Stock Market Update and US Stocks Watchlist – 29 June 2022

The full post is available to view by members only. For immediate access:

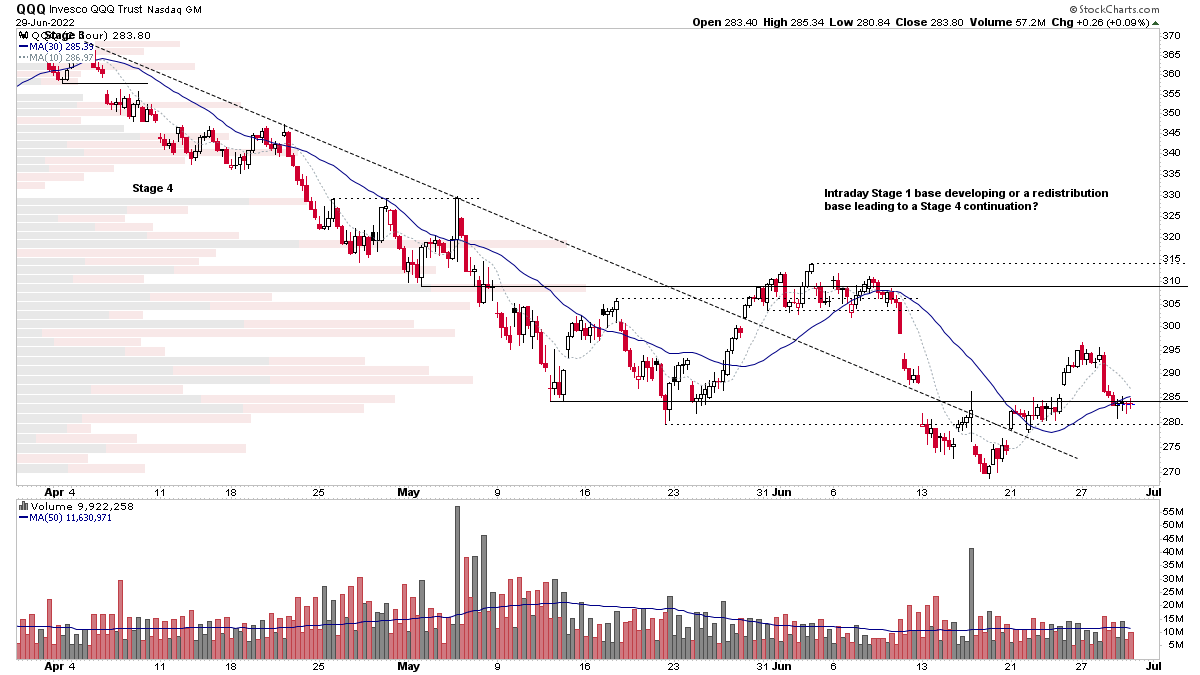

While there is no denying that the US stock market is currently in a major Stage 4 decline, with every major US stock index in Stage 4 on the weekly timeframe that the primary Stages are determined on. The more recent price action over the last month is much more subjective, as it differs across the indexes, with some like the Nasdaq 100 (QQQ) above forming tentative base structures, which may be forming into intraday Stage 1 in Phase D. But could easily still just be redistribution structures, as we've yet to see a change of behaviour from the lower lows and lower highs.

We saw in the study of the previous Stage 4 declines over the last 40 years that the indexes don't tend to bottom in the same way as individual stocks, as the indexes rarely form the large well-defined base structures that we see in the Wyckoff schematics. So it highlights the importance of looking at the market breadth weight of evidence and leading individual stocks for clues, as the stock indexes themselves are lagging indicators.

US Stocks Watchlist – 29 June 2022

There were 20 stocks for the US stocks watchlist today.

