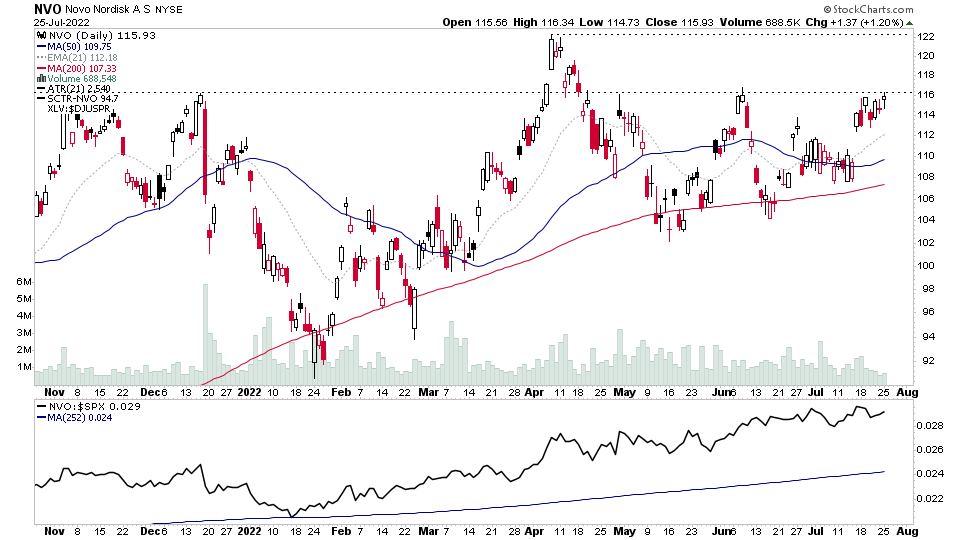

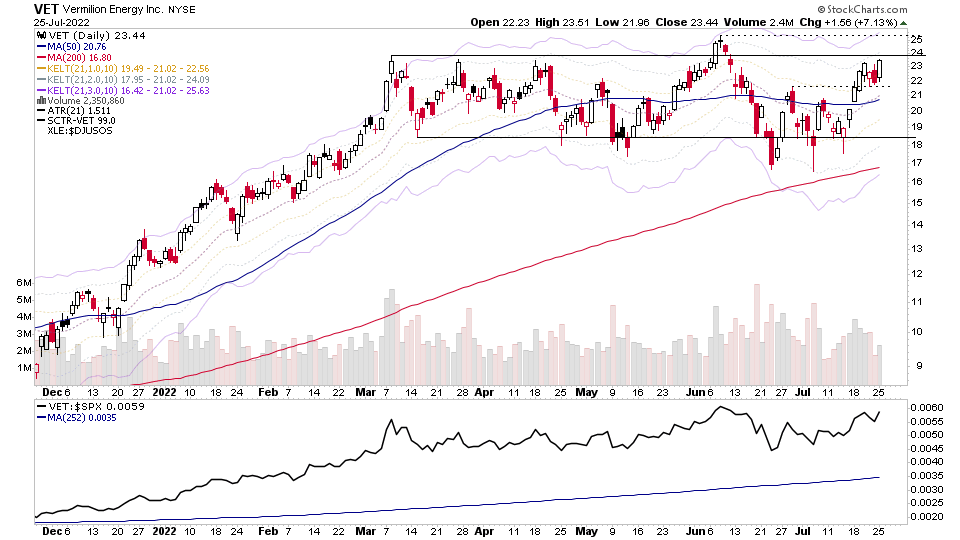

CEIX, FNKO, NVO, VET + 28 more...

