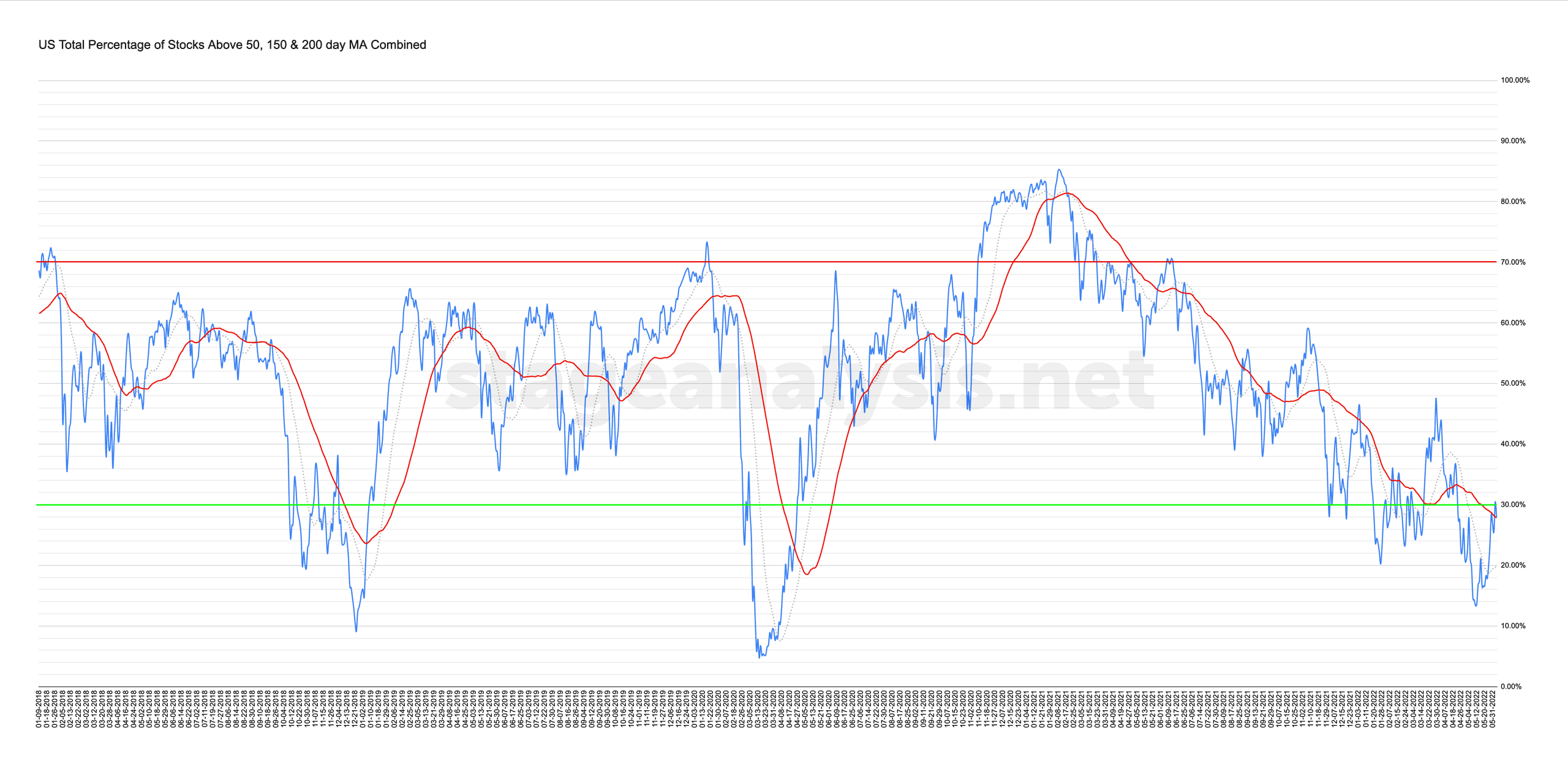

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

27.96% (-0.50% 1wk)

Status: Neutral / Difficult Environment in Stage 4 zone

The US Total Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined chart moved back above the key 30% level briefly on Thursday – which it hasn't been above since the 21st April – but then fell back below it again on Friday to close the week at 27.96%. Which on a Week-on-Week basis was a small decline of -0.50%.