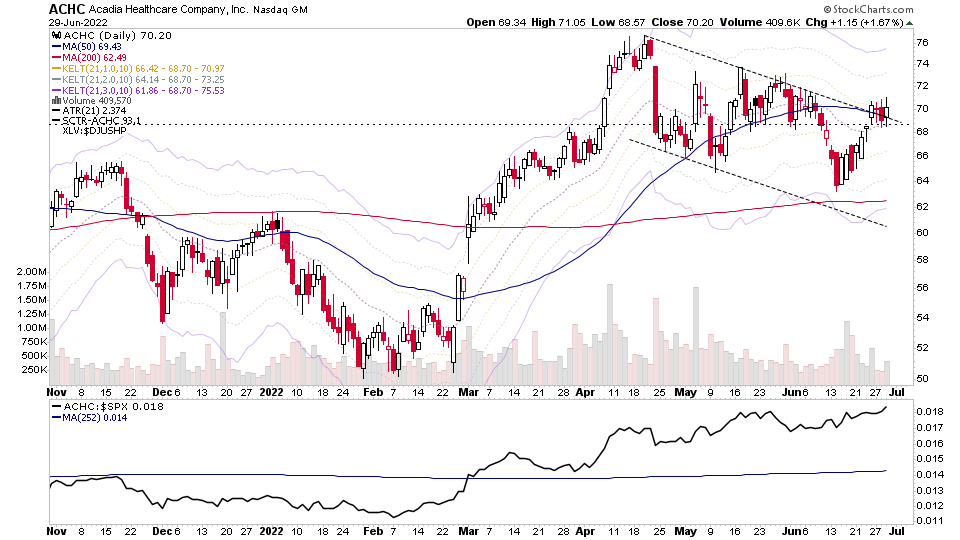

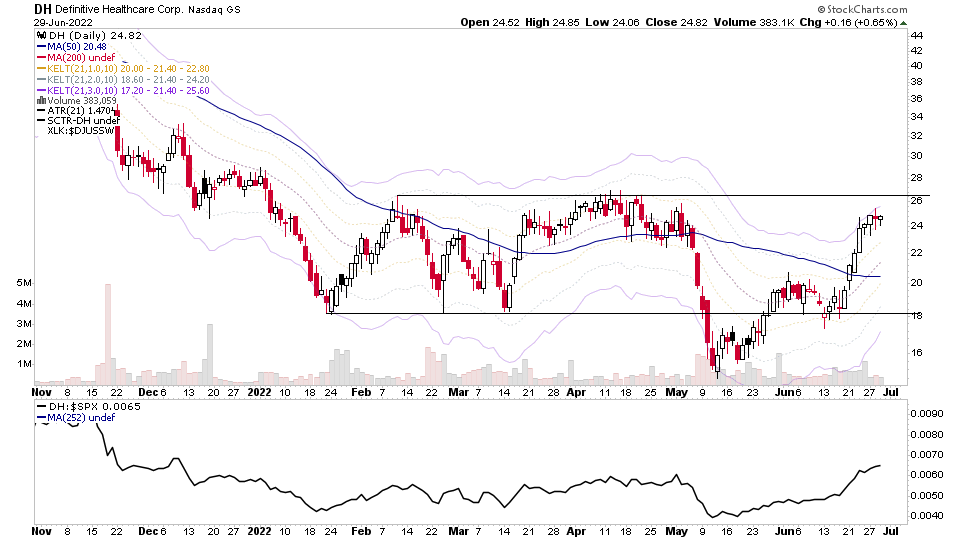

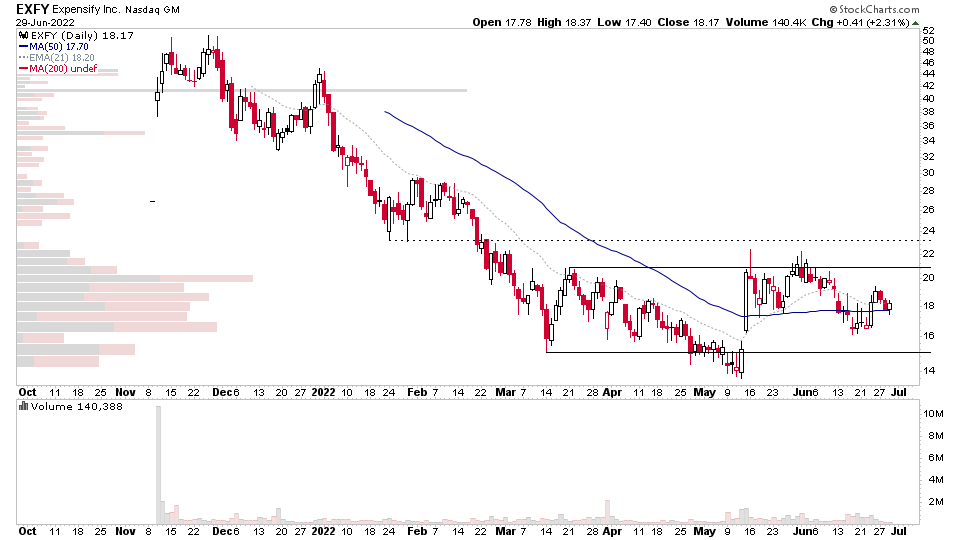

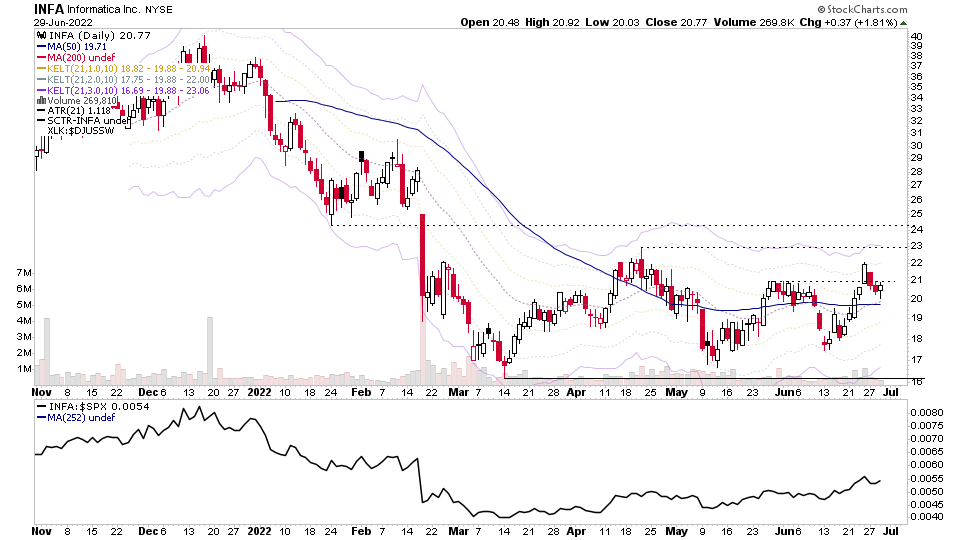

ACHC, DH, EXFY, INFA + 16 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.