US Markets Consolidate at Resistance in Stage 4 and the US Stocks Watchlist – 5 June 2022

The full post is available to view by members only. For immediate access:

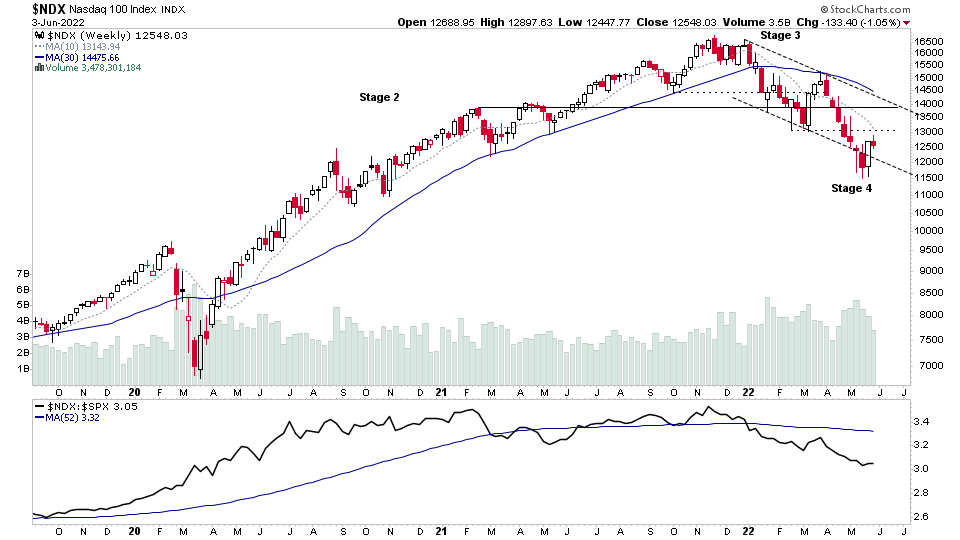

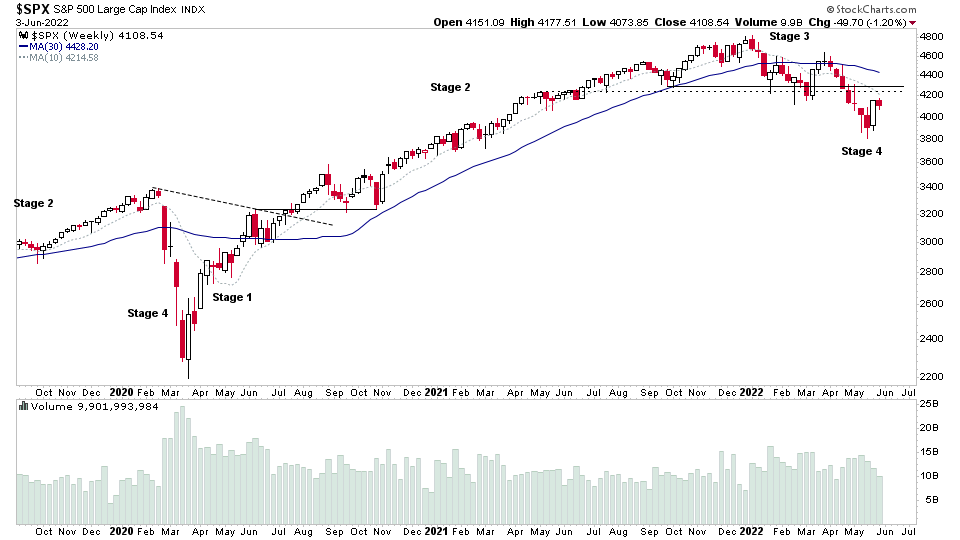

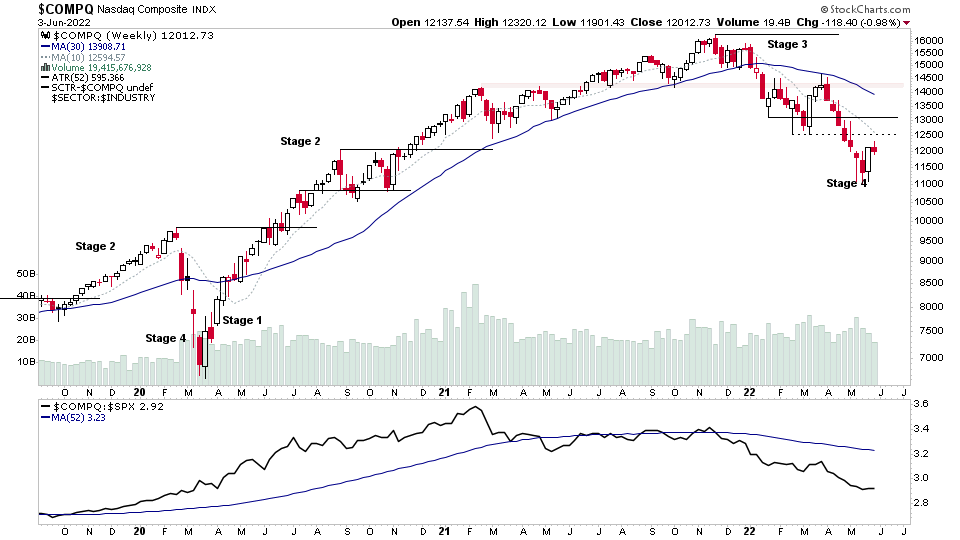