Bitcoin

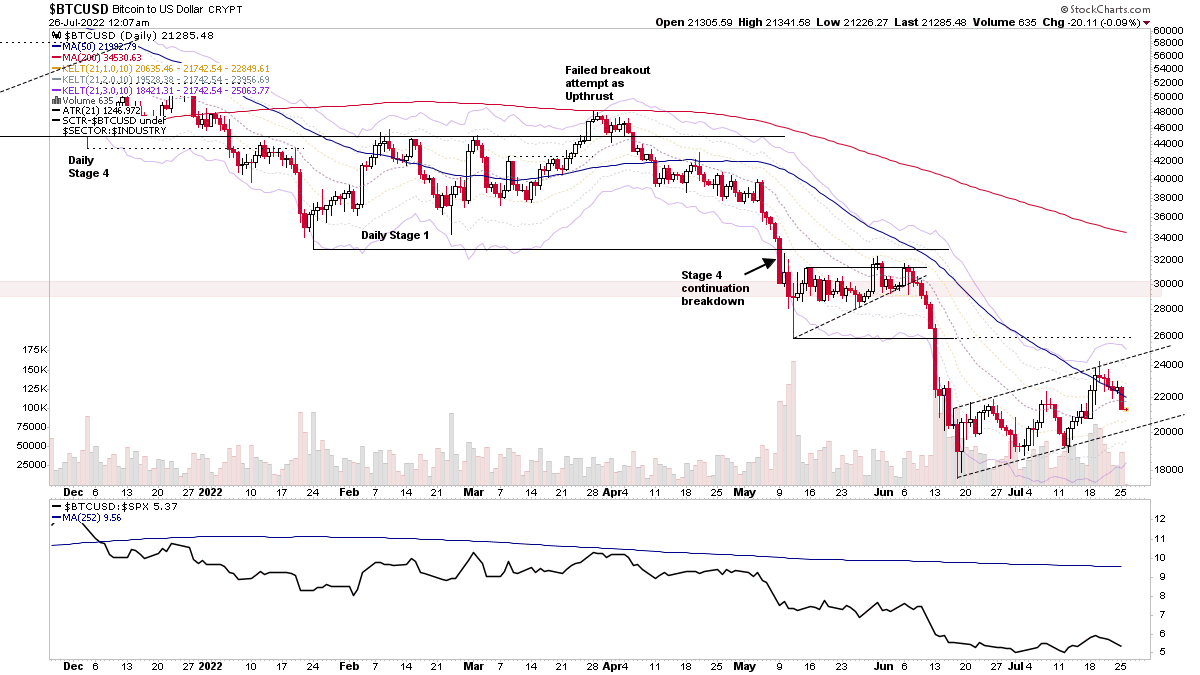

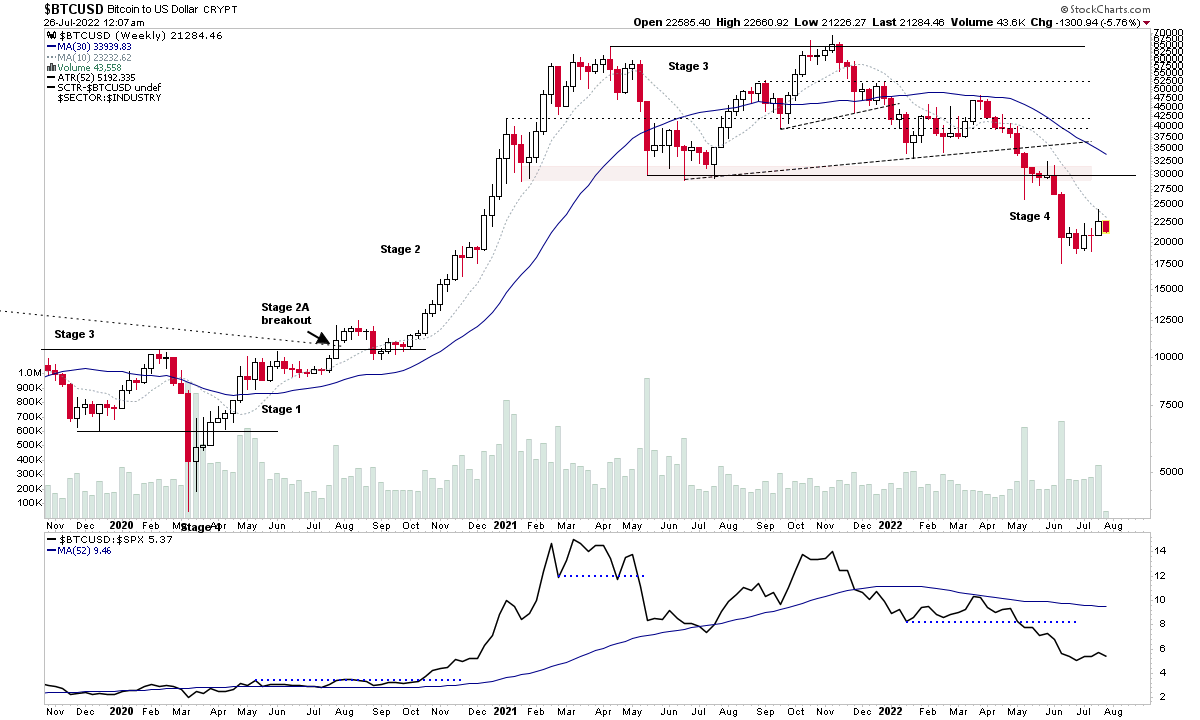

Moving back below the 50 day MA within the current short term channel. So is it another short-term Upthrust within the Stage 4 decline, or can Bitcoin find support and form another higher low? For the time being the only thing that is certain is that it's in a deep Stage 4 decline, and so even if it can manage a counter-trend rally, a weekly Stage 1 could still be a long way off yet, although there is a chance that we are seeing the fledgling part of it forming. But it could just as easily be another redistribution base. So not much to do unless you are trading on the lower intraday timeframes, of which it could be a potential UTAD.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.