SNAP – Stage 4 Continuation Breakdown on Earnings and Bitcoin Bear Flagging

The full post is available to view by members only. For immediate access:

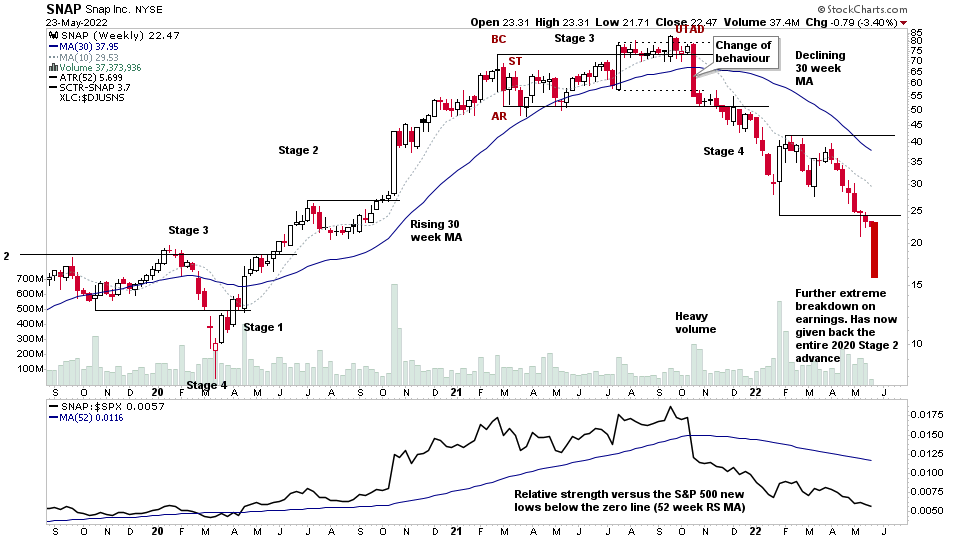

SNAP made another massive continuation breakdown on earnings in the after hours trade in its late Stage 4 decline, and has now given back the entire 2020 Stage 2 advance, and joins the likes of PTON, ROKU, PYPL, SQ, PINS and many more former 2020 leading stocks that have come full circle and given it all back again since breaking down into Stage 4 during various points over the course of the last year.

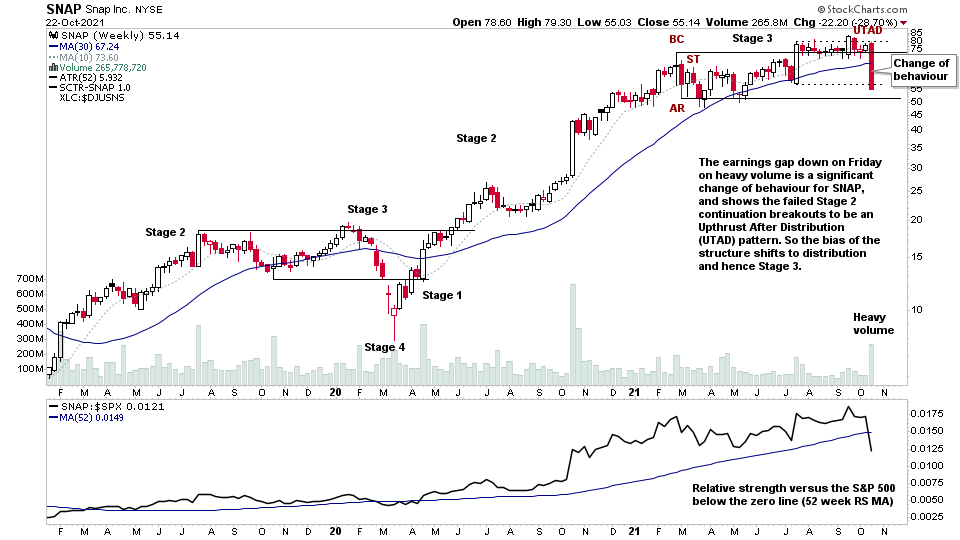

I've attached the SNAP Chart from the October 2021 Earnings below that I posted at the time in the forum and on Twitter, as the initial large earnings gap down at that point changed the structural bias towards distribution, with a failed Stage 2 continuation breakout that turned into a Upthrust After Distribution (UTAD) pattern – which as you may know is an initial short entry point in the Wyckoff method. And hence a logical exit point if you are still holding onto a stock that is in late Stage 3, after a large Stage 2 advance.

So while it may be a bitter pill to swallow if you get caught on an earnings gap down like that. As you can see, it's often better to cut and run at that point immediately, as the move into Stage 4 can happen a lot quicker than the advance higher in Stage 2 does in most cases.

Hence this is a good example of how understanding both the Stage Analysis and Wyckoff methods can help to avoid a Stage 4 disaster like SNAP has turned into. As you should be exiting during Stage 3 once you start to see a change of behaviour, and not holding out hope and letting a stock you hold fall deeply into Stage 4.