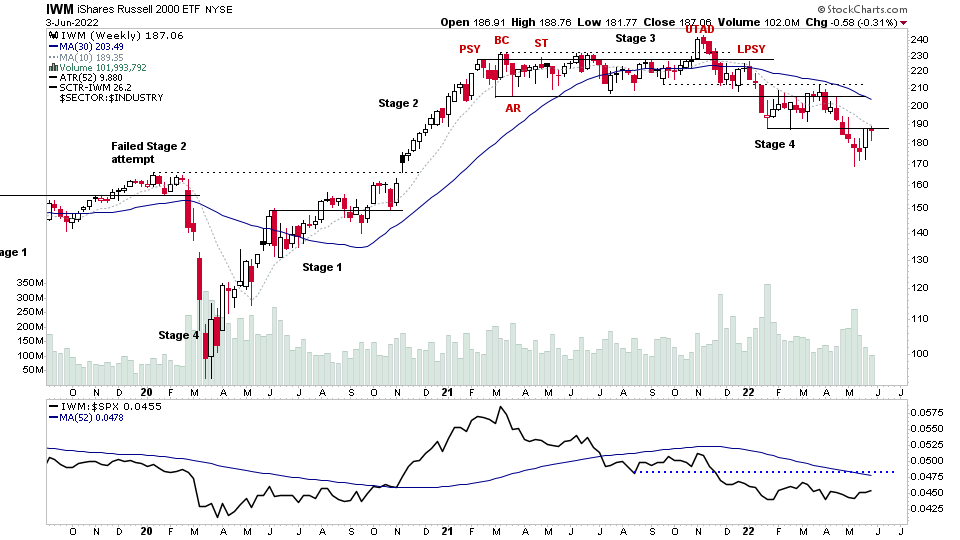

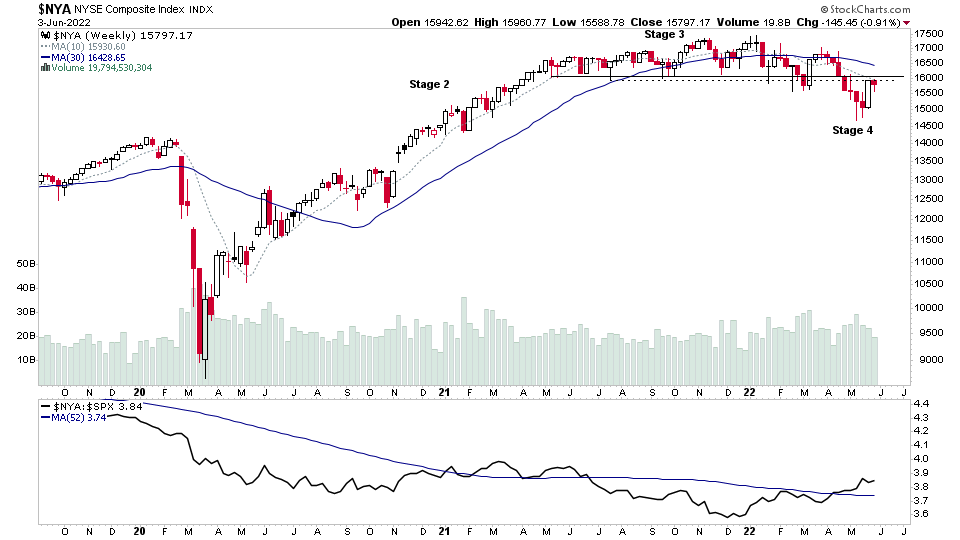

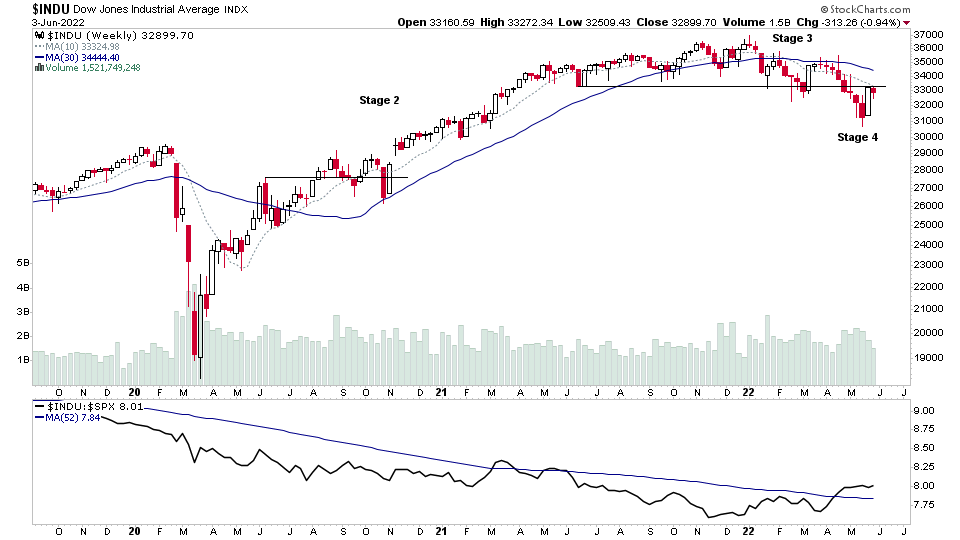

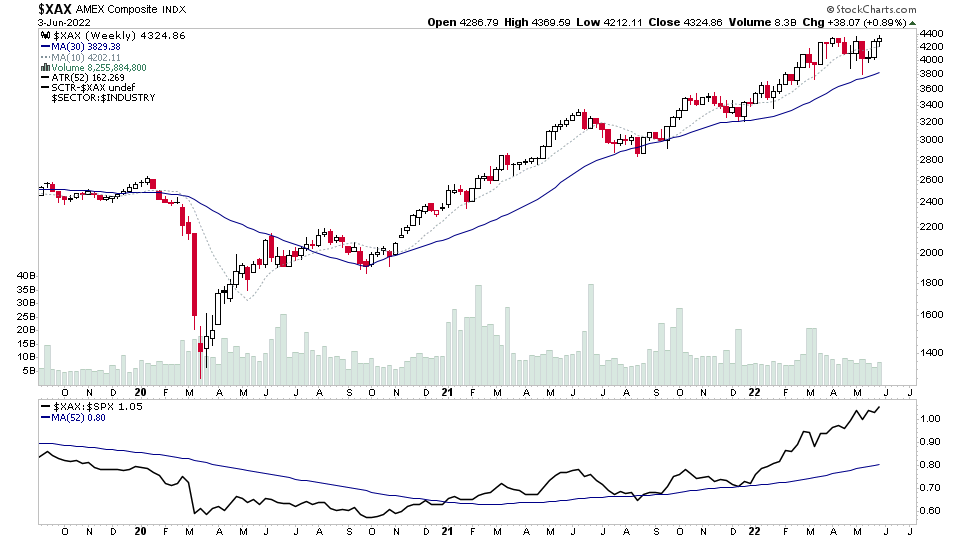

The majority of the major US market indexes all closed another week in Stage 4, except the AMEX, which continues to push towards new highs in Stage 2. So the primary market trend remains in a weekly Stage 4 decline. But many indexes have rallied back towards prior breakdown levels over the last few weeks, and are consolidating near to those levels.

US Stocks Watchlist – 5 June 2022

There were 17 stocks for the US stocks watchlist today.