So it was a consolidation week following last weeks strong advance from lower levels of +11.85%, and even though it moved slightly lower. It gave the declining 50 day MA a chance to catch up and so the overall average line actually closed the week above its 50 day MA that we use for a signal on this breadth measure. Although not by much, as it only closed +0.14% above the 50 day MA on Friday.

Hence last weeks status remains in place of still being on Difficult Environment status, but in a Neutral position. So there is a possibility of status change to a tentative Positive Environment if it holds above the 50 day MA next week and makes further progress. But it's not there yet, and could just as easily resume the trend lower from the current consolidation. As it remains in the Stage 4 zone.

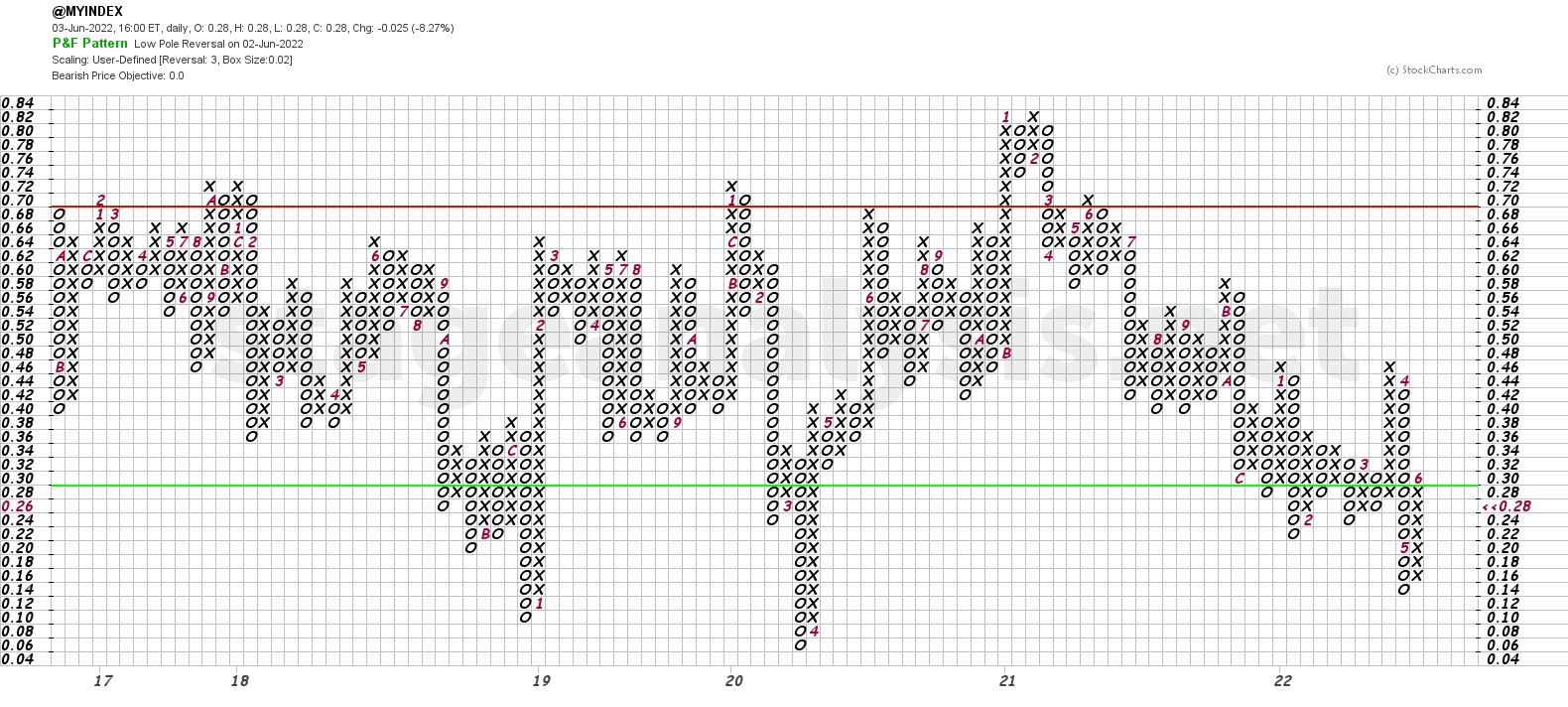

The Point and Figure chart added a further X to its current column, but closed a few boxes lower. However, it hasn't reversed to a column of Os, and so the P&F status remains on Bull Alert status.

I'll discuss these charts and the other charts based from this data in more detail in the members weekend video (due out later on Sunday afternoon EST).

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.