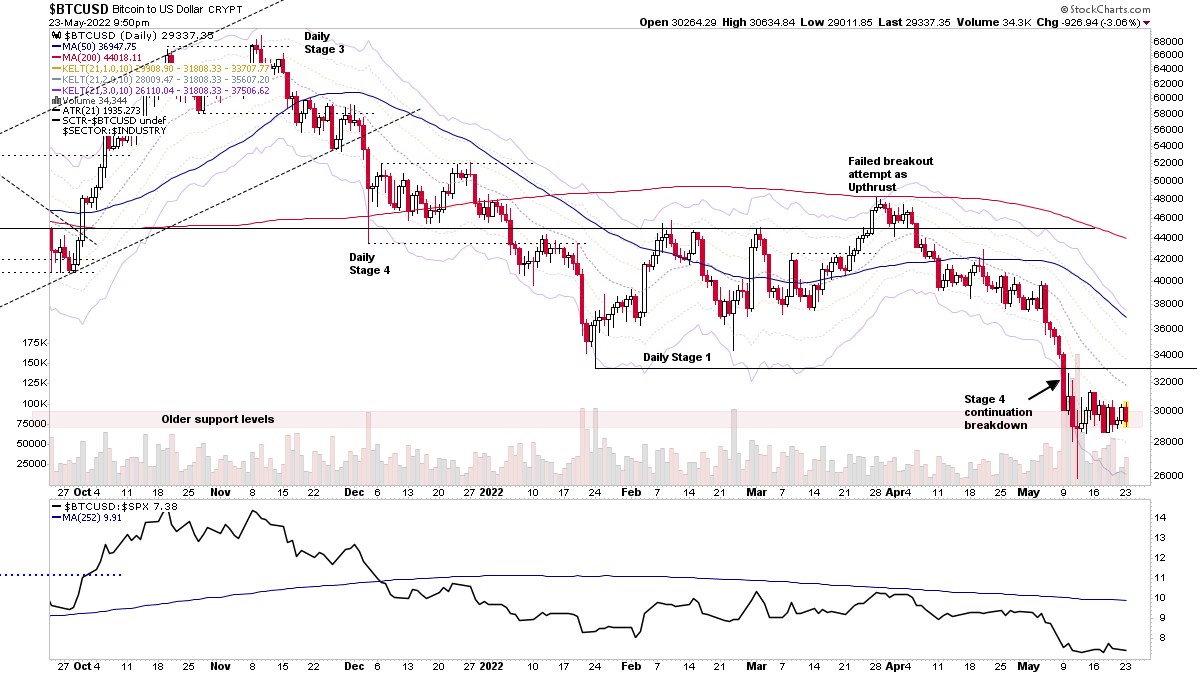

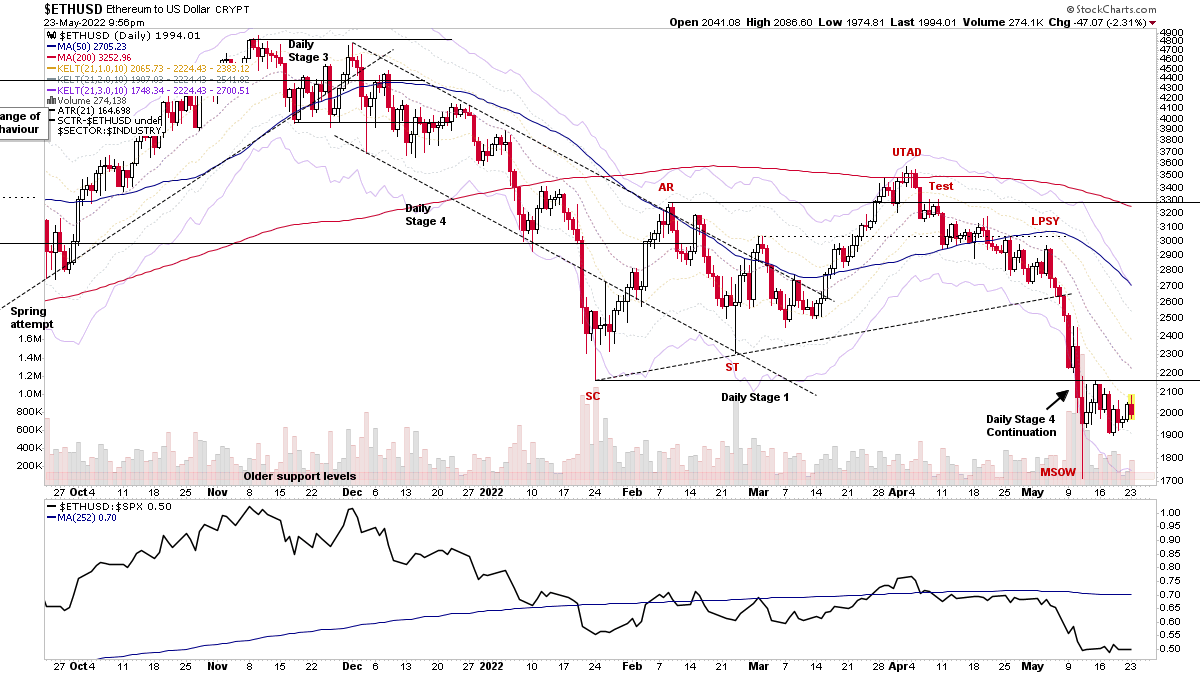

Bitcoin & Ethereum Bear Flag in early Stage 4

The major crypto coins of Bitcoin and Ethereum are both developing bear flag patterns at their long term support levels in early Stage 4, and so look vulnerable to a further continuation breakdown attempt. Also, the fact that they couldn't rally today with the stock market could be a potential negative for stocks, as they are good proxy of speculative behaviour at the moment.

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.