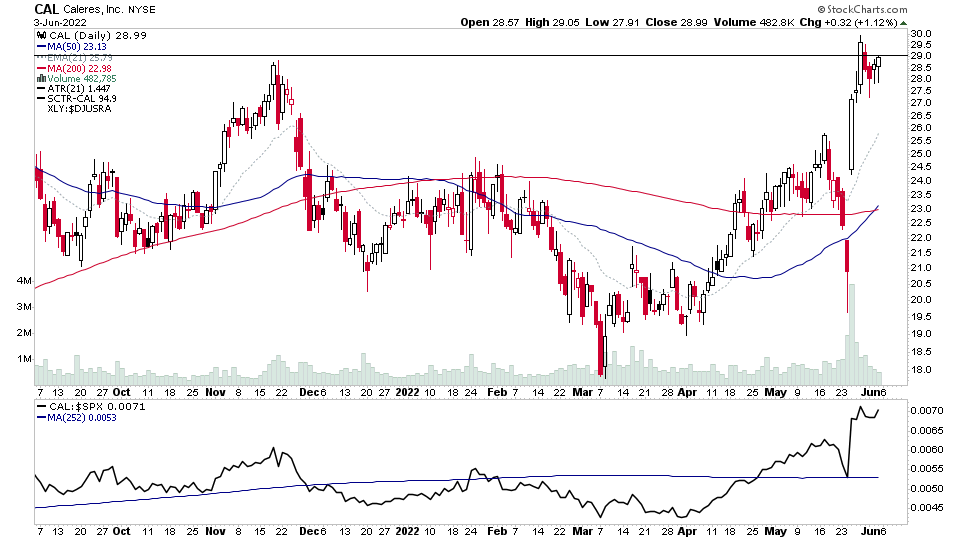

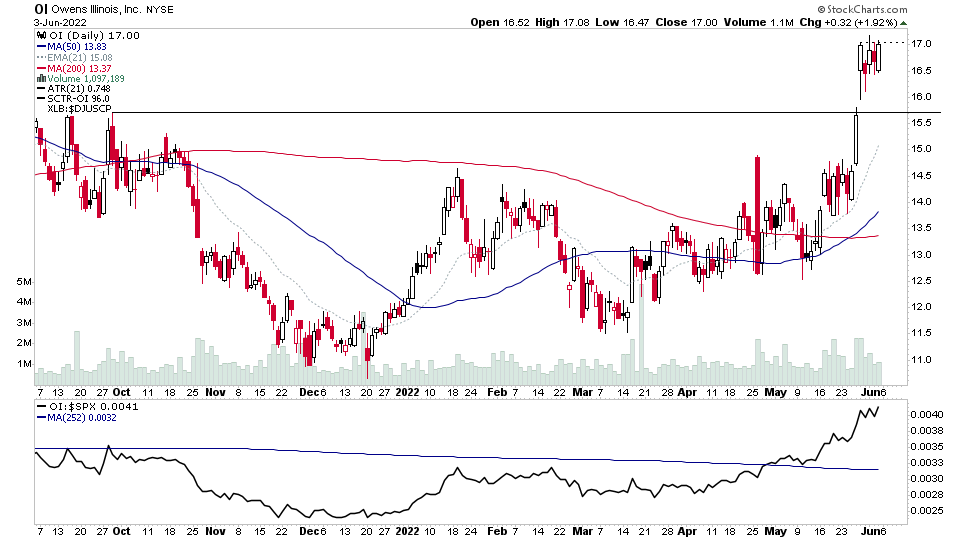

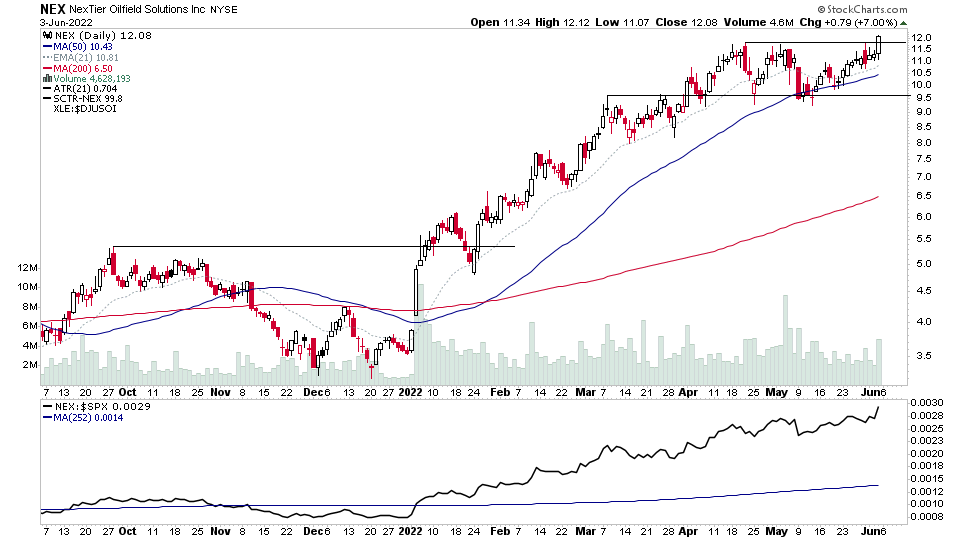

SIMO, CAL, OI, NEX + 14 more...

I'll go through the watchlist stocks in detail, as well as the rest of the weekend update in the members weekend video which is due out later on Sunday afternoon EST.

SIMO was removed as it's merging with MXL.

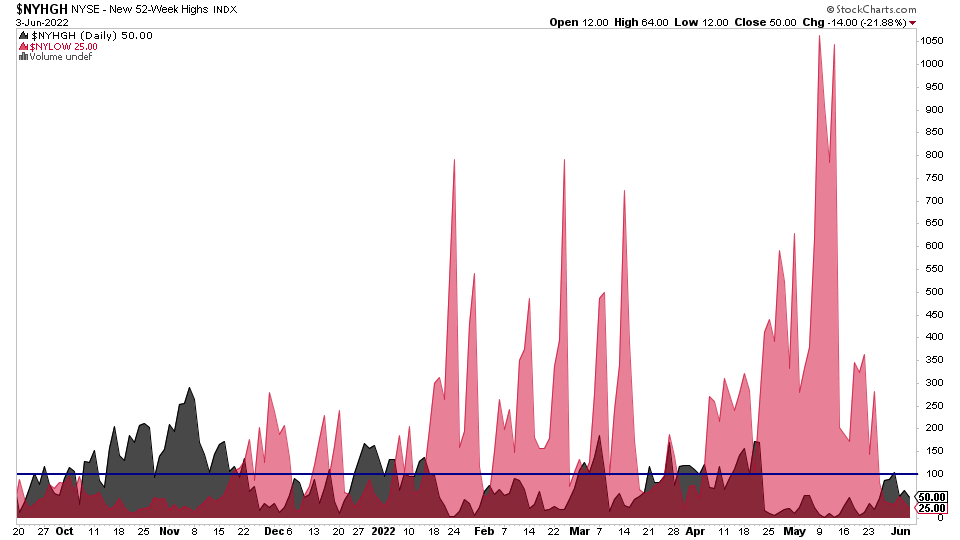

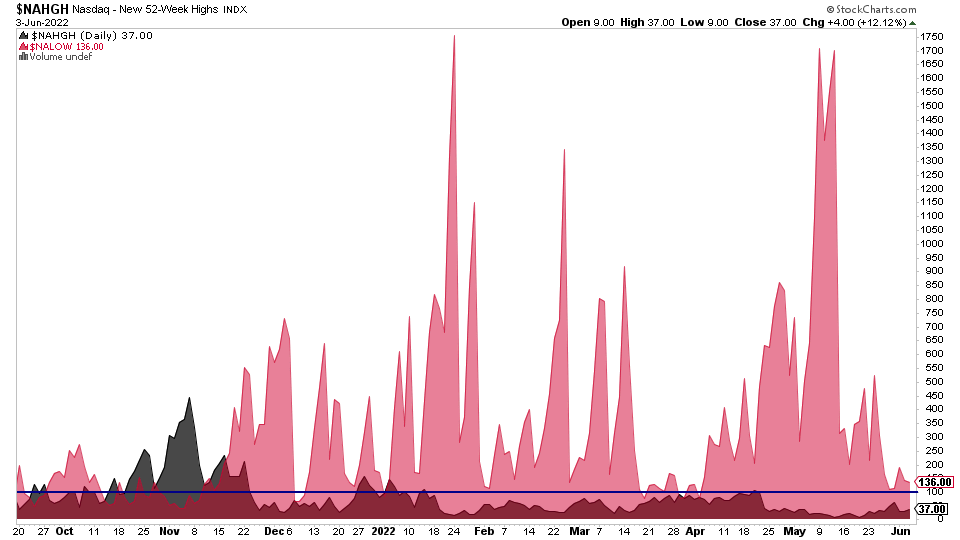

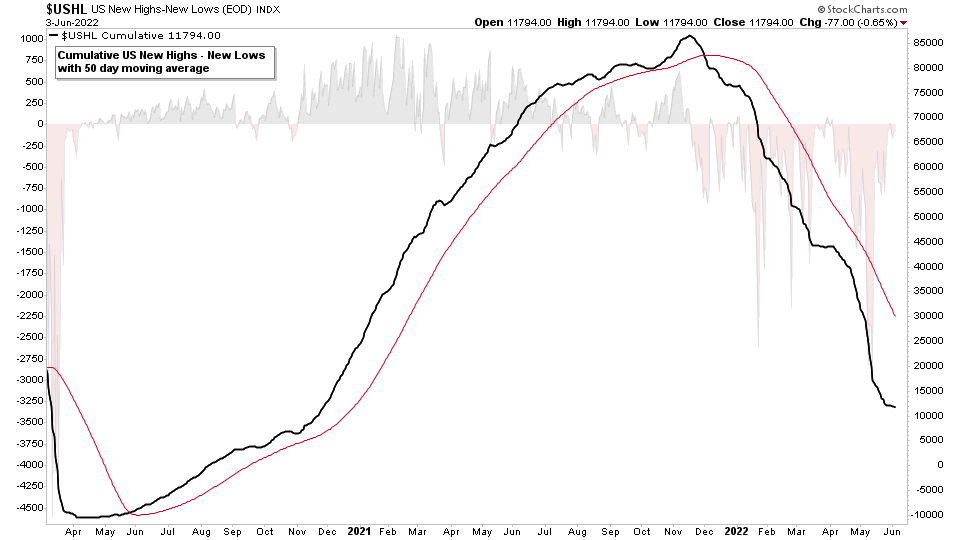

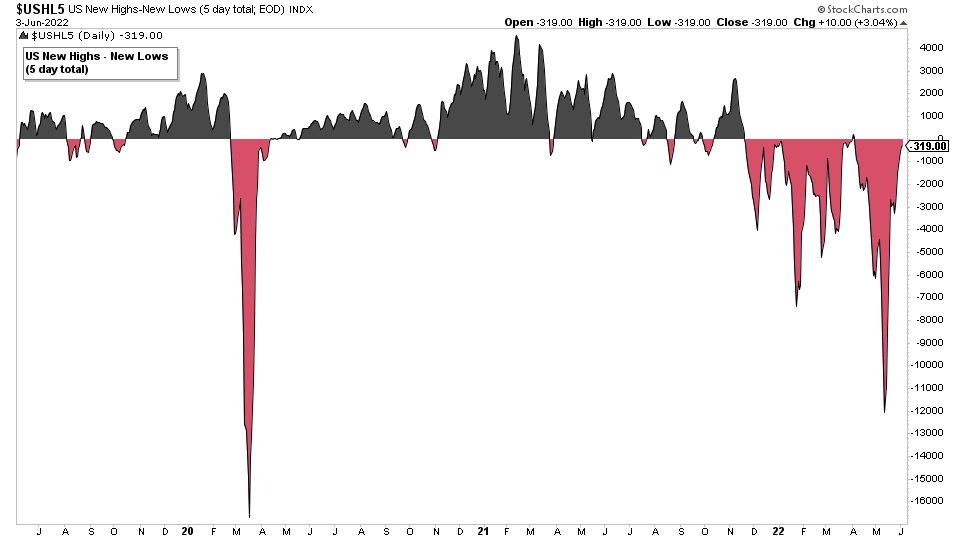

Market Breadth: US New Highs - New Lows

Continued improvement with the amount of new lows declining gradually. But all still remain in negative territory and we still need to see the amount of new highs overtake the new lows and with much higher levels.

The 5 day average is recovering back towards the zero line, so there's potential that it could see postive levels in the coming week if the counter trend rally continues to progress. But the cumulative line is a much slower measure and will take many months to turn around even if we see consistent improvement. But for now remains in a Stage 4 decline.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.