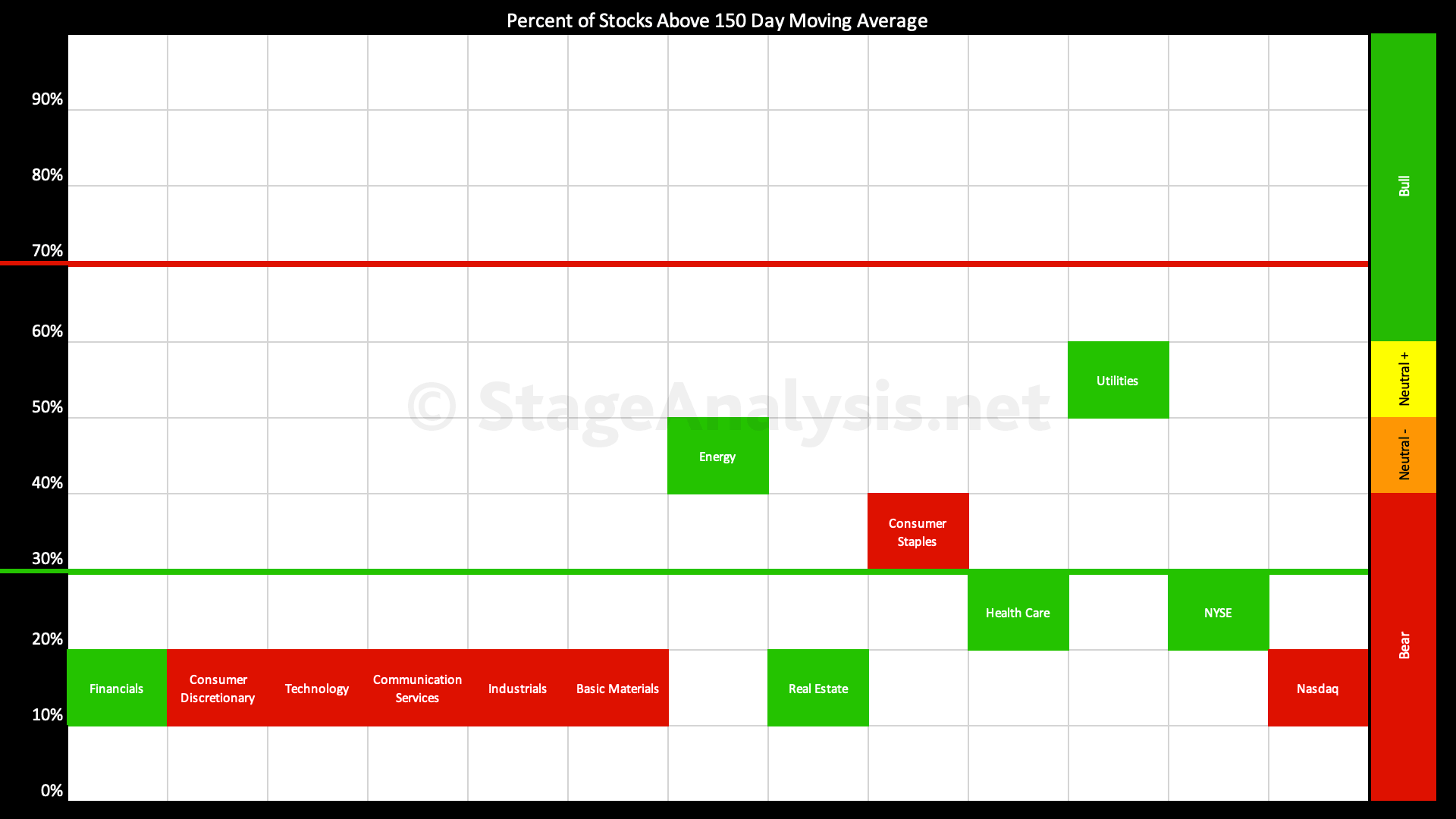

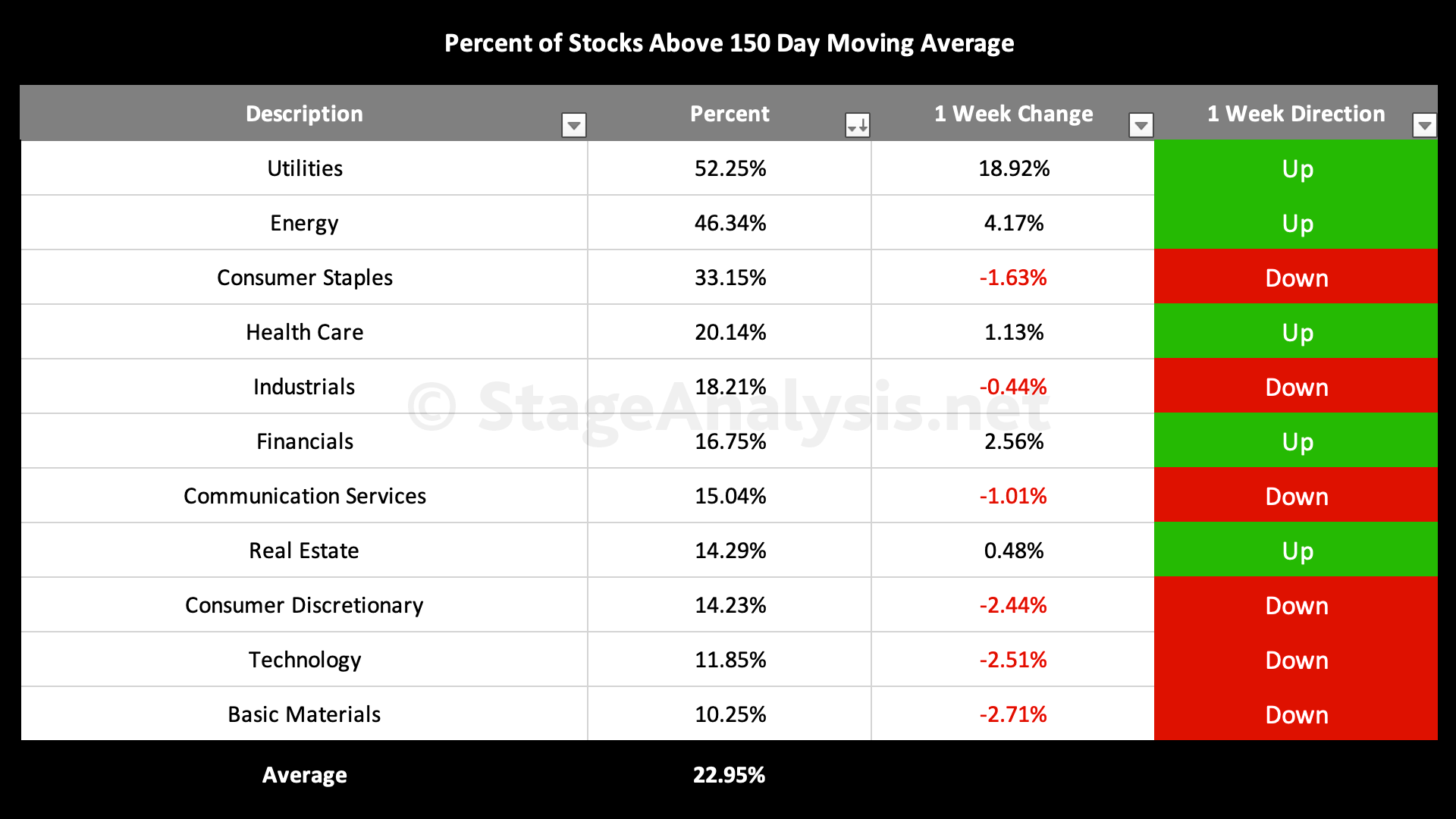

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

Average: 22.95% (+1.50% 1wk)

- 0 sectors are in the Stage 2 zone

- 2 sectors are in Stage 1 / 3 zone (Utilities, Energy)

- 8 sectors are in Stage 4 zone (Consumer Staples, Health Care, Industrials, Financials, Communication Services, Real Estate, Consumer Discretionary, Technology, Basic Materials)

The Sector breadth table has deteriorated further through June as it currently sits at 22.95%, but it did get down to a new 2022 low of 15.78% on the 17th June. So it has improved by +7.17% over the last two weeks. But if you compare the chart to 14th May post you can see that while the majority of groups are still in the same spots in the lower range. The Energy sector has finally dropped out of the Stage 2 range (i.e. above 60%), which had been holding up the overall average, as it was above 90% as recently as 4 weeks ago, and so has dropped over 45% through June.

There are now zero sectors in the Stage 2 zone and only 2 in the Stage 1 / Stage 3 zone. Hence the vast majority of sectors are in the extreme of the lower range and it is looking very weighted to the negative side in Stage 4, which is a rare occurrence. So as this is a contrarian indicator, we'll be looking for which sectors start to move out of the lower zone first for signs of potential new leadership. But until that happens, caution remains prudent, as it is a Stage 4 market and hence in the Stan Weinstein's Stage Analysis method that generally means staying out of market for investors, except for rare A+ quality setups, but short-term traders can still find opportunities on both sides of the market, but the majority of those will be on the short side while in a Stage 4 downtrend, and using progress exposure to get long stocks on any short-term counter trend rally attempts.